Good morning! A couple of interesting bits of news today:

- ZPG (LON:ZPG) - recommended offer at 490p

- Carpetright (LON:CPR) - interim funding

- Interserve (LON:IRV) - FCA notification

- Thalassa Holdings (LON:THAL) - trading update

- Ceps (LON:CEPS) - final results

ZPG (LON:ZPG)

- Share price: 489.4p (+30%)

- No. of shares: 438 million

- Market cap: £2,145 million

Recommended cash acquisition of ZPG Plc

After just four years on the market, it looks like Zoopla will be returning to private hands. The ZPG Board recommend voting in favour, and 31% of the votes have already been promised (30% from Daily Mail and General Trust P L C (LON:DMGT) and 1% from the ZPG Directors).

It's a large transaction, even for SilverLake, which calls itself "the global leader in technology investing." GIC (Singapore's sovereign wealth fund) and a Canadian pension fund will also be participating.

With the bid priced at 490p, today's share price says that there is little doubt it will be voted through.

SilverLake promises to actively improve ZPG's performance:

In addition to its in-house value creation team, Silver Lake has a strong network of portfolio companies and contacts in the sector which can bring value to ZPG's operations through operational improvements

But the existing management team, brand and culture will be preserved:

Bidco expects the existing personnel of ZPG to continue to contribute to the success of ZPG following completion of the Acquisition, and does not intend to initiate any material headcount reductions within the current ZPG organisation as a result of the Acquisition.

No "material" headcount reductions - an important proviso. It's still possible that there could be some redundancies.

Brokers were forecasting EPS of c. 17.6p this year, so the bid is at a hefty 28x earnings.

The read-across to Rightmove (LON:RMV) is very positive. Rightmove is forecast to make EPS of 179p this year, and a similar earnings multiple applied to it would result in a share price of c. 5015p.

I would argue Rightmove deserves a higher multiple than ZPG. It's up nearly 7% today to 4910p.

I've always been biased toward Rightmove, as the #1 player in this niche, even though it has been losing a little bit of market share to Zoopla and others in recent times.

In hindsight, it would have been satisfactory if I had picked up some RMV shares when it was trading at c. 4400p over the past few months.

Unlike estate agents such as Purplebricks (LON:PURP), online property directories benefit from real network effects and so are very difficult to displace. Today's ZPG takeover helps to confirm their value for me (ZPG also owns Uswitch and PrimeLocation).

I still don't hold any RMV, but it remains on the watchlist. Hopefully, there will be a moment when preparation meets opportunity and I will be able to pick some up at a reasonable price.

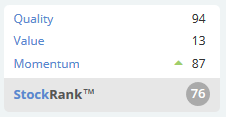

Stocko classifies RMV as a high flyer:

Carpetright (LON:CPR)

- Share price: 37.65p (-5%)

- No. of shares: 71 million

- Market cap: £27 million

Paul analysed Carpetright's CVA proposal in some detail last month. Here's the link. In summary: the company is seeking to raise equity and to lower its rent bill, with the agreement of its landlords.

We know that trading has been very poor. Q4 (Feb to April) like-for-like sales were down 10.5%. We are now in Q1 2019 and I can only assume that difficult conditions persist.

In April, the company announced it would need up to £15 million of fresh funding to see it through the equity fundraise. This is on top of £12.5 million it borrowed from its largest shareholder in March.

Today, it announces that the £15 million in interim funding has been achieved, again from the largest shareholder.

The terms are extraordinarily expensive: 18% p.a., plus a £2.25 million arrangement fee.

I think this mean the annual interest bill will be more than £3 million p.a., making the effective interest rate on the £15 million net proceeds closer to 21%. The loan matures in July 2020.

According to the announcement, the loan "has been made to the Company on normal commercial terms, on an unsecured basis and does not have any unusual features".

Fair enough, but if borrowing at an effective 21% interest rate represents normal commercial terms, then the existing equity is probably worth very little.

An equity raise for up to £60 million will be launched a week from now. The new shares might be a reasonable investment, but the existing shares are extremely speculative until we know the placing price.

Interserve (LON:IRV)

- Share price: 75.6p (-2%)

- No. of shares: 146 million

- Market cap: £110 million

A very short update from this support services and construction group:

Interserve Plc (the "Company") has received a formal notice that it has been referred to the Enforcement Division of the Financial Conduct Authority for investigation in connection with the Company's handling of inside information and its market disclosures in relation to its exited energy from waste business during the period from 15 July 2016 to 20 February 2017.

This is a large company with a workforce of c. 80,000 (according to its homepage), but the equity doesn't look like it's worth much.

Paul last reviewed the company in October 2017, and declared it uninvestable.

I've just had a quick look at the final results for 2017. Net debt grew to £500 million, and lenders were given warrants over 20% of the company, exercisable at 10p.

The new debt facilities mature in 2021. The company should survive until that point, but then will once again be dependent on the goodwill of its lenders.

On an underlying basis, the company achieved an operating margin of 2.5%. This is another Carillion-type business, doing government contracts and other labour-intensive work on very low margins.

Today's announcement is consistent with Paul's description of the business as "accident-prone". Even if it leads to nothing, it's another red flag for investors.

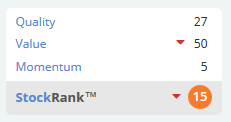

Stocko algorithms help to warn us away:

Thalassa Holdings (LON:THAL)

- Share price: 83p (-2%)

- No. of shares: 19.4 million

- Market cap: £16 million

This is a deep value situation, for those of you interested in such things!

I have been mulling over whether or not to buy some, and my finger has been hovering over the buy button. In the end, I've decided not to buy any today.

Background

Thalassa was previously in the oil and gas services business. However, its holdings have transformed over time and all it has now are an underwater robotics company, a 25% shareholding in Local Shopping Reit (LON:LSR), and a big pile of cash.

Cash was reported at $20.3 million (£15 million) at December 2017. Let's adjust this down for some share buy-backs it has made since then, and use a £14.7 million cash estimate.

We don't have results for the year ending Dec 2017 yet, by the way - extremely late, and we learn today that they won't be released until June. Last year, they were released in April. I wonder if there might be a strategic reason for this?

Assets

Thalassa's 25% stake in Local Shopping Reit (LON:LSR) is worth £6.8 million at today's share price.

So the cash plus the LSR stake alone are worth c. £21.5 million - more than the current market cap.

On top of that, there is a potential $10 million (£7.4 million) payment in contingent consideration for a big disposal Thalassa made last year ("WGP"). This payment will be made "contingent on certain customer contracts being entered into within 5 years of completion".

Finally, there is the robotics company (external link).

It was previously hoped that this company would receive a $2 million investment for a 20% stake, valuing Thalassa's stake at $8 million. However, the potential investor, the same entity which bought WGP from Thalassa last year, has pulled out.

Thalassa has invested at least $7 million in robotics so far. Its fair value is impossible for me to ascertain.

NAV calculations

Let's do a bear case scenario. Assume the $10 million contingent consideration never gets paid and the robotics business is worthless.

Then the cash and LSR stake together are worth c. £21.5 million, assuming no cash burn. The NAV per share for Thalassa is 111p (since there are 19.4 million shares).

Now let's make a few bullish assumptions, instead. Suppose that the $10 million payment will be received soon and the robotics company is worth $7 million, the amount invested in it so far.

This gives total value in Thalassa of £34 million, and NAV per share of 176p.

I'm being quoted 85.7p to buy. So the potential gain is 30% in the bear case scenario, and over 100% in the bull case scenario.

But...

I can't quite bring myself to pay up for these shares.

Checking the rationale for the WGP disposal last year, one of the reasons given was that it:

provides the Board with the platform to execute its strategy of focusing on acquisition of other assets, which in the opinion of the Board have the opportunity to generate capital growth and superior returns for shareholders

While the promise of further buy-backs is encouraging (today's announcement says there could be a further £1 million in buy-backs), the excerpt above suggests that the company is not in liquidation mode - and I can't see much evidence that it intends to liquidate soon. So I don't think shareholders will be able to access the 111p-176p in underlying value very quickly.

In summary, I view Thalassa as an eccentric investment fund with a robotics holding, a REIT holding, and with the potential to make additional investments in the months and years ahead. Up until last October, it owned shares in a mining company with projects in Australia and Papua New Guinea!

So maybe there is some sense in pricing it at a significant discount to NAV. Having said that, the current discount does look too harsh to me.

As always, please do your own research if you are considering any of these stocks - my calculations and estimates could easily be wrong!

Ceps (LON:CEPS)

- Share price: 37.5p (-5%)

- No. of shares: 13.2 million

- Market cap: £5 million

This is another quirky little investment company.

We are below the £10 million lower limit for market caps - so be careful! These can be terrible shares to trade, even in small size.

The mission statement is clear enough:

The Company is engaged in acquiring majority stakes in entrepreneurial companies.

Today's results are for the year ending December 2017. So this is another company which is quite slow to report.

It has six subsidiaries across a wide variety of sectors.

The textile subsidiary, Friedman's, contributed over 60% of the EBITDA for the year (£1.2 million out of the £1.9 million total).

Partly due to further growth at Friedman's, operating profit for CEPS as a whole has more than doubled to £1.1 million. But this is masked by a big impairment charge at another subsidiary. So there is a loss on a reported basis.

The Board is increasingly enthusiastic about prospects, and wants to pay a dividend as soon as it is able to:

Recognising the confidence that the Board has in the future of the Company, the clearest tangible signal of this confidence is to reintroduce the payment of an annual dividend. It is twenty years since the Company last paid a dividend and the Board feels that now is an appropriate time to provide shareholders with a revenue reward for holding the shares.

Unfortunately, the balance sheet isn't overly strong.

If you exclude the equity attributable to minority interests, the equity for ordinary shareholders is worth just £3.6 million. This is against borrowings of £5.7 million.

Even after 2017's impairment, the value of intangibles on the balance sheet remains significant at £5.6 million (mostly goodwill, plus some customer lists).

So if you deduct the value of intangibles, the balance sheet has negative tangible equity.

Something else worth noting is that the Board would like to have the freedom to double the share count, to bring more businesses under its wing:

Among other resolutions to be proposed, the Board will seek authority to allot shares equating to 100% of its present issued ordinary share capital in line with the requirements of our acquisition strategy.

It looks possibly too small to justify being listed at its present size, so maybe a fundraising should be welcomed - to make better use of its listing. It might also reduce its borrowings.

Trading so far in 2018 is "marginally behind the Board's expectations".

Putting it all together, and considering that the market cap is less than 5x operating profit, the shares look fairly priced to me on my initial inspection.

It wasn't a very exciting day in RNS-land, I'm afraid! Hopefully there will be more to chew on next time.

Have a fine weekend.

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.