Good morning!

Not much to report on from my hotel room this morning, which is just as well since I only have about an hour before I have to leave to speak to the crowd at Mello.

There were excellent presentations yesterday from Impax Asset Management (LON:IPX), Scientific Digital Imaging (LON:SDI) and Judges Scientific (LON:JDG), and probably lots of other companies I missed.

Today I'll look to attend presentations from Water Intelligence (LON:WATR), Sosandar (LON:SOS), Character (LON:CCT) and Avation (LON:AVAP).

In this report I will try to cover:

- Creightons (LON:CRL)

- Future (LON:FUTR)

- Staffline (LON:STAF)

Creightons (LON:CRL)

- Share price: 28p (pre-market)

- No. of shares: 62.5 million

- Market cap: £17.5 million

Final results timetable and trading update

(Please note that I currently have a long position in CRL.)

Not sure how the market might react to this - I don't see any broker forecasts - but it's ok from my perspective.

H2 revenues will be "broadly similar" to H1. For context, the H1 result was £22.3 million (with PBT £1.4 million).

"Broadly" usually means "a little lower", so we might see full-year revenues of c. £44 million, maybe?

Revenues in FY 2018 were £34.8 million, so that would be a 26% increase.

The company has also enjoyed a little bonus:

a one-off benefit from the recovery of R&D expenditure through the government's corporation tax rebate scheme in the region of £350,000 in respect of 2016/17 and 2017/18 and thereafter for the duration of the scheme, the company is likely to receive an annual benefit proportionate to our allowable R&D expenditure.

I presume this means about £180k benefit for each financial year, adding up to £350k in total.

When you have a market cap of less than £20 million, every little helps. I'm happy to continue holding.

Future (LON:FUTR)

- Share price: 914p (+7%)

- No. of shares: 82.5 million

- Market cap: £754 million

I haven't looked at this one in a while, so I've just been reacquainting myself with its media brands, several of which I recognise.

Key points from today's update:

- full year results should be ahead of expectations

- revenue +100% to £109 million, helped by acquisitions. Most revenue is now derived from the US.

- various adjusted profit measurements growing rapidly

- statutory operating profit +163% to £10 million

I want to separate organic growth from growth by acquisition. Future says there was organic media revenue growth of 38% at constant currencies. Media revenue is 70% of the total - the rest is in the Magazine segment.

Later, the statement says there was organic revenue growth in the "core" business of 14%.

My view - I have to cut this short due to time constraints. I don't have a strong view on this share yet. The balance sheet is stuffed full of intangibles and historic losses, so the NCAV (current assets minus total liabilities) is a very large negative number. It has a large debt facility to help it keep growing. If profitability is sustained, it should be fine.

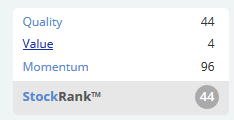

My initial impression of this aligns with the StockRank view that it's a Momentum Trap, possibly overvalued, but I haven't had the time to do as much research as I would need to reach any firm conclusions. So take this with a larger grain of salt than you normally would!

Staffline (LON:STAF)

- Share price: 500p (-40%)

- No. of shares: 28 million

- Market cap: £140 million

Adjusted EBIT forecast reduced to £23 - £28 million, versus prior forecast of £43 million.

There are a lot of excuses given, and problems with publication of the accounts. At the end of the day, this doesn't seem to have been such a good business after all. I no longer study the recruitment sector in any detail, having decided that there are easier ponds in which to fish.

That's it for today, have a great weekend and normal service shall resume next week.

Cheers

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.