Good morning from Paul & Graham (Paul is still travelling, we may hear from him later!).

Ok, we're all done for now!

Explanatory notes -

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom),

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Summaries

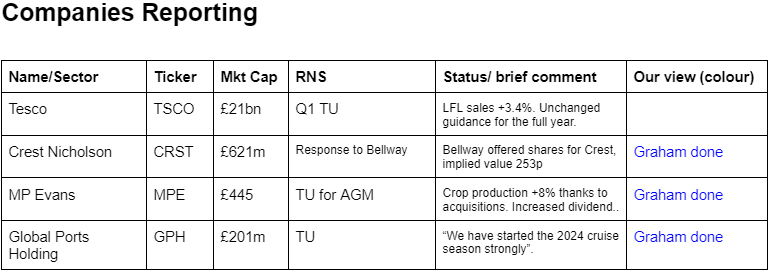

Crest Nicholson Holdings (LON:CRST) - up 10% to 233.5p (£600m) - Response to announcement by Bellway - Graham - GREEN

A day after the latest profit warning from Crest, we learn Bellway has been interested in picking this one up. The indicated prices do strike me as opportunistic, and I agree with Crest’s decision to reject them. However, bid interest does give me the confidence to nudge up my stance on this to be outright positive.

M P Evans (LON:MPE) - up 0.6% to 845p (£448m) - Trading Statement - Graham - AMBER/GREEN

A pleasant AGM trading update that reiterates some news while also providing the latest information on fruit processing, palm oil production and sales prices. I view this as a decent agricultural stock. With minority interests bought out and an ongoing share buyback, there are reasonable prospects for EPS growth.

Global Ports Holding (LON:GPH) - down 8% to 241p (£184m) - Trading Statement and Delisting - Graham - AMBER/RED

The majority shareholder wishes to take this one private, and might offer three dollars per share. This one seems very complicated and risky to my eyes, and with a delisting likely to be imminent, I would give it a miss.

Graham's Section

Crest Nicholson Holdings (LON:CRST)

Up 10% to 233.5p (£600m) - Response to announcement by Bellway - Graham - GREEN

It’s funny how quickly your views in the market can be proven right or wrong - sometimes on the same day!

We covered Crest Nicholson’s latest profit warning in yesterday’s report.

Last night at 5.45pm, in response to press speculation, Bellway (LON:BWY) announced that it had made a (non-binding) offer for Crest Nicholson on 7th May.

Key features of the offer:

An all-share offer, BWY shares for CRST shares.

CRST shareholders would hold 17.1% of the enlarged group.

Implied value of 253p per CRST share, a 30% premium to CRST share price at the time.

Rationale from Bellway:

The Board of Bellway believes that there is compelling strategic and financial rationale for a combination of Bellway and Crest Nicholson which would bring together the strength of each business with complementary brands to reinforce Bellway's position as a leading UK housebuilder, while enabling Crest Nicholson shareholders to benefit from the scale of the combined business, a reduced risk profile, lower indebtedness and an enhanced landbank to capitalise on the long-term structural growth opportunity in the UK housing market. In addition, the Board of Bellway believes a combination would deliver significant operational synergies and support sustainable shareholder returns through the cycle.

This morning we have a response from Crest Nicholson.

They point out that based on last night’s close, the implied premium is only 18.8%.

Their view: the offer “significantly undervalued” Crest.

Additionally, they reveal a previous offer was made in April, with a slightly worse exchange rate between BWY and CRST shares. This was thought to “fundamentally” undervalue Crest.

They provide a brief insight into their thinking:

As outlined in its half year results on 13 June 2024 for the period ended 30 April 2024, Crest Nicholson remains confident in its standalone prospects, in particular given conclusion of the review of provisions for completed development sites supported by external consultants, its highly attractive land portfolio and the new leadership of Martyn Clark.

Graham’s view

In yesterday’s analysis, we looked at possible catalysts and reasons that the Crest Nicholson share price might improve towards its tangible NAV (£774m, or 301p per share). Takeover activity was mentioned - but of course it’s not easy to predict the timing of deals if you don’t have insider knowledge.

If I was a shareholder or Board member of Crest, I would be holding out for 301p+. Why sell the assets to Bellway at a discount to TNAV? Bellway is perfectly placed to extract synergies, develop the landbank and to generate at least TNAV from Crest’s assets, using its economies of scale (it’s about four times bigger than Crest). It should be willing to pay a fair price for this.

Therefore, I agree with the rejection of Bellway’s recent offers.

Crest is adamant that it has finished the review of provisions needed for prior work, and about the attractiveness of its land portfolio. That being the case, there is no reason for them to sell up at a discount.

And from Bellway’s point of view, surely a price around NAV would still be a profitable deal for it?

I’m going to nudge up my stance on this from AMBER/GREEN to GREEN. My reasoning is that we now have external validation of the attractiveness of Crest’s assets to potential acquirers, although of course it remains to be seen whether or not Bellway will pay full price for them. But the bid interest does allow me to look past recent difficulties and take a positive stance here.

M P Evans (LON:MPE)

Up 0.6% to 845p (£448m) - Trading Statement - Graham - AMBER/GREEN

We occasionally mention this one, e.g. Paul looked at it back in September. It produces palm oil in Indonesia, so it’s not your typical domestic stock!

Key points from today’s AGM update:

Fruit processed up 8% to 631,400 tonnes.

Rapid growth “has abated to some degree in recent months”.

Growth has been supported by acquisitions: “whilst yield from these estates remains relatively low, significant progress is being made to improve agronomic standards”.

MPE operates six palm-oil mills, with total palm oil production up 10% in the first five months of the year.

Prices: the average crude palm oil price was down slightly on last year ($997 vs. $1,001).

Acquisition: MPE has bought out the minority stakes in most of its Indonesian subsidiaries, for a total cost of $14m. I think these stakes were all held by one individual. It should be good news but I’d be interested to know more about the backstory - why did MP Evans feel that they needed to have a local partner originally and why do they not need a local partner now?

Dividend: 45p total dividend for 2023 (vs. 42.5p for the previous year).

Graham’s view

I have viewed this as a decent agricultural stock - it has been around for a long time, generating profits and rising dividends.

The most recent balance sheet value was $467m (excluding intangibles and minority shareholders), or £367m, and the market cap does currently trade at a premium to that.

But something that caught my eye here was the company’s decision to start buying back its shares. It originally announced this in June 2022.

In 2022, it spent nearly $5m on buybacks.

In 2023, it spent nearly $10m on buybacks.

In March 2024, it announced the extension of its existing buyback programme, saying that it now had a GBP £2m budget to buy shares until June 2024. It said:

The Board maintains the view that its overall business and its assets are currently undervalued, with the current enterprise value being below the independent valuation of its assets.

The Group's robust balance sheet continues to provide the opportunity to repurchase shares at advantageous levels that will be earnings enhancing.

Here are the latest valuation metrics. There's a nice yield even before considering that funds are being returned to shareholders through buybacks, too:

As usual, I get interested when I see a “value” stock buying back its own shares - because the long-run effects on earnings per share can be very nice indeed.

Of course in the short-term, the crude palm oil price is more important. But I think that in the long-run, this could continue to be a nice stock to hold.

Global Ports Holding (LON:GPH)

Down 8% to 241p (£184m) - Trading Statement and Delisting - Graham - AMBER/RED

Strange goings on here today at GPH, “the world’s largest independent cruise port operator”.

First thing this morning we had a trading update. Here’s an excerpt from the table, with seemingly good progress:

The Co-Founder, CEO and Chairman says:

"The 2024 Reporting Period was one of significant achievement for Global Ports Holding. We successfully expanded our cruise port network, completed our largest-ever investment project, and increased our shareholding at a number of key ports. In addition, we strengthened our balance sheet through a successful investment-grade-rated issuance of secured private placement notes and extended the concession length at a number of ports.

We have started the 2024 cruise season strongly and we are well positioned to be a key enabler and beneficiary of the cruise industry's continued growth and success in the years ahead."

It should be noted that this company is carrying significant net debt: $674m (excluding leases) as of March 2024. This is much larger than the number shown for September 2023 ($561m), when Paul covered it last.

Bond issuance: the company has been active in the debt markets and issued two bonds for a total $145m that are (just) investment grade, with a rating of BBB-. They are long-term, amortising over 21 and 15 years respectively.

Dilution: the majority shareholder of GPH increased its stake with an additional 5.1 million shares, “in partial satisfaction of the debt owed”. This majority shareholder has a 59% holding in GPH, according to the StockReport.

The trading statement did not seem overly dramatic, but it was followed up around 11:30am with the following:

GIH as the controlling shareholder is convinced of the merits of moving the business into private ownership and intends to seek delisting of the Company and taking it private. Although as a standard listed company delisting can be implemented through a decision by the board of directors of the Company and neither a shareholder vote nor a squeeze-out is required, GIH is considering a possible cash offer of US$3.00 per share (the "Offer Price"), to be implemented by GIH's wholly owned subsidiary, Global Ports Holding B.V. ("Bidco"), for the issued and to be issued share capital of the Company not already owned by Bidco, as a liquidity opportunity in conjunction with the delisting. GIH and Bidco are in discussions with potential providers of funding. There can be no certainty that an offer will be made.

Three dollars per share equates to about 236p, and as I type this the share price of GPH is still marginally above this level. But there is no certainty that this offer will even be made! And if not, then shareholders will be left holding a private company.

Graham’s view

I’m going to leave Paul’s AMBER/RED stance on this one unchanged. This is really a Turkish company to my eyes, not a domestic stock, and with a majority shareholder who is no longer interested in the public listing.

Of course that could very well mean that the shares are a bargain, and the majority shareholder no longer wishes to share the company’s success with minority investors. But at the end of the day, it’s the majority shareholder who decides the price (if any) they wish to pay to buy the others out.

Too complicated for me, and with some major risk factors (huge debts, the presence of the majority shareholder, and foreign risk). So I agree that this should be treated with great caution.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.