Good morning! Welcome to the Small Cap Value Report, our daily analysis of small cap share news.

Some interesting stories out this morning:

- Patisserie Holdings (LON:CAKE) - shares and the CFO suspended as the company investigates accounting irregularities.

- Sosandar (LON:SOS) - placing and half-year trading update

- Walker Greenbank (LON:WGB) - interim results

- Miton (LON:MGR) - solid inflows

- Vertu Motors (LON:VTU) - interim results

- Hollywood Bowl (LON:BOWL) - trading update

Market Volatility

A quick word on "market volatility" (often a euphemism for market weakness, but there we are).

The FTSE 100 is testing support around 7200 as I speak. We have made a fresh six-month low.

Overall sentiment in the market has been a frustrating headwind for many investors. The measure that I particularly track is the FTSE All-Share Total Return Index: this is down 2.7% year-to-date.

Within that, the more domestic-focused FTSE 250 Index has under-performed (total return is down 3.6% year-to-date). I get these numbers direct from FTSE.com.

Looking at the junior market, where many private investors are active, the AIM All-Share Index (AXX) has had a horrific sell-off over the past five trading sessions.

It closed at 1092 on October 3rd. Only a week later, and it's at 1019: a sharp, fast fall of some 6.6%.

Some of the most popular and higher-valued AIM stocks have had a particularly nasty week:

- ASOS (LON:ASC) down 13%

- Burford Capital (LON:BUR) down 20%

- Fevertree Drinks (LON:FEVR) down 23%

- Abcam (LON:ABC) down 13%

- Blue Prism (LON:PRSM) down 17%

- Keywords Studios (LON:KWS) down 17%

- Learning Technologies (LON:LTG) down 21%

- First Derivatives (LON:FDP) down 30% (with the help of a short attack)

- accesso Technology (LON:ACSO) down 14%

My own portfolio hasn't gone unscathed. While I've had some success with Volvere (LON:VLE), my other large holding Burberry (LON:BRBY) has fallen by 13% over the past week.

What to do? I'm not the first to say this by any means, but it's really important to be set up in such a way that you can psychologically handle the downswings and the prospects of a bear market.

For some people, that means exiting their positions at trailing stop-losses. For me, it means gradually increasing my equity exposure as markets weaken. I remain a net buyer of equities and have 20% of my portfolio sitting in high-yield fixed income funds, which I will switch entirely into equity if prices suffer a proper collapse.

If you're interested in following the macro winds, it's essential to keep an eye on the Federal Reserve, which appears determined to continue raising interest rates (this makes sense to most economists while the US economy has above-target inflation and extremely low unemployment).

The US 10-year yield has broken higher to 3.2%, a level not seen since 2011.

In my view, we now have the key ingredients for a bear market: growing fatigue and anxiety from enterprising investors with respect to the valuations of speculative tech companies and small-caps, plus a withdrawal from the market by risk-averse investors who can now get the yield they want in the bond market.

Consider for example this story by The Times on British American Tobacco (LON:BATS) (where I have a long position). There are many reasons people might want to sell British American Tobacco (LON:BATS), but the 6% yield is not to be sniffed at. The problem is that when you have holders who are income seekers at heart, they will some day compare the stock with a bond and say "why take a chance"?

For those who have the stomach for it, I think the best course of action is to embrace corrections and bear markets as representing those periods of time when Mr Market gets pessimistic about many more stocks than he usually does, and treat it as an opportunity. Fortune favours the brave!

Patisserie Holdings (LON:CAKE)

- Share price: 429.5p (suspended)

- No. of shares: 100 million

- Market cap: £446 million

I'm sorry for the bad luck of anyone who was holding this.

Sky News broke the story last night, and it has been confirmed by the company today. It would appear to have caught everyone completely by surprise, not least Luke Johnson (owner of 39 million shares):

"We are all deeply concerned about this news and the potential impact on the business. We are determined to understand the full details of what has happened and will communicate these to investors and stakeholders as soon as possible."

There are "significant, and potentially fraudulent accounting irregularities" at the company and its true financial position is unknown.

It's a stock I've looked at from time to time, and never noticed any red flags. As has been mentioned in the comments, maybe its excellent financial and operating performance has been almost too good to be true?

Maybe, but I don't think we should invent reasons for concern if we genuinely can't find any. I viewed the company as a high-performing roll-out with a correspondingly high valuation, with the potential for shareholders to be rewarded if the roll-out continued to go well.

The CFO has been suspended but has not been charged or accused of any malfeasance. It's still too soon to know what has happened.

CAKE had £28.8 million of cash at March 2018 according to the interim results. The Sky News story says "there were suggestions that the hole in the accounts could be £20m or more".

If I had to guess, and it would be a complete stab in the dark, I would go along with the idea that the cash pile has been stolen from, and that steps were taken to hide its effects from the accounts. That would be a relatively simple explanation. Please bear in mind that it's pure speculation on my part.

And it's hard to believe that anybody would take part in such activity - like the Madoff scam, it's inevitable that it would be found out eventually.

The good news is that £20 million is not such a huge sum in comparison to yesterday's market cap, that CAKE shareholders such as Luke Johnson may be willing and able to support the company if it needs a fresh injection of funds, and that it might still be possible to recover some of the missing funds.

We will just have to wait and see. This story isn't over by a long shot.

2.15 PM UPDATE: BREAKING NEWS

Bombshell RNS that HMRC filed a winding-up order again CAKE's principal trading subsidiary on 14 September (a winding-up order is when a creditor hasn't been paid and asks the court to liquidate the debtor).

The winding-up order was publicly advertised on 5 October. The Board of Directors has found out about it today.

This is very, very strange. Fortunately, the amount owed is not very large in the grand scheme of things: £1.1 million. But it says that things have been hidden from the Board/top management.

I would be surprised if the company was liquidated over a £1 million debt. Unfortunately, we have to presume that there are other skeletons in the closet. And it's not actually clear that the company has £1 million spare at this point.

Sosandar (LON:SOS)

- Share price: 37.5p (+3%)

- No. of shares: 107 million (pre-placing)

- Market cap: £40 million

Let's talk first about the trading update from this early-stage online fashion retailer.

The "official" revenue forecast being shown by Reuters for the current financial year (ending March 2019) has been stuck at £3.9 million for some time. Commentators such as our very own Paul for example, who owns SOS stock, has previously called for something more like £4 million - £5 million (see his July analysis).

Today we learn the company expects to have made revenues of £1.8 million in H1. Merely repeating that performance would of course give us £3.6 million, but there should be a healthy dose of growth on top.

Customers have been "repeat ordering more frequently and with a higher basket size" - excellent. Growing trust and loyalty to the company.

Returns levels have increased, and this is attributed to the higher-than-expected rise in customer acquisition and the high demand for dresses in Spring/Summer. I'm trying to figure out how this makes sense.

If the customer base is more weighted toward new customers than the company expected it would be, then the returns levels will also be higher than expected (because as the company says, new customers need to find their correct fit).

But then surely the company has more repeat customers now than it did last year, so all else being equal the overall trend for returns should be lower?

I guess the Spring/Summer factor with this year's heatwave could be responsible for the overall trend being higher. Let's continue to keep a close eye on this metric. It has increased to 52%.

Growth rates remain extremely high as the company grows from a low base, and the outlook is confident.

Placing

As predicted by bears and flagged as a risk by many including myself, the company has needed to raise more capital.

It's quite a modest level of dilution, thankfully. We have £3 million (gross) raised by the issuance of 9.4 million new shares at 32p. So existing shareholders are diluted by less than 10%. The discount to last night's share price is not too large, either.

I will need to see the H1 accounts before I can make any guesses as to when or if the company might need to raise fresh funds. I would assume that it is sorted for at least 12-18 months.

My view - an interesting share but it's still too early-stage to fit into my own investing strategy. I also suspect that it would be possible for a new entrant to build something of equivalent value for less than £40 million, rather than buying shares at this valuation.

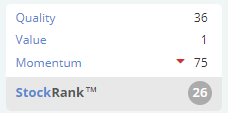

The StockRanks share my caution, classifying it as a Momentum Trap and giving it a Value Rank of 1.

If you pick wisely, then buying into early-stage companies such as this can be incredibly rewarding. It's just not very easy to pick the right ones!

Walker Greenbank (LON:WGB)

- Share price: 73.5p (-1%)

- No. of shares: 71 million

- Market cap: £52 million

It's a depressing results statement from this interior furnishings group, as almost everything is still going backwards.

A quick comparison with Sosandar feels appropriate, to show the premium that the market places on growth.

WGB has achieved a sales number c. 30x the sales achieved by SOS, and its H1 operating profit is worth more than half the total gross funds which the stock market has raised for Sosandar so far, including today's placing. WGB's H1 operating profit is in the ballpark of SOS's forecast full-year sales.

And yet their valuations are comparable. WGB's market cap is only c. 20% higher than the pre-placing SOS market cap.

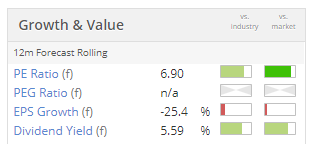

It has the standard characteristics of a value stock: low P/E, high dividends and falling earnings.

Board changes - significant changes at the top of the company. The CEO steps down, and a NED becomes Interim Executive Chairman.

Outlook - in line with expectations for the year ending January 2019, subject to the sales trend continuing to get "less bad". Sales continue to fall, but are falling less quickly than before!

Licensing income - the only really bright spot, this income stream increases 35% to £2 million. As a general principle, I love licensing income because it requires no capex and can be thought of as "free income". The company affirms that it is "high margin and an increasingly significant source of Group profits".

My view - once you get over the fact that overall sales trends are dispiriting, it starts to look like an interesting share. The balance sheet seems ok with net tangible assets of £34 million and a modest debt load. So I reckon that this is worth looking into in a bit more detail, especially for value hunters.

Miton (LON:MGR)

- Share price: 67.4p (-1%)

- No. of shares: 173 million

- Market cap: £116 million

Time for the regular quarterly update from Miton (LON:MGR). This is Q3.

The trends here are beautiful: net inflows remain high at over £300 million, consistent with previous quarters.

There is a lag between inflows and revenue as fund management fees are typically generated over time, not just at the point of inflow. Prospects look superb as September 2018 AuM is 38% higher than September 2017 AuM.

It's a gap in my portfolio that I don't own any good, traditional fund management companies such as this one. I've tried to be too clever for my own good, and am waiting for sentiment to turn and we have an equity bear market before I pick them up.

Miton's CEO is aware that things may turn soon:

....we are well-placed for an environment where returns on all asset classes may be challenged by the end of quantitative easing and rising interest rates."

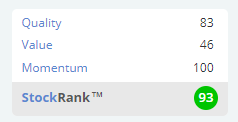

Even with the assumption that a bear market is due and is imminent, I suspect that MGR shares offer reasonable value at these levels:

Vertu Motors (LON:VTU)

- Share price: 39p (-4%)

- No. of shares: 385 million

- Market cap: £151 million

This is the fifth or sixth largest motor retailer in the UK, operating across a range of brands.

Sales are up 8% LfL but gross margins have slipped a little and adjusted PBT is down 13% to £18 million.

Tangible NAV is reported at 45.9p, so the shares are offering a discount to this.

Outlook is in line with recently revised expectations. Very helpfully, the company discloses that it believes the adjusted PBT forecast for the full year is £22 million.

There is a worrying issue in the broader market as total UK vehicle registrations fell by a massive 20.5% due to EU regulations on emissions.

I didn't realise we were in for such a regulatory shock. Searching around, I see that Audi's European sales fell by 56% in September. VW sales were down 46% in Germany. Total new car registrations dropped by 17% in Spain..

The company is also battling with the Sterling exchange rate, and that factor in combination with the emissions rules means there is a shroud of uncertainty hanging over supply.

Despite the gloom, the company thinks its shares are undervalued and has also announced a buyback for up to £2 million.

My view - much like the company, I reckon that VTU shares are probably undervalued. Holding it through these worrying times is likely to be unpleasant and difficult except for the very patient, though. And it's not something I would add to my own portfolio, simply because I Iook for businesses which enjoy greater differentiation versus their peers than car dealerships can typically achieve.

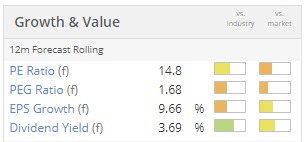

The value metrics are undeniably very nice. See the discount to tangible book:

Hollywood Bowl (LON:BOWL)

- Share price: 209.5p (+4%)

- No. of shares: 150 million

- Market cap: £314 million

A "robust performance" and earnings for the year ended September 2018 to be in line with expectations.

Good cash generation and returns, so "the Board is considering returning additional capital to the Group's shareholders" - excellent.

It's a brief update but I retain my very positive impression of this company. I suggested last December that the business might be predictable enough to carry a higher debt load and boost shareholder returns by carrying less equity. That's always a risky thing to say but it appears that the company itself may agree.

I've developed enough trust with this share that I could consider adding it my portfolio, next time I'm shopping:

All done for Wednesday. Cheers!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.