Morning!

There is still an overhang from yesterday, but for now I'm studying today's results. I got as far as TEG by close of play:

- Superdry (LON:SDRY) (-4%) - final results

- Equals (LON:EQLS) (+2%) - trading statement

- Alpha FX (LON:AFX) (+8%) - trading statement

- Ten Entertainment (LON:TEG) (+2%) - trading update

- 600 (LON:SIXH) (+2%) - final results

- Charles Stanley (LON:CAY) (+1%) - trading update

Superdry (LON:SDRY)

- Share price: 436p (-3%)

- No. of shares: 82 million

- Market cap: £358 million

This is within our small-cap limits - not something that I would have expected, if you asked me a couple of years ago! These shares were changing hands at £20 at the start of last year.

Co-founder Julian Dunkerton is back and his first priority is to "steady the ship", in his own words:

All the team in Superdry are working incredibly hard to deliver the direction set out, with a real focus on returning the business to its design-led roots and getting the retail basics right.

Results

- revenue flat (£872 million), gross margin down 250bps to 55.6%

- underlying PBT £42 million (from £97 million)

- net cash £36 million

Outlook

There is no crumb of praise for previous management, who get the blame for the problems which now need to be fixed:

Given the scale of the trading downturn in FY19 and the lead times required to rectify the product range and proposition, management view FY20 as a year of reset, creating a platform from which Superdry can return to long-term profitable growth. We expect our financial performance in FY20 to reflect market conditions and the historic issues inherited.

Revenue is set to show a "slight decline" in FY 2020, "particularly in the first half".

Dunkerton's statement

This is important - it outlines his vision for reinvigorating the brand and the company. Nothing else really matters.

Key objectives:

- focus on design, rather than the "buyer-led approach" of the previous CEO. Using a combination of in-house designers (which Dunkerton will work with) and the SuperDesign Lab (a consultancy led by SDRY's other co-founder).

- return to previous quality of product

- reduce lead times, drive cost efficiency

- create "more visually exciting brand assets". Bring social media activity in-house to improve social influence.

- limit discounting again (this was a hallmark of SDRY's traditional strategy)

Ecommerce

The FY 2019 ecommerice performance was a worry: sales up only 1.6%. I'd want to see this growing much faster, to compensate for the weakness in retail (-3.7%).

Dunkerton says that when he first joined, "there was a large amount of stock available in our warehouses but was not accessible to customers". He has now made this stock available online, at the higher retail margin, and it is achieving full price sales. The potential SKUs online have increased from 60,000 to 140,000.

That's great news for investors and customers but is it a rookie error by the previous management team, that they didn't do this? It sure sounds like it is.

Dunkerton describes this as a "quick win". He says that he also had a quick win by creating a better jackets proposition for the upcoming season, by appealing to "more clearly defined demographics".

Wholesale

Lots of ideas for wholesaling too - more products with short lead times and doubling the product options (more womenswear, more sport and a premium range), but he will also keep its classic products permananently in stock.

Financials

What I really care about are Dunkerton's plans, and whether they make sense. Let's take a few moments to look at the financials, though.

Retailing - I've already noted that Ecommerce revenue didn't grow fast enough to offset the decline in stores.

We aren't given detailed, like-for-like retails sales numbers, to account for store openings and closures. The company acknowledges that LFL performance was negative in each major territory. The UK/ROI, its largest teritory, looks to be in the worst shape.

Gross Margin - loss of margin is blamed "primarily" on the previous managers choosing to discount in the face of a challenging retail environment..

Operating Margin - Dunkerton wants to restore a double digit EBIT margin. The operating margin has collapsed to 5.5%, thanks to "the deleveraging effect of negative LFL performance in the owned store estate". There was also a negative contribution from increased distribution costs in Wholesale operations.

Impairments and onerous lease provision - The company has decided to write down its results this year massively, to recognise retail pain today rather than at some point in the future. Note that these are non-cash charges.

Impairments: assets related to stores have been written down in a huge way. Leasehold improvements, furniture, and lease premiums have taken the brunt of the hit (see Note 12).

Onerous lease provision: this is an £86.9 million charge reflecting the fact that retailing cash flows are not expected to match the costs of leases out to FY 2023. It goes on the balance sheet as a liability.

In future periods, there will be less depreciation of store assets (because they have already been impaired) and the onerous lease liability will be reduced. These will both help to boost SDRY's reported profits in future periods.

How to analyse this: I think the best way to analyse this is actually to eliminate the benefit to future reporting periods that is created by the impairments and onerous lease provisions.

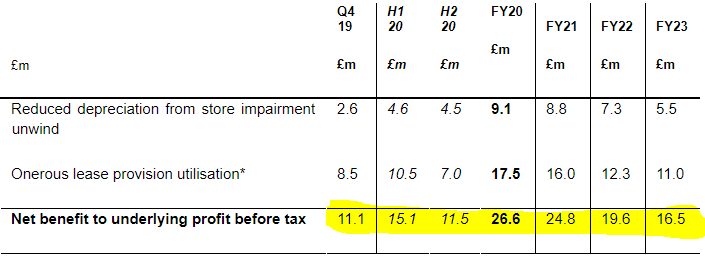

So what I would do is reduce future PBT by the amounts shown in yellow above. This means reducing FY 2020 by £26.6 million, etc.

Accelerated impairments and onerous lease provisions are artificial measures, in my view. So I prefer to look at numbers which ignore them completely!

Viability Statement

Because SDRY has a premium listing, it has to present a "Viability Statement" for a period longer than 12 months. You don't get that on AIM!

SDRY's viability statement includes a few important words of caution for potential investors.

...the Directors have a reasonable expectation that the Group will have sufficient resources to continue in operation and meet its liabilities as they fall due over the period to April 2023. However, a sustained downturn as a result of the new strategy not turning the business around, and a failure to renew the RCF, would threaten the viability of the business over the four-year assessment period.

This is not as bad as a qualified going concern statement, which only concerns the next 12 months.

However, it's still an important amber flag that the company is in some danger over the medium-term. Its future depends on the continued availability of its £70 million RCF.

That won't come as a huge surprise - we could figure that out ourselves. The company has lease commitments of £424 million, after all, and net cash of £36 million. And we know that retailers are inherently leveraged and vulnerable to like-for-like sales declines.

The "downside scenario" which it uses for its going concern statement involves:

- A 10% decrease in LFL stores sales for FY 2020, and then a 5% decline for FY 2021.

- Ecommerce and Wholesale revenues declining in FY 2020 before recovering in FY 2021.

- Small growth across all channels for 2022 and 2023.

The Viability statement is saying that if weak growth is not achieved at least by 2022/2023, and if the RCF isn't renewed, then it could be curtains.

Again, this isn't earth-shattering news, but I think it's worthwhile to note a company's own words on this sort of thing.

My view

I have a soft spot for this brand - I like it, personally.

SDRY could be a multi-bagger if Dunkerton succeeds, and I like the sound of his plans.

On the other hand, this is not a sleep-sound type of investment.

My stance in retailing is unchanged: I hold the best-in-class UK retailer (Next (LON:NXT) ) and the best-in-class UK luxury fashion brand (Burberry (LON:BRBY) ).

I view SDRY as a Championship team: good quality, especially under Dunkerton, but not a best-in-class retailer or a best-in-class brand. I might also put Ted Baker (LON:TED) in this bracket: very good, but not a Premiership team.

Superdry (LON:SDRY) and Ted Baker (LON:TED) have similar P/E ratios and similar market caps. If somebody told me that I had to add another two retailers to my portfolio, I would add them.

However, I'm not forced to do it, and I don't currently have the risk appetite for it.

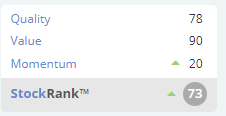

The StockRanks express a favourable view of Quality and Momentum:

Where I would disagree with the StockRanks, from time to time, is that they might not fully account for certain risks, and the risk associated with lease liabilities is one of those (although lease liabilities will be going on-balance sheet in future periods, so this could change).

Good luck to all holders. Let's continue to monitor the situation, and see what Julian can do!

Equals (LON:EQLS)

- Share price: 128p (+2%)

- No. of shares: 164 million

- Market cap: £210 million

This used to be known as FairFX (FFX). The name change is confirmed for customers here. The rebranding "reflects the diversification of the business over the last two years".

I've written positively about this company, saying last month (at 115p) that it had "grown into its valuation".

This update is in line with expectations, so I won't dwell on it for long.

Key points:

- Currency transactions and deposits (which the company calls "Turnover") are up 17.5%.

- Revenue margins slightly improved.

- Very fast growth in corporate expenses product, reasonable growth in international payments.

- Access to the US market has been achieved via a contract with Metropolitan Commercial Bank in New York. Launching a corporate platform in the US later this year.

My view

This company's updates have really impressed me and I suspect that it deserves a strong rating, given the growth opportunities that have opened up for it. A great candidate for more detailed research.

Alpha FX (LON:AFX)

- Share price: 780p (+7.6%)

- No. of shares: 37 million

- Market cap: £289 million

AFX reports a stunning 60% increase in revenue for H1, compared to last year.

The core UK corporate market has driven this, helped by "acceleration" in European revenue.

Despite the costs of moving office in London, it expects full yea earnings to be ahead of expectations.

My view

I've been doing a little bit of reading around this. Corporate FX broking is a competitive space, and it's a space where I've suffered some frustration through my holding in Record (LON:REC).

Something is clearly different about AFX, and I'm coming round to the view that it is the culture of very hard work and honesty which has been instilled by the founder-CEO (who is also a 26% shareholder).

In January last year, the CEO personally responded to a disgruntled former employee, who wrote on glassdoor.com that the company was "a cult, not a job".

I recommend that you read the entire thing yourselves, including the employee complaints.

Some key points that I take away from this are:

- the CEO follows the principles of "radical transparency" as set forth by the likes of Ray Dalio at Bridgewater Associates. The CEO calls it "radical candour". Others might call it brutal honesty. This means that employees can find themselves at the receiving end of much more criticism than they are used to. The individual who wrote this negative complaint says that they were offered a salary cut within a few months of joining!

- monitoring - the individual says that they were monitored "like a factory worked in a communist country. The CEO responds that the sales systems are about helping people work "smarter", not harder. I wonder if web browsing is monitored?

- fitness - the individual complains about being "forced to get up and exercise at 5am in the morning and provide evidence". The CEO responds that this is not compulsory! But employees do have the option to start later three days a week, so that they can exercise in the mornings and have more time in the evenings for other things. I like this sort of policy!

- zero work/life balance - the CEO responds: working at Alpha isn’t your normal 9-5. It does require more commitment, but I believe it rewards more than most too.

I'm leaning towards the view that the individual who complained was simply a poor fit for the organisation. There are plenty of 9-5 type companies and jobs out there.

He or she is in the minority, however, in terms of their negative feelings towards the company. AFX has a 4.5 star rating from 61 reviews. 85% would recommend to a friend, and 91% approve of the CEO.

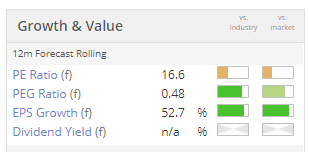

This background reading has left me with an even more positive impressive of AFX. Whether it's worth 33x earnings is a more difficult question, however!

Ten Entertainment (LON:TEG)

- Share price: 241p (+4%)

- No. of shares: 65 million

- Market cap: £157 million

Ten Entertainment Group plc ("TEG" or "the Group"), a leading UK based operator of 45 bowling and family entertainment centres, today announces a trading update for the 26 weeks to 30th June 2019.

This is a pleasant update. Performance is in line with expectations.

Like-for-like sales growth comes in at 7.4%, thanks to normal (wet) weather and no repeat of last year's heat wave.

TEG says that "underlying" LFL growth is "stable and encouraging", which I guess means stripping out the effects of the heat wave.

Besides the organic LFL growth, there is also a little growth from new sites. These sites are being converted to TEG's format, a process which the company calls "Tenpinisation"!

The company has increased spending on customer experience, marketing and product innovation, which it expects will help drive growth in the long-term.

My view - this update is completely inoffensive. The company has made nice progress and shown that softer trading last year probably was caused by the weather.

I like this share and its rival, Hollywood Bowl (LON:BOWL). As a theme, I think it makes a lot of sense to bet on consumer "experiences". It would be tricky for someone like Amazon ($AMZN) to disrupt and destroy this business model!

When it comes to picking individual stocks, I don't know whether I'd prefer Ten Entertainment (LON:TEG) over Hollywood Bowl (LON:BOWL). TED is cheaper, but BOWL generates better quality metrics. Both look attractive. I'd need to do more detailed research to decide between them.

Out of time for this evening - I will have to work hard to eliminate this backlog by the end of the week!

Thanks for your patience.

Good night,

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.