Good morning!

I'm keeping a very close eye on announcements from retailers, after recent concerning economic data, and the profit warning from DFS yesterday.

Tesco (LON:TSCO) put out its Q1 (Mar-May 2017 inclusive) trading update today, which was surprisingly good. Its UK LFL sales performance rose to +2.3% in Q1, which was stronger than any quarter last year. So that seems to have placated the market, which had yesterday sold off retailer & hospitality stocks quite sharply.

Retail sales data

I was rummaging through the ONS report, released yesterday, on retail sales, which is here.

The headline bullet points in the report sound alarming, and triggered a sell-off yesterday;

This seems to have triggered journalists & commentators to produce headlines about retail sales plunging, and worst growth in 4 years. However, on closer inspection, this data is talking about sales volumes. Yet the overall value of sales is rising much more strongly, because prices have gone up (see the last bullet point). Obviously, volume * price = value.

Therefore, to have any sales volume rise at all, when prices are up 2.8% Y-on-Y, actually isn't bad at all. So I am wondering whether yesterday's panic might have been a bit of a red herring? Tesco's reassuring update today seems to confirm that things may not be bad, after all?

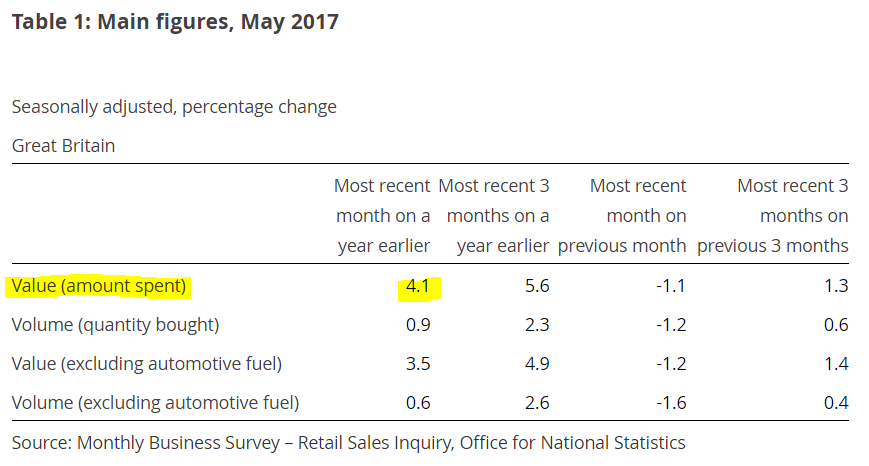

Here's the table showing that retail sales (amount spent) in May 2017 was actually up 4.1% on May 2016. That doesn't sound too shabby to me:

However, these updates (ONS, and Tesco) only go to the end of May 2017.

Also, retailers are facing serious cost headwinds, and I doubt many are likely to generate enough LFL sales growth to absorb cost pressures next year & beyond, let alone this year.

Political upheaval

The problem is that all the UK political upheaval started on 8 June, with the hung parliament. Therefore we might well see a plunge in consumer confidence & spending this time next month, when the June figures are announced.

Mind you, when the Brexit vote happened, consumers seemed to shrug it off quickly. So who knows what might happen this time? Higher inflation is curtailing disposable income now though.

Another election could be held in the next year (quite likely, when the distribution of parliamentary seats gives no obvious secure coalition possibility), history tells us (e.g. 1974) that the initial swing continues further at the second election, when there are 2 elections close together - see the Feb 1974 and Oct 1974 elections. I think we could be in a very similar situation now - an incompetent Tory PM clinging on to power, as things deteriorate.

So that means the very real possibility of a Corbyn-SNP Government in the not-too-distant-future, which is likely to be catastrophic for the stock market. I don't think this risk is being taken seriously enough by investors, and that could be a costly mistake. Corbyn has made no secret of his wish to punish the rich and businesses, raise corporation tax (initially to 26%, but likely to go much higher after that, in my view). That would reduce corporate earnings, and probably cause a capital flight out of the UK - so weaker sterling & higher inflation.

For the purposes of these reports, I'm only interested in the economic effects, not the rights & wrongs of the politics - that's for Twitter rants!

Set against that, a higher spending UK Govt could be good for some companies, in the short term anyway. It seems likely that, whoever is in power, will need to turn on the public spending taps to stand any chance of being re-elected. Younger voters especially seem to be in a demanding mood, and don't know or care about the consequences of fiscal profligacy - so might end up learning the hard way.

All this provides potential risks & opportunities for investors. It's one of the things that makes me feel increasingly cautious. So I'm selling things that are speculative, or where my conviction level isn't high. Holding cash on the sidelines, and balancing up longs with shorts, is my current strategy - but as always I reserve the right to change that stance at any time, if the facts change.

Another Greek bailout

What else, oh yes there's just been another Greek bail-out.

I'm currently reading a remarkable book by Greek's former Finance Minister, Yanis Varoufakis, called "Adults in the Room". It's absolutely riveting, and is highly recommended. He points out very bluntly that these repeated bail-outs are not actually bailing out Greece at all. They are bailing out Greece's creditors. Without these Greek bailouts, the French & German banking systems would have collapsed, and probably the Euro too.

He is extremely critical of Merkel, Lagarde, and the EU generally - accusing them of being blatant liars, and hanging out Greece to dry, for their own political & economic purposes. It's also a balanced book, in that he admits the many failings of Greece itself. His explanations of how oligarchs bled the country dry, is most revealing. Well worth a read, and it's surprisingly easy to follow too - quite conversational in style, and he explains complex subjects clearly.

Liquidity

Yesterday's mini panic threw up the thorny issue of lack of liquidity in small caps. This is a big problem. If you want to sell when other people are also trying to sell, then the price can absolutely tank. We saw that in quite a few private investor favourite shares yesterday.

Furthermore, it can sometimes actually be impossible to sell. E.g., I put in a sell order yesterday, to dispose of 5,000 shares in an impulse buy called Eagle Eye Solutions (LON:EYE) , and my broker only managed to sell 1,000 shares. There was nobody prepared to buy it. In that type of situation, the market price is basically fictitious. If you were a forced seller, then you might have to take a 10%+ haircut on price. If you held in larger size and tried to sell, you probably wouldn't be able to sell at all.

I recall recently one very, very illiquid stock. I tried to sell, and was quoted a price of 10p by the market maker. The published market price was something like 40p at the time! But the MM would only buy a few hundred quid's worth at that price!

So the lesson is that illiquid stocks can be impossible to sell when the market turns ugly. Therefore the time to take profits is when the price is rising, not when it's falling - as it's sometimes too late by that time.

Hence why personally I've moved significantly into cash before there's any crisis. There might not be a crisis, in which case, fine - I can move back into the market when it suits me.

When am I going to write something about small caps, I hear you ask?!

There's very little news today, but throughout this afternoon I'm going to have a look at the trading updates or results from;

SThree

Interquest (LON:ITQ) - scandalous rip-off of small shareholders by MBO

Fusionex International (LON:FXI) - another scandalous rip-off

System1 results from yesterday

So this report should be finished by about 5pm.

EDIT: Sorry, I fell asleep on the sofa, and then had to assemble some flat-pack furniture.

Also, the tower block tragedy has massively been on my mind lately, so I didn't feel like writing about shares.

Will try to catch up over the weekend. I'm not a machine, and just write when it flows. Sometimes it doesn't. Enjoy the summer weather! :-)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.