Good morning!

Plenty of interesting little updates today.

I shall work through this list:

- Somero Enterprises Inc (LON:SOM)

- XP Power (LON:XPP)

- Petards (LON:PEG)

- Quartix Holdings (LON:QTX)

- Lighthouse (LON:LGT)

There have also been requests for me to cover some of the asset management companies which had trading updates this week. Duly noted!

Regards,

Graham

Somero Enterprises Inc (LON:SOM)

- Share price: 370p (+8%)

- No. of shares: 56 million

- Market cap: £208 million

This is a US-based provider of concrete "screeding" machines - they allow for new concrete floors to be made perfectly flat.

We've covered this stock plenty of times here before. It's one of the few quality overseas stocks on AIM!

Today's update let us know that the company continues to perform well, and was ahead of expectations in H2.

As a result of the strong H2 performance, the Board now expects 2017 revenues will be slightly ahead of market expectations of $84.7m, EBITDA will be comfortably ahead of market expectations of $26.0m driven by the volume increase and effective operating cost management, while net cash at 31 December 2017 is expected to be not less than $18.5m, well ahead of market expectations of $16.5m.

It's helpful that the market expectations are given, so we don't have to guess what they are!

Most of the new revenue comes from geographic expansion, rather than from new products.

The company has many excellent characteristics, not the least of which is the apparent lack of competition in manufacturing these niche products.

The only criticism I've seen fit to make is that it hasn't made new product development a slightly bigger priority. It typically spends 2% of sales on product development, and introduces at least one new product per year. Could it be a little bit more ambitious than this, perhaps? Only $1 million of 2017's revenue growth has come from new products.

One of the benefits of being careful with its development spending is that the cash pile keeps growing. And the company has been quite generous in paying out surplus cash to shareholders in the past. However, it sounds like it will be hoarding most of the existing cash pile going forward:

...the Board has concluded the growth and increased complexity of the business necessitates an increase to the level of net cash to be maintained by the Company to a minimum of $15m at 31 December each year going forward.

A few other quick notes:

- The trading update notes the benign effects of economic recovery. This is a good example of a cyclically exposed stock.

- In terms of the geographic growth, I've also expressed a little bit of scepticism in the past about whether the Chinese would be willing to pay up for this kind of US expertise in construction. Consider this excerpt from today's update:

In China, H2 2017 trading grew compared to H2 2016 and improved from H1 2017 driven by recent demand generation and marketing initiatives as the Company works to gain traction in its effort to penetrate this significant market.

It would be incredibly lucrative if Somero's products took off in a big way in China, but I think we have to cautiously assume that this will be difficult.

- On the positive side, changes to the tax law are set to benefit Somero Enterprises Inc (LON:SOM).

Conclusion: Continues to do well, beating market expectations and trading at reasonable valuation ratios. Paul, in the comments below, reckons it is on a 2018 PE ratio of 13x. Definitely worth keeping on our watchlist here.

XP Power (LON:XPP)

- Share price: 3700p (+2%)

- No. of shares: 19.2 million

- Market cap: £710 million

I continue to cover this supplier of power components, despite its increasingly large market cap, as it is regularly requested in the comments.

Also, it's usually performing really well, and we like to highlight good companies here!

It now primarily sells its own products from manufacturing facilities in China and Vietnam. Today's update is in line with expectations.

2017 was a fantastic year for XP, and it was also a beneficiary of exchange rates, so that reported revenues for 2017 are up 29% (22% excluding the exchange rate effects).

The £17 million acquisition "Comdel" is said to have performed in line with expectations, too.

This is one of the few shares which pays quarterly dividends. The next quarterly dividend is expected to be "not less than 28p", which would be a healthy increase on last year's Q4 dividend of 26p.

It's a testament to the stability of cash flow generation that it continues to pay quarterly dividends despite having a small net debt position following the above-mentioned acquisition. The quarterly dividend stream stretches all the way back to 2010.

The outlook is simple and positive, without promising too much:

We are encouraged by the continued strong order intake experienced across the business during the second half of 2017 and the overall book to bill level for the year. We enter 2018 with positive momentum and therefore expect to grow orders and revenue in 2018 above that in 2017.

As a reminder, the book-to-bill ratio is the ratio of new orders on the order book versus the orders which have been billed (or invoiced) to customers. So for companies like this, you can use their order book or the book-to-bill ratio as a predictor of future financial performance!

XP Power's order intake was 31% higher in 2017 versus the prior year, and that's excluding the currency effect. The orders were also noticeably higher than revenues.

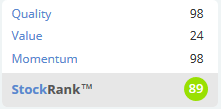

Conclusion - likely to deserve a high rating, especially relative to the current stock market environment with the markets at all-time highs. It has a StockRank of 89, albeit with a weak ValueRank.

As previously noted, this no longer has an A-rating according to the Greenblatt Magic Formula, due to the lower earnings yield (higher valuation). It still ranks as a high B, according to Stockopedia.

It's not really my style to buy into a stock with strong momentum such as this but I think I can understand why it's so highly-rated.

Petards (LON:PEG)

- Share price: 20p (-5%)

- No. of shares: 56 million

- Market cap: £11 million

This tiny stock provides video surveillance and other security-related products for the transport sector and the emergency services, and electronic systems for the defense sector.

The shares are down today as pre-tax profit from trading operations for 2017 will be lower than previously expected, as some work has been delayed into 2018.

Strangely, the actual pre-tax profit, including exceptional items, will be higher than previously anticipated. £700k in cash has been received "to settle a historic matter", and no further details can be given, according to the terms of the settlement. All very mysterious!

£700k is certainly helpful, but has no long-run effect on Petard's valuation, as it's just a one-off payment.

This is an eminently contract-driven business, with big chunky orders and their timing determining the performance in any given period.

Petards now has an order book of £18 million, of which £12 million is scheduled for 2018.

Note that the order book amount doesn't limit the company to only earning £12 million of revenues in 2018. Hopefully, it will earn more than that, with new orders coming in during the year. Revenues in 2017 were £15.6 million, so £12 million wouldn't be a very satisfactory sales figure for 2018.

I've just checked last year's results. Last year, at the equivalent time, Petards had an order book of £20 million, of which £12 million was scheduled for 2017.

So the revenue outlook is, if anything, slightly weaker now than it was a year ago.

Conclusion - I strongly considered this company a few years ago, when the shares looked really cheap, but decided in the end that the chunky orders were just too difficult to predict.

It doesn't have a very good track record in cash generation, and has had to raise money. Last month, it converted loan notes into shares, increasing the share count by 18.5 million (33% of existing shares). The rationale was as follows:

At the present time the Company requires its cash reserves to finance its on-going working capital and investment activities. The Loan Notes mature in September 2018 and the Board does not wish to enter 2018 with the outstanding Loan Notes of £1,479,872 showing as current liabilities as it believes this may have an adverse effect on the perception of the Company from both a commercial and investment perspective.

That problem has gone away, at the cost of significant dilution, and the company should have a very strong cash balance which now includes the mysterious additional £700k.

So maybe now is a good opportunity to look at Petards again? The balance sheet is probably stronger than it has been for quite some time. On the other hand, underlying trading sounds lacklustre. Could be worth further investigation.

Quartix Holdings (LON:QTX)

- Share price: 378p (+5%)

- No. of shares: 47.6 million

- Market cap: £180 million

This is a successful little telematics business serving some 11,000 business customers with 83,000 vehicles in the UK alone (it is also growing in the USA and France). Paul and I have written positively about it in the past, with only some concerns on the valuation.

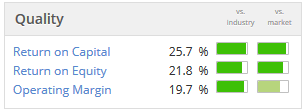

The long-term financial trends are highly attractive. Note the high operating margin of c. 28%:

This update is ahead of expectations: revenue is "slightly" ahead, while profit is "moderately" ahead.

Checking the forecasts, the growth trend in net income is set to have stalled in 2017, which looks primarily due to heavy investment in growing the US business. Quartix technology is tracking 9,000 vehicles in the US, so it's still very small relative to the group as a whole.

Given how much effort has gone in to developing the US business, and the potential rewards if it succeeds, it will be very important to see this bear fruit in the next year or two.

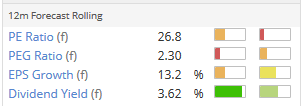

This growth potential is probably what accounts for the hefty valuation attached here:

I must wonder if the share price increase is warranted today, though, since the profit beat is large due to the deferral of product development spending until 2018. These costs will instead weigh on the 2018 results.

The revenue beat is due to one of its insurance customers coming back from a low-cost competitor (Quartix also provides its technology to insurance companies, but deliberately reduced its activities in this space earlier this year, to get rid of low-margin activities). That's a nice sign - it means Quartix is still competitive with insurance companies, even at its higher price point.

Finally: the company has a new CFO, although the previous one will assist his replacement with preparation of the 2017 results. I don't think we need to have any special concerns around this change. The incumbent had been with the company for 10 years. That's long enough!

Conclusion

Having looked at Quartix a few times now, I'm leaning toward the view that its high rating is justified.

The quality of performance in terms of cash generation is undeniable, the risks are mitigated by a diversified customer base, and there is an attractive growth opportunity in the US (this is the greatest source of uncertainty). Telematics is likely to be a growing industry in the years/decades ahead, and while barriers to entry are few, Quartix looks like it has as good a chance as anyone to be one of the winners in the space.

Lighthouse (LON:LGT)

- Share price: 22.5p (+14%)

- No. of shares: 128 million

- Market cap: £29 million

This is a financial advice business which I last covered almost a year ago, with the shares at 14p.

I didn't act on my positive view on it, however, and have missed out on the share price growth since then.

A year ago, it was benefiting from reduced operating costs, higher revenue per advisor and a bonus tax credit.

Today's update says that 2017 was ahead of expectations thanks to "affinity connections" (working in partnership with trade unions and other membership organisations) and the effects of higher revenue per advisor.

This is a very short update, and doesn't quantify anything, but the house broker has nudged up the revenue, EBITDA and PBT forecasts all by about 6%. This puts the shares, after today's rise, on a 2017 PE ratio of nearly 16x, with modest growth expected in 2018.

Conclusion - whereas I was positive on the outlook for shareholders at 14p, I now think these shares are likely to be fairly priced.

Lighthouse does have an interesting new venture in asset management which could boost performance further down the road, so the growth story isn't over here by any means, even if financial advisor growth cools off.

But I'm also a bit unsure about how a long-term competitive advantage can be achieved in this niche. I'd have thought a somewhat modest rating was warranted here, given the employee-intensive nature of its activities. For that reason, I'm a lot more interested in other financial stocks.

Impax Asset Management (LON:IPX)

- Share price: 206.5p (-1% today)

- No. of shares: 128 million

- Market cap: £264 million

This environmentally-focused asset manager keeps going from strength to strength.

I haven't got much more to add on top of what I've said in recent months about it - please see the archives here.

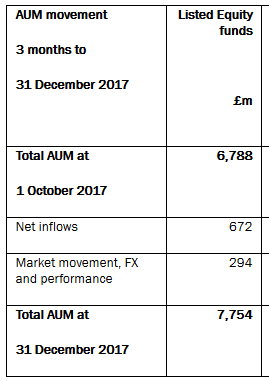

Q1 (ending December, since the financial year-end is in September) was another brilliant quarter for Impax. Inflows to the listed equity funds came in worth almost 10% of the AuM it started the quarter with. Combined with investment returns, we get a 13% increase in total AuM in Q1 alone.

In total, it's a 63% increase in AuM for the calendar year 2017.

The CEO remarked that the "pipeline remains strong", suggesting continued optimism for 2018.

Shareholders can also look forward to the acquisition of Pax World, which is still due to close.

My opinion

Firstly, well done to everyone who took the plunge and has enjoyed a trebling in the share price over the past year.

If I was to be super-critical, I'd point out that the stock does have a concentrated customer base. Its success is due to some large institutional mandates, with the top three customers accounting for nearly 40% of its revenues last year.

So that's the main risk factor here. These institutional mandates can come and go in large chunks. The flows have been excellent at Impax for quite some time now, thankfully.

Even with the increased valuation, therefore, I don't think this stock is massively overvalued. If the Pax acquisition goes well. I can see it growing into the current share price over the next two years.

That's all I've got for today, cheers!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.