Good morning, it's Paul here! Graham is having the day off today.

There's not much news today.

CVAs

There seem to be lots of interesting things going on at the moment. Mothercare (LON:MTC) seems to be pressing ahead with its CVA & refinancing. I didn't get time to report on that yesterday.

Carluccios restaurants is apparently the next chain lining up a CVA.

I wonder how long landlords will tolerate this tidal wave of CVAs? There was an interesting tweet today from a leisure sector property fund manager, who pointed out that CVAs are meant to be a mechanism for saving struggling companies. Instead they are now being used as a property restructuring tool. It sounds as if attitudes are already beginning to harden.

CVAs are also a reward for failure. Poor old French Connection (LON:FCCN) (in which I have a long position) has had to soldier on with all its loss-making shops, continuing to occupy them & pay the rent, because it had a big cash pile (somewhat depleted now). Whereas financially weaker retailers can just threaten to go into Administration, and then negotiate a CVA instead, and walk away from all their problem shops - thus subsequently having a big competitive advantage.

Short squeeze

Yesterday was a good reminder of the dangers of short-selling. The price of Ocado (LON:OCDO) went through the roof, on an impressive contract win for its technology. These deals have been a long time coming, but they do seem to be happening now.

In what was a very crowded short trade, the squeeze (where shorters become forced buyers) was eye-watering just to observe. It's certainly made me think twice about whether I should be doing a relatively small amount of shorting at all? Although I wasn't short of OCDO, so it didn't affect me personally.

Carpetright (LON:CPR)

Share price: 36.7p (up 10.4% today, at 10:50)

No. shares: 71.3m before fundraising, 303.8m after fundraising

Market cap: £26.2m before fundraising, £111.5m after fundraising

The main points of this deal were already known, apart from the price, which has been set at 28p, a 15.8% discount to last night's price. This is a surprisingly modest discount, given that the company is insolvent without this fundraising.

New shares: 232,463,221 new shares are being issued in this placing/open offer. I have shown the before & after valuation above.

CarpetRight is in the happy position of having strongly supportive major shareholders. Without them, I think it would have probably gone bust. Its biggest shareholder, Meditor, has already provided it with a £12.5m bridging loan, to enable it to continue trading until the Placing funds have been received, and is also taking up as many shares as it can (without triggering a bid) at 29.99% of the resulting shares in issue both before and after the fundraising.

Crescent, which holds 12.08% of the shares, is doing the same, in taking up enough new shares to maintain its position.

Open offer - I'm a bit confused about how this is going to work, so have asked my broker to clarify, and will amend this section once I have the answers.

The open offer seems to give full pre-emption to existing holders - who can apply for 88 new shares for every 27 existing shares. If you multiply that out from the existing 71.3m shares, it works out at 232.4m potential new shares going to existing holders, if the take up rate is 100%. That equals the full number of new shares being issued. Clawback from placees is mentioned.

So it's sounds as if other participants in the placing could be squeezed out. After all, it makes sense for existing small holders to take up their open offer entitlement, if the share price remains well above the 28p open offer price, which it currently is. That would give an instant profit, and they could even forward sell in the market now, given that this is no longer inside information.

Incidentally, I was made an insider on this deal a couple of days ago. Because I respect, and strictly adhere to the rules on inside information, I did not breath a word to a soul. That's the way it's supposed to work. I strongly disapprove of any commentator breaching confidentiality, and broadcasting, or gossiping about fundraisings which are underway. You won't ever get anything like that from me.

Here are some other key points of the CarpetRight fundraising (NB. This is not a comprehensive report, so as always, you should read the company documentation in full if necessary);

Prospectus will be published today on the company website

The deal is underwritten, and is being undertaken by Peel Hunt, so the company is highly likely to get the money - therefore this deal is largely de-risked now.

Fees - are huge, as you would expect - £65.1m gross, £60.0m net, so £5.1m in fees.

An (unnamed) aggressive new competitor is mentioned, as having harmed CarpetRight's performance, as well as the general malaise for consumer spending. This is a worry - what if CarpetRight is in structural decline, and may fail again in future, if competitors eat its lunch? Can anyone tell me who this competitor is, so I can check them out?

Closing 92 sites, of which 11 are non-trading sites.

Rent reductions of 30% or 50% on 113 sites, creating £5m of annualised cost savings.

Break clauses on reduced rent stores - providing further flexibility to exit from the weaker sites in future.

Profit effect - I'm not 100% sure on this, but the company seems to be saying that it expects profit to rise by about £19m p.a. That should transform the future performance of the group.

My opinion - CVAs are a much better solution for problem retailers, than pre-pack Administrations, because the business can continue trading as normal, and trade creditors are not affected in this case.

CVAs are in effect now being used as a tool to restructure property portfolios, thus giving struggling businesses both a lifeline, but also a competitive advantage over their more solvent competitors. That clearly isn't fair, as it's rewarding failure. However, as with many things in life, sometimes being pragmatic is the best overall option.

My main worry with CarpetRight, is that it might be a long-term declining business, and that the CVA could give it a shot of adrenaline, which would then wear off, as competitors continue to erode its business.

On the other hand, this restructuring gives it the best possible chance, as all problem stores are being ditched simultaneously. That will allow big cuts in central costs, and also they are raising enough money to refurbish all the remaining stores.

There has been some disruption to trade, as you would expect, and there is also reputational damage to think about. However, in say a year's time, when decent profits should be rolling in, then I suspect investors might quickly forget the problems of the past. For that reason, I have attempted to participate in the placing, but am not sure currently whether I definitely got any shares or not.

Anyway, we'll see what happens, but this company seems to be almost out of the woods now, with this restructuring likely to conclude successfully.

Ideas for reform of fundraisings

I don't agree with the current system for fundraisings. In my view, once we're out of the EU, we should persuade Government to drastically simplify & speed up fundraisings for listed companies. In future, fundraisings should be done;

- Fast (1-2 weeks max)

- Electronically

- With full pre-emption rights

- Simple, and abbreviated prospectuses, or even no prospectus at all for smallish deals

- Minimum paperwork

- Shares should be suspended the moment the process starts

- Price should be set by demand & supply, through an online auction process

- Full access should be given to private investors, on the same terms as institutions.

Alternatively, if companies want to get specific institutions on board, then there could be another process to allow placings to be done the existing way, providing the discount is no more than 5% of the open market price, and dilution is no greater than say 25%.

We have the technology to make the above process easy. It's inertia, and vested interests in the City (just look at the fat fees earned for fundraisings now!), and our EU membership, that prevent these changes from happening.

Whether you agree with Brexit or not, there is no doubt that once we've left, there are all sorts of opportunities for us to create a much better, simpler legal & regulatory framework in the UK, and thereby enhance London's position as a leading financial centre.

T Clarke (LON:CTO)

Share price: 84.5p (up 4.45% today, at 12:58)

No. shares: 41.8m

Market cap: £35.3m

AGM Statement (trading update)

This is a building services group, concentrating on complex electrical & IT installations, e.g. at new build & refurbished office blocks.

Today's update says;

We are pleased to report that we continue to expect revenues and profits for 2018 to be in line with current market expectations.

To put those in context for the year ending 31 December 2018, these are forecast to be revenues of £300 million, underlying profit before tax of £7.0 million and underlying EPS of 13.2p.

We also expect to maintain our trend of underlying positive movement in net cash year-on-year.

How wonderful to see the middle paragraph, where the company clearly sets out exactly what the market forecasts are. Top marks to the company & its advisers! This information is vital for private investors, who cannot get hold of broker notes, after the disaster that is MiFID II. I'll keep banging on about this issue, until all companies are giving us this vital information. Waffley text is not good enough - we need facts & figures, as given above.

It's so important that smaller companies are shareholder-friendly towards their private investors. After all, we create the liquidity in the market, and we set the share price. So treating us with contempt (as many companies still do) is an act of self-harm by smaller companies. They need to engage with private investors, and provide us with the information we need to decide whether to buy the shares or not. Some brokers & PRs get this already. Others are stuck in the past.

Order book - reassuring information here too;

Our forward order book has been replenished and as at 30th April 2018 stood at £368 million, increasing from £337 million as at 31st December 2017.

Encouragingly, we are seeing no lack of opportunities, but we maintain a strict policy only to bid for projects that meet our internal risk analysis and where we are comfortable with the covenant and market reputation of the contractual counterparty.

A list of impressive-sounding contract wins is given.

Directorspeak - upbeat;

Once again, TClarke has made an excellent start to the year and the Board looks to the future with continued confidence.

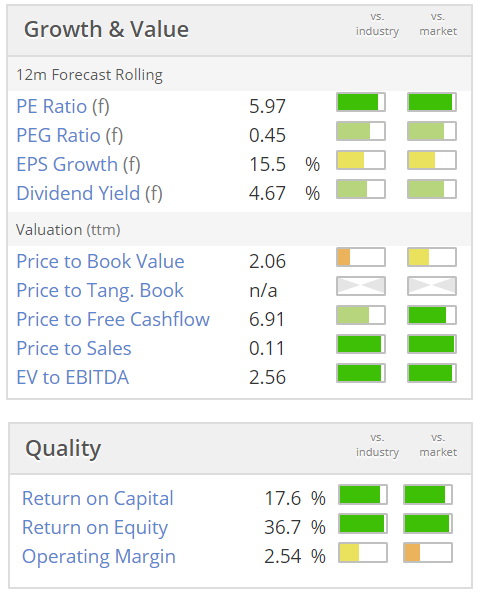

Valuation - clearly it looks very cheap. However, it should be cheap, because it's a very low margin contractor, whose workload is highly cyclical;

My opinion - it's a share that I've held before. It certainly looks superficially attractive on a low PER, and with a decent divi.

The balance sheet isn't great, but if you strip out the £23.4m pension deficit (which is a manageable, long-term issue), then NTAV would swing from a negative to a positive number.

The big problem with low margin contractors, is that these large, complex contracts, can easily go wrong. There's little profit to absorb extra costs from rectifying problems. That makes shares in this sector very risky. That is reflected in a lowly valuation.

We also have to consider cyclicality. There's a lot of commercial construction work going on at the moment, because interest rates are so low. That won't last forever (mind you, we've been saying that for almost 10 years now!)

Overall, I've decided not to buy any contracting companies at all any more, it's just not a sector that interests me. If you are prepared to touch this sector, then CTO certainly seems good value - providing nothing goes wrong with any big contracts.

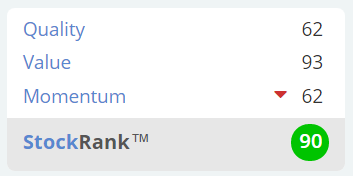

Stockopedia likes the numbers too, calling it a "Super Stock", and with a high StockRank;

I'm not convinced that the algorithms consider cyclicality, and sector risk though.

That's it for today.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.