Good afternoon, Graham here.

Paul and I appear to have got our wires crossed about who was doing today's report.

I'm going to do a late version of the report now, with the help of Jack Brumby.

Sorry for the lack of communication and lateness! We are on it now.

Today's report covers:

- Character (LON:CCT)

- J D Wetherspoon (LON:JDW)

- GAN (LON:GAN)

- TM17 (LON:TM17)

By Jack:

Character (LON:CCT)

- Share price: 355p (-4%)

- No. of shares: 21.4 million

- Market cap: £76 million

Profit warning.

‘Through a combination of these factors, the profit before tax for the Group for the year ended 31 August 2019 is likely to be in the range of £11.0m - £11.5m., slightly under the lower end of current market expectations.’

This toy company is one of the more popular stocks on the site - and recently, as many of you know, the share price has unravelled as a result of Hasbro bidding for Peppa Pig IP owner Entertainment One. It’s been quite a dramatic decline.

That’s a drop of about 38% over the past couple of months. Alas, when it rains it pours.

The company says:

‘The second half of the financial year just ended has seen several factors negatively impacting our business. The most significant factor has been the failure of the retail market in Scandinavia to fully absorb the sales vacuum caused by the liquidation in January this year of Top Toy, OVG-Proxy ApS's ("Proxy") largest customer until its demise.’

Add to this Sterling weakness (with the $/£ proving particularly painful for the group) and the fact that Character’s recent purchase of Proxy needs a bit more TLC than was originally anticipated… It’s clear that conditions are tricky for management right now. When it rains it pours.

As for Peppa Pig, Character says:

To date, there has been no dialogue between the Company and Hasbro as to its future intentions for Peppa Pig and, although it is unlikely that a definitive position in that regard will be known for some time, discussions have taken place with eOne and it has been agreed that the Group's current Peppa Pig licence (due to expire on 31 December 2020) will be extended for an additional six months to expire on 30 June 2021.

Quality, cash flow, capital allocation

There’s a lot to like about Character save for its obvious weakness of being quite dependent on the remarkable popularity of Peppa Pig (and its own lack of intellectual property). Supplier or customer concentration is a fact of life for many small cap companies, unfortunately. This risk has crystallised somewhat in recent weeks for Character.

That aside, Character Group is a cash-generating machine. The group chucked off 41p free cash flow per share in FY18, giving its shares a free cash flow yield of 11.4%. What’s more, Character’s management has historically been quite shareholder-minded when it comes to deploying this cash.

Over the past five years, the group has brought back about £11m of shares, it has paid out nearly £15m in dividends, and it has gone from net debt of -£4m to net cash of £20m. This performance may have been turbo-charged by Peppa Pig sales, but at least shareholders have benefitted from the plunder.

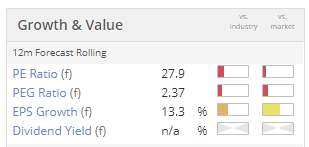

You can see its Quality credentials for yourself:

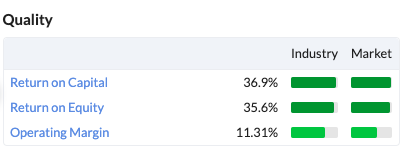

In fact, the group has a Quality Rank of 99. Here’s how Stockopedia comes to that conclusion:

Unfortunately, these quality metrics can’t completely spare Character from external shocks. No company operates in a vacuum and problems have piled up.

Balance sheet - is fine. Strong, in fact, with net cash of c£20m and a current ratio of more than 2x.

My view

Character Group operates in a highly profitable, but fragile, niche. It has no real barriers to entry that I can see save for its reputation and existing relationships. That said, management owns shares and the group has demonstrated a track record of redistributing cash to shareholders.

If you take a long-term view and back the management, then these levels could be a buying opportunity. My hunch is that in the short term, lower conviction holders will have been rattled by recent developments and more selling pressure is to come. This could be wrong, of course, but some of the issues CCT has pointed to could take a long time to work their way through the system. Brexit disruption could be a dominant market dynamic for years to come. Top Toy is also unlikely to be the last toy retailer to go into liquidation.

That said, Character has a clean balance sheet, strong cash generation, and high returns on capital. Management is experienced and has skin in the game. Assuming the company can navigate these trickier markets and continue its habit of returning cash to shareholders, then this could be a contrarian buy. I just think risks have increased, and I wouldn’t expect momentum to improve anytime soon.

Also by Jack:

JD Wetherspoon

- Share price: 1546p (-0.3%)

- No. of shares: 105 million

- Market cap: £1.63 billion

Who would’ve thought JD Wetherspoon would become so… politicised.

Chairman and founder Tim Martin has become one of the most vocal proponents of Brexit and his Chairman’s Statements have become go-to reading for people on either side of the debate.

Regardless of where you stand on politics, you can’t deny that the man knows how to run pubs. JDW is probably the only modern pub chain that has elevated itself to ‘brand’ status - this should not be underestimated. Everybody knows what they are going to get at a Wetherspoon’s: an affordable and diverse selection of high-quality beers, well-maintained toilets, boat loads of coffee refills, and a cheap fry up - often in a stunning freehold property.

Trading

Like-for-like sales are up 6.8% in the year making for total sales of £1.8bn (+7.4%) and profit before tax is down slightly at £102.5m, although the group has invested a substantial sum of money into its estate (£167.6m in the period, vs. £110.1m in FY18). Of this sum, £35.2m was invested in new pubs and pub extensions (2018: £35.9m), £55.2m in existing pubs and IT (2018: £64.7m) and £77.2m in freehold reversions, where Wetherspoon was already a tenant (2018: £9.5m).

This leaves free cash flow per share of 92p, by the company’s own calculations, vs. its current share price of 1,541p.

The last two weeks of the year were better than the year as a whole, which bodes well as the chain heads into the new financial year.

Margin is down and debt is up but, with JDW, this is usually a sign that it is investing wisely and further establishing its competitive moat (of low prices, high quality, little debt, and lots of freehold property). Indeed, debt has gone up this year as a result of the pub group buying its properties.

View

There are few companies that are genuinely run as if they aim to be around forever. It is far more common to see companies run in a short-termist, EPS-targeting, option-vesting manner. When you do encounter those companies run for the long-term, you can usually tell from the accounts and management commentary.

Games Workshop is one of them, and Goodwin also comes to mind. I think JD Wetherspoon is another. I urge you to check the group’s statement if you have time. In it is a table that is literally too long to post on here, showing Wetherspoon’s sales, profits, and cash flows from 1984 through to 2019. Not many companies provide investors with that kind of perspective because not many companies genuinely think in terms of decades.

That said, the group’s shares are quite expensive right now. With 900 pubs around the UK, there is probably scope for more growth, but I suspect you can probably get better returns elsewhere. It’s a quality operator though, probably the best pub company in the UK.

By Graham:

GAN (LON:GAN)

- Share price: 86.5p (+19%)

- No. of shares: 85 million

- Market cap: £74 million

Trading update and conclusion of strategic review

August 2019 Internet Gambling Growth for NJ

This is a B2B provider of software to the gambling industry.

I've written about it a few times before - see the archives.

The bull thesis is that it's going to exploit new opportunities in the US, and become a much, much bigger business. Historically, it hasn't been profitable.

H1 results

Today's results show revenue increasing by 145% (not a typo) to £11.3 million.

- the company moves into profit (£0.7 million).

- cash balance bounces higher to £9.1 million, no debt.

- US is responsible for 78% of turnover (the rest from Italy).

Of the revenue in the period, £3 million was attributable to a patent which GAN licensed to a US company.

This patent is to do with linking a casino reward card/reward points with online gambling accounts.

While the £3 million license is not recurring in nature, there could be more deals like this to come:

The Patent was awarded to GAN in September 2014, successfully defended in H1 2017 and has now been licensed for substantial consideration setting a precedent for additional Patent licensing agreements.

Discussions with more land-based casino operators are underway.

Looking at other revenue sources for GAN, £4.3 million was from "real money gaming operations recurring revenue". This revenue source has more than doubled, compared to the prior year.

Other major developments in the period include legal online betting for the first time on the Super Bowl in New Jersey (GAN's platform was used) and six more US states enabling online gambling (Rhode Island, Montana, Indiana, Iowa, Tennessee and Illinois).

Outlook

The CEO is positive on the company's prospects, to say the least:

We have an incredibly positive outlook for the remainder of 2019, as the recent launch of Internet sports betting and casino gaming in Pennsylvania, the Company's current sales pipeline and existing contracted clients are projected to significantly enhance GAN's revenue and EBITDA prospects.

H2 will benefit from "the seasonally strong Winter period" and the new NFL season from September. More specifically, GAN will be involved in Fanduel for Flutter Entertainment (LON:FLTR) in Pennsylvania and the real money online casino for Parx in New Jersey.

Strategic Review

Instead of accepting a bid to go private, GAN has decided that a US stock market listing will be in the best interests of its shareholders.

Can't argue with that: the US markets tend to give companies the highest valuations. And with GAN now being a US-centric company, US investors are likely to be friendly to it.

I note the company says it "received multiple bids from multiple parties during the FSP". So maybe there is still scope for a takeover bid at a future date?

My view

There is a lot of information to digest - sorry for all the detail, but nearly all of it seems important! There is a lot more in GAN's RNS announcements today. They have even published an RNS specifically outlining the huge growth of the online gambling industry in New Jersey.

As for whether I would invest in these shares, I am tempted to have a "flutter" but that's all it would be - I don't really know how to value GAN's patent and software.

I am much more comfortable investing in a B2C brand like 888 whose market positioning I have some ability to analyse and to judge (and I do have a long position in 888).

What I find particularly interesting about GAN is that its growth helps to confirm the explosion in online gambling activity in the United States. 888, Flutter Entertainment and others could potentially benefit in a huge way from these developments.

GAN's enterprise value of £65 million might well turn out to be too cheap, given that revenues doubling again before too long does not seem out of the question. For example, a few more patent licensing deals with casinos would result in more large cash flows straight to the company, probably without needing to spend very much at all (except maybe on lawyers, to defend the IP).

The recurring revenue side of the business is also very strong, doubling in a year. What's to stop it from continuing to grow along with the US onling gambling industry?

So in summary, I do think that this is an intriguing share and might be worthy of additional research. For those of us who can't achieve a deeper understanding of the B2B gambling landscape, there are probably safer ways to access the growth of the gambling industry in the US.

Team17 (LON:TM17)

- Share price: 295p (-1%)

- No. of shares: 129 million

- Market cap: £381 million

Taking a look at this in response to reader requests.

Team17 has been listed for little more than a year.

The name will ring a bell for those of you who have ever played Worms (I must admit that I played it quite a bit).

The company says that it is still making "significant revenues" from its back catalogue of games, including Worms.

I note that it develops its own IP in-house while also supporting "indie" (independent) games from external developers (in exchange for revenue share). It says:

Digital distribution... has significantly reduced barriers to entry for developers looking to bring games to market. Through our Games Label, we can support independent developers of all sizes (wherever they are located in the world) to launch their titles and maximise their commercial value.

As we know, digital distribution was a key issue for investors in Game Digital (GMD), now owned by Sports Direct.

H1 Results & Outlook

The growth rates in this half-year report are terrific. As with Frontier Developments (LON:FDEV), it's important to bear in mind that game developers have a production and release cycle which creates spikes and troughs in their sales figures.

Indeed, Team17 wastes no time in reminding investors of this, and that the "revenue profile across FY19" is "more H1 weighted than previous years due to release schedule."

The Board is "comfortable with full year expectations", implying that the strong H1 was already baked into the plans for the year.

The full-year revenue forecast is c. £51 million, versus £30.4 million in H1. So the revenue split is approximately 60:40.

My view

I'm impressed! It looks like this company is well-diversified among many different titles. Also, given the emphasis being placed on its back-catalogue, Team17 creates the impression that it doesn't have to reinvent the wheel every six months - it will always get at least some revenue from the existing titles.

The diversification and back-catalogue should serve to take a lot of the risk out of the stock.

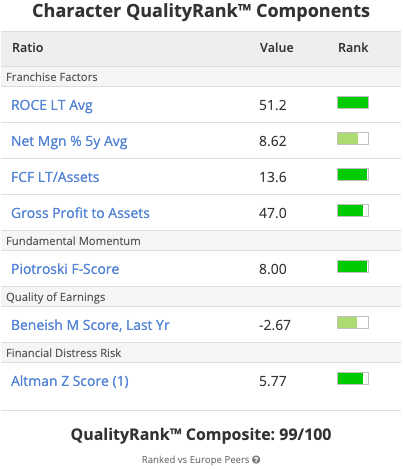

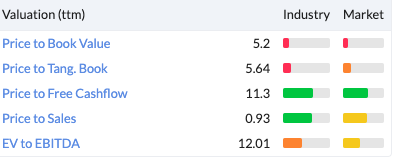

The market seems to be equally impressed as I am, awarding the company a very high rating:

Is it worth this rating? I don't know, but I like what I've seen so far and look forward to keeping an eye on this one in future.

That's it for this week, have a good weekend everyone.

Cheers

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.