Good morning!

The list for today is going to be something like this:

- J D Wetherspoon (LON:JDW)

- Conviviality (LON:CVR)

- Burford Capital (LON:BUR)

- TechFinancials Inc (LON:TECH)

- SimplyBiz

- H & T (LON:HAT)

J D Wetherspoon (LON:JDW)

Wetherspoon shares are marginally lower after beating H1 forecasts but expressing caution on H2.

LfL sales were up 6.1% in H1, but slower growth and higher costs are anticipated in H2, so the full-year forecasts are unchanged. Here's the half-year report. Relevant for a wide range of companies in the sector.

Conviviality (LON:CVR) (suspended)

Conviviality has confirmed that it is working on "the possibility" of an equity fundraising, to fund its VAT payment.

Given that its existing lenders were already maxed out, and probably unimpressed by the company's ability to make cash flow projections, this has seemed the most likely outcome.

To its credit, it did succeed in cancelling today's dividend payment, saving £8 million. That relieves some of the pressure - I was penciling in a 50p placing price, but that is looking a bit pessimistic now.

Of course, this is purely speculation on my part: it all depends on the hunger of existing shareholders, and the demand for new shares. It's impossible to tell where the demand for more shares will find equilibrium against forthcoming supply (incidentally, this is why dilution is so risky for existing shareholders - you have no idea how bad the dilution is going to be). Funding could happen at almost any level.

The irony is that Conviviality paid out nearly £20 million in dividends last year, and is now scrambling to find £22 million from somewhere.

Even before this VAT débâcle, I thought Conviviality's dividend payments were questionable. Over the last three financial years, including this one, it has raised over £190 million (gross) from shareholders to fund acquisitions, paying significant fees. At the same time, it has distributed £27 million in dividends, triggering tax liabilities for shareholders. Given all the frictional costs involved, why raise funds and return funds at the same time?

Not paying a dividend this week was the right thing to do, but not paying a dividend for the previous two years would also have been sensible, in my opinion.

Hopefully, trading will continue as normal with suppliers and customers, and the problems will not become any more serious. As the company itself said regarding this year's forecasts:

To the extent that the current situation creates operational difficulties, this may negatively impact the adjusted EBITDA range.

If and when the shares resume trading, I would remain very cautious about getting involved. I've been a sceptic for quite some time not just on Conviviality's valuation but also on its strategy. The former is likely to be reset at a more realistic level, but we still don't have any evidence that a more prudent strategy will be pursued in future.

Burford Capital (LON:BUR)

- Share price: 1402p (+2%)

- No. of shares: 208 million

- Market cap: 2,918 million ($4,085 million)

I'm a little bit reluctant to write about this one, because 1) the market cap is well beyond our limits at the SCVR, and 2) it's much more difficult to analyse than the average company. But I'm happy to say a few words, since so many readers are interested in it.

Firstly what is it - it's a law firm, specifically focused on litigation finance. This means taking large stakes in legal claims, using its own capital and also now using the capital of others.

It has been a spectacularly successful investment:

According to the latest figures, its balance sheet equity has soared to $800 million, of which $351 million is money invested by shareholders ("share capital"), and $423 million is retained earnings ("revenue reserve"). It has also paid out around $65 million in total dividends, according to a quick calculation by me.

The entire asset base is now $1.5 billion, with the main entry being the all-important "investments" - i.e. stakes in legal cases. These investments are now worth some $1,075 million.

Investments are written up as their value increases, but Burford argues that it does this conservatively, not writing up the value of its claims to their full value in the secondary market:

The reality is that we all live in a world of market valuations of assets. Fund managers mark their entire portfolios to market all the time. We operate much more cautiously, given that the secondary market for litigation risk is less developed, but fair value accounting is a fact of life and our marks have historically been shown to be reliable.

My opinion

I do find it difficult to have a strong view on Burford. I suppose I could simply congratulate the company and its investors for their success, and leave it at that. But I can say a little more.

One objective fact is that it is an innovator in its field, and has had tremendous profitability and growth so far.

As a financial stock, this is another case where I would be using the book value as my anchor number, thinking in terms of what multiple of book value makes sense.

The number currently attached to Burford is 5x book value ($4 billion market cap, $800 million net assets). If we assume that investments are worth an additional $200 million due to conservative accounting, we get 4x book value.

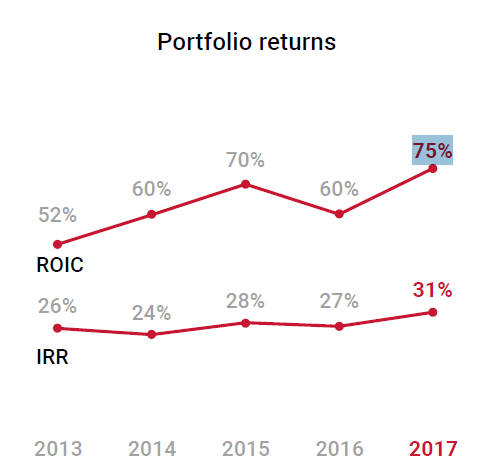

This says that investors are expecting very serious returns in the future. Based on the track record, it looks reasonable to expect above-average returns:

The main risks I would say are probably a) concentration risk in investments, and b) defending the company's competitive position, as more capital is likely to flow into the sector.

Concentration risk has declined as the company's portfolio has grown. This is a good thing, although it may perhaps be difficult to maintain a 31% IRR over a much larger portfolio.

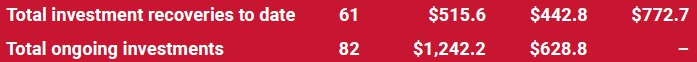

The table below summarises the company's track record in its lifetime: it has committed $516 million, invested $443 million and recovered $773 million so far from 61 investments, generating the return statistics shown in the previous chart. There are a further 82 cases where it has invested $629 million, and not yet made any recoveries.

Arguably, we could mark the ongoing cases up by a lot more than $200 million to produce a bigger book value and a lower effective price/book value multiple.

While previous successes have been concentrated (e.g. the Peterson case, which is probably still undervalued on Burford's balance sheet), future successes are likely to be far less concentrated.

Moving on to think about competitive prospects, it must surely be inevitable that more capital will be attracted into this space.

Last year, Burford made what I thought was an unconvincing argument as to why new entrants would not be able to compete with it:

Second, the litigation finance market is still relatively nascent and new entrants need to raise capital to compete. The providers of that capital can see Burford’s publicly disclosed returns, and sensibly demand comparable returns from new entrants. Thus, discounting to achieve volume will result in immediate underperformance by the new entrant, which will in turn lead to investor unhappiness and the refusal to advance incremental capital.

I don't see the sense in this, because Burford's returns have been huge. Even if a competitor were to underperform Burford by a few percentage points, they would still beat average equity market returns and virtually all traditional investment markets.

That was the second point in a three-pronged argument as to why competition would remain muted in the short-term. I do think that competition will heat up eventually, but it looks like the company is right that competition remains weak for now.

On balance, I'm neutral toward the stock. It's an interesting and unusual one. There are some significant risks attached to it, and an adventurous valuation, but it keeps doing really well. And there is not much point in making forecasts for next year, because anything could happen:

TechFinancials Inc (LON:TECH)

- Share price: 24p (+11%)

- No. of shares: 72.5 million

- Market cap: £17 million

Notification of CEDEX Token Pre-Sale Event

I'm mentioning this as a measure of the ongoing crypto-mania. This is an RNS announcing the scheduled launch of a new coin related to diamonds.

Working within the Ethereum (ETH) eco-system, the new coin will be assisted by a proprietary algorithm which will estimate the value of the underlying assets.

Every diamond is unique, and this is why exchanges for diamonds don't exist in the same way as you have exchanges for gold, silver, copper, etc. Previous attempts to create liquid markets in diamonds have failed.

When you read the prospectus for a new equity issue, it can be alarming to realise how few rights you have as an ordinary shareholder, and the extent of the risks to which you are exposed.

New crypto-currencies, however, are on another level completely.

Consider these risk warnings from the whitepaper for the CEDEX Coin (CEDEX means "Certified Blockchain Based Diamond Exchange). The emphasised points are mine:

CEDEX tokens hold no rights and confer no interests in the equity of CEDEX. CEDEX tokens are sold with an intended future use on CEDEX platform and all proceeds received during the token sale may be spent freely by CEDEX on the development of its business and the underlying technological infrastructure.

CEDEX tokens should not be acquired for speculative or investment purposes with the expectation of making an investment return.

The Tokens are designed and intended to perform as a functional utility for use only on the Company’s business platform that is yet to be developed.

Because CEDEX Tokens confer no governance rights of any kind with respect to the Network or Company or its corporate afliates, all decisions involving the Network or Company will be made by Company at its sole and absolute discretion, including, but not limited to, decisions to discontinue the Network, to create and sell more CEDEX Tokens for use in the Network, or to sell or liquidate the Company.

At least when you buy an equity, you have some rights - the right to vote at meetings and get a dividend. When you buy a coin, you have no rights at all.

The SimplyBiz Group Plc

Another new float worth mentioning, SimplyBiz is another service provider to financial advisers. It has that in common with IntegraFin Holdings (LON:IHP), whose flotation I also covered recently.

SimplyBiz claims to be "the UK's largest support services compliance provider for intermediaries (by revenue)". It is headquartered in Huddersfield.

The Placing will raise £30 million for SimplyBiz (to pay down debt) and £34.6 million for selling shareholders.

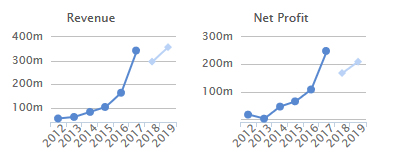

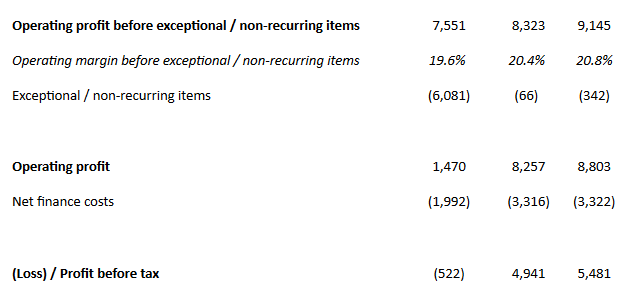

An opening market cap of £130 million is anticipated, versus historic numbers (2015 to 2017) as follows:

If exceptional costs remain controlled and if finance costs are much lower after the fundraising, then the valuation against 2018 earnings might turn out to be quite reasonable.

H & T (LON:HAT)

- Share price: 347p (+4%)

- No. of shares: 37.4 million

- Market cap: £130 million

(Please note that I own shares in H&T)

This pawnbroking group remains an important share for me, despite having more than halved my position in it. If I hadn't sold a chunk, it would have ended up being more than 25% of the portfolio. But I still have a healthy holding in it.

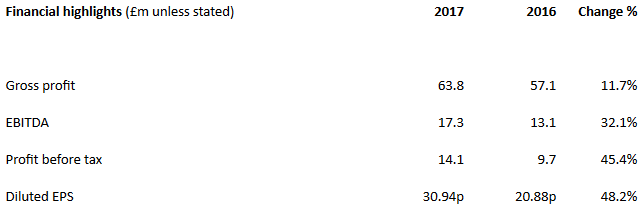

The financial highlights from these results (published on Tuesday) are excellent and speak for themselves.

If you drill into the segment information in footnote 2, there was a £4.7 million increase in gross profit, after taking into account impairments on personal loans. (The above gross profit numbers do not take these impairments into account.)

When you include the effect of impairments, H&T's increase in profitability was surprisingly broad-based, despite the stunning growth in personal loans.

There was little or no improvement in profits from gold purchasing, pawnbroking scrap and "other services" (FX, electronic buyback, cheque cashing and Western Union).

The core pawnbroking operation, on the other hand, delivered a respectable 4.5% improvement, with profits up by £1.3 million. Its pledge book finished the year up by 11.6%, so hopefully there will be some momentum for it through 2018 as well.

Retail did even better, helped by the company's est1897 jewellery brand and the successful roll-out of the est1897 website. This segment result was up by £1.6 million, as higher volumes offset lower margins.

Finally, personal loans were the biggest contributor to growth, as expected. This segment produced an extra £2.2 million in profits (after impairments) as the personal loan book almost doubled to £18 million.

Some shareholders have been wondering why the share price has seemed a bit subdued, on a trailing PE ratio of 11x, despite excellent results. The most plausible explanation I can give is that buyers are held back by the ongoing threat of further FCA action.

Half of H&T's personal loans fall under the FCA's definition of high-cost short-term credit. In the latest update on its review of high-cost short-term credit (link), the FCA said:

There is an emerging picture of a case for possible intervention in a number of markets but also a recognition of the limits of what can be achieved through traditional regulatory interventions alone.

Among the potential solutions mentioned in the update is the idea that government should subsidise losses or give tax breaks to non-profit lenders and credit unions. This would be a negative for everybody else in the industry.

Ultimately, it appears unlikely that the FCA will do serious damage to the pawnbroking and personal loan business model, especially in the case of H&T whose services are well understood by customers and highly competitive against existing alternatives. But I think that this is probably the main concern which overhangs the share price for now.

The outlook is fine, and trading is in line with expectations:

The Group has enhanced its ability to serve a wider customer base, both in store and online, with growth in its well-established core products and the newer unsecured lending offering. This diversified approach to growth reduces the risks inherent in any individual objective and positions the Group to capture share in this exciting market.

The balance sheet shows net tangible assets of about £90 million, and total balance sheet size of £142 million. Bank borrowings reached £22 million, from a facility which now allows maximum borrowing of £35 million. I am comfortable with all of these numbers.

I might finish by noting that H&T currently enjoys a near-perfect StockRank of 98.

That's enough for today. Thanks for dropping by and enjoy the weekend.

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.