Good morning, it's Paul here with the last SCVR for this week.

Estimated timings - should be well before 1pm official finish time, as it's quiet for news today.

Update at 11:15 - today's report is now finished.

.

Wey Education (LON:WEY)

Share price: 25.5p (up 10%)

No. shares: 138.5m

Market cap: £35.3m

Wey Education plc (AIM: WEY), the online educational services group is pleased to update the market on current trading for the year ending 31 August 2020.

Unsurprisingly, this online education group has been a beneficiary of the covid crisis, and is trading well;

Trading has continued to be very positive since the publication of the group's interim announcement in May and is in excess of expectations. Group turnover is expected to be in excess of £8m for the financial year ending on August 31, 2020, an anticipated growth of in excess of 30% from the previous year.

Group Profit Before Tax (after adjusting for share based payments and amortisation of acquired intangibles) is expected to exceed market expectations of £0.5m (2019:(£0.6m Loss)).

Profits would have risen more, but it has spent more on marketing. That's not a very convincing argument to me, because the nature of this business is that heavy marketing spend is vital, as that drives growth.

My other reservation about this business model, is that it's not like selling software, where growth drops straight through to profits. Wey has to provide a complex & expensive education service, employing teachers, and making sure everything is well organised & executed. I think that limits growth to some extent, and that costs rise as it expands. Hence I'm not as excited about this share as I used to be when first researching it.

T o my mind the valuation looks a bit toppy. After all, if this was a mature business, we would probably only value it (making just over £0.5m profit p.a.) at maybe £3-5m? Hence the additional c.£30m premium in the current valuation is investor expectations for growth.

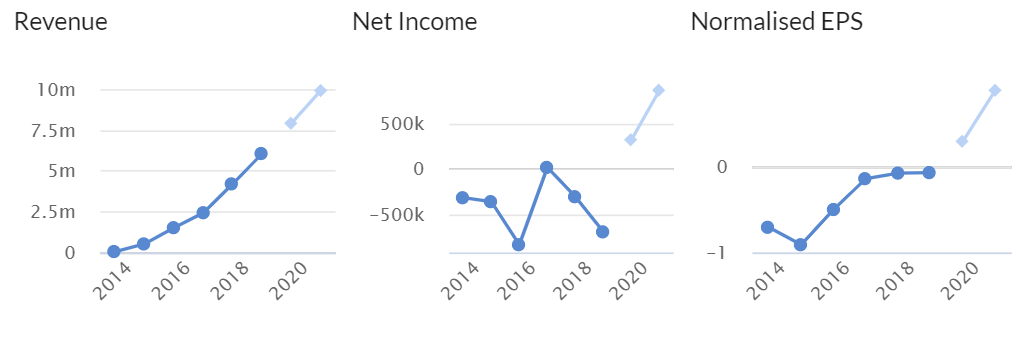

As you can see, growth has been steady, but it's only just breaking into profit;

.

My opinion - it's clearly operating in a good sector, benefiting from covid. I think we should do far more teaching online - it's obviously better than getting 30 bored teenagers into a classroom, where they're only really interested in messing around & goading the teacher. That's not possible online. Also what life skills are learned in schools? Nothing that relates to adult society, as far as I can see. Dealing with bullies? That's about it.

Is the growth at Wey exciting enough to justify the valuation? I'd be looking to pay no more than 20 times next year's forecast earnings, which is 20 x 0.9p = 18p per share. The current share price of 25.5p is well above that, which personally I'm not prepared to pay. So, on valuation grounds, it doesn't interest me at this level. I remember buying around 6p some time ago, which represented much better risk:reward than the current level.

.

Gattaca (LON:GATC)

Share price: 50p (up 15%)

No. shares: 32.3m

Market cap: £16.2m

Gattaca plc (LSE-AIM: GATC), the UK's leading specialist Engineering and Technology recruitment business, today provides the following trading update for the year ending 31 July 2020.

.

.

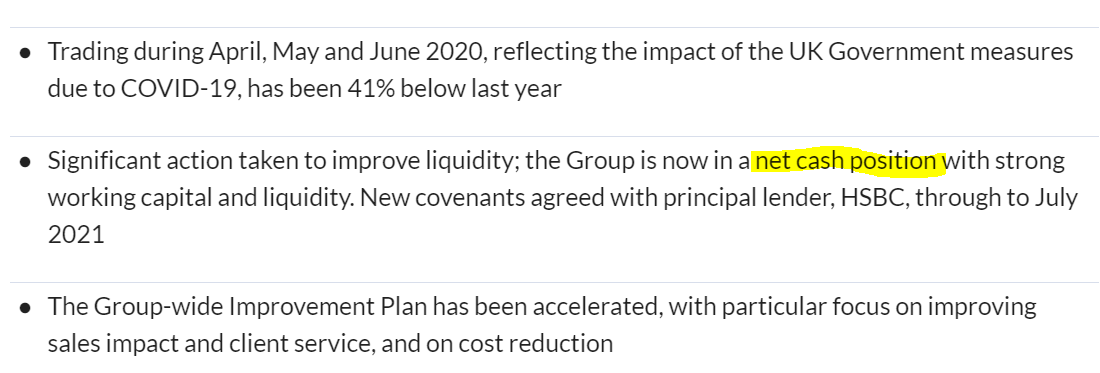

Liquidity - note that the net cash position excludes invoice discounting debt, so it's not really a net cash position overall.

Also note that reduced revenues has led to working capital unwinding - i.e receivables turning into cash. That would go into reverse as revenues recover. There's a £10m deferred VAT benefit too. Hence I think we need to treat the current position as somewhat artificially good.

Cost-savings of over £3m are in the pipeline. I expect like many other companies, the covid crisis has brought into question the need for offices, when staff can work fine from home. That could help margins improve in the this whole sector.

Broker note - there's a detailed note out today from Equity Development, if you're interested.

My opinion - there might be some value here, but the sector doesn't interest me at all.

.

I'll leave it there for today, as there's nothing else of interest.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.