Good morning from Paul!

Today's report is now finished. Have a lovely weekend!

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. OR it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom),

Paul's 2023 share ideas, with live prices.

New SCVR summary spreadsheet from July 2023 to date, updated at weekends (very useful quick reference tool, search for ticker using CTRL+F). Hover over cell for pop-up notes.

Frozen SCVR summary spreadsheet for calendar 2023.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Other mid-morning movers (with news) -

Audioboom (LON:BOOM) - up 6% to 270p (£44m) - Reach announcement - announcements marked “Reach” are PR releases, for information and/or to ramp the share price often ahead of fundraisings, a cynic might say. Today BOOM says it’s now 4th in the US podcast ranker, based on audience numbers. A change to Apple iOS17 has reduced industry-wide downloads by 32%. BOOM says this is good, providing more accurate consumption data.

Paul’s view - remains negative on the fundamentals, see our extensive archive on BOOM’s poor track record. However at just £44m mkt cap, someone might see strategic value in the company, possibly? This share price doesn’t tend to be linked to its business fundamentals, which remain poor. So I’ll go with AMBER/RED, as anything could happen, and ad markets could recover. Last H1 results were terrible due to a big onerous contract. Might need another placing at some stage, but didn’t look critical, with £5.3m net cash at June 2023.

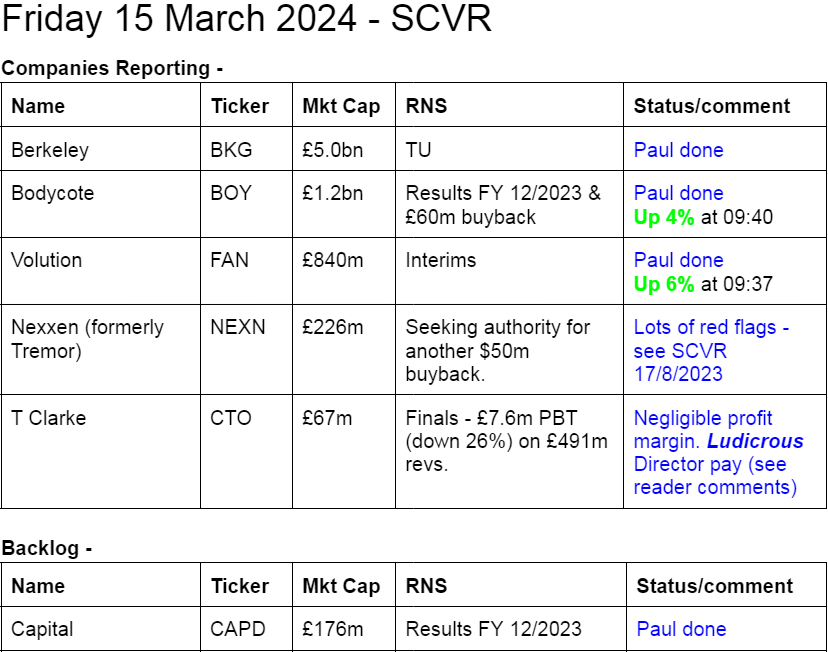

Summaries of main sections

Capital (LON:CAPD) - 91p (£176m) - FY 12/2023 Results - Paul - GREEN

I have a quick look, following a reader request yesterday. Low PER, strong balance sheet, and upbeat outlook make this seem interesting at a first glance. Although profit/cashflow seems to end up being spent on heavy capex, with only modest shareholder returns.

Berkeley group (LON:BKG) - 4,677p (pre-market) £5.0bn - Trading Update - Paul - AMBER

In line trading update today. Interesting that house prices are firm, and ahead of plan, whilst volumes remain a third down on LY. I was hoping for more recovery signs. Price possibly up with events for now, but medium term recovery seems likely.

Volution (LON:FAN) - up 6% to 450p (£891m) - H1 Results [slightly ahead] - Paul - GREEN

Decent H1 numbers, and FY 7/2024 outlook is slightly ahead. Very good PBT margin indicates pricing power. Liberum increases its forecast a tad. Valuation still looks reasonable to me, and I see potential upside on modestly set forecasts, as its end markets may be about to begin a cyclical recovery perhaps? Balance sheet not the best after multiple acquisitions, but not a deal-breaker. Overall, I like it.

Bodycote (LON:BOY) - Up 3% to 653p (£1.25bn) - FY 12/2023 Results - Paul - GREEN

This is my first ever look at Bodycote, so I might have missed something. It looks a remarkably good business, at a bargain price. So well worth you taking a closer look I'd say. Post a comment if you know the company, I'm interested to hear your views - it almost looks too good to be true on my initial review. So maybe there's some lurking problem I'm not aware of?

Paul's Section:

Capital (LON:CAPD)

91p (£176m) - FY 12/2023 Results (y'day) - Paul - GREEN

This was a late reader request last night, so I had a quick glance, and think it might be worth a closer look (ie. I can see some attractive traits, but haven’t done in-depth work to be certain it’s good).

CAPD calls itself a “complete mining services provider” for exploration & drilling, lead & haul services, fleet maintenance,and geochemical analysis.

Fixed assets are large on the balance sheet, so it must be renting out kit I assume, and capex is heavy ($69m in 2023), resulting in fairly modest distributions to shareholders with a 2.6c final dividend + 1.3c interim paid in Oct 2023 (forecast yield 2.9% per StockReport).

Revenue in FY 12/2023 was $318m (up 10%)

Good operating margin, with $60.3m operating profit, up 1%

Note it is also building up an investment portfolio, so that needs more work, it was $47.2m at Dec 2023.

Net debt of $69.8m doesn’t look excessive vs fixed assets or profits.

EPS was either up, or down, depending on whether you take into a large investment gain in 2022. Ignoring that, basic EPS was 19.1c in 2023, so 14.9p = PER 6.1 - obviously an attractively low rating, with possible upside if earnings can continue growing.

Outlook - all sound upbeat, and guides revenues of $355-375m (2023: $318m). Gravy [Edit: Eh?! Where did "gravy" come from LOL?!] Capex again is guided at $70-80m. Various growth projects mentioned.

Paul’s opinion - worth a closer look, as I’ve only had time for a very quick glance. The low PER and strong balance sheet (NTAV is well above mkt cap) combined with decent quality scores on the StockReport, and high StockRank of 94, all point towards this looking interesting. Maybe some readers could elaborate in the comments if you know it better than I do?

Downsides? Vagaries & cyclicality of the mining sector, and uninspiring shareholder returns.

5-year chart - pretty good, considering this includes the pandemic -

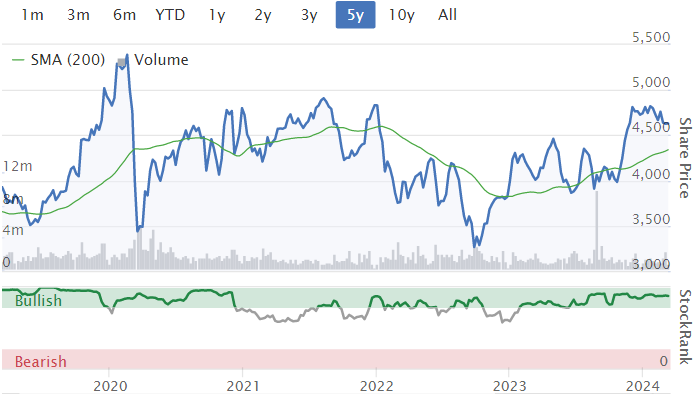

Berkeley group (LON:BKG)

4,677p (pre-market) £5.0bn - Trading Update - Paul - AMBER

A large housebuilder, year end is FY 4/2024.

I’m watching this sector because it’s a good indicator of the health of the economy & consumer confidence overall, and a lot of things are at least partly triggered by housing transactions, eg building supplies, carpets, furniture, DIY spending, etc. Although as we saw during the pandemic, if people can’t move, they often do up their existing homes.

Today’s update covers the 10 months to 29 Feb 2024, my summary of the main points -

Says its business model is unique in long-term regeneration of brownfield (ie previously used land, as opposed to greenfield) sites.

Trading in line with consensus of £550m PBT FY 4/2024.

Reaffirms guidance for £1.5bn PBT for the 3 years to 4/2026 - which implies no annual profit growth in the next 2 years, so this looks a soft target, I hope mgt aren’t going to bank huge bonuses for beating an easy target?

Visibility good - all sale secured for FY 4/2024, and >70% sales FY 4/2025 also “secured” (definition is what? Exchanged contracts, or just sales agreed?)

Sales rates consistent with H1, ie a third down on LY.

Enquiry levels are good from potential home buyers.

Pricing “stable”, and above plan.

Build cost inflation now negligible.

Net cash at year end should be higher than at H1 (£422m)

Extended bank facilities to Feb 2029, at £800m gives loads of financial headroom.

Target shareholder annual returns of £283m, with £227m due to be paid by Sept 2024.

Paul’s view - nothing much to get excited about here. I was expecting more bullish talk about recovery. That said, BKG has remained decently profitable, despite volumes having dropped by a third due to well-known macro factors. Its profit seems to have been in a downward trend since 2018, so I don’t think this would be my first pick in the sector.

Will a new Govt allow housebuilders to continue making huge profits from throwing up jerry-built new houses, and rewarding shareholders so generously? That worry, combined with a strong sector-wide recovery in share prices since last autumn, means I’m not personally interested in chasing this sector any higher for now. That said, there seems little doubt the cycle has bottomed out and hence earnings look set to begin improving. So I can also see the bull argument.

Volution (LON:FAN)

Up 6% to 450p (£891m) - H1 Results [slightly ahead] - Paul - GREEN

Volution Group plc ("Volution" or "the Group" or "the Company", LSE: FAN), a leading international designer and manufacturer of energy efficient indoor air quality solutions, today announces its unaudited interim financial results for the six months ended 31 January 2024.

Checking our archive here, Graham and I have been GREEN on this share 3 times since July 2023, including coveted podcast “mystery share” status on 5/10/2023 at 370p/ share.

Marking its own homework, FAN headlines its H1 results with this -

Strong earnings growth, provides confidence of further progress in the second half of the year

Some H1 numbers -

Revenue up 6% to £173m (almost all the growth has come from 3 recent acquisitions)

Adj PBT up 10% to 35.0m (very impressive 20.2% PBT margin - clear pricing power here)

Adj basic EPS up 10.5% to 13.7p

Adjustments are fine, all relating to acquisitions (mainly goodwill amortisation), so I’m perfectly happy with the adjusted numbers.

FY outlook - looks good -

"Our strong performance in the first half, together with the tailwind from our three recent acquisitions, gives the Board confidence in delivering adjusted earnings per share for the current financial year slightly ahead of consensus1.

1. Bloomberg consensus adjusted earnings per share forecast for the year ending 31 July 2024 is 26.1p.

Crystal clear reporting there, and with a helpful footnote - marvellous! Why can’t all companies be this transparent? Often because they’re trying to cover up something untoward, a cynic might quip!

Valuation - the PER is 17.2x on the previously guided FY 7/2024 consensus of 26.1p, so if they achieve slightly more, I’d guess at c.27p, which improves the PER to 16.7x.

There might be further upside in FY 7/2025 as markets possibly improve?

Ah I’ve just read an update from Liberum (many thanks) which raises its FY 7/2024 forecast to 27.0p coincidentally the same as my total guess!

Future years’ forecasts are left almost unchanged at 28.3p (FY 7/2025) and 29.8p (FY 7/2026). I’m encouraged that hardly any improvement in earnings is forecast, as that should leave scope for future upgrades, and reduce the risk of 30% crashes on profit warnings. Hopefully.

Net debt (excl leases, as always here) is £54.2m (6.1% of the mkt cap), almost unchanged from a year earlier. That might sound a lot to a small cap investor, but it’s only 0.7x adj EBITDA (quite low), which is the measure that banks, and private equity seem to use.

Balance sheet - notable for the very large intangible assets from multiple acquistions of £257m. Take these off and NTAV isn’t good, at negative £(22)m. So I disagree with management saying their balance sheet “remains strong”, when it isn’t. Maybe I should drop into their office in Crawley, and go through the numbers with them?! I think it would be more accurate to say that the business relies on bank debt, but it’s at a fairly safe level (providing profits/cashflow don’t fall off a cliff in future).

Note it makes a presentational error of including lease debts within borrowings in a single line, instead of splitting them out on the face of the balance sheet, otherwise debt looks worse than it really is.

“Refund liabilities” is an oddity, at £12.2m within current liabilities, but not large enough to make me want to investigate further. Why is it making provision for refunds though?

Overall then, the balance sheet is not strong, it relies on debt. However the debt levels are not a concern, so it’s OK.

Cashflow statement - looks really good, and remember these are only half year numbers. It generated a lot of cash, has very little capex. Most of the cashflow was spent (roughly equally about £8-10m on each) on dividends, debt reduction, and acquisitions.

To me, this means the company has, if it were to stop acquisitions and repaying debt, the ability to pay a dividend yield of c.6% in a steady state (it’s currently paying c.2% yield).

Or put another way, it’s generating enough cash to keep paying modest divis, and making smallish bolt on acquisitions, and reduce debt, all at the same time. Pretty good!

Paul’s opinion - I like FAN. It looks a good QARP (quality at reasonable price) share.

Hopefully it should see end markets gradually improve, although I think it seems to have put in a creditable performance given tough macro over the last few years.

I’m happy to stick with GREEN again.

It’s the sort of thing that could be a bid target for a US buyer, I imagine.

Bodycote (LON:BOY)

Up 3% to 653p (£1.25bn) - FY 12/2023 Results - Paul - GREEN

A new one for the SCVR, as I continue my push into mid-caps. Roland seems to like it - see the general Stockopedia archive here.

A quick glance at the StockReport shows me it’s worth investigating (modest PER, reasonable yield, balance sheet support, high StockRank, and fairly good quality measures).

What does Bodycote do? From its corporate website -

The leading provider of heat treatment and specialist thermal processing services worldwide

Heat treatment encompasses a variety of techniques and specialist engineering processes which improve the properties of metals and alloys and extend the life of components and is a vital part of any manufacturing process.

I don’t understand anything about its activities, but the numbers below are telling me that this is a good quality business, with pricing power, that nicely grew its profit in 2023 despite tough macro -

Other things I like -

Significant margin improvement; on track to achieve margins in excess of 20% over the medium term…

Disciplined capital allocation resulting in the £52m acquisition of Lake City in January 2024 and a £60m buyback commencing 15 March 2024…

Outlook -

Despite macroeconomic uncertainty we expect to deliver further progress in 2024. We anticipate a reduction in the level of energy surcharges, reflecting further normalisation of energy prices.

2024 should see us take another step towards our medium term margin target of more than 20%.

The Board remains confident in the Group's prospects for continued profitable growth.

Pity about the use of the meaningless catchphrase “profitable growth”, never mind.

What’s the catch here?!

Is there massive debt? No, it has net cash of £12.6m (excl leases), £51.7m net debt including leases.

Is there a pension deficit? Doesn’t seem to be anything significant, just £11m in non-current liabilities.

Balance sheet - NAV £792m, less £333m intangible assets, gives a very healthy £459m NTAV. So its large £505m PPE (fixed assets) are almost all owned outright, with equity.

Inventories seem negligible for the size of business, at only £29.5m, which I’m guessing must be because it does things to customer components, instead of taking inventory risk itself. That’s a lovely business model!

Nothing else of concern, this balance sheet is excellent.

Paul’s opinion - I’ve run out of time now, but have to say I’m bowled over by this. Why hasn’t anyone taken it over? The numbers make BOY shares appear significantly undervalued, so I must have missed something.

With this sort of value & quality available in a mid-cap, it does make me wonder why I’m bothering with small caps!

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.