Good morning from Paul!

All done for today! Have a lovely weekend.

More rail strikes have been announced, days and companies are listed by Sky here. Dare I say it, but if that's the full extent of the strikes, it doesn't look too bad. The hospitality sector in particular could really benefit from having an uninterrupted festive season, so let's hope a solution can be found to this very long-running problem.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

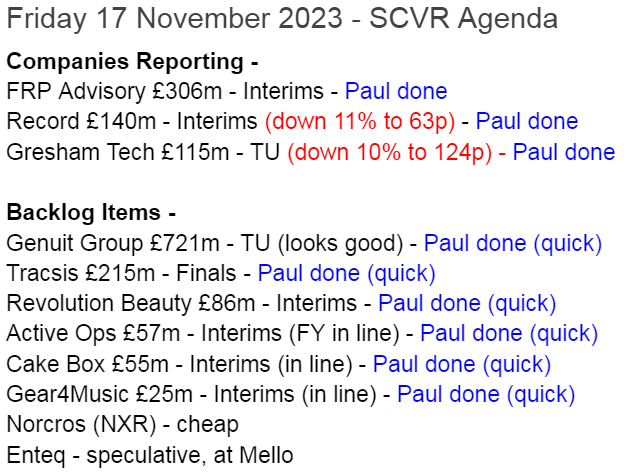

Summaries

Frp Advisory (LON:FRP) - 122p (pre market) £306m - H1 Trading Update - Paul - AMBER/GREEN

This insolvency (and related services) group is trading well. Now likely to beat forecast for FY 4/2024. Valuation looks more reasonable than in the past, and with a favourable macro outlook for insolvency practitioners, and a 4% yield, I can see that gloomy investors might find this share attractive!

Record (LON:REC) - down 11% to 63p (£125m) - Interim Results - Paul - GREEN

H1 profit drops 16%, but full year (trimmed) expectations are reiterated. Excellent divis here, strong balance sheet, and lovely cash generation. Taking into account the much cheaper share price of late, I think this looks appealing value, for a good quality business.

Gresham Technologies (LON:GHT) - down 14% to 118p (£99m) - Trading Update - Paul - GREEN

An in line update from this specialist software company. The last 4 years have seen it establish very good profit growth. Today's sharp fall seems unjustified, and I crunch the numbers below, concluding that this share looks quite attractive.

Quick comments -

Genuit (LON:GEN) - 315p (£783m) - Trading Update - Paul - AMBER/GREEN

This positive update caught my eye on Weds this week. It’s a building products group, formerly called Polypipe. Despite challenging macro, it’s upbeat, saying FY 12/2023 should produce operating profit marginally above market expectations. That’s despite volumes being 11% down on an LFL basis. It says cost/efficiency gains and new product launches have mitigated lower volumes sold. Net debt sounds under control, reducing to 1.1x EBITDA by Dec 2023 year end.

Paul’s opinion - just on a quick look, I think this is pretty impressive, given tough market conditions. Efficiency gains now should help power profits up when demand recovers. Check out the chart to see a nice base forming, at only a fraction of the 2021 highs. There have been more shares issued though, share count has risen from 202m pre-pandemic, to 249m now. Overall, I quite like it, decent divis too of 3.9%, and a reasonable PER of 12.3

Looks worthy of closer inspection.

Tracsis (LON:TRCS) - 802p (£241m) - Final Results - Paul - AMBER

The market likes these results, as Tracsis’s share price has risen from c.700p to 800p this week.

Adj EPS is up an impressive 19% to 38.5p (PER 20.8x)

Tiny dividends. Earn-outs for acquisitions now paid off. In line exps outlook for FY 7/2024 (c.40p), with an H2 weighting expected. Balance sheet OK, with c.£10m NTAV, including £15.3m cash (no interest-bearing debt). Cashflow OK, but not particularly impressive considering the £241m market cap.

Paul’s view - valuation looks up with events, so TRCS shares wouldn’t interest me at this level. It all depends on what the future holds, so if you think earnings might grow more strongly than broker forecasts, it could be worth paying up. That’s where more detailed research is necessary, I’m only doing brief reviews here remember, I’m not trying to predict the future! Nice company, and v good track record, but I can’t go above AMBER at this high valuation.

Revolution Beauty (LON:REVB) - 27p (£84m) - Interim Results - Paul - RED

A very chequered history, for this online & wholesale makeup company, which I won’t repeat, it’s all in our archive.

Does it stack up now the dust has settled, and new management installed? Boohoo seems to be in driving seat here, with 27% of the shares. Although previous management seem to still have big positions too. No sign of Mike Ashley though, very strange!

Much improved H1 numbers, REVB traded around breakeven, as opposed to big losses in the prior year comparative period.

Revenue up 20% to £90.4m in H1.

Gross margin (just as important) also up strongly from 41.4% to 49.4%.

Excessive inventories (which we spotted here long before the proverbial hit the fan!) have been reduced considerably, from £97.5m (ludicrous) to £58.6m (still way too high). That’s “gross”, but the bal sht shows £42.3m inventories. Note 10 is confusing.

Net bank debt still a big problem, at £23.5m, so it’s highly dependent on the £32m RCF.

Guidance on EBITDA margin is raised, but I can’t find any broker forecasts, and since £6.4m EBITDA in H1 turned into nothing at the PBT level in H1, then EBITDA forecasts aren’t really much use.

FCA is investigating market abuse regulations - possibility of a fine, I wonder?

Balance sheet is weak, with NTAV negative £(15)m. Dependent on bank debt. Looks like it might need a placing to repair the bal sht.

Going concern - some distinctly worrying stuff in here, concluding with a “material uncertainty” warning.

Paul’s opinion - it looks as if the business has been stabilised, but there are still problems and risks to work through. My hunch is that they’ll probably succeed in turning it around, and the margins on makeup are good, so it should be possible to turn this into a decently profitable company. At some point though, I think fresh equity will probably be needed. I don’t see sufficiently good risk:reward at £84m to want to get involved, so it’s not for me. I have to flag high risks, irrespective of what the eventual outcome might be (could be good or bad, I don’t know). High risk means I have to view this RED for now.

Activeops (LON:AOM) - 85p (£61m) - Interim Results - Paul - AMBER/RED

What on earth does this mean? -

ActiveOps plc (AIM: AOM), a leading provider of Decision Intelligence for service operations, is pleased to announce its unaudited results for the six months ended 30 September 2023.

It seems to be a SaaS company.

A 2021 float which we’ve looked at a couple of times, concluding that it was floated at an excessive valuation. It dropped by about ⅔ in 2021-2 and has since stabilised, going roughly sideways for the last 18 months.

H1 revenue £13.1m (up 7%), but only trading around breakeven, PBT £0.1m.

Outlook - acceleration in ARR expected in H2, and trading in line with expectations for FY 3/2024 (StockReport shows only £0.4m net profit).

Balance sheet - small, only £2m NTAV, but being a software company it gets paid up-front, so is sitting on a healthy £9.9m cash pile.

Paul’s opinion - a small software company, only growing revenue 7%, trading at breakeven, but valued at £61m. Why?! It needs to significantly accelerate growth, and profitability, to get even close to justifying this valuation. It might be a good idea if the company can actually explain what its software does! Both the RNS and a video on its website have left me none the wiser.

Cake Box Holdings (LON:CBOX) - 149p (£59m) - Interim Results - Paul - GREEN

Cake Box Holdings plc, the specialist retailer of fresh cream cakes, today announces its half-year results for the six months ended 30 September 2023.

I quite like this business, it’s a successful, expanding, franchiser of cake stores.

H1 revenue up 7% to £18.0m (low, because it excludes the stores revenues), £2.4m PBT (up 18%), EPS up 20% to 4.45p, and interim divi up 11% to 2.9p. That all looks good.

It looks like there’s an H2 seasonality to profits.

Outlook - on track to perform in line with market expectations.

Balance sheet is fine, and includes about £6m net cash.

Paul’s view - shares look good value, on 13.7x forecast EPS of 10.9p for FY 3/2024.

Various problems in the past did cause trust issues for me. However, solid interim numbers showing profit growth, in line outlook, nice balance sheet, cracking forecast dividend yield of c.6%, combine to make this share look attractive. Plus continued roll-out potential from more new sites, which can be done quickly, as they’re set up and run by franchisees. Looking good, I have to be GREEN on this!

Gear4music (HOLDINGS) (LON:G4M) - 120p (£25m) - Interim Results - Paul - AMBER

Gear4music (Holdings) plc, ("Gear4music" or "the Group") (LSE: G4M), the largest UK based online retailer of musical instruments and music equipment, today announces its unaudited financial results for the six months ended 30 September 2023 ("the Period").

A loss of £(1.9)m in the seasonally quieter H1, worse than £(1.0)m in H1 LY.

Outlook is in line for FY 3/2024, driven by higher gross margin and cost-cutting, offsetting lower volumes. Strategy is to prioritise profit, not revenue growth, which makes sense to me.

Balance sheet is a bit too dependent on the £24m bank loan for my liking, although overall asset backing is OK, and inventories are high before Xmas.

Paul’s view - it’s difficult to get excited about this company, now the exciting growth has disappeared. I don't see any evidence that previous acquisitions have added value. That said, a £25m market cap leaves scope for a re-rating in the next bull market. FY 3/2025 should benefit from the hefty central cost reductions (IT team scaled back). I can see merit in both bull, and bear cases, so I’ll sit on the fence. AMBER it is for now. I wonder if mgt might tire of the listing, and take it private?

Paul’s Section:

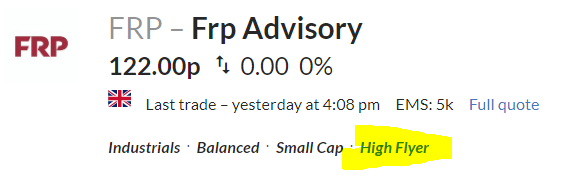

Frp Advisory (LON:FRP)

122p (pre market) £306m - H1 Trading Update - Paul - AMBER/GREEN

FRP Advisory Group plc, a leading national specialist business advisory firm, announces a trading update for the half year ended 31 October 2023 ("H1 2024").

They’re being coy about what the company actually does! It’s mostly an insolvency practitioner, the other listed one being Begbies Traynor (LON:BEG) . FRP also does corporate finance work, such as M&A, and arranging debt finance for clients.

Trading looks good, but it’s a pity they follow (below) the fashion for reporting EBITDA, when most investors I know would much prefer to be told Profit Before Tax and EPS as more credible performance numbers -

The Group's performance was strong during the first half, with continued growth in revenues and profits as well as further investment in the team.

The Group expects to report revenue for H1 2024 of £58.7m, up 19% on the prior year (H1 2023: £49.4m), and underlying adjusted EBITDA* of £15.5m, up 34% on the prior year (H1 2023: £11.6m).

Valuation - there’s a helpful note out today from Cavendish, saying that H1 has achieved 54% of its FY 4/2024 forecast EBITDA, and there’s usually an H2 bias to trading (since decisions on administration, etc are often made early in the calendar year, which is FRP’s H2).

Therefore it strikes me that forecasts are likely to be at least 10% light of what's achievable.

Current forecast for FY 4/2024 is:

£111.8m revenues, £28.6m adj EBITDA, £25.4m adj PBT, and adj EPS 7.6p.

I’m going to guess that 8.5p is probably more realistic, given tough macro (which helps FRP), and a strong H1. Hence at 122p/share I get to a likely PER of 14.4x which looks about right to me.

Dividends are quite generous, with the StockReport showing a 4.0% forecast yield, with probable upside on that too.

Outlook - sounds good - and as mentioned above, it looks set up to beat existing forecast -

Trading since 1 May 2023 has been positive and if current activity levels continue, the Board remains confident of at least achieving full year expectations.***

***The Company believes consensus market expectations for FY 2024 to be revenue of £112.2m and adjusted EBITDA of £28.8m.

Divisional outlook - some interesting snippets in here, for more general read-across - watch out for debt-laden companies, being the key message for us -

Restructuring -

During the 2023 calendar year, the restructuring market has seen an increase in activity levels, including administrations approaching pre-pandemic levels. Companies with significant borrowings who have rolled off lower interest rate arrangements are now subject to much higher debt service costs, with interest rates now considerably higher than the 2009-2021 period. Businesses are also exposed to much higher levels of cost inflation.

Certain sectors such as construction, property, casual dining and food service, retail, administrative and support services are finding current trading conditions particularly challenging.

Corporate finance -

Moving into H2 2024, the pipeline of new opportunities remains solid and we are continuing to see good levels of activity across the national Corporate Finance practice. We are seeing signs of an increase in debt refinancing and restructuring related M&A activity.

Net cash has fallen, due to work-in-progress sucking in cash as revenue grows. That’s normal in this sector - fees are often run up for a while, and then settled from asset sales (which can take quite a long time). It still looks to have plenty of liquidity though -

The Group's balance sheet remains strong with an unaudited net cash balance as at 31 October 2023 of £11.7m** (H1 2023: £21.0m). In addition, the Group has an undrawn revolving credit facility of £10m.

Headcount has risen from 536 (Oct 2022) to 622 (Oct 2023), with the increase mainly coming from an acquisition.

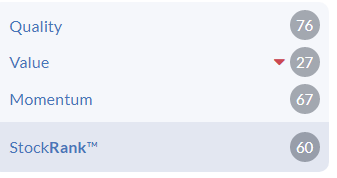

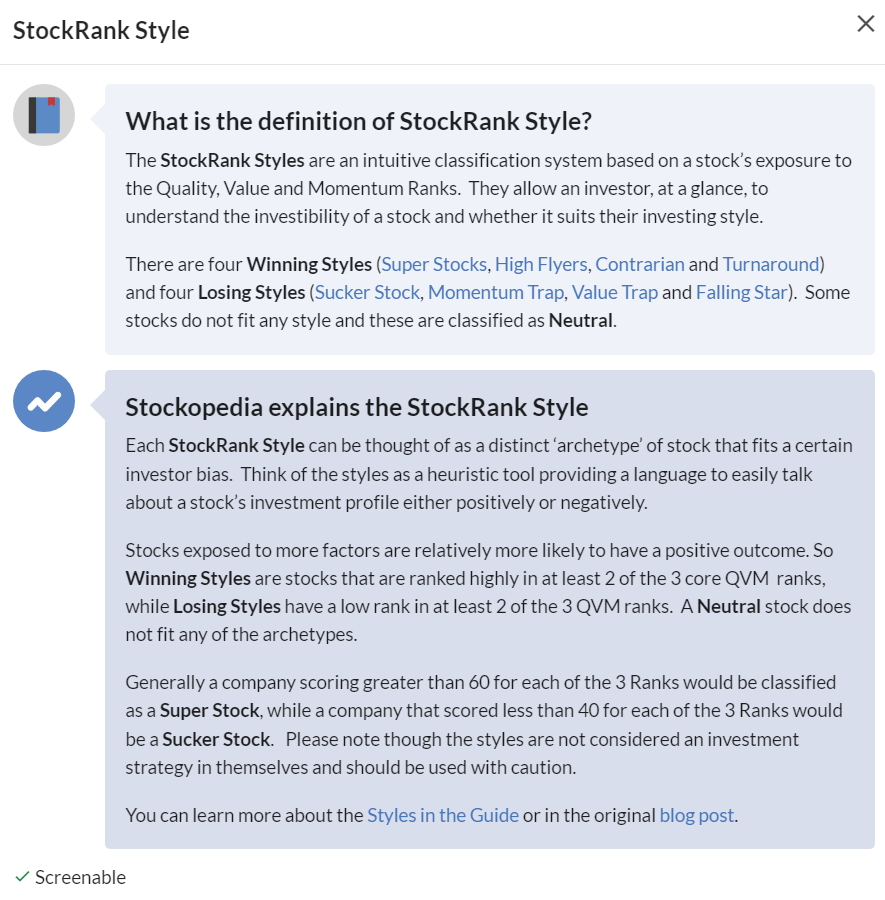

Paul’s opinion - looking back, we’ve tended to view FRP as amber. There’s nothing wrong with it, the accounts are fine, it's a good quality business I think, but there’s not really a lot to make it stand out when we have so many other more interesting, and often better value shares to own. This is also reflected in an upper middle StockRank, although it's classified as a "High Flyer" in the styles section under the company name on the StockReport.

Given the improving outlook for insolvency work, and the likelihood of beating forecasts, plus a more reasonable valuation than in the past, and a 4%+ dividend yield, I’m warming to this share. It’s likely to be reporting positive newsflow, with an ahead of expectations update looking highly likely in the spring.

For those reasons, I’ll nudge my view into more positive territory at AMBER/GREEN.

Some investors like to hold shares in FRP and BEG to help sleep at night, given these companies are counter-cyclical, benefiting from a worsening economy.

.

FRP floated just as covid was breaking out in March 2020. So considering the timing, it's been a fairly safe port in the storms of the last 3 years, with some divis on top too -

Record (LON:REC)

Down 11% to 63p (£125m) - Interim Results - Paul - GREEN

Record plc ("Record" or "the Company"), the specialist currency and asset manager, today announces its unaudited results for the six months ended 30 September 2023 ("H1-24").

Checking back through our previous reviews,

30/6/2023 - AMBER/GREEN - 93.5p - I reviewed FY 3/2023 results, which were strong (PBT up 34%). The founder retired. Rising costs mentioned. OK Bal Sht. Nice yield of nearly 5%. So overall I was moderately positive.

18/7/2023 - GREEN - 83p - Graham this time, taking a more positive view than me, based on the strong long-term track record. Although the Q1 update was disappointing.

On to today, we have a change of CEO announced as being planned for March 2024 year end, so this looks orderly. Outgoing is Leslie Hill, after 31 years at Record (4 years as CEO), and internal CEO Jan Witte is now group CEO-elect.

This tickled me -

Leslie Hill, Chief Executive Officer, commented, "I have loved almost every day at Record…

As a large shareholder, I will remain a supportive and interested ally in our wonderful company, which I believe has a very bright future ahead.

Interim Results -

Revenue down 3% to £21.5m in H1

Lower operating profit margin of 29% (LY H1: 34%)

PBT down 16% to £6.3m - still a lot of profit in a half year, for a company valued at £125m.

Interim divi up 5% to 2.15p (historically it split interim:final divis evenly, and pays special divis on top)

Webinar on IMC at 15:30 today, which I’ll listen in to, if I’ve not put down roots at The Mary Shelley (my local ‘spoons)

Balance sheet - looks fine to me, simple with no funnies. £14.8m cash and no interest-bearing debt. £27m NTAV, healthy working capital position. No issues here.

Cashflow statement - simple and good. This is a strongly cash generative business, that pays out most of that cashflow in dividends. Very nice.

Outlook - sounds mixed, but is in line with expectations overall -

"Our client proposition remains strong as does our pipeline of tangible opportunities across our broad product suite. Our growth in financial terms is not linear and delays in new product launches alongside stubbornly high inflation have led to a decrease in our operating margin for the period.

However, looking ahead, we anticipate further fund launches and growth across our range of products which we expect to increase our profitability over the medium term.

"The Group remains well positioned financially, with increased cash generation and a strong balance sheet to support its future growth plans.

The Board remains confident in the delivery of market expectations for the current financial year. I believe the business remains capable of delivering on the targets set out in February, albeit achieving them may take longer than originally anticipated."

Broker consensus forecasts - peaked at about 6.1p, and have been edged down to about 5.1p now for FY 3/2024.

Valuation - at 63p today, the PER is 12.4x FY 3/2024 forecast. That seems very good value to me.

Existing forecasts show almost all earnings being paid out in divis, which fits the historic pattern, with typical divi cover of ranging from 1.1x to 1.4x. Therefore, shareholders are looking at a dividend yield (adjusted for today’s share price fall) of about 7.7% - which the company can afford, as it doesn’t need the cash for anything else (no capex to speak of).

This looks cheap to me, I like it!

Paul’s opinion - not great results, with profit down 16%, but the share price has fallen a lot, more than compensating, in my view.

It doesn’t sound as if the business has gone seriously wrong, and outlook comments reassure that profits should return to growth.

Solid balance sheet, excellent cashflows, and very generous dividends, make this share appeal to me more, now it’s cheaper, and priced like a mature, value share.

I can’t avoid giving it a thumbs up at this price, because the value on offer outweighs a slightly disappointing set of numbers. GREEN.

Could be a good entry point perhaps?

Gresham Technologies (LON:GHT)

Down 14% to 118p (£99m) - Trading Update - Paul - GREEN

A nice clear description here -

Gresham Technologies plc (LSE: "GHT", "Gresham", "Group", "Company"), the leading software and services company that specialises in providing solutions for data integrity and control, banking integration, payments and cash management, is pleased to provide an update on trading and the discontinuation of its legacy IT contracting services business.

FY 12/2023 is on track - with 98% revenue visibility (at end Oct) for the full year -

The Company expects FY23 Group revenues and earnings to be in-line with market expectations.

Singers has helped us with an update note today, leaving estimates unchanged for FY 12/2023: revenue £50.2m (up 3% on 2022), adj PBT £7.4m (up 10%), EPS 7.7p (up 3%)

Note that GHT has established an excellent profit growth track record, after many previous years of rather erratic & lacklustre profitability -

£Adj PBT

FY 12/2020: £1.8m

FY 12/2021: £4.0m

FY 12/2022: £6.7m

FY 12/2023: £7.4m forecast, but confirmed in line today.

[source: Singers note, with thanks]

That’s impressive stuff, and very much the sort of progression I look for when selecting ideas to research further. The valuation seems quite modest for a software company that’s grown earnings nicely, with a PER of 15.3x

Outlook -

The Company continues to have a solid pipeline of opportunities from both new and existing customers and expects to close additional Clareti subscription business before the end of the year which will contribute to the Group's Annualised Recurring Revenue ("ARR") and FY24 planned revenues…

Except for the reduction to revenues directly attributable to the discontinuation of the IT contracting line of business, the Company is making no other material changes to its guidance for FY24 revenues…

Since the move to a Clareti subscription model in 2019, and the acquisition of Electra in 2021, the Company benefits from a strong base of recurring revenues. Clareti recurring revenues now account for 75% of FY24 planned Group revenues on a like for like basis excluding the discontinued contracting services business. Whilst the macro-environment is expected to remain challenging, the above factors support management's confidence in the Clareti business and prospects for on-going growth.

So far, so good. Why’s the share price tanking then? (down 14% as I type this)

Exit from legacy, low margin business providing IT contractors to a major customer - this is explained in detail, with this financial effect -

The Company expects to recognise £8.5m in revenue from these agreements in FY23 with fixed margins of 13% and will discontinue the business from January 2024.

I can see why GHT wants to improve its margins by ditching this element of its work, but surely this is giving away £1.1m of profit? Unless there are other overheads associated with it? It’s not clear from the RNS what the bottom line impact would be, or if the 13% margin mentioned above is just the gross margin?

I think we need more detail on the rationale for this move. For me, profit is profit, and I don’t really care if it’s high margin, low margin, or a combination of both.

Paul’s opinion - this share is looking interesting, in my opinion.

Singers has lowered FY 12/2024 forecast to 7.0p. What rating should we put it on? Software companies with good profits, and mostly recurring revenues, can easily pull a PER of 20x I think. Often they’re premium bid targets too. So to my mind, 140p-ish seems a fair valuation. Currently priced at 118p, I think this share is looking quite good.

I’ve checked the last balance sheet & cashflow statement, and am not impressed. Negative NTAV and high spending on intangibles means there’s little scope for divis. I think it needs to focus on building up the cash pile, although customers paying up-front means it can trade fine with a weak balance sheet. These are not deal-breaking concerns though, so I’m happy to continue with my previous GREEN view back in Jan 2023.

A rather slow burner in 20 years as a listed company -

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.