Good morning, it's Paul here.

General election - Tory landslide

I'm writing this at 00:42, so only a few results have come through so far. However, they're in line with expectations (!!) set by the exit poll which indicates a Tory landslide.

(Update at 05:14 - it's just been declared by the BBC that the Conservatives have officially won, with an overall majority.)

I'm extremely relieved, as the potential damage from a Marxist Corbyn Govt, would have clearly been utterly catastrophic for the economy & our investments, not to mention the country as a whole.

Sterling has strengthened further overnight - which makes imports cheaper (good for non-food retailers).

Removal of the political uncertainty (Corbyn was a bigger fear than Brexit, in my view), means that we could see some terrific rebounds in small cap shares in the next few days. I think we could see a lot of investors deploying their cash piles to buy small caps from the opening bell today.

I can foresee consumer confidence improving now (also good for retailers, and the housing market), plus backed-up deals & capex could now resume. This is the best possible election outcome in my view, and could be really bullish for bombed out small caps. Let's hope I'm right.

Expected timing - I've got to head into London, so this report will be short, and early - should be finished by 9:30 am. Therefore I won't have any time for reader requests today, I'm afraid. Friday is usually very quiet for news, so it shouldn't be a problem.

Update at 09:46 - today's report is now finished.

There are only 2 companies in my universe issuing updates today, so this is the agenda;

Amiad Water Systems (LON:AFS) - profit warning

Hollywood Bowl (LON:BOWL) - final results FY 09/2019

Amiad Water Systems (LON:AFS)

Share price: 220p (pre-market open - indicated opening price down 18%)

No. shares: 22.7m

Market cap: £49.9m

Trading update (profit warning)

Amiad (AIM: AFS), a leading global producer of water treatment and filtration solutions, provides the following update on trading for the year ending 31 December 2019.

I last looked at this company here in 2013, so am a little rusty on it. It seems to have been listed on AIM since 2005, and has a reasonable track record of paying divis. Therefore, I'm a bit more relaxed about it being an overseas company listed on AIM, which often have something wrong with them (hence why I tend to avoid most of them). If something has been around for 14 years, and paid out regular divis, then it's probably OK.

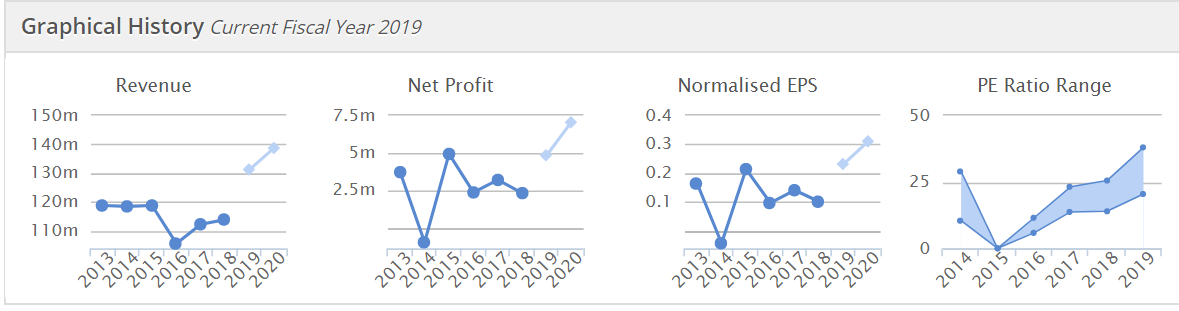

For context, here are the historical graphs;

Clearly, it's a proper business, and usefully profitable. NB the company reports in US dollars.

What's gone wrong today?

- Project delays resulted in 2019 revenues to be "slightly below market expectations"

- Forex movements & sales mix have hit gross margins

- Net profit for 2019 will be "materially impacted" by IFRS 16 - I don't understand the explanation given as to why

Financial impact sounds quite serious, this looks a big profit miss;

As a result of the lower-than-expected revenue, the gross margin pressures and the impact of the adoption of IFRS 16, the Company expects net profit for full year 2019 to be $3m-$5m below market expectations.

Outlook - upbeat, despite the setbacks above. As I don't know this company, I have no idea how much weight to put on the Directorspeak.

Looking ahead, the Company expects to enter 2020 with a higher backlog than at the same point in the prior year and is experiencing encouraging sales activity.

In addition, as previously noted, the Company continues to focus on implementing measures to increase internal efficiency and reduce its cost base.

As a result, the Board continues to look to the future with optimism.

My opinion - I can't find any broker research on this company. It looks illiquid, with a small free float (Stockopedia is showing 27.6%).

There's are unusual announcements dated 11 Sept 2019 and 22 Nov 2019, about a potential equity investment into the company from an existing major shareholder.

I'm not interested in taking this any further, it's just not the sort of thing I would ever invest in.

Hollywood Bowl (LON:BOWL)

Share price: 249p (up 6% today, at 08:17)

No. shares: 150.0m

Market cap: £373.5m

Hollywood Bowl Group plc, ("Hollywood Bowl" or the "Group"), the UK's market leading ten-pin bowling operator, is pleased to announce its audited results for the year ended 30 September 2019 ("FY2019").

A lot of UK-focused shares are up 5-10% today on the General Election result. So it's difficult to ascertain whether BOWL's results have been well received, or whether the share price would have risen today anyway, without results being issued?

I've never covered this company before, but looking at our archive here, Graham has written a lot about it, so I'll have a read of his previous articles to get me up to speed.... and I'm back in the room! Really excellent briefings from Graham there.

Graham's most recent article here on 8 Oct 2019 covers the positive trading update issued just after the year end closed. So there shouldn't be any surprises in today's actual figures relating to the same period.

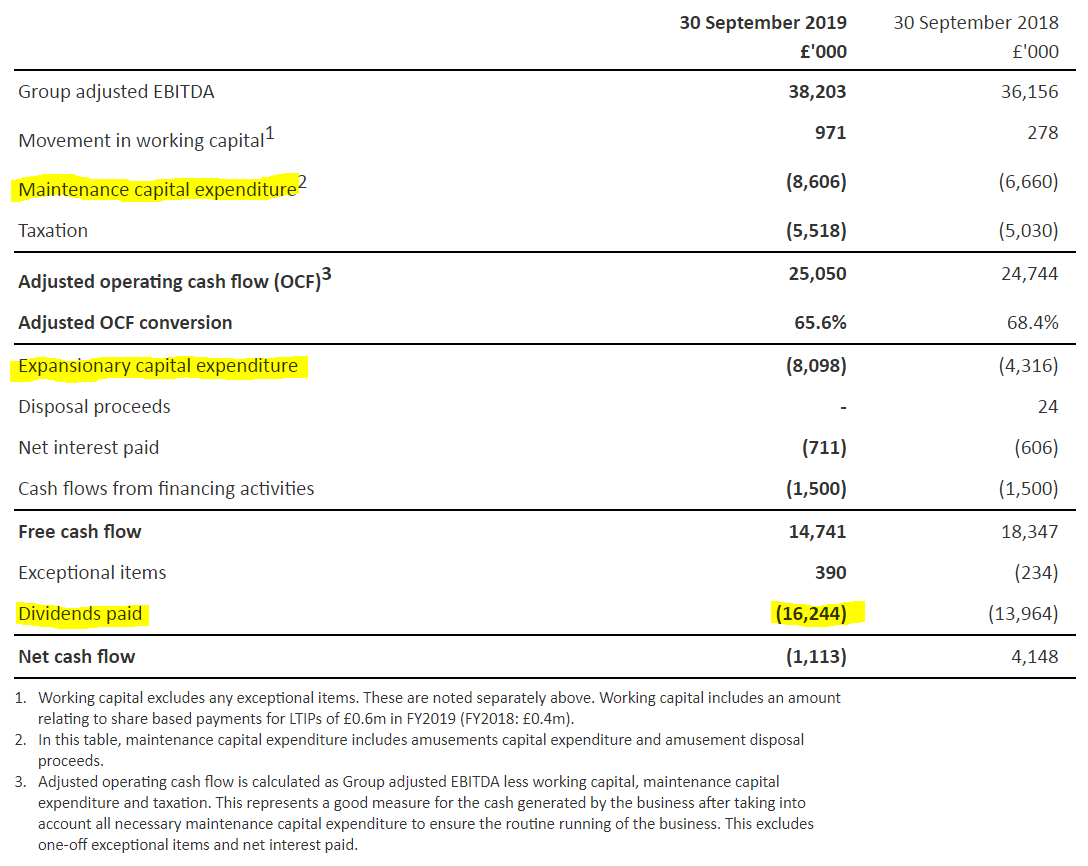

Results - this is a very good business, generating a lovely profit margin, and even better cashflows. It pays out big divis, and is funding further expansion & refurbishments at the same time.

I particularly like this very informative summarised cashflow statement. It's very helpful to split out maintenance capex, and expansionary capex (new sites). This enables us to much better understand the underlying picture;

Balance sheet - Graham has mentioned before that he thinks it could be geared up a bit more with debt. I like it just how it is!

IFRS 16 has not yet reared its ugly head. That will apply from the new financial year which began on 1 Oct 2019.

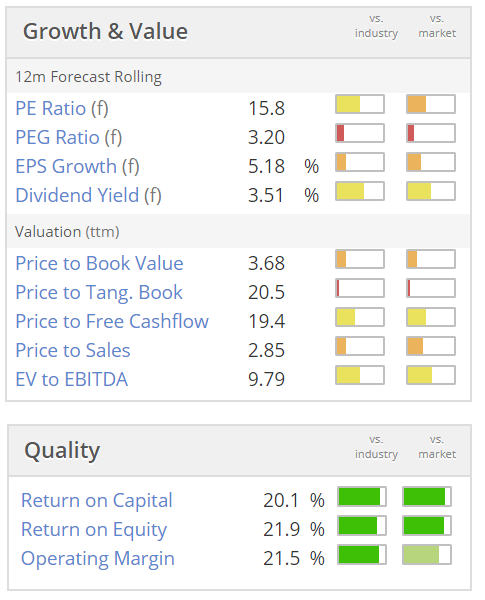

My opinion - I really like these figures. It looks a good quality, growing business, at a reasonable price. Moreover, today's EPS looks like a small beat against forecasts.

The divis are good, with it paying specials on top of the ordinary divis.

Graham made the excellent point that this type of business, being an experience, cannot be disrupted by Amazon with a cheaper online alternative.

Overall, I like BOWL, and think it's worth a closer look.

There is a smaller alternative, which looks to be better value on a PER basis, Ten Entertainment (LON:TEG) - although I didn't like the way management & major shareholder Christopher Mills treated small shareholders there a few years back when it was called Essenden. They bought it from us on the cheap, then re-floated it a few years later at a much higher price. I've got a long memory for things like that, and avoid companies/management which do that type of thing. The worst example of that was FDM (Holdings) (LON:FDM)

The valuation at BOWL doesn't seem excessive by any means, for a growing, highly cash generative business;

That's all there is for me to report on today.

Have a lovely weekend.

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.