Good morning!

I will scroll back and look at events from earlier in the week, once I've covered today's news.

- Thomas Cook (LON:TCG)

- Audioboom (LON:BOOM)

- Miton (LON:MGR)

- Flowtech Fluidpower (LON:FLO)

- GYM (LON:GYM)

Now let's catch up on two stories from ealier in the week:

- 600 (LON:SIXH)

- Mercia Asset Management (LON:MERC)

Thomas Cook (LON:TCG)

- Share price: 8.5p (-36%)

- No. of shares: 1536 million

- Market cap: £130 million

The fat lady is singing for shareholders at Thomas Cook (LON:TCG), where the proposed recapitalisation envisages that "significant amount of the Group's external bank and bond debt will be converted into equity". Commiseration to anyone who is holding this.

We've not written much about Thomas Cook in this report. For me, there were two obvious reasons: 1) until recently, it hasn't qualified as a small-cap, and 2) the writing has been on the wall that the equity was headed for disaster, so there would be little to say.

IG says that these shares are unborrowable, but I know one or two bears who managed to open short positions - well done to them!

Prospects remain extremely bleak, even at 8.5p. If the company avoids administration and has an orderly recapitalisation, the best-case scenario that I can imagine for existing holders is that the fundraise happens at 1p (putting a value of £15 million on the existing equity).

The only reason for creditors and new equity investors to offer crumbs to the existing equity is to get the recapitalisation voted through. But if shareholders reject the recapitalisation, then administration beckons and with it, the likelihood that they get nothing at all.

Needless to say, I reckon these shares are uninvestable - further downside to come of at least 90%.

Audioboom (LON:BOOM)

- Share price: 255p (unch.)

- No. of shares: 14 million

- Market cap: £36 million

New podcast studios open in New York City

Audioboom has opened new recording studios in New York. This confirms what I've said before - the company is transitioning into a content company, rather than a technology company.

It's important for companies to be clear about where their competitive advantage lies. YouTube*, for example, created the best video platform, and ordinary people voluntarily created content for it (eventually with the incentive that they could take a share of YouTube's advertising revenue).

Audioboom has decided to do things the other way around: it is going to incur the cost of content creation, and then hope to cover its expenses and generate profits through advertising revenue. This is more like the business model of a traditional TV or radio network, rather than a cutting-edge technology company.

Miton (LON:MGR)

- Share price: 45.55p (-3%)

- No. of shares: 173 million

- Market cap: £79 million

Miton sees (small) net outflows from both equity funds and multi-asset funds. The overall Q2 outflow is £87 million (about 2% of AuM). This follows a flat Q1.

Investment performance was strongly positive (although this is less interesting, since it's largely beyond Miton's control). The overall result is that AuM increased 8% in six months.

CEO comment:

"In common with much of the industry, we experienced outflows from our UK equity funds reflecting both the wider concerns about the UK market and the divergence in returns from different parts of the market, post the 2016 Brexit vote. Our funds are actively managed and at times their performance will differ from peers and the wider market."

Miton does have some US and Europe funds (e,g, the US Opportunities Fund) but their numbers are being dragged down by the outflows from UK funds.

The UK equity market already struck me as a bit unloved, and announcements like this help to confirm my suspicions.

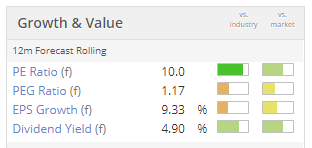

Miton shares pass four of Stocko's screens (including income) and are cheap on a variety of metrics:

My view: There is always a question mark around diversification. Miton now has four distinct investment teams, each managing at least £600 million. The diversification across different teams and geographies seems ok to me, so I think the valuation here is too cautious.

The StockRank is 89.

Flowtech Fluidpower (LON:FLO)

- Share price: 132p (+5%)

- No. of shares: 61 million

- Market cap: £81 million

This H1 update is in line with expectations.

As a measure of cash generation, net debt has reduced by £1.1 million in six months, which is after making a defcon payment. So on a fair underlying basis, the debt reduction is more like £2.7 million. Net debt is £18.8 million.

My overall impression of this company is positive, but my understanding of its activities isn't strong enough to forecast is prospects. Value hunters may wish to sniff around.

GYM (LON:GYM)

- Share price: 250.75p (+3%)

- No. of shares: 138 million

- Market cap: £346 million

This update is in line with expectations.

Everything is on track, with 15-20 gyms to open this year. "Another year of strong profitable growth for shareholders".

Membership numbers are up by 10% compared to a year ago, and average monthly revenue per member is up 5.6%, too - a nice combo. Extra revenue is being picked up from premium memberships and other sources.

This looks like one of the better rollout stories - it reiterates that "strong operating cash flows [are] funding the rollout of new sites".

Memberships can be cancelled at any time, which might make revenues a bit more volatile compared to traditional gyms, but I suppose this is an essential part of the low-cost model!

From Wednesday:

600 (LON:SIXH)

- Share price: 20.3p (1%)

- No. of shares: 117 million

- Market cap: £24 million

This engineering group has had a great year, disposing of its pension scheme and simplifying the financial outlook for investors. It provides machine tools, components and laser systems.

There has also been a huge improvement in operating margin (on an underlying basis, it increases to 8.1% versus less than 3% last year).

65% of revenues derive from the USA, with only 15% from the UK. It has 3 sites in the USA (versus 2 in the UK). I don't think the operating margin improvement came from currency movements - this might be worth checking. The company says most of its purchases are in dollars, too.

Outlook sounds fine:

Despite certain macro-economic and political uncertainties impacting customer sentiment, enquiry and quotation activity remains stable with revenue visibility underpinned by an improved orderbook.

As we've noted before, there are 44 million warrants outstanding, enabling convertible loan holders to convert their loan into shares at 20p each. The loan notes and the warrants expire in February 2022.

So the share count could increase to 160 million, for a market cap of £32 million ($40 million) at 20p.

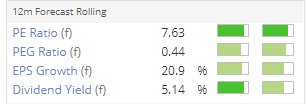

600 says that its adjusted net income from continuing operations this year was $4 million, leaving us with an adjusted P/E multiple of 10x.

The adjustments look reasonable to me - they relate to things like the pension scheme, the convertible loan, changes in tax rates, onerous lease provisions, etc. (see page 42 of the annual report).

Aside from the convertible note, net debt at year-end was $5 million.

My view - This seems to be in good shape and offer decent prospects.

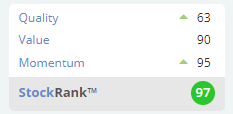

The StockRanks absolutely love it, giving it an almost perfect score:

From Tuesday:

Mercia Asset Management (LON:MERC)

- Share price: 32.7p (-1%)

- No. of shares: 303 million

- Market cap: £99 million

I've not looked at this one before, but it attracted some great comments underneath Tuesday's report.

It's a specialist asset manager, providing equity and debt to businesses in the UK regions (i.e. not in London). It had a noteworth win with Blue Prism (LON:PRSM), which turned out to be a 100-bagger for it.

In addition to its own funds, it manages the best part of £400 million on behalf of third parties.The majority of this is in venture capital, with the rest in private equity and debt.

It uses 3rd party funds at the start of a company's life. The most promising investees are then eventually brought on to Mercia's own balance sheet, after achieving a certain amount of growth and scale (presumably this transfer happens at a fair price to 3rd party investors).

Of Mercia's directly owned portfolio, 37% of the value is in the top 3 holdings: nDreams (17%), Oxford Genetics (11.6%) and Warwick Acoustics (9%). So it's not fully diversified but nor is it very heavily concentrated.

30% of the directly owned portfolio is still classified as "early stage" (maybe pre-revenue), while just 8% has reached profitability. The key sectors are:

Results

- Net assets £126 million, NAV per share 41.6p.

- Operating profit £2 million (from £1.3 million)

- Cash and equivalents of £30 million.

Outlook confident and determined.

Notwithstanding the challenging political, economic and market sector climate, the Group looks forward to this financial year with great energy and purpose. The Board will remain focused on the progress of the largest balance sheet direct investments and the pace and scale at which these are being developed.

My view

This suits me in terms of the sector and I like the strategy - it makes sense. There's plenty of talent in UK regions away from London, and the deals might be available at better prices than you would find in London.

I also like the mix of 3rd party and direct investing, though I need to do more research into how it works.

Profits are currently small relative to market cap, and I think they could be lumpy, depending on the timing of exits from big investees. Of more interest to me is the Net Asset Value per share (41.6p) and whether this is a reasonable estimate. More work is needed to figure this out, but thanks to readers for flagging it to me! I will look into it.

That's it for today, and for the week - thanks everyone!

Have a good weekend.

Thanks,

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.