Good morning, it's Paul & Jack here with the SCVR for Friday.

Agenda -

Paul's Section:

Parsley Box (LON:MEAL) - £5.9m placing (mainly funded by Directors) completes, so the company lives to fight another day.

Srt Marine Systems (LON:SRT) - also does a 25% discounted placing at 30p. Only 10% dilution though, so shareholders can't complain in the circumstances. So the lesson seems to be that there is still funding available for companies with a good story to tell, but institutions are clearly demanding a hefty discount, which is likely to do permanent damage to share prices. So why hold anything that is likely to need more funding, when you can probably buy in cheaper when the discounted placing is announced?

Sig (LON:SHI) - 2021 results don't impress me. Eking out a tiny margin from huge turnover, just doesn't look a very good business model. Outlook comments are upbeat, so it looks like 2022 might be a better year. Overall - very uninspiring. I have to ask, are they just busy fools? Maybe the company needs to merge with a competitor, and strip out duplicated costs, to create a business that actually makes some money?

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Paul’s Section:

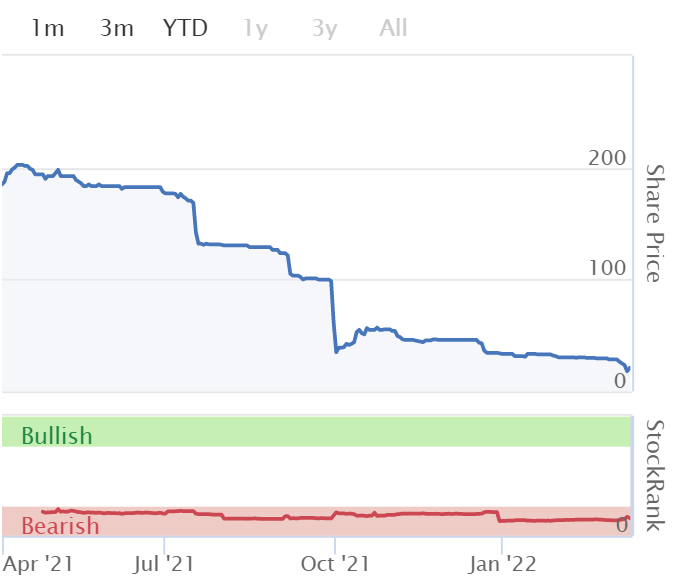

Parsley Box (LON:MEAL)

There’s confirmation today that the £5.9 placing (mainly funded by Directors & their associates) at 20p has completed (subject to a General Meeting vote, which should be a formality).

Having slept on this, I am very impressed that Directors are personally backing this refinancing.

Although looking back at the AIM Admission Document, MEAL floated at 200p, 10x the current placing price. Also, of the 8.5m shares in the original float, only 2.5m were new shares, with the bulk (6.5m shares) being selling shareholders, who banked £13m, at what was now clearly a ridiculous over-valuation. Although to be fair, the current Directors only seemed to sell less than 10% of their existing shareholdings at IPO. The main sellers were former Directors, VCTs, and a long list of small shareholders who exited. So there was nothing particularly untoward about that (see Part IV, Section 24, of admission document)

Maybe putting in their own cash to have another go at making this idea work, will focus minds? Good luck to them, it would be good to see this succeed, but I won't be investing.

The valuation still looks too high to me, given that the growth story has largely gone, and it’s now all about surviving. That doesn’t interest me as an investment proposition.

Above all, management need to mystery shop their own product, and improve the recipes, many of which are simply awful. No wonder revenues are not growing.

This is a good example of why so many small cap investors completely avoid IPOs. So many of them are over-priced, and often speculative junk! This is also a good reason why I don't buy shares in brokers any more. They're only interested in short term fee income, and bonuses for the staff. Whilst trashing their reputations with investors by flogging over-priced rubbish, all too often. It's not very good really, is it?

Srt Marine Systems (LON:SRT)

33p (down 15% at 09:16) - mkt cap £54m

Another placing. This time it’s at 30p (a 25% discount).

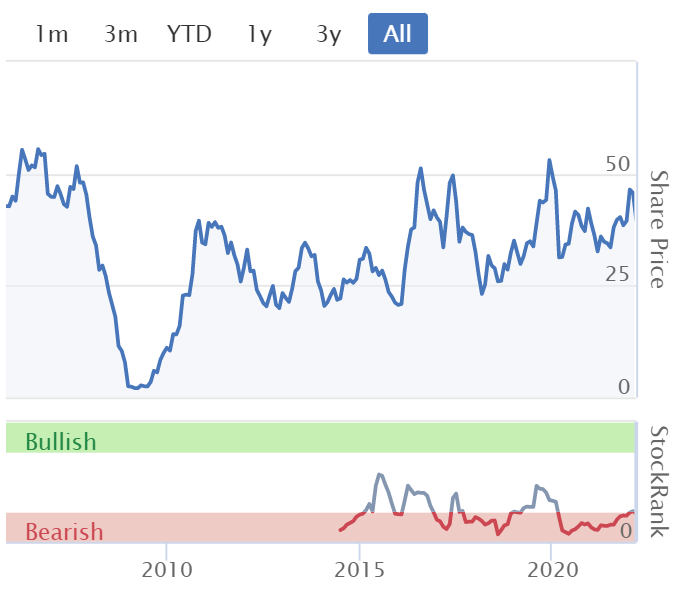

16.4m new shares are being issued, which is only 10% dilution of the 164m shares already in issue, which I don’t think anyone can complain about, given the very long, erratic & unconvincing track record. Is this the ultimate jam tomorrow company?

Still, the current newsflow on orders does look promising, if they can actually pull it off this time?

17 years as a listed company, amazingly - here's the share price performance -

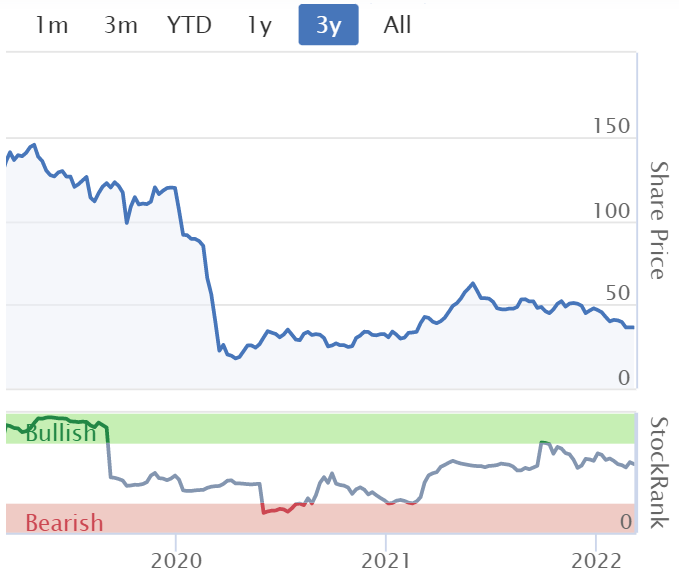

Sig (LON:SHI)

39.3p (up 5% at 09:36) - market cap £462m

SIG plc ("SIG", "the Group" or "the Company") today announces its results for the full year ended 31 December 2021 ("FY 2021" or "the year").

I’ve had a quick skim of the numbers, and can’t see anything of interest.

My main problem with this company, is that it’s big (£2.3bn revenues), but doesn’t really make any money.

Underlying profit before tax is only £19.3m, despite 2021 showing a strong recovery in sales from pandemic-hit 2020.

Another worry, is that operating lots of depots, and employing lots of staff, will it be able to cope with inflationary pay rises, necessary to attract & retain good employees?

The low gross profit margin of 26.3% suggests it has little pricing power.

There’s quite a lot of debt, £128.6m, plus loads of lease liabilities on top of that.

Energy costs must be a worry too, with lots of depots to heat & light.

No dividends for now.

Outlook - upbeat, but no cash generation, so what’s the point?

In the near-term we are anticipating some remaining impact from material shortages, but these are gradually abating. We have started the year well, and ahead of plan, helped by a continuation of the robust demand seen in late 2021. This, together with the effectiveness of our supply chain management and commercial agility, gives the Board increasing confidence over the full year performance.

We expect to be free cash flow neutral for the year, before returning to sustainable free cash generation thereafter, enabling us to continue to invest in and drive our strategic goals.

My opinion - the investment case seems to rest on it achieving further growth, and better margins. Personally I wouldn’t want to bet on that, given all the macro headwinds right now.

It looks a very marginal business, and I’m not really sure why it exists, operating barely above breakeven in good years, and generating thumping losses in (frequent) bad years.

Surely we can find better shares to buy than this?! I'm sure the joke has been cracked before, but it looks like this company's ticker is missing a final letter!!

.

.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.