Good morning!

These are the stocks I've noticed so far today:

- Angling Direct (LON:ANG) - pre-close trading update.

- HaiKe Chemical (LON:HAIK) - proposed cancellation

- Plant Impact (LON:PIM) - cash offer

- CVS (LON:CVSG) - interim report

- MTI Wireless Edge (LON:MWE) - final results

- Elektron Technology (LON:EKT) - disposal of subsidiary

- Athelney Trust (LON:ATY) - annual financial report

I'd also like to give readers the link for an anonymous, 3-minute survey which could help companies to engage with private investors better. It's available here (external link).

Also, time permitting, I will circle back to Jarvis Securities (LON:JIM) and Laura Ashley Holdings (LON:ALY) which reported yesterday.

Angling Direct (LON:ANG)

- Share price: 98p (+1%)

- No. of shares: 43 million

- Market cap: £42 million

We've covered the difficulties at Fishing Republic (LON:FISH) in recent months, so it's a pleasant change to see a fishing-related company that is performing well!

I haven't been able to find any difference in terms of the markets served by Angling Direct (LON:ANG) and Fishing Republic (LON:FISH). So presumably they are in direct competition.

Angling Direct (LON:ANG) is s a recent float, hitting the market last July. We haven't covered it in the SCVR before.

Today's update says that revenue for the full-year ending January 2018 was ahead of expectations at £30.2 million.

Like-for-like store sales are up 10%, which is the same pace that was reported at the interim results.

Scrolling back to those interim results, I see how important the online (e-commerce) platform is to Angling Direct - slightly bigger than store sales, and growing at a massive pace. The year-on-year growth rate reported today in online sales is 54%.

The outlook is "very positive" despite economic uncertainty, higher labour costs and margin pressure from online competition.

My opinion: I should probably reserve judgement for now, seeing as it's a new float and we haven't had a complete set of results yet.

However, I can see analyst forecasts for 1.9p EPS in the year just finished, rising to 3.1p in the current financial year (ending January 2019).

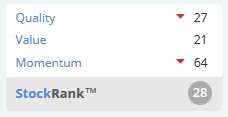

So the market is giving this a fairly ambitious valuation, as the ValueRank of 21 reflects:

In terms of quality, it looks and feels like an industry which is structurally low-margin, or at least with somewhat modest profitability in relation to sales. The interims produced an operating margin of 6%, an improvement on 3.5% achieved in the prior year. I wonder if there is a constant race to the bottom in pricing?

That said, the growth rates shown by Angling Direct in online sales are stunning. If the company is getting that formula right, and keeps stealing market share, it should do well in the years ahead.

Happy to leave this on the watchlist from now on.

HaiKe Chemical (LON:HAIK)

- Share price: 27.5p (+49%)

- No. of shares: 38 million

- Market cap: £11 million

Proposed Cancellation, EGM and Exit Facility

A quick word on this China stock which is seeking to leave AIM.

It has been listed for a long time - since 2007.

Unlike £NBU and £CAMK, which disappeared leaving investors penniless, HaiKe Chemical (LON:HAIK) is giving shareholders what looks like a reasonable exit price, of 30p. Some investors will make a fine profit, at that level.

The reasons given for leaving AIM all sound sensible. In my own words, these reasons are:

- The company can't raise any new money on AIM

- The administrative/financial burden of listing

- Shares are illiquid with a free float of less than 50%

All things considered, therefore, it makes good sense for the company to leave.

And it shows us not to tar all foreign or Chinese companies with the same brush. The exit facility at 30p gives shareholders a clean exit. It sounds to me as if all minority shareholders will be able to get out.

But it's also a reminder of why I am very cautious about going below or around the £10 million market cap these days. You do face the very real prospect of a delisting, if the company doesn't grow to a size where the listing makes sense. And then it's a matter of luck as to whether you get a favourable or an unfavourable delisting.

Plant Impact (LON:PIM)

- Share price: 10.25p (+74%)

- No. of shares: 95 million

- Market cap: £10 million

Another quick note as we say goodbye to this R&D-driven crop enhancement company, which is under offer from Croda International (LON:CRDA).

Plant Impact has a long history of losses, and is identified by the Stockopedia algorithms both as Speculative and as a Value Trap.

In December, it acknowledged that it would need around £7 million in funding by April 2018. Despite the huge reduction in the share price over the last year, I can't help feeling that shareholders should be relieved that this didn't turn into a zero?

CVS (LON:CVSG)

- Share price: 1127.5p (-8%)

- No. of shares: 65 million

- Market cap: £728 million

Proposed Accelerated Bookbuild

This is a bit too big for us to cover in this report, but I have noticed veterinary/animal care as a sector with great potential long-run growth, so I do take an interest in this company.

CVS buys up veterinary practices and incorporates them within a group structure which includes laboratory services, crematoria, an online pharmacy-retailer ("Animed Direct"), etc.

Today's figures show the cost of acquisitions catching up on the company. Operating profit reduces from £9.5 million to £8.1 million.

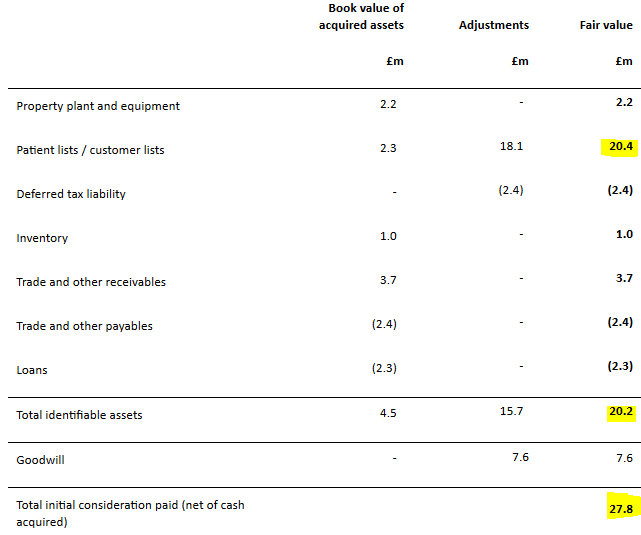

Drilling into the figures, what appears to be dragging most heavily on results is the amortisation of intangible assets (mostly customer lists) acquired from new veterinary practices added to the group. In other words, the expense associated with buying all of those customer lists is being reflected now in increased charges on the income statement.

I hope you can read the highlighted numbers above.

What it says is that for the last six months, CVS paid £27.8 million to acquire new businesses. It reckoned the fair value of the net assets acquired was £20.2 million, leaving goodwill behind of £7.6 million.

And if you look at what the acquired book value consists of, it is more than fully accounted for by the value of patient/customer lists (£20.4 million of lists versus £20.2 million total value).

The value of these lists decays over time, and it is this decay which is dragging on reported profits.

Amortisation of intangible assets increased from £7.6 million a year ago to £9.3 million today. If it had merely stayed the same, then CVS's operating profit would have increased rather than falling by 14%.

Debt/Fundraising: As Paul has noted before with CVS, doing so many acquisitions has been a big strain on cash. Net debt increases by £17 million to £100 million, with a negative £30 million effect thanks to the acquisitions in the period.

According to the latest RNS, £60 million was raised today in new shares priced at 1075p. This will be used partly to pay down debt but also to help fund £40 million of deals in the pipeline.

The discount to yesterday's share price resulted in strong support:

The Placing was heavily oversubscribed and has received strong support from both existing and new investors.

My opinion

This reminds me a lot of Dignity (LON:DTY) - buying up lots of small, professional service businesses in a fragmented market.

I'm a bit cautious about the idea that veterinary practices should be consolidated. I can also see good reasons why they might do well being privately owned by partners.

My other little gripe is that the company continues to pay dividends even while its debt pile is increasing and it's selling shares.

The money raised today will be spent on yet more acquisitions, resulting in more and more intangibles on the balance sheet.

I could understand the strategy a little better if organic growth was very large, so that there was a strong self-financing element to the expansion.

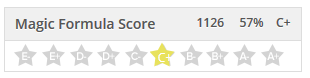

Overall, therefore, even though I like this sector, I'm not sure if this is the right way to get involved with it. The "Magic Formula" score, incorporating one of my preferred measures of quality financial performance, also takes a cool view on this share:

MTI Wireless Edge (LON:MWE)

- Share price: 27p (+3%)

- No. of shares: 53.6 million

- Market cap: £14 million

Final Results and Scrip Dividend Alternative

I don't feel qualified to judge the merits of this - it's a small antenna business, based in Israel. I haven't studied it before.

It describes itself as:

a market leader in the manufacture of flat panel antennas for fixed wireless broadband and a wireless irrigation solution provider

The results today are very good, in terms of sales growth (13%) and translating this to EPS growth (30%).

When Paul covered it in 2016, he remarked that debtors were on the high side.

Versus $26.4 million of revenue, MTI carried average receivables of some $9.4 million during the year. On average, therefore, it is taking customers about 130 days to pay their bills. That does seem on the high side, doesn't it?

I haven't studied this in any depth but it looks like it might be worth exploring for those whose risk tolerance extends to overseas companies (mine rarely does, but I'm willing to make exceptions).

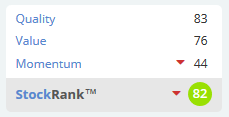

The StockRank is nice:

Elektron Technology (LON:EKT)

- Share price: 23.4p (+5%)

- No. of shares: 186 million

- Market cap: £43 million

This is a small deal in stock market terms, £0.8 million being paid for a subsidiary, with up to a further £0.8 million payable depending on sales in the first year after the deal.

CEO comment:

"The disposal of Queensgate represents the final step in our strategy of simplifying our operations and will enable management to focus solely on those businesses which the Board believes offer potential for sales and margin growth, namely Bulgin, Checkit and Elektron Eye Technology."

We've not been covering Elektron in the SCVR. I've had a quick look at the interim report, and I see that at least some of its subsidiaries have been profitable. Excluding the Checkit business mentioned above, it made a £2.4 million operating profit from continuing operations in H1 2018. At the same time, it was selling off other non-core business.

I suspect that Queensgate may have contributed an operating loss in H1 2018, as it was loss-making in FY 2017. If so, then getting rid of it immediately improves Elektron's pro forma result.

So maybe there is value hidden in Elektron, underneath the loss-making businesses it has been carrying?

It has a very healthy cash position of c. £5 million (January 2018) and the major subsidiary, Bulgin, was reported to have had a good year in the most recent trading update.

Another stock to keep an eye out for, the next time it releases results.

Athelney Trust (LON:ATY)

- Share price: 260p (unch.)

- No. of shares: 2.2 million

- Market cap: £6 million

I mention this for no other reason than that its Annual Financial Report is usually quite entertaining. This one looks promising. Enjoy!

Jarvis Securities (LON:JIM)

- Share price: 495p (+1%)

- No. of shares: 11 million

- Market cap: £54 million

Final Results (yesterday)

This is a super little financial stock.

It offers a no-frills execution-only share dealing service to retail customers, and an outsourced share dealing & custody administration service to institutions. Many of us are familiar with it through "X-O", its retail arm.

It has some of the best characteristics you look for in a share: huge returns on capital (capital-light business model based on technology and efficiency) and tremendous cash generation and cash flow conversion (it's easy to charge customers when all of their cash is sitting right there in their account with you).

I have owned this share in the past, but what spooked me out of it was the view that the offering was maybe a little bit too basic, and that customers would be drawn to more sophisticated or colourful offerings, e.g. the new share dealing service by IG Group (LON:IGG) (in which I hold shares).

Those fears have so far been unfounded, as commission and fee income continues to rise.

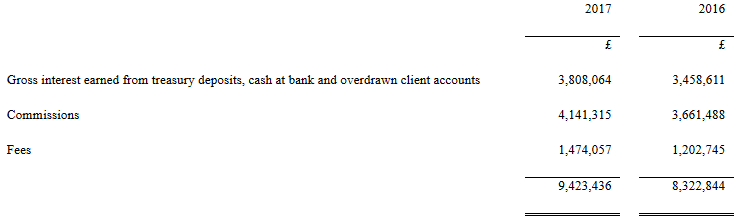

Revenue breakdown is as follows:

A cheap, no-frills service offering is consistently popular, it appears.

As you might also have noticed, interest income is also a significant component of revenues.

In this regard, Jarvis Securities (LON:JIM) is a "sleeping giant" with respect to interest rates: it's one of those companies which will see its income rise substantially if interest rates return to "normal".

(Another example of such a stock is Park (LON:PKG), which I hold)

For the current year, with revenues up 13% and expenses only up 7%, we get a 21% increase in PBT, thanks to the operating leverage.

Another point worth mentioning is the realistic and humble tone always struck by the Chairman/CEO. Interestingly, he now seems to think that the company has crossed a milestone in terms of size:

These changes coincide with what I feel is a maturing of Jarvis as a company. Realistically we can no longer consider ourselves to be a small company. We now have considerable client assets in custody and under administration - though we are nowhere near the size of the largest brokers in the industry. Our market capitalisation is now over five times that of ten years ago. The challenge Jarvis has over the coming years is to embrace the change that growth requires without losing sight of the factors that have brought commercial success to the business in the first place. This challenge should not be under estimated, although I am confident we have the right staff and culture to succeed.

The shares aren't particularly expensive, on a PE of about 15x the earnings just seen.

I'll probably continue to watch it from the sidelines for now, but I'd be really interested to buy it during a bout of pessimism.

Laura Ashley Holdings (LON:ALY)

- Share price: 5.5p (-4%)

- No. of shares: 728 million

- Market cap: £40 million

Interim Results (yesterday)

Share price destruction continues with this one unabated. Even as a bear/sceptic in relation to this share, I am a bit surprised that it has fallen so low and so quickly. My last report on it was in June 2017, when the share price was 12p.

It feels like just the other day that these were trading around the 25p-30p region!

Most of you will have some familiarity with the stores - home furnishing and womenswear for a mature audience.

Like-for-like retail sales are pointing down, falling by another 0.5% in the latest half-year period (LFL retail sales fell 3.1% during the previous financial year). Furniture suffered the most, down 4.4%.

The famously huge stream of dividends was cancelled as of last year, and we got confirmation yesterday that this decision will not be reversed in the short-term.

Despite all the negatives, the company is still profitable, albeit at much lower levels. It made PBT of £4.3 million (previous year: £7.8 million). Sterling was weaker compared to the previous year, and that is not something that Laura Ashley can do anything about (besides hedging).

Indeed, the company claims that GBP weakness was "the most significant single factor in the fall of profit before tax".

The company is shrinking, closing 25 stores in the period, with the result that total sales fell by nearly 8% to £134.7 million.

At least this is an orderly wind-down. The challenge will to be shrink quickly enough and with as little friction as possible, to prevent turning the present difficulties into a terminal decline.

Outlook for the full year:

The Board have reviewed the first half results and forecasts for the remainder of the year to 30th June 2018 and, given the continued market challenges, considers that net pre-tax profit for the year will fall below market expectations.

Net debt has increased compared to a year ago, up to £29.2 million (I had to pull out last year's report to make the comparison). Of this, nearly £21 million relates to a building which the company bought in Singapore for £31 million.

My opinion: the big positives associated with this share were supposed to be the online platform and the international franchising and licensing revenues.

However, even these ventures are showing limited success. Online sales are up 5% while franchising and licensing revenue fell 3%.

And the big cloud hanging over it remains: the foreign ownership of most (60%) of the stock, and questions over whether the company will bother to continue with its stock market listing for the long-term. If it goes through a period of unprofitability, as it may do soon, perhaps that will be seen as an attractive moment to take it private?

I need my portfolio to be reasonably liquid at the moment, so I can't create any new positions where there is a delisting risk.

This remains suitable only for the brave, sadly.

All done! See you next week.

Cheers,

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.