Good morning!

I'm afraid I lost internet connection at work for several hours, preventing me from researching and publishing. Sorry about that.

I did manage to do a phone interview with Duke Royalty (LON:DUKE) at 3pm so I'll be publishing that soon.

I'll try to fill out today's report with some more companies:

- Gocompare.Com (LON:GOCO)

- Foxtons (LON:FOXT)

- Proactis Holdings (LON:PHD)

Gocompare.Com (LON:GOCO)

- Share price: 65.5p (-6%)

- No. of shares: 418 million

- Market cap: £274 million

(Please note that at the time of publication, I have a long position in GOCO.)

I've been holding this price comparison group since December. Those who've been watching it for a while might remember that ZPG (Zoopla) tried very hard to buy it for 110p in 2017.

Last year, it was reported that private equity groups wanted to take it out at c. 103p.

So I've been feeling quite happy about my sub-70p purchase.

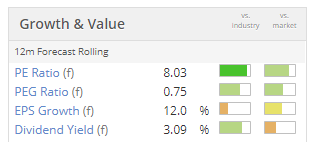

It trades at a single-digit PE, and spends most of its earnings trying to grow the business. It targets a 20%-40% payout ratio, meaning that 60%-80% of earnings are available for reinvestment.

In 2018 (the figures just announced today), GOCO generated £35.5 million of cash from operations.

It ended up spending almost £54 million on investments, mostly on external businesses.

I do much prefer organic growth rather than an aggressive acquisition strategy. In this specific case, however, Gocompare's acquisitions seem highly complementary, and aren't so large as to make me uncomfortable.

GoCompare now owns:

- The Global Voucher Group (£36 million price tag), owner of myvouchercodes.co.uk

- EnergyLinx (£9 million price tag)

GoCompare is also internally creating:

- Weflip, a new automated energy switching service.

Let's consider today's results in some more detail.

Because there are multiple segments, we should consider them separately.

Price comparison

This is the core GoCompare.com, plus Energylinx (acquired in June 2018).

Revenues are down 3% (£5 million), but through careful management of the ad spend to focus only on the most profitable opportunities, distribution costs are down 25% (£12 million).

Because of this, the price comparison "trading profit" is up 11% (£6.6 million).

"Trading profit" could be seen as the gross margin for the unit, as it is before the units administrative costs.

Thanks to these administrative costs being fixed (in fact they partially declined), the adjusted trading profit for price comparison is up 15% (£7 million), for a total of £54 million.

As I've said before, GOCO's strategy has been to focus on profits and margins rather than the top line. These full-year results confirm this strategy.

Rewards

The voucher business makes an "adjusted operating profit" of £2.8 million in its first year under GOCO ownership. Seems reasonable versus an original £36 million valuation.

Weflip

Negligible revenues and a small loss as GOCO didn't start marketing it properly in 2018.

Group Profitability

After £11 million of central group costs, the total adjusted operating profit is £44 million (2017: £36 million).

There are £6.5 million of "adjusting items" (2017: £3 million). You could conservatively take the view that about half of these are recurring in nature and are therefore "real" costs (e.g. restructuring and other corporate costs).

So while operating profit is £37.5 million, it could be argued that real underlying operating profit is more like £41 million.

A number that I like to use is NOPAT (net operating profit after tax). I estimate this by taking the after-tax value of underlying Operating Profit, so in the case of GOCO that would be about £33 million. It's the net income that the company would have generated if there was no debt and no interest expense.

I can then compare this number with enterprise value, capital employed, etc., to get metrics that look at the company from the perspective of both the debt and equity.

Balance sheet

GOCO has net debt of £67.5 million (December 2018), so the enterprise value is in the region of £340 million. So from this point of view, GOCO is being valued at just over 10x earnings (using EV/NOPAT).

The balance sheet is wafer thin as there is no PPE and little by way of current assets is required.

There are significant intangibles and so the NTAV is negative to the tune of some £66 million. The lenders have funded the acquisitions, basically.

Outlook

More of the same from the core business with a "disciplined performance" expected, i.e. highly targeted ad spending. There willl be "modest" revenue growth and stable margins, and a H2 weighting (as mentioned in the comments, the H2 weighting is not news).

£10 million in marketing spend will be directed to weflip, as that's where GOCO sees the big future opportunity - higher margins and recurring revenue.

My view

The market is a little disappointed by this announcement but I'm happy to keep holding it with a very small piece of my portfolio (2%).

The way I see it, it doesn't need to do that much right to be a success from the current valuation. GoCompare is a really well-known and trusted brand and Weflip has the potential to become another one (and an even more profitable one, if it succeeds).

If profits in the core business remain stable for the next few years, perhaps even rising a little with the help of some operational leverage, GOCO will have lots of cash with which to invest in Weflip and pay down its debts.

At some point, I expect that the industry could consolidate and it probably will get bought out by a competitor (e.g. Moneysupermarket.Com (LON:MONY), perhaps?).

While I don't have massive conviction and wouldn't make this a core holding, I do suspect that it is undervalued.

Foxtons (LON:FOXT)

- Share price: 60.8p (-1%)

- No. of shares: 275 million

- Market cap: £167 million

One of the more impressive things this London estate agent has done in recent memory is convincing investors to buy its shares at 230p at the 2013 IPO.

As of 2018, its performance is pretty woeful with £111 million of revenues being converted to just £3.6 million of adjusted EBITDA and a pre-tax loss of some £17 million, after impairments and restructuring.

What's going on?

- Sales-based revenue is down 15% as transactions in London property decline.

- Lettings revenue is up 1%, showing "resilience" (lettings is generally stable in comparison to sales).

- Lettings revenue now 85% larger than sales revenue. Tenant Fees Bill expected over the summer, which will require mitigation.

- Six Foxtons branches closed, mostly in peripheral areas (61 left in total)

- Marketing spend refocused

- Non-recurring charge of £16 million to shut down branches and write off goodwill associated with the Sales segment (mostly non-cash charges).

- Cash balance remaining of £18 million and debt free.

- There will be no dividend on the back of these results.

Outlook

No change to the outlook for sales - low transaction levels foreseen in the short to medium term. Sales market is "very subdued with less visibility on exchanges proceeding"

Lettings, on the other hand, has "resilience" and that market enjoys some positive momentum.

My view

This is a straight bet on the London property sales market recovering, as it inevitably must at some point in the future.

Without that recovery, the lettings market seems unlikely to justify the current market cap - it generated adjusted EBITDA of £6.7 million in 2018 (2017: £12.1 million).

On the other hand, if sales made a recovery soon, then Foxton shares could prove to be a winner from the current level. The share price did make sense in 2013 at 230p, based on how it was performing at that time.

This isn't the sort of thing that I would bet on but others with keener insights into London property might be tempted.

Proactis Holdings (LON:PHD)

- Share price: 50.2p (-56%)

- No. of shares: 95 million

- Market cap: £48 million

This is a share that I avoided simply because it was a debt-laden, acquisitive, B2B software business. Rules like this are designed to keep me out of trouble without having to employ too many brain cells (though I appreciate that Gocompare.Com (LON:GOCO) could also be viewed as debt-laden and acquisitive).

Today's update from Proactis is grim.

Some H1 numbers are given and are not referenced against prior expectations.

- H1 revenues of £27.7 million means that sales are falling organically. Excluding an acquisition, revenues are just below £25 million which means maybe a 9% fall on an organic basis.

Profit warning time:

During January and February the Group has experienced a lower level of retention and a deterioration of the pipeline in the Group's US and European operations... the Board now considers that it is unlikely that the Group as a whole will deliver significant growth for the remainder of the current financial year ending 31 July 2019.

Static revenue means that the acquisitions will barely replace lost business.

If you want to look for a simple red flag, it was the $132 million acquisition of Perfect Commerce in 2017. It was such a big deal, relative to the size of Proactis, that it was always going to come with risks attached.

The CEO of Perfect Commerce became the CEO of the enlarged Group, but he is moving on to pastures new and has been replaced by the Proactis CFO. The new CEO has begun an "in-depth review".

My view

This remains outside the universe of shares that I would consider buying.

Specifically in relation to today's profit warning, it was disclosed that adjusted EBITDA for H1 is expected to be £8 million, and net debt was £40 million at period-end.

For FY 2018, adjusted EBITDA was about £12 million larger than statutory operating profit.

So we can expect lots of deductions from this £8 million figure to eventually get the bottom line.

Net debt at £40 million could still be manageable but honestly I would prefer to be short this stock rather than long of it.

StockRanks identified it as a Momentum Trap and when it loses its momentum, I'm guessing that the StockRank will be bashed.

Sorry for the lateness of today's report - I was out of action for 3 or 4 hours for reasons beyond my control. Better luck tomorrow! If it is quiet, I will do a roundup of stories I missed and were requested during the week.

Thanks

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.