Good morning folks,

The market has crawled higher this morning, giving frazzled investors a little bit of relief after a tricky week.

There is supposed to be a Weekend Effect, with stocks doing worse on Monday compared to Friday. Is it really true? I have no idea! As discussed in yesterday's report, investors are jittery at the moment, so perhaps we can have another big sell-off on Monday.

There are updates today from:

- Real Good Food (LON:RGD)

- Equals (LON:EQLS)

- Corero Network Security (LON:CNS)

- Quarto Inc (LON:QRT)

I'm likely to run out of content after discussing these shares. So if any of you are still here this afternoon, you can read my review of Once Upon a Time in Hollywood.

Real Good Food (LON:RGD)

- Share price: 6.5p (-10%)

- No. of shares: 100 million

- Market cap: £6.5 million

Real Good Food plc, (AIM: RGD) the diversified food business, today announces its final results for the year ended 31 March 2019.

This company has been causing headaches for investors for quite a while.

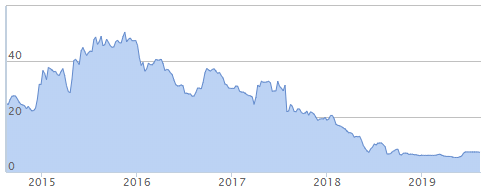

The long-term performance helps to tell the story:

Background

In May, it was fined and censured by the London Stock Exchange for "multiple and serious breaches of the AIM rules and a pattern of unacceptable conduct by the Board". The disciplinary notice can be downloadedhere (PDF file).

The Directors responsible for those breaches are gone, and we have a new Board.

It has completed four disposals, leaving it with two core divisions. So hopefully a much simpler story from now on:

- Cake Decoration (comprising Renshaw and Rainbow Dust)

- Ingredients (Brighter Foods)

Results

Today's results pertain to FY March 2019 - doesn't it seem quite late to publish them?

- Revenue at the continuing businesses falls by 3.4%

- Huge goodwill impairment (£18.7 million)

- The two divisions are said to be profitable, before impairment

Good improvement in Adjusted EBITDA is reported, but I doubt that this is a relevant metric for investor since depreciation will be a real and significant cost at the underlying businesses.

Indeed, the adjusted EBITDA comes out at £1.9 million for the year, but the depreciation charge is nearly £1.6 million. So you if include depreciation in the result, you are left with something only a few hundred thousand pounds over breakeven.

And that's before including huge financial charges. There is an acknowledgement in today's statement that "the Group's level of debt outstanding remains higher than a business such as Real Good Food should have, given its business model".

Net debt was £35.7 million, dwarfing even the adjusted EBITDA figure.

Outlook

Trading is "in line with our modest expectations for the year". The company is focused on reducing debt, which sounds appropriate.

My view

As a general rule, food manufacturing businesses don't interest me too much.

And this company's potted history and above all its high debt load are enough to turn me off this stock completely.

StockRanks correctly identify it as a Value Trap. It's very cheap against net assets, and the company points this out in its commentary today.

Let's consider this in more detail. The company says:

the Group's balance sheet retains a significant tangible asset base, goodwill that has been written down to realistic levels, and has net assets significantly in excess of the Group's current stock market capitalisation. This is an important measure in establishing the Group's financial worth in the future.

Unfortunately, I can't accept this statement at face value. Net assets are £26.6 million, yes, but that includes £52 million of intangible assets. There is still a huge amount of goodwill on the balance sheet, even after the writedowns which have already taken place.

In other words, if you strip out the intangibles, the company has significant negative net tangible assets.

The company also looks cheap against sales, but it's not a very high-margin business and so it probably should be cheap against sales.

Overall, I see this share as one to strongly avoid. I could be wrong, but I just think that equity value looks very slim when you take the debt load into account.

Equals (LON:EQLS)

- Share price: 108.5p (-1.4%)

- No. of shares: 165 million

- Market cap: £179 million

Placing and Open Offer to raise up to £16 million

This was flagged on Wednesday.

Equals confirms a £14 million placing and £2 million open offer.

The purpose: "accelerate corporate offering, facilitate market consolidation through bolt-on acquisitions and provide growth working capital."

The reference to "growth working capital" implies that the company hasn't used up all of its reserves, but that it merely has no more cash with which to carry on any more growth of the business. That might well be true, but as I discussed on Wednesday, it did look as if cash at this company has been heading for zero.

In this regard, the company says:

Equals would benefit from more collateral to fund both the expansion of its corporate international payments business and also its card-based businesses.

If you're happy with its product development and growth opportunities, the cash burn won't be a concern. On the positive side:

In FY 2018 the Company doubled its year-on-year transaction volume to £2.4 billion, and reported a seven-fold increase in adjusted EBITDA to £7.5 million. The Group now serves more than 1 million customers with over 30,000 business customers, including Netflix and KFC.

Trading update - trading has remained strong and in line with expectations.

My view - there is a lot happening at this company and the decision to raise funds with modest dilution to shareholders appears to make a lot of sense. I still think that this one is worthy of more detailed research.

Corero Network Security (LON:CNS)

- Share price: 3.55p (-44%)

- No. of shares: 402 million

- Market cap: £14 million

Commiserations to anyone who held this one last night.

This company's H1 EBITDA loss is set to increase to $2 million (from $1.4 million) as sales in the pipeline failed to materialise as expected.

The pipeline is said to have grown strongly, with high hopes for H2, but it's reasonable for investors to feel jaded when they read commentary like this.

Outlook

Things get worse in the outlook statement.

Management expect revenue for the full year ending 31 December 2019 to be approximately 20% higher than revenue for the prior year (2018: $10.0 million) and anticipate an increased EBITDA loss for the full year (2018: EBITDA* loss $2.1 million), as a result of the additional Corero direct sales investment in the second half of 2019 of approximately $1.0 million.

There could be "a requirement for additional working capital prior to being cash generative". The Chairman has indicated that he would support this.

My view

It seems unwise to get involved in a company which could run out of cash and need an injection of funds from the Chairman, at a price that can't be predicted. I can only agree with Stocko that this has the hallmarks of a Sucker Stock - a stock that is statistically unlikely to generate an attractive return.

Quarto Inc (LON:QRT)

- Share price: 66.5p (-1.5%)

- No. of shares: 20 million

- Market cap: £14 million

This is another debt-laden micro-cap which has been in the wars.

The CEO describes these results as "encouraging" and they are in line with expectations, but the company really needs a good H2, which is the seasonally stronger half.

The main bright point today is that net debt has been reduced by $8 million, compared to a year ago. It is now $65 million (£53 million, nearly four times the company's market cap).

Selling books is currently difficult, and likely to remain so:

The book trade market remains soft, while in the co-edition market, further consolidation is impacting both English and foreign language sales, especially on the Adult segment. As a result, the Group expects the trading environment in the second half to be more challenging than in prior years.

H2 tends to be much stronger, but this outlook statement suggests we don't have all that much to look forward to.

My view - worth keeping an eye on this one, but I suspect that the market is right to keep the market cap at low levels for as long as its debt levels are elevated and profitabilty is elusive.

Once Upon a Time in Hollywood

It's a quiet Friday, and I promised you a review, so here are my thoughts on Once Upon a Time in Hollywood. I will not include any spoilers.

Firstly, I think that Tarantino fans will not be disappointed. It has all the things we like about his work: multiple storylines, a large cast, unique camera angles, and a surprise ending.

Secondly, those who hate Tarantino's work will also not be disappointed. They will have to deal with a narrative that doesn't seem to go anywhere for periods of time, dialogue that exists purely for its own sake, excessive bloody violence, and a few main characters who fulfil stereotypes rather than giving us the chance to witness something more real.

The keys to enjoying this film are:

- Relax, it's a comedy (sort of). The same could be said about Pulp Fiction and Jackie Brown. Tarantino isn't trying to tell us something important about the world or about ethics. He is offering us a few hours of entertainment and escapism, that's it.

- Don't expect it all to make sense on the first viewing. As is sometimes the case with Tarantino movies, there are too many details to take them all in, the first time you see it. If you don't understand something, you can always watch it again. Just enjoy the things that you do understand.

- Go with the flow. There are elements of truth and fiction, and you might not always know which is which. It's just an attempt to tell a story in an interesting way, nothing more. Treat it like you would treat a friend who is telling you an amusing anecdote.

Is it a good film? Well, I enjoyed it very much and I would watch it again. So for me at least, it achieved its aims. Some great actors, great acting and a great director. Hard to go wrong!

Well that was a fun way to round out an exciting and eventful week.

Have a good weekend! Paul is back on Monday.

Best wishes

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.