Good morning from Paul!

All done for the day, and the week. Have a lovely weekend everyone!

Explanatory notes -

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom), Video update of results so far, June 2024.

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Phil Hanson's data analysis measuring performance of our colour-coding system in the SCVRs, from July 2023- Mar 2024 (with live prices). My video explaining/reviewing it.

My other video (June 2024) - How to screen for broker upgrades on Stockopedia.

Companies Reporting

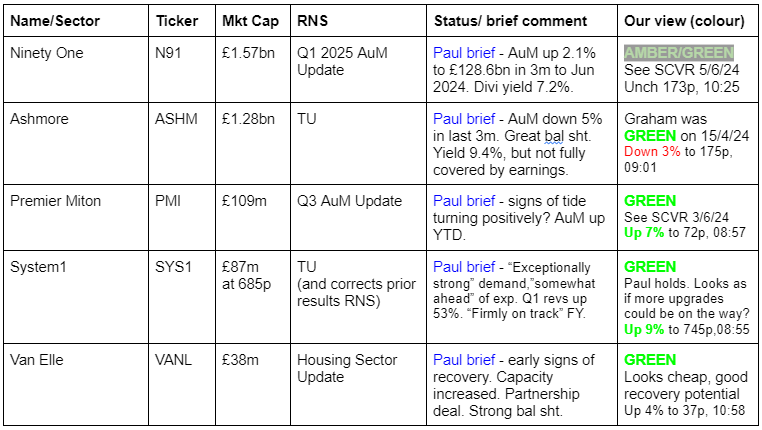

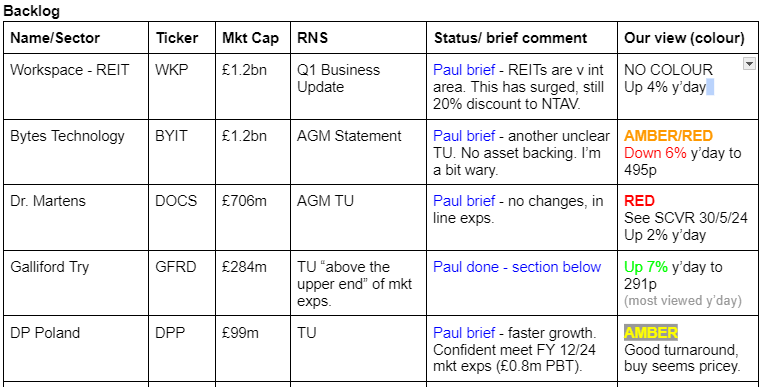

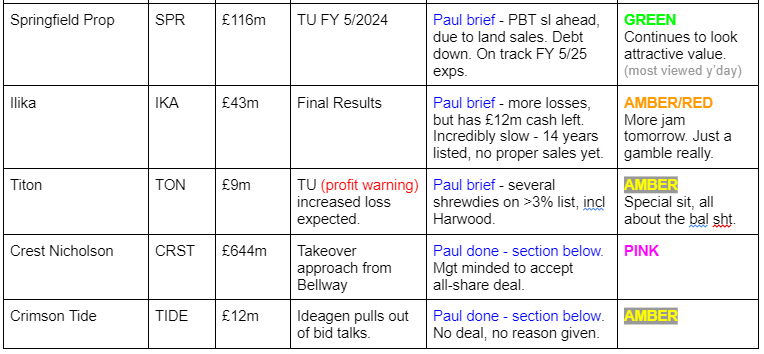

I've set myself a challenge, so see if I can do quickish comments on all the items we didn't cover yesterday - edit: success!

Please note, "Paul brief..." in blue below means that I'm not planning on adding any additional comments.

We're continually tweaking & trying to improve the format of this table below, hopefully people like the changes. It's also really useful for us, the writers, so we can keep track of our work, and prioritise better.

Summaries

Crest Nicholson Holdings (LON:CRST) - 251p (£644m) - Statement re revised (takeover) proposal - Paul - PINK

Looks likely that all-share takeover by larger rival Bellway (LON:BWY) could go ahead, as CRST management have now indicated their support.

Crimson Tide (LON:TIDE) - down 33% y’day to 180p (£12m) - No offer from Ideagen - Paul - AMBER

Takeover talks with Ideagen fell through yesterday, with no reason given.

Galliford Try Holdings (LON:GFRD) - up c.9% y’day (£308m) - Trading Update - Paul - AMBER

Our first look for a while. Good TU yesterday, above top end of market expectations. Very low margins, which it hopes to increase. Cash position is entirely due to favourable timing, with almost nothing in NTAV overall. Ambitious long-term 2030 targets would be bullish if achieved. Overall, I can't get excited, and think it looks priced about right after a big recent rise.

Paul’s Section:

Crest Nicholson Holdings (LON:CRST)

251p (£644m) - Statement re revised (takeover) proposal - Paul - PINK

As usual with takeover situations, forms 8.3 and the like clutter the list of RNSs. Wouldn’t it be good if the Stocko techies could add a button on the news page for each company that gives the option to hide news clutter like this?!

Large housebuilder Bellway (LON:BWY) approached mid-size houseuilder Crest Nicholson Holdings (LON:CRST) about a possible all-share takeover deal in June 2024, which CRST management rejected. Bellway has improved its indicative offer, which is now 0.099 new Bellway shares for each CRST share. Bellway shares were 2644p last night, so that values CRST at 262p (this will obviously vary, as BWY shares change in price).

There’s a small sweetener of a 1p divi that’s already in the pipeline, so not really a sweetener as shareholders would get it anyway, and a 3p special divi on top.

I’m not keen on all share deals, as it can create an overhang of sellers. However, in this case BWY is larger and more liquid than CRST, so it could be a benefit and the CRST element (which has always been accident-prone) could re-rate. CRST shareholders would own 18% of the combined group.

Bellway shares are still at a discount to NTAV, of 0.92x tangible book (per the StockReport).

CRST shares are at a larger discount, at 0.80x, but CRST has had a series of problems, so it makes sense that it would be on a lower rating.

The offer price is a 28% premium to the undisturbed price before deal talks were announced in June.

CRST Directors have confirmed agreement to this potential deal, and would recommend it.

Paul’s view - I can see the logic for this deal, which is subject to various things, so isn’t necessarily going to happen, although I’d guess that it seems likely to proceed. With a chance that a higher competing offer from someone else is possible.

Crimson Tide (LON:TIDE)

Down 33% y’day to 180p (£12m) - No offer from Ideagen - Paul - AMBER

This comes off my pink takeover list, as Ideagen has walked away from talks, with no reason provided.

TIDE reminds us that its recent results showed a return to “operational profitability”, and that it has cash of £2.6m.

Checking those numbers, TIDE made a loss after tax of £(0.3)m for FY 12/2023, improved from £(1.24)m loss in 2022.

Checkit also approached TIDE re a takeover bid with an all-share proposal in June, after previous approaches going back to Jan 2024, which TIDE rejected as being on unattractive terms. I like its balance sheet, which is robust, and included £3.25m cash (and no borrowings) at 31/12/2023. Looks like the cash pile has gone down by c.£625k since the year end, which is concerning.

Paul's view - the mpro5 product at TIDE does look interesting. Management strike me as a little odd. It's been listed for a very long time, and failed to scale up or make meaningful profits.

Galliford Try Holdings (LON:GFRD)

Up c.9% to 296p y’day (£308m) - Trading Update - Paul - AMBER

Galliford Try Holdings plc, the UK construction group, today provides an update on trading for the year ended 30 June 2024. The Group expects to announce its results for the full year on 19 September 2024.

Shares here have had a lovely surge recently, and we’re overdue a look at this one, not having covered it properly for a while.

There’s a positive trend on the broker consensus - although as a very low margin business doing mainly big infrastructure construction projects, profit can be volatile - hence why valuing it on a PER basis could be problematic (PER is better suited to companies with more predictable & consistent earnings) -

Yesterday’s news reads positively, although note that the forecast PBT is only about 1.9% of mid-range forecast revenue. So it wouldn’t take a lot of unexpected costs to badly hurt, or even eliminate profit in future. Do I want to pay £308m market cap for a business that’s only eked out c.£29m PBT in a good year, on c. £1.6bn revenues? No.

Broker update - many thanks to Panmure Liberum, with an update note yesterday. It's raised adj EPS by 3% to 22.2p, a PER of 13.8x. Long-term, it reckons that if the ambitious 2030 targets are hit, then earnings could triple - that's your bull case on this share in a nutshell!

Cash & Balance Sheet - it’s good that they report average month end cash (although average [working] daily cash is the gold standard for reporting), of £155m (with a spike up at the year end to £227m).

It’s worth reminding people that the cash pile comes entirely from favourable working capital timing (getting paid before it pays liabilities). So the net current asset position when last reported at 31/12/2023 was an overall deficit on working capital -

The total balance sheet at 31/12/2023 was £102.3m NAV, reducing to a negligible NTAV of £3.5m after removing intangible assets.

So is this a strong balance sheet? Actually, no. It just benefits from generous payment terms from its customers. This means the superficially great cash position is quite flaky. It could vanish if Govt policy changes, to be less generous in payment terms to contractors. I’m not saying that will happen, just flagging the risk, and that if you’re valuing this share on a low EV valuation, I think you’re making a fundamental error. But it’s open to discussion, different investors see the numbers in different ways.

Targets - this is where it gets more interesting. These latest targets are ambitious, but if they even get close to achieving these 2030 targets, then the share price would surely be a lot higher in 6 years’ time. Trouble is, with plenty of competition, how are they going to win business on higher margins when it's competitively tendered? -

Outlook - it sees plenty of pipeline opportunities. It predominantly operates in public & regulated sectors. Examples are given of projects secured in 2024 YTD (or where it is partly involved so the bigger numbers below won’t all flow to GFRD) -

Paul’s view - I can’t get excited about GFRD, I’m afraid. Very low margin contracting businesses rarely interest me, although as we saw with Renew Holdings (LON:RNWH) (15-bagger from 2010 to 2017!) there can be stand-out performers hidden in the sector. It’s very difficult to find the big winners though, as there’s nothing obvious about them. You only find out after the event that the winners executed well, and did lots of good acquisitions. Meanwhile far more companies in this sector execute badly, and destroy shareholder value. There are plenty that have gone bust over the years. So very much a needle in a haystack type of sector, although I think this sector might be coming back into fashion with some investors - a nice tailwind.

There seems to be a good momentum trade going on here, so it might appeal to some investors/traders.

Balancing up the pros & cons, I can’t get above AMBER, but good luck to holders. It’s trading quite well, has a good outlook and visibility, which has been reflected in a strong share price of late.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.