Good morning! Let’s see what’s in Tuesday‘s RNS.

We have updates from:

- Hollywood Bowl (LON:BOWL)

- Air Partner (LON:AIR)

- YouGov (LON:YOU)

- Argo Blockchain (LON:ARB)

Hollywood Bowl (LON:BOWL)

- Share price: 231.6p (+2%)

- No. of shares: 150 million

- Market cap: £347 million

Hollywood Bowl Group, ("Hollywood Bowl" or the "Group"), the UK's largest ten-pin bowling operator, is pleased to announce another strong performance for the year to 30 September 2019.

PBT is set to come in "slightly ahead of market expectations".

The prior forecast for PBT was £20.9 million.

Like-for-like revenue growth is 5.5% - not bad. It's easy to forget that like-for-like expenses tend to increase as well, perhaps by 3% or so. So the LfL revenue growth should be more than enough to offset that.

Checking the archives, I see that rival company Ten Entertainment (LON:TEG) reported LfL sales growth of 7.4% in H2. As a sector, bowling is clearly doing rather well this year!

Capital return

I wonder if management of BOWL read this report? Either way, they seem to agree with my view that the company is stable enough to carry a smaller equity cushion (e.g. see my remarks here and here and here).

The company's net debt at March 2019 was just £5.3 million, versus operating profit of £16.8 million in the previous six months. That debt figure was after payment of special dividends. So it was virtually debt-free, relative to profits.

Therefore, I can support this stance:

The Board remains committed to investing in the business while considering the appropriate use of surplus capital to enhance shareholder returns... Therefore, in line with the Group's capital allocation policy, the Board is considering returning additional capital to the Group's shareholders.

It's a cash-generative, successful business. So long as its sites remain well-invested, and there is no financial stress, I don't see why anything left over shouldn't be sent back to shareholders.

BOWL management have already demonstrated their shareholder focus by paying a couple of special dividends, but maybe they can push the boat out a little bit with their next move?

I suppose we do have to take the recession risk into account. The question is whether the company would be able to weather an economic storm, even if it was carrying a larger debt load?

Checking the historic figures, I see that it was unprofitable from 2013 to 2014, which was before the company listed.

My instincts are that the company would be OK in a recession, since bowling trips are a cheap form of family entertainment and are easily justified if foreign holidays becomes less affordable. But this is a judgement call.

My overall stance is that I continue to view the company positively, and the StockRanks agree, calling it a High Flyer.

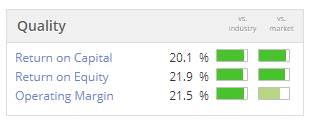

Quality metrics are great:

Note however that these mertics are before the implementation of IFRS 16 in the company's financial statements. I expect that these metrics (ROC, ROE) will deteriorate for BOWL and for all other companies with substantial leases, after the implementation.

At the H1 results, the company confirmed there will be a big impact:

"IFRS 16 [is] expected to have a significant impact on reported assets, liabilities and the income statement of the Group..."

While the value of the company won't change, the capital-intensive nature of what it does will become more apparent, as it will for all companies which lease property.

Air Partner (LON:AIR)

- Share price: 83.6p (-9%)

- No. of shares: 52.9 million

- Market cap: £44 million

Half year results for six months to 31 July 2019

Thanks to Tamzin for posting this video (and all her other videos) in the comments.

Air Partner providers charter aircraft and a host of related services.

These results show that "underlying" PBT is down 29.5%, while statutory PBT (i.e. the PBT without any adjustments) is up 6.8%.

Let's unpack this.

- gross profit is only slightly down, at £17.2 million

- In relation to the fall in underlying PBT, the CEO says in the PiWorld interview:

"one of our suppliers in Europe, which was a one-off for this year, was unable to advance with capacity, and that meant we had to look at alternatives for supply".

I've been searching the RNS for more detail on this supply factor, and this is the best I can do. Under "Risk Factors", the CFO says:

Economic uncertainty affects corporate, government and individual customers and affects the quality of supply of aircraft as operators consolidate or leave the market. These trends are outside the Group's control, but the strategy remains to diversify the addressable market and broaden the customer mix.

In addition to the "lack of supply", we also have higher expenses from recruiting activity (Board and management team) and new offices in Singapore and Houston. The company is bullish that these higher expenses will in turn drive growth, in future periods.

Charter

This had a "mixed performance", with some bright spots but also some negatives:

- "a drop in tour operations activity in France, a reduction in flying by a key customer in the UK, as well as small decreases in activity in the US and Italy".

As a result of these challenges, gross profits in Charter fall from £8.4 million to £7.2 million.

Other sources of gross profit:

- Ptivate jets increased to £6 million.

- Freight increased to £1.9 million.

- Consulting and Training increased to £2.1 million.

Statutory PBT increased, and this is due to the absence of all the exceptional costs incurred last year - mainly accounting review costs and abortive acquisition costs.

This gives us a much cleaner result for underlying PBT, which is always something that I like to see.

I think it's fair to say that the accounting problems are behind AIR now.

Outlook statement

The company outlook is in line with expectations although the market doesn't fully agree, having marked the shares down by over 5%:

We are encouraged by the progress we have made in what has been a difficult first half of the year for the aviation industry. In particular, the growth in Consulting & Training and the success of our US business clearly demonstrate that we are delivering on our strategy to diversify revenues across the Group.

Acquisitions are being assessed, and the company has net cash of £4.3 million, so it should be in a position to make a purchase.

I note however that the company had drawn down £5.5 million under its RCF, as of the balance sheet date. This suggests to me that it needs to use a lot of cash to fund its daily operations (since otherwise there is little reason to use an RCF which also being in a net cash position).

My view

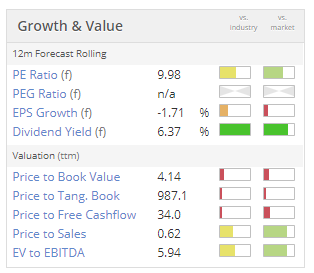

On valuation it does look cheap:

But I don't have a strong view on its prospects or its competitive positioning. As regular readers will know, I tend to avoid airlines and I also tend to avoid companies in the "support services" space.

Air Partner is arguably in both of these categories.

Having said that, the profits and dividends are real and it's showing a lot of ambition for the future.

To me, this situation is finely balanced and I'm neutral.

YouGov (LON:YOU)

- Share price: 535.5p (-0.5%)

- No. of shares: 105 million

- Market cap: £561 million

Full year results for the year ended 31 July 2019

Larger than we normally cover, but I do find this one intriguing.

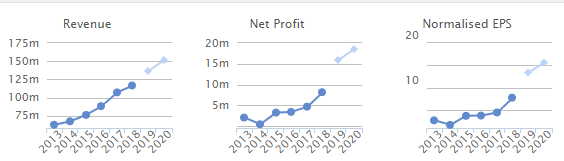

It has always looked very expensive, but the high rating turns out to have been justified by excellent earnings momentum.

Today's results show statutory PBT up by an amazing 65% to £19.5 million.

The company has benefited from very few "exceptional" items this year, only £1 million of them versus almost £5 million last year.

Net cash is an admirable £38 million.

Outlook is more important than historical results:

Trading since the year end has continued positively. While Brexit continues to create uncertainty in the economic and political environment, especially for UK and European businesses, the international spread of our revenues, with a significant and growing US weighting, cushions us from volatility. In the context of both the macro-environment and our own plans to accelerate our investment in technology and geographic expansion, we remain confident in our growth prospects for the year and beyond.

Business plan

The company has succeeded in its five-year plan to treble profits, and it has done this by focusing on scalable products with good operational leverage, rather than the custom research projects it traditionally focused on.

Scalability is a feature we should be looking out for in our investments - businesses and products which can grow without any additional fixed overheads.

In YouGov's case, it worked on creating products which many different customers could use, rather than continuing to focus on the one-off projects which had to be delivered on a case-by-case basis.

In its own words:

"The strategy was to focus on growing our Data Products and Data Services divisions, which have operational leverage, even though it meant withdrawing from custom research projects that, while profitable, did not benefit from the strengths of our unique connected-data system. Our investment in technology and products during the last five years has created a platform for scalable profit generation and has enabled our business to consistently deliver results ahead of the market."

Looking ahead, the company's new growth plan is again very challenging. The strategic pillars t will focus on are:

- integrating and adapting its huge data bank to allow it to be used as a research tool in lots of new and different ways.

- creating audiences for advertisers and selling to these audiences ("ethical activation")l.

- building resources which can be used by the general public, thereby turning its own website into an internet destination.

Cash flow has improved (this was previously a bit of a concern, due to the buildup of intangibles, if I recall correctly).

Net cash generated from operating activities is an impressive £30.75 million.

Scrolling down to the footnotes, I see that the company capitalised £4.8 million of internally developed software, while writing off £4.6 million through an amortisation charge.

Similarly, it spent a bit more on developing its "consumer panel" (the people who respond to surveys) than it wrote off.

The discrepancies aren't huge, so I'm inclined to give the company the benefit of the doubt.

Balance sheet - the company does have a little bit of balance sheet value: £108 million in net assets, or £10 million if you exclude intangibles, PPE and other non-current assets.

My view

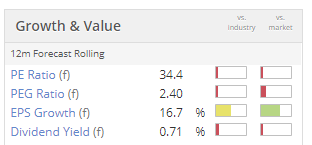

I'll probably still be watching this company from the sidelines when it has a £1 billion market cap, rather than participating in the rise.

It's just too hard to pay up for a company at this sort of rating, without a huge amount of conviction:

Argo Blockchain (LON:ARB)

- Share price: 8.5p (+2%)

- No. of shares: 294 million

- Market cap: £25 million

Revenues increase 75% in Third Quarter

This quirky little bitcoin operator changed its strategy from one which made no sense ("mining-as-a-service") to something much more reasonable (mining for its own account). Under this new strategy, it might actually succeed!

This update confirms £3.6 million of revenue from crypto mining in Q3, "at a mining margin of approximately 73%" (I guess this is the gross margin).

It is seeking to double the number of machines being used for production, adding 6,000 on to the current fleet.

Tactical change - it is going to regularly exchange crypto for fiat from now on, "to avoid additional exposure to Bitcoin pricing". Sounds reasonable. This will (marginally) reduce the volatility of its results.

My view - with its new strategy, and this tactical change, I think it's possible that this is a decent vehicle for PIs to gain crypto exposure (if that's what they're looking for).

For those who already trade shares, it might be simpler to buy a stake in this, versus using some other online wallet or trading facility.

If crypto coins turn out to be the investing equivalent of rat poison (Buffett) or "turds" (Munger), then shares in Argo can't be worth much less than the coins themselves will turn out to be.

Companies saved for later in the week, if things quieten down: Time Out (LON:TMO), Franchise Brands (LON:FRAN) Stock Spirits (LON:STCK), Motorpoint (LON:MOTR).

Thanks for all the comments and suggestions, as always.

Best regards

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.