Good morning, it's Paul here.

The good news is that I'm finally starting to get over quite literally the worst flu/chest infection of my life. It's been absolutely horrendous - I've been bed-ridden for 22+ hours per day, for the last fortnight. It felt like I was almost suffocating some of the time.

Anyway, that's why my reports last week were so terrible. I got up at 7am each day, did a quick review of the RNS & wrote up some snippets. Then I felt so ill that I had to go back to bed, and nothing else happened for the rest of the day.

I'm only explaining this, because I don't want subscribers to think that poor quality reports are becoming the norm. Quite the opposite - I really want to boost the quality, now that the SCVRs are part of the Stockopedia subscription. You should see a marked improvement in the coming days/weeks, as I gradually get back on my feet again, health-wise. Thanks for bearing with me.

Also apologies to people who manage far worse health problems of their own. I'm lucky enough to have enjoyed good health for the last 50 years, but this last thing really did knock me for six. I did wonder if it was pneumonia actually. But anyway, it seems to be clearing up now.

T Clarke (LON:CTO)

Share price: 128p

No. shares: 43.0m

Market cap: £55.0m

... the Building Services Group, issues a Trading Update covering the period from 1st January 2019 to date.

This is a contractor for mainly complex electrical & IT fit-outs for office buildings. I visited one of their sites some time ago, and it was very interesting to see just how complex the work is for a major office block. The trouble is, that reinforced to me that the consequences of something going wrong, or being mis-priced and/or having cost over-runs, makes this quite a risky area to operate in. Especially as its profit margins are wafer thin.

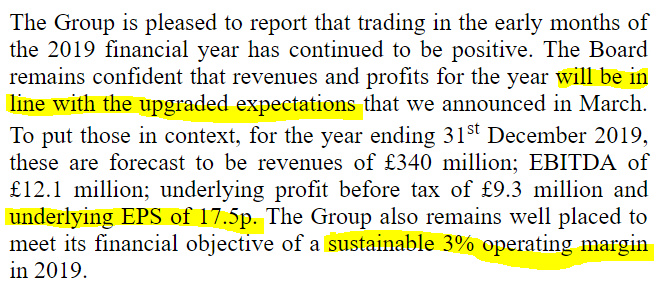

This update is excellent, in its clarity, and providing hard figures, instead of waffle that we all too often get from other trading updates. So top marks to the company & its advisers;

The 17.5p EPS figure coincides with the Stockopedia forecasts. That gives a 2019 PER of 7.3 - cheap maybe?

Outlook - comments are positive. Order book is up;

We are pleased with the continuing high quality of our forward order book, which as at 30th April 2019 remains strong at £403 million (2018: £368 million).

My opinion - I have a policy of not touching any contracting-type businesses. The reason for that being that so many have gone wrong. Risk is high (from contracts going wrong in some way), but reward is poor - with low net profit margins. Therefore it's the worst combination of risk (high) : reward (low). Plus the sector is highly cyclical.

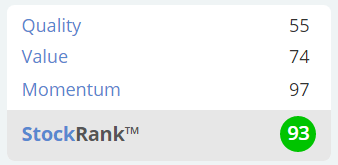

Stockopedia's view - is much more positive, with a high stock rank.

Shareholders have done well in the last six months (see chart below). Although of course that's no guide to what might happen in the future. We're probably nearing the end of this economic cycle. Hence personally I'm not going near any shares that are highly cyclical. The recent burst of enthusiasm for this share might be a good selling opportunity, perhaps? The trouble is, if you try to pick the top, that there might not be any liquidity to sell into, once a downtrend has started.

Premier Technical Services (LON:PTSG)

Share price: 78p (up 13% at close of play)

No. shares: 123.2m

Market cap: £96.1m

Premier Technical Services Group PLC, the niche specialist services provider, is pleased to announce a trading update for the 12 weeks to 31 March 2019.

It's a calendar year-end, so this update is for Q1.

This is an acquisitive group, which does various activities such as high level cleaning (of high rise buildings, church spires, etc), fire safety, electrical testing, fall-arrest equipment. For more info, its group website is here.

The bull case for the share is that its activities are;

- High margin

- Mostly recurring in nature - often driven by compliance

- Acquisitions can be made more efficient

The bear case is;

- Various red flags in accounts - in particular very high receivables (88 days is way too high, for a business that claims to be run like a well-oiled machine)

- Excessive management rewards from bonus scheme that perversely incentivises them to increase risk by aggressively growing through acquisitions, debt and raising more equity - not necessarily in outside shareholders' interests

- Questions have been raised over how the company achieves such a high net operating profit margin, and that it's mostly achieved via big adjustments in the accounts

- Multiple acquisitions where performance seems to suddenly improve immediately & substantially post acquisition - so questionable accounting treatment

- Questionable property & consulting income transactions, that don't look right, at first view

There was an interesting bear dossier released a little while ago, raising some pertinent questions about PTSG's accounts. A contact sent me a copy of this, which I read with interest. It came with a "do not forward to anyone" caveat, so my apologies to the people who have asked me to forward it to them - I'm not allowed to.

I don't think there was any particular smoking gun in the dossier, but certainly a lot of question marks. Too many question marks to make this share investable. Indeed, I did open a small short position on it myself, but the stock lend was recently withdrawn, as my short position was offsetting someone else's long position at Spreadex. The upside of this is that Spreadex can often let you short something small, against their other client who is long. The downside is that, when the long person closes, the short is also closed automatically closed out. The upside of this, is that the long punter tends to close out when the shares have fallen and they can't take any more pain - thus locking in a modest profit for my (now closed) short position.

Having been extensively shorted, you can see that the share price has been really whacked of late. Although this is over a period when many smaller, and growth companies, got really smashed down. A lot have recovered, but with accounting questions remaining, PTSG has not yet recovered much;

Shorters may have been successful in driving the share price down. However, shorters are also future buyers of the stock, as ultimately shorts have to be closed.

In my experience, short sellers tend to do much deeper research than longs, and are often (but not always) correct, in highlighting questionable accounting practices, and sometimes worse. So I regard shorting as a useful function to put a brake on excessive market prices. If the shorters are wrong, then the share price will recover, as they become forced buyers. Plus a temporarily depressed price, for a good company, gives bulls a nice buying opportunity.

Trading update - this reads quite positively, to summarise it;

- Q1 2019 trading has been strong

- Acquisitions trading ahead of management expectations

- Good contract renewals, and new contracts

- Confident of achieving expectations for 2019 full year

My opinion - this is a very straightforward decision. If you believe the accounts, and are prepared to value the share on adjusted earnings, then it's dirt cheap on a PER of 5.5.

If you don't believe the accounts, then it's probably best to give it a wide berth.

In my view, there are too many red flags - NB these are things which indicate that there might be something wrong. Equally, it could all be fine. But why take the risk, when you don't have to?

So for me, it's a firm thumbs down, as this goes in the "too risky" tray.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.