Good morning!

There's not a whole lot to report on today.

- Filta Group (LON:FLTA) is in line with expectations for H1.

- Volution (LON:FAN) is in line with expectations for FY 2018.

- Leeds (LON:LDSG) results are out for FY 2018 and the outlook for FY 2019 is in line with expectations.

House of Fraser is entering administration, after no solvent conclusion to negotiations could be reached.

While reading around the story, I ended up reading the Wiki biography of Philip Day, one of the businessmen who has been mentioned as a potential buyer.

It's fascinating to see how he has built an empire by buying up a long list of companies out of administration.

It goes to show how well someone can do by being opportunistic and waiting for the right time to pounce.

Mike Ashley of Sports Direct International (LON:SPD) is another astute businessman rumoured to be in the fray for House of Fraser.

He also has a track record of buying stakes in troubled businesses. Rather than buying them out of administration, he has been buying shares in fellow high street names at depressed prices, in the open market.

The names in his portfolio include Debenhams (LON:DEB) (where he is the top shareholder), Findel (LON:FDL) (again, top shareholder), GAME Digital (LON:GMD) and French Connection (LON:FCCN).

While the ultimate success of his stake-building in these enterprises is yet to be seen, it's been very interesting to see him build the portfolio.

What we can learn from these two men? Few people will have their business insights, but I suppose we should also try to be opportunistic, to be patient, and to stick to the sectors we understand best. That's what they've done, and it seems to be working out pretty well for them so far!

I would say that their specific investment styles would best be classified as value investing - they are buying up companies where the existing equity is worthless or at a much lower value than it was before. We don't have to mimic them precisely, but it's worth noting that it is possible to build serious returns pursuing this type of strategy.

One of my largest holdings, Volvere (LON:VLE), does this - it finds companies where there may be a temporary problem with a bank loan, and it takes out the bank from the capital structure to create its equity stake.

Another fund manager I greatly admire, Howard Marks, works along similar lines. He created a very successful investment firm, Oaktree, by specialising in high-yield bonds and distressed debt. I strongly recommend his book: The Most Important Thing - Uncommon Sense for the Thoughtful Investor.

It looks like I've veered into a huge tangent - guess that's what happens on a Friday morning when the RNS feed is quiet!

11am update: We have confirmation that Mike Ashley / Sports Direct has purchased House of Fraser for £90 million.

Sports Direct shares don't seem to have moved much in advance. I'd be curious to hear from any shareholders - how do you feel about your company becoming a sprawling retail empire?

Filta Group (LON:FLTA)

- Share price: 229p (unch.)

- No. of shares: 27 million

- Market cap: £62 million

Filta Group Holdings plc (AIM: FLTA), a provider of fryer management and other services to commercial kitchens, provides a trading update for the six months ended 30 June 2018...

This update is in line with expectations.

If you check the archives, you'll see that I generally say nice things about this company.

Performance remains encouraging. I won't repeat everything in the announcement as it suffices to say that the company hasn't put a foot wrong.

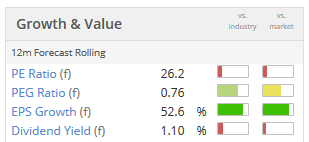

The forward P/E ratio of 26x is, unfortunately, justified. I'd love to see this share at a cheap valuation so that I could buy some, but I don't see that happening any time soon.

It's categorised by the algorithms as a High Flyer. For those of you who are happy to ride the positive momentum of a high-quality company and not worry too much about short-term valuation, I guess that makes this share a potential candidate for your portfolio.

Volution (LON:FAN)

- Share price: 198.5p (-0.5%)

- No. of shares: 199 million

- Market cap: £395 million

Filta is a boring company - cooking oil filtration and fryer management for kitchens.

Volution is debatably even more boring. We are now talking extractor fans and ventilation systems.

Boring is good. If you are a value investor, you want to invest in places where there is no excitement and nobody else is looking. Boredom keeps people away.

This full-year update is rather boring, too. It's in line with expectations.

There are lots of percentage growth numbers given and I can't immediately see what the overall rate of organic growth was.

Total sales growth was 11.3%, but that's with the help of four acquisitions. The integration of these businesses is going according to plan.

On the other hand, the transition to a new factory in Reading has been delayed and this will impact full-year results with higher costs.

It's extremely boring but the business seems pretty solid and the shares are cheap-ish (the forward P/E ratio is 12.5x).

So if you can master the art of concentration, this might be worth looking into in a bit more detail.

Leeds (LON:LDSG)

- Share price: 29p (+4%)

- No. of shares: 27 million

- Market cap: £8 million

This company imports textiles from China to its warehouse in Germany. We rarely cover it in this report.

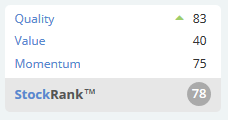

The StockRanks view it as Contrarian. It is indeed looking rather cheap.

For example, it has net asset value per share of 69.4p - more than double the current market cap.

If I deduct goodwill from the balance sheet, I calculate tangible NAV of 65.4p - still very high relative to the share price.

Peter Gyllenhammar is on the register with a 21% holding. He is usually good at spotting bargains.

Consider what it does:

The Company offers its customers a comprehensive range of fabrics of all qualities, and including both basic and fashion items. The customer base has traditionally been retailers and small wholesalers of fabrics destined for use in apparel or furnishings. In recent years the Company has successfully diversified, and an increasingly high proportion of sales are now to European manufacturers of ready-made items.

There's nothing wrong with this, but I don't consider traditional distribution businesses to make for particularly attractive investment opportunities.

Their profitability is often a function of some particular insight the managers have into their industry niche. If someone else discovers the same insights, or if the customers figure out how to go straight to source, or if exchange rates go the wrong way, then profitability can get squeezed.

Profits have more than halved at Leeds, for the following reason: Trading conditions have been difficult with increased competition and pressure on margins.

The outlook is more positive, stating that "we are well placed to return to previous profit levels for the group".

It could be worth researching this a bit more, if you like the "deep value" investment style. Leeds has a massive Value Rank of 96.

That's all for now. Have a fine weekend!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.