Good morning, it's Paul here with the SCVR for Friday.

It's a quiet day for news. Remember that I only cover results & trading updates for some sectors. I'm not going to comment on other stuff, like speculative drug companies jumping on the Covid-19 bandwagon! Because I have no insights on anything like that.

Here is the link to yesterday's report - in case you missed it, I added new sections on Up Global Sourcing Holdings (LON:UPGS) and Cenkos Securities (LON:CNKS) in the afternoon/evening.

Today's report is now finished.

Barratt Developments (LON:BDEV)

Share price: 515.8p (down 0.6% today, at 09:13)

No. shares: 1018.3m

Market cap: £5,252.4m

(I currently hold a long position)

This update from the UK's largest housebuilder is very similar to recent updates from other housebuilders.

Key points;

- Phased re-opening of sites, from 11 May (not re-opening in Scotland - no reason given)

- Social distancing marshals on each site will enforce compliance with new procedures

- Reduced level of customer interest - this seems at odds with other housebuilders, who sounded more upbeat about demand

- Limited number of additional completions this FY 06/2020

- 11,776 completions YTD, very similar to LY (11,723)

- Forward sales of 12,271 houses, £2.85bn

- Taking same cash conservation measures as others

- Cash - £430m, plus undrawn £700m RCF, plus Govt CCFF scheme funds if needed - sounds strong, no issues with solvency, as with other housebuilders - the whole sector is vastly more financially secure than in previous recessions

- Outlook - guidance was withdrawn on 25 March. No update given. This is no good, they should have a very clear idea of the outturn for FY 06/2020, given that few further completions are anticipated.

My opinion - my view remains positive on this sector. With interest rates at historic lows, I don't see any likelihood of house prices falling a lot. Hence with building work resuming, this sector could continue recovering. I imagine the Govt is likely to want to stimulate activity, hence a drop in Stamp Duty seems likely, in my view.

Balance sheets are a joy to behold in this sector, they're amazingly strong. Other sectors could learn from this. Corporate financial strength needs to be increased across the board in Western economies. Hence, as indicated by Shoe Zone (LON:SHOE) for example, dividends may be withheld until companies have strengthened balance sheets, which could take several years. Given that housebuilders have such strong balance sheets, then I expect they should continue to be good dividend payers.

James Cropper (LON:CRPR)

Share price: 900p (down 1.6% today, at 09:58)

No. shares: 9.55m

Market cap: 86.0m

Further to its announcement of 24th March, James Cropper is pleased to provide an update on the expected outturn for the year to 28th March 2020 just ended and on our expectations for trading during the current year.

It's helpful when announcements start with a brief description of the company's activities. Investors & commentators look at hundreds of companies, and it's not easy to remember what activities they all do. Cropper doesn't provide that information today. As an alternative, each company's StockReport here on Stockopedia provides a Profile Summary near the bottom. In this case it starts with;

James Cropper PLC is engaged in the manufacture of specialist paper and advanced materials...

Performance for FY 03/2020 looks strong. Although this would only have had a slight negative impact from COVID-19, right at the end of the year;

Year ended 28 March 2020

As a result of delivering on the growth strategies within each division, the Group produced a strong performance last year with positive growth in both revenue and profits. Market penetration and expansion has been achieved across the divisions.

Adjusted pre-tax profits (excluding IAS 19 impact) are expected to be well ahead of market expectations for that period and in excess of £6m.

COVID-19 impact - the above is a really good starting point, but as I would expect, performance has since deteriorated -

Whilst the Company was on track to continue growing, the impact from COVID 19 will have a negative effect on product demand in each of our divisions...

See the RNS for more details of divisional performance.

Outlook - for the new financial year ending 03/2021 is quite detailed, which is good - we need this kind of information from companies, rather than guidance being completely withdrawn;

...we are expecting that the course of the financial year will be as follows:

the first quarter to June 2020 to incur a large negative impact and it will be loss making. During this period, the Company is making use of the Government's Coronavirus Job Retention Scheme to furlough more than 50% of staff in the UK operations.

In the next two quarters, to December 2020, we expect still to see a negative effect and to continue to be loss-making, albeit with some recovery evident.

For the final quarter to March 2021, we expect progressive recovery towards a more normalised situation and the Company anticipates being back into profitability.

That's useful information, but it doesn't provide any actual figures. So I'm still largely in the dark, or at least experiencing twilight.

The business is now, we believe, in an 18-24 month recovery period. The Company expects a hit to cash during 2020-2021over the period of the COVID-19 pandemic and as we return to more normal trading conditions...

That's interesting, and it chimes with what a lot of CEOs in America are saying (I've been glued to CNBC in recent weeks - it's very good for intelligent views & commentary, at least whenever that clown Jim Cramer is not participating). This all adds weight to the idea that a V-shaped recovery seems fanciful - something I've been saying here recently. This makes the stock market's massive rebound in April seem premature.

Cash/liquidity - key point;

- Cost-cutting done

- No final dividend

- £12m available headroom on cash/bank borrowings - "sufficient to weather storm"

- Looking into borrowing for future capex

Balance sheet - I've reviewed the last one, as at 28 Sept 2019. Overall, it looks OK, so I don't see any issues here re solvency. Although that depends on how bad the losses are this year, which the company doesn't provide any guidance on.

A couple of cautionary points;

Receivables - could need a doubtful/bad debt provision, if customers are unable to pay CRPR's invoices.

Fixed assets quite high, so this is a fairly capital-intensive business.

Big pension deficit - I'm very wary about these right now, because ultra-low interest rates drives up the liabilities, and the stock market correction may have pushed down asset values in the fund. This is a key point to research, for anyone considering a purchase here.

My opinion - it looks an OK business, nothing special. Therefore I would only be interested in buying its shares if it became dirt cheap, which is not the case now.

The pension scheme is a major negative. No dividends for now. Losses this year, but they don't say much - must be significant given that 50% of staff have been furloughed.

Overall then, I don't see any reason to want to buy this share. Another consideration is the ludicrous bid/offer spread of 850p to 950p. If you pay full ask, you've therefore incurred an immediate 10.5% loss - which is absurd. Out of curiosity, I checked the real prices with my broker - it's 860.5p bid (2,500 shares), and 940p offer (1,500 shares). That would still equate to an 8.5% instant loss - which nullifies any logic for buying this share.

Analyst forecasts have not yet been reduced, so the forward valuation metrics are currently meaningless.

.

.

Kromek (LON:KMK)

Share price: 17.5p (down 13% today, at 11:20)

No. shares: 344.6m

Market cap: £60.3m

Full year trading update & COVID-19

Kromek (AIM: KMK), a worldwide supplier of detection technology focusing on the medical, security screening and nuclear markets, provides an update on trading for the 12-month period ended 30 April 2020 and its business response to COVID-19.

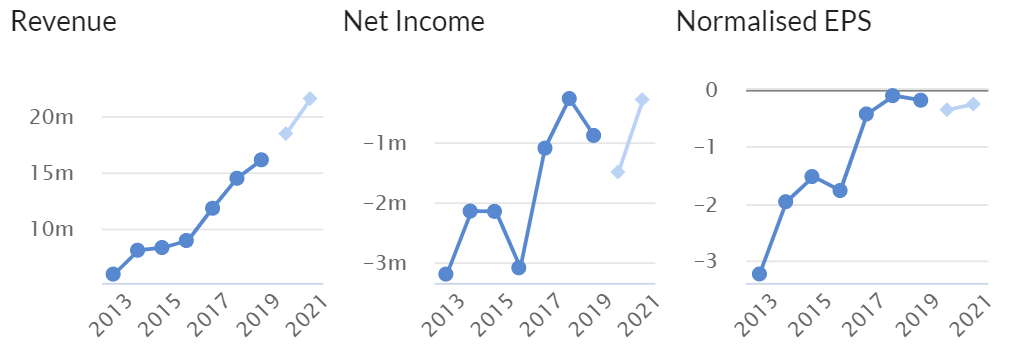

This story has been around for a long time. As you can see below, it is making progress, but 7 years of losses, and a tripling of the share count over that period, must be trying the patience of even the most optimistic shareholder.

.

.

Profit warning -

- Kromek was doing OK until end Feb 2020

- Mar & April saw impact from COVID-19

- 2 key contracts delayed into FY 04/2021

- FY 04/2020 revenue £14.5m (well below £18.5m forecast)

- Adj EBITDA breakeven - but this translates into adj LBT of -£4.6m, which looks pretty grim to me

- Multi-year contracts, which it reckons gives good visibility

- Making ventilators - no indication of profitability of this sideline

- Cash of £10m, debt of £5m, hence net cash of £5m

Cash preservation measures look significant -

...ceasing all discretionary capital expenditure; curtailing all travel and non-essential spend; and, securing a short-term rent concession on the Group's leased properties. These measures, along with others in the pipeline, are expected to reduce monthly running costs and cash outflow, generating annualised savings of approximately £3m.

Outlook - too uncertain to give guidance. Board confident it can withstand the current situation.

My opinion - I'm surprised that the market cap is as high as £60m, given the poor track record - being unable to break into profit, after a long time trying. Maybe it could succeed in future, but I have no way to assess the likelihood of that happening. Therefore, for me it would only be a punt, not an investment. Hence it's not of interest to me. It's probably only going to appeal to punters, or experts in the sector who are able to determine if the products are any good or not. The 58% gross profit margin suggests its products must be pretty decent, to have some pricing power.

.

.

That's me done for the day, and the week.

Many thanks for your comments, very useful points often.

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.