Good morning,

Thanks for the comments, I'm planning to cover at least the following:

- Sosandar (LON:SOS)

- On The Market (new float)

- Photo-Me International (LON:PHTM)

- Hollywood Bowl (LON:BOWL)

Will then assess what to cover after that, possibly Marlowe (LON:MRL).

Best,

Graham

Sosandar (LON:SOS)

- Share price: 18.4p (-3%)

- No. of shares: 107 million

- Market cap: £20 million

This is an online womenswear brand which recently (last month) reversed into a shell on AIM. Adam Reynolds, who has been involved in similar deals to bring shells back to life, was Chair of the shell prior to the deal.

There are some great comments on this in the thread below, including one by Paul. So on the basis that Stockopedia is a "hive mind" of sorts, producing far more intelligence than any one individual could ever produce, I strongly recommend that you check out the comment thread!

Today's update is brief:

Sosandar plc (AIM: SOS.L), the online women's fashion retailer, is pleased to announce that trading since 31 August 2017 to the end of November has exceeded management expectations. The new funds raised at the time of the reverse takeover on 2 November 2017 are enabling the business to acquire larger and wider ranges of product and has also enabled the business to accelerate its media and marketing activities. Investment in new marketing channels has yielded strong results and will be further expanded in order to drive new customer acquisition.

I've taken a quick look at the Admission Document on the company's website. Sales for the five months ended August 2017 were c. £240k with cost of sales £123k.

Given how early-stage it is, this is almost purely a bet on the management team. The joint-CEOs are the founder and former editor of Look magazine. You can imagine how their experiences at Look might be very helpful and give them a fresh approach to online retail.

It's a bit too early-stage for my portfolio, but it's probably worth taking a look at this for anyone interested in ASOS (LON:ASC), Boohoo.Com (LON:BOO), etc, as another competitor in the space.

The strategy in the admission document is as follows:

Sosandar is an online womenswear brand specifically targeted at a generation of women who have graduated from younger online and high street brands, and are looking for affordable clothing with a premium, trend-led aesthetic.

So it isn't competing head on with "price-led" retailers, but it still wants to be affordable. Fair enough.

Since it's only selling its own-brand product, and not competing on price, the most important thing is that the brand itself is unique and memorable.

I'm certainly not the person who would be able to figure that out on my own, so I'll leave this for now and defer to those who might have keener insights.

-----------------------

Paul writes in the comments (please note that he owns shares in this company):

Sosandar (LON:SOS) - "Trading update makes generally positive noises, but gives no figures. Since the share price already has considerable expectations built into it, I think today's news won't necessarily move the share price up. It should however give holders comfort that things are going to plan (or rather, better than plan), hence preventing the share price from going down.

The only forecasts I have are a detailed note from Turner Pope from Aug 2017, which is the broker that floated Sosandar. This shows forecast revs of £1.0m this year 03/2018, rising to £3.3m 03/2019, and £9.4m 03/2020.

PBT is forecast at -£1.9m this year, followed by -£1.4m 03/2019, and a small maiden profit of £0.1m in 03/2020. Whilst these figures may look unexciting in terms of profitability, they look very exciting in terms of revenue growth. The market would extrapolate out the rapid growth rate, and value the shares on a racy multiple. I can foresee a £50-100m valuation within a year or two, if growth is strong. That may sound crazy, but we're in a bull market, where online fashion businesses that are demonstrating strong growth are given hefty valuations. Just look at the bonkers valuation given to hapless Koovs (LON:KOOV) a while ago, even though it was generating tiny revenues and huge losses.

SOS is well-funded for now, and exited the IPO process with net cash of about £7m, I believe. So it shouldn't need to come back to the market for more cash for the foreseeable future.

SOS is now one of my largest personal holdings, because I'm backing the experienced, and capable management. If you look at what they achieved in 1 year from startup, it's astonishing. Hence why I think the premium valuation is justified.

Note that there is about 18% potential dilution from share options for the founder management, as they had been diluted down to only 5% each from previous funding rounds, and the key people need to be incentivised. Not ideal, but I can live with it. Critics have said that there's something wrong with Sosandar, because management got diluted so much in the early stages, compared with say Boohoo.Com (LON:BOO) founders who retained almost 100% control before floating. What these critics overlook is that BOO was funded by an existing, highly profitable wholesale business (called Jogo/Pinstripe). So the BOO founders already had pots of money, so were able to fund BOO from scratch without dilution. Founders of Sosandar just weren't in a financial position to do that.

Anyway, time will tell whether this is an inspired stock pick, or bull market froth!"

END.

On The Market

I'm not sure why this has taken quite so long, but OnTheMarket today reminds us that it intends to raise £50 million and float. I first covered it in August, when it made the initial announcement.

As previously announced on 4 August 2017, OnTheMarket plc will seek to offer a minority stake to investors as part of the IPO with OnTheMarket's entire issued and to be issued share capital being admitted to trading on AIM. The objective is to raise approximately £50 million of new equity capital which will be used to fund the growth of OnTheMarket, already the third biggest UK residential property portal provider in terms of traffic.

This is the property portal owned by agents, who want to take control away from Rightmove (LON:RMV) and ZPG (LON:ZPG).

I can understand why they would want to do that, but I continue to lean toward the view that there is only space for at most two highly profitable companies in this space. Due to the network effects of this kind of website, smaller portals are of much lower value. Think Google or Facebook versus their nearest competitors in search or social networking! OnTheMarket is still much smaller than both Rightmove (LON:RMV) and ZPG (LON:ZPG).

Also, the expertise to run a web portal is very different to the expertise required to run a property agency, so I don't see why OnTheMarket would be any better than its larger competitors.

The only way I could see it working would be if the agents acted in unison to keep their listings off of both of the big portals. It tried that initially, and is still trying to incentivise agents to focus on their OTM listing and to hold on to their OTM shares:

A key part of the Group's growth strategy involves implementing appropriate incentives for agents to make a long term commitment to list their properties on the portal and the rapid building of its agency branch base. This will be achieved in part through offering equity participation following Admission to selected new agents alongside long term listing agreements, with arrangements in place to restrict agents from the short term sale of any such shares and to align their interests as shareholders with the success of the Group.

There is logic to this, but won't agents be highly tempted to sell their shareholdings, whenever they need some extra cash? Convincing large numbers of estate agents to be far-sighted and to hold on to valuable shares for the long-term, rather than liquidating them in the short-term, sounds very difficult to me.

It's a fascinating question but I'd be much more comfortable holding shares in Rightmove (LON:RMV), which has a unique position in the domestic market and has excellent economic characteristics (albeit that it is not cheap):

Photo-Me International (LON:PHTM)

- Share price: 180.75p (-3%)

- No. of shares: 376.5 million

- Market cap: £680 million

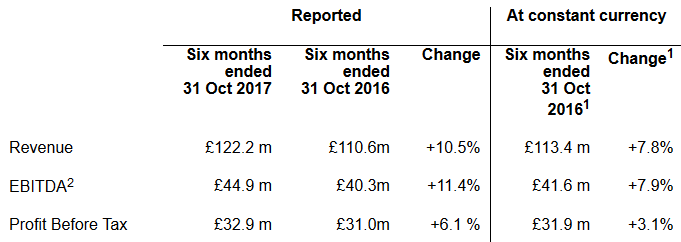

This vending machine operator (photo-booths and laundry units) issues results for the six months to October 2017. The results are in line with expectations.

The constant-currency movements are very important since Photo-Me earns only 27% of its revenue from the UK & ROI segment. Most sales are from Continental Europe, particularly France. So I would focus on the percentage changes on the far-right hand side of this table.

I've written positively about this company in the past, on the basis that it was being managed well, was shareholder-oriented with heavy dividend payments from very healthy cash generation, and earned impressive margins.

There has been a worry about people taking selfies for passport photos and driving licenses instead of using a photo-booth. The response has been positive, as the company works with various European governments to encourage the use of photo-booths rather than self-taken pictures.

E.g. today's report informs us of the following:

In the UK, positive conclusion of discussions with Her Majesty's Passport Office and of the testing of the new online passport service; E-passport photobooths being rolled out across the UK, from mid December 2017.

With the photo-booth sector being mature and low-growth, emphasis for growth is now firmly on the laundry side of the business. The number of laundry units is up almost 50% over the past year, and revenues per mature unit are rising, too.

While the company offers full-services launderettes and B2B laundry services, the main growth element here is the self-service unit where small business and individuals can wash larger bundles than domestic washing machines can handle.

The company defines its "segments" as its different geographical regions, which makes it a bit trickier to get detailed financial info on how the laundry service alone is performing. "The Group is not managed around product lines", but instead around geography. We do know that laundry revenues for the period were £17 million, now material in the context of the group as a whole.

The outlook statement is good. No big surprises, as the growth strategy is executed:

In the medium term, it is anticipated that laundry revenue will grow significantly as a proportion of the total Group revenues and satisfactory progress is being made towards our target of 6,000 total laundry units (owned and sold) deployed by the end 2020.

Banking? One interesting little section concerns a potential new growth opportunity in retail banking, turning the photo-booths into ATMs. It would be fantastic if that evolved into something commercial. ATMs and photo-booths are both a little bit old-fashioned now. Putting them together in the same physical space, especially since photo-booths should already be enabled to read banks card, sounds good.

My opinion

Things are pretty much "as you were". This remains a healthy cash generator in rude financial health and generating strong returns on its capital for shareholders.

The PBT growth is a little bit weak, at 3% on a constant-currency basis, and I think this reflects the fact that laundry service margins are perhaps not so high as the photo-booth margins, and the photo-booth business remains under some pressure despite the company's best efforts.

The very helpful Risk section in today's report underlines again the threat of various governments taking regulatory action which would change the way people take passport photos.

Today's results also include £2.3 million in one-off profit on a property sale which was valued in the books at almost nothing prior to sale. So the results given are, if anything, an overstatement of the underlying profit prior to the sale.

Overall, therefore, I can understand why some shareholders might have lightened their holdings here today.

I've been positive about this share at slightly lower levels. At current levels, given today's results, it looks fairly valued to me.

Hollywood Bowl (LON:BOWL)

- Share price: 204.9p (+8%)

- No. of shares: 150 million

- Market cap: £307 million

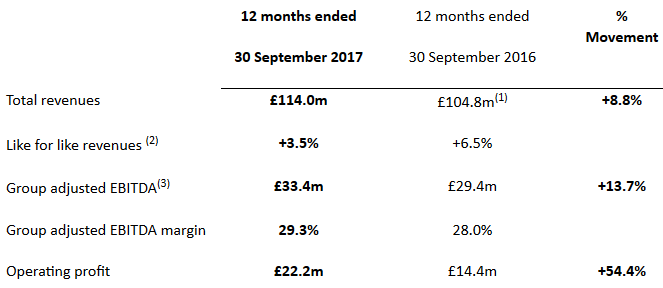

This is a ten-pin bowling operator which we've covered twice so far this year - check the archives to see the previous articles. It's the largest bowling company in the UK with 58 sites.

We already had a trading update for the full-year, where we learned that LFL revenue growth for the full-year was 3.5%, while total revenue growth was 8.9%, after a strong H2. H1 had been held back by dry weather (nobody wants to bowl when it's nice outside!)

The stock has been listed for just over a year and so far at least, it hasn't disappointed. The PE outfit which floated it is now fully divested.

These results are encouraging. Note however that the prior year saw £5.2 million in exceptional costs, which artificially depressed last year's operating profit. Excluding them, the underlying operating profit of £22 million in 2017 is 14% better than 2016.

Net debt falls to £8 million, insignificant compared to the company's profitability. Net debt/adjusted EBITDA is just 0.24x.

Indeed, the company had hinted at making a capital return due to the robust cash generation here. There will be a final dividend of 3.95p and a special of 3.33p, so total payouts this year of more than 9p per shares. The Board is happy with a debt/EBITDA ratio around 1x on average, so I can see generous payouts continuing for the considerable future.

CEO comment includes:

"We expect to continue this positive momentum as we intensively manage the portfolio for growth and deliver a high-quality customer experience, which continues to be great value for money.

It does sound like value for customers, at an average of £8.70 per game.

I've remarked before that this company has excellent clarity in its financial reporting, breaking out maintenance and expansion capex.

The text in this report is also very clear. The company's strategy includes being co-located with the top cinema in each new town that it enters. And when it rebrands or refurbishes a property, it demands at least 33% return on investment. Simple and good.

Being careful with its roll-out, it only opened 3 new stores in the most recent financial year.

My opinion

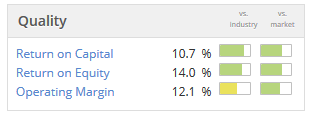

I like this company. It's executing plans well, it's another example of a market leader (and there are some benefits of scale in supplier negotiations), it's well-capitalised, and there are no obvious red flags.

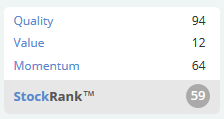

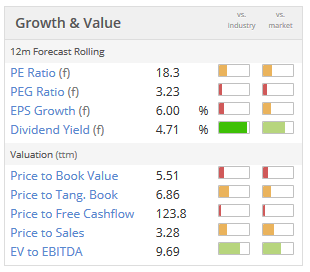

The only change that I might recommend is that perhaps the company is slightly too conservative on the balance sheet side of the equation? It's quite capital-intensive but the returns seem predictable enough that perhaps it could safely use a higher debt load. That would help to give the ROE a bit of a boost:

Marlowe (LON:MRL)

- Share price: 347.5p (+2%)

- No. of shares: 34 million

- Market cap: £120 million

This is an investor in support services businesses, specifically in fire, air ventilation and water services. It was a cash shell up until c. 2015, when it raised funds and began to take on its present form.

It wants to be "the UK's leading group of critical asset maintenance businesses", with cross-selling opportunities between its various services.

These results are on the back of four acquisitions, so the headline revenue gains are meaningless. Two further acquisitions have taken place since period-end. It had £18 million in debt facilities at period-end, so plenty more ammunition for purchases.

Outlook for the full year is in line with expectations:

The second half of the year has started well and we remain confident of delivering a full year performance in line with market expectations.

My opinion

Treating this as an investment company, and assuming that the prices paid for its subsidiaries have been approximately fair, I'd treat this first and foremost on an NAV basis. Book value is £48.6 million (September 2017), of which £37 million is intangible assets which were acquired with the purchase subsidiaries: goodwill and customer relationships.

This market cap implies that the combined entity has a value more than double the value of the funds which have been ploughed into it by shareholders so far. That's a lot of synergies from cross-selling and scale, and to be blunt is just a bit too high for me to be believable.

It is profitable, and if the deals have been shrewd and if management is high-quality, then some premium would certainly be reasonable. But I will leave this one alone for now.

That's it from me today.

Cheers,

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.