Good morning from Paul & Graham.

Agenda

Paul's Section:

MJ GLEESON (LON:GLE) - it warns that the cancellation rate has shot up recently, which shouldn't come as a surprise to anyone. Being a low price, starter home builder, GLE should be relatively well protected from any downturn, because some buyers are expected to trade down, partially offsetting reduced demand from existing customers. Housebuilders look stunningly cheap to me, with the whole sector trading well below net tangible asset values. Hence I would see any continuing share price weakness as increasing the buying opportunity. They generally don't have any debt, and are sitting on cash piles, as well as owning huge land banks outright. So this time it really is different, even allowing for a housing market downturn.

Graham's Section:

Liontrust Asset Management (LON:LIO) (£727m) - H1 numbers are released at this fund manager, following the detailed H1 update last month. Outflows were large and with sales reportedly remaining difficult, it’s too soon to bet on the trend reversing to inflows at this time. The bounce in asset prices since the end of September has at least produced a recent uptick in AuMA. H1 revenues are slightly higher than a year ago but unadjusted profits are sharply lower as they digest the acquisition of Majedie. There is a huge emphasis these days from many quarters on sustainability, ESG and Net Zero, and Liontrust is very focused on these trends. It’s not my top pick in the sector but I do suspect that Liontrust shares, like most others in the sector, are underpriced.

Northamber (LON:NAR) (£13m) [no section below] - this tiny company has a 63% shareholder and continues to be a case study in bad capital allocation. Net tangible assets are £23m and they remain locked up in a business that is inherently unable to earn an economic return. Perhaps some day, the assets will be released and put to good use, but who knows when that might be? Today’s full-year results (FY June 2022) reveal the company has made a fresh operating loss on £66m of empty revenues. Northamber has not made a meaningful operating profit since 2005: if markets and economies were efficient, a company like this would have released its assets to more productive use a long time ago. [no section below]

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Paul’s Section:

MJ GLEESON (LON:GLE)

374p (pre market open)

Market cap £215m

MJ Gleeson plc (GLE.L), the low-cost housebuilder and land promoter, is holding its Annual General Meeting (AGM) later today at which Dermot Gleeson, Chairman, will make the following comments…

Several larger housebuilders have recently reported slowing market conditions, as expected given macro conditions. Gleeson is not immune, and today says this -

"In September we announced record revenue and profits for the year to 30 June 2022 and said that we were well-positioned to deliver further profitable growth in the current financial year, notwithstanding the outlook for the broader economy.

Shareholders will be well-aware that since then much has changed. The market volatility and sharp increase in interest rates following the mini budget impacted buyer confidence and caused a significant slowdown in demand.

Gleeson Homes cancellation rates which for the first ten weeks of the year were 20% have, over the past six weeks, increased to 41%.

Net reservation rates have reduced, over the past six weeks, to 0.26 per site per week against 0.42 for the same period last year…

Despite this, they don’t sound particularly concerned -

Whilst it is far too early to call a recovery, we were encouraged by yesterday's Autumn Statement. We would expect to see the re-emergence of buyer confidence as the wider macro volatility subsides. What is more, there are good reasons to hope that an improving outlook for longer term interest rates will result in greater mortgage availability and affordability.

Average selling prices for FY 6/2023 to date are well up on last year -

The average selling price on new reservations since the start of the financial year was £186,500, an underlying 9.0% higher than the same period last year.

This is a key attraction with this share - being at the affordable, bottom end of the market, plus people are trading down -

Despite these higher prices, our homes remain attractive to first time buyers and a couple on the National Living Wage can still afford to buy a Gleeson home on any one of our development sites. Furthermore, we are now seeing interest from customers who might previously have considered a more expensive property built by another developer but who, in the current environment, are attracted by Gleeson's more affordable price points.

Pipeline is multi-year (it sold 2,000 houses last year, for context) -

Land continues to be available at sensible prices and the pipeline remains strong. Gleeson Homes has a land pipeline of 16,484 plots with a gross development value of £3.1 billion, of which 8,607 plots are owned and 7,877 are conditionally purchased.

As with other housebuilders, it complains about the congested planning system.

Range of outcomes for the current year -

For the Group as a whole, the outlook for the current financial year is dependent upon the pace of recovery in the housing market. Having reviewed a number of scenarios, the Board believes that Gleeson Homes could deliver volumes anywhere in the range between 1600 and 2000 units.

Next update will be on 13 Jan 2023.

My opinion - as we discussed at Mello, housebuilders are debt-free, and typically trading at a significant discount to tangible net assets. That means a deep recession in the housing market is already priced-in to shares, and recovery is in for free - very attractive in my view, although there could be some short term pain, on negative sentiment.

For this reason, in my view the whole sector is attractively valued.

Gleeson is my sector pick, because it’s operating at the affordable, bottom end of the market.

Many housebuilders have June year-ends, I don’t know why.

We must have seen peak earnings for 2021/2, so it’s widely expected, and known, that earnings are likely to fall.

There’s an interesting benefit to selecting a smaller housebuilder, in that the new 4% residential property developers tax comes with a £25m exempt profit allowance. Therefore GLE should pay little tax. Whereas larger housebuilders will pay proportionately more.

Long-term, this share, and others in the sector, should do very well I think. In the meantime, being priced well below tangible asset value, risk:reward looks highly favourable, and the cheaper they get, the more I’d be inclined to buy.

Other housebuilder shares have bounced recently, whereas GLE has hit a new low, so that's another reason to be bullish on this one, in my view, as market conditions are the same for all of them -i.e. getting more difficult in the short term due to macro factors.

.

The market cap is currently £202m (346p per share * 58.3m shares in issue).

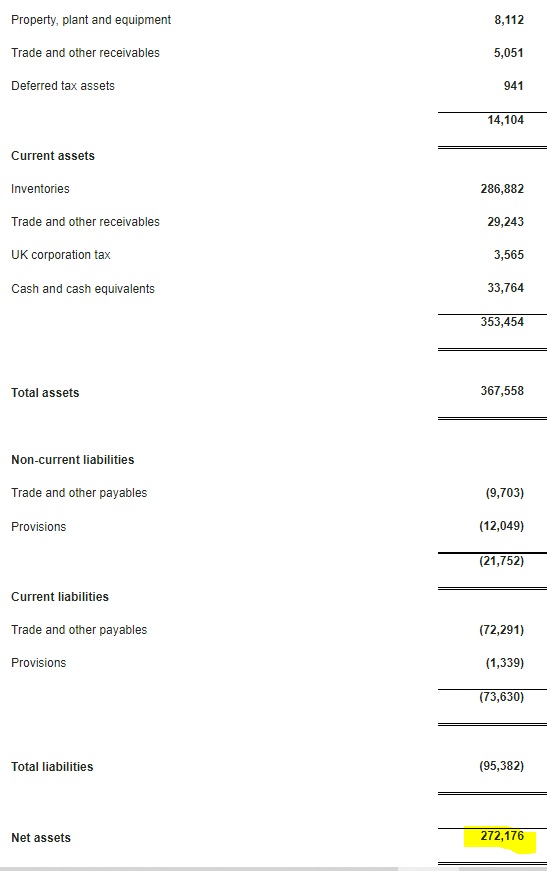

This is what you get for your £202m market cap - £272m of tangible net assets! This is an amazingly strong balance sheet, and remember the inventories are all in at cost, but are worth more than cost. This asset backing should mean very limited downside risk from here, and upside in for free, even if property market conditions are weak for a while.

.

.

Although I should point out that in the severe housing market of 2008-9, Gleeson took a big hit to its balance sheet, which reduced net assets from £159m to £103m, a write-down of about 35%. Currently, the discount to NAV is about 26%, so the stock market is currently pricing in a stepp drop in house prices, of about three-quarters of the severity of 2008, which seems quite extreme to me. In other words, there is considerable housing market downside already priced-in to the share price of 346p.

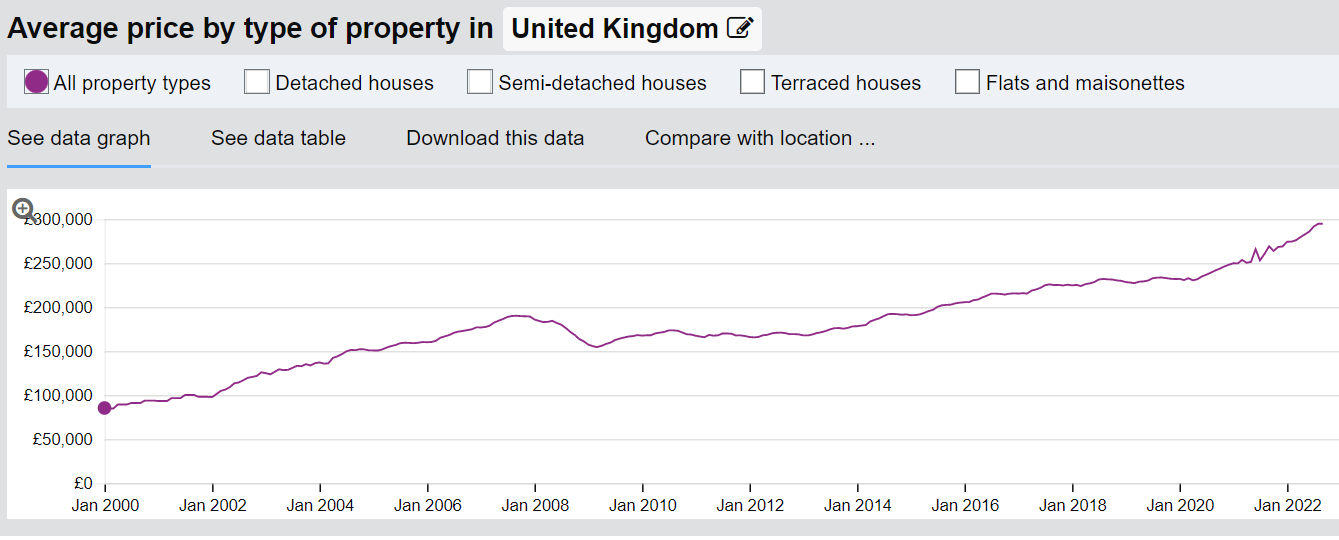

Land Registry data shows that average house prices peaked at £190k in late 2007, and bottomed out at £154k in March 2009, a fall of 19%. It then recovered about half the loss by 2010, then went sideways for 3 years. Then in 2014 the current bull market in residential property began in earnest, as you can see -

Graham’s Section:

Liontrust Asset Management (LON:LIO)

Share price: 1120p (+1.5%)

Market cap: £727m

The fund management space continues to be one of my favourite investment themes in the current environment. Let’s get up to speed with events at Liontrust.

Today the company has published its interim results for the H1 period ending September 2022. Last month, it issued a detailed H1 trading update which I covered here.

Key points:

- Net outflows during the six-month period were £2.2 billion.

- Assets under management and administration fell from £33.5 billion at the start of the period to £31.7 billion, despite adding £5.1 billion in assets from the takeover of Majedie Asset Management.

And the financial results:

- Revenues +1.6% compared to H1 last year.

- Adjusted PBT +9% to £42.9m.

- Actual PBT fell 55% due to the impact of the Majedie acquisition.

The acquisition has at least prevented Liontrust from experiencing a much larger fall in AuMA so far this year. Interestingly, Majedie’s sellers agreed to receive a fixed number of Liontrust shares, a deal format they may have regretted as the value of LIO shares subsequently tumbled! But Liontrust was shielded from any harm caused by that volatility.

This is what the Chair has to say about that deal now:

The acquisition of Majedie Asset Management has been impacted by global events and their effect on investment markets, which we could not foresee at the time of purchase. Buying Majedie was consistent with the strategy of continuing to diversify our investment management and distribution capability. This leads to a more robust and resilient business over the long term as we have proved with Liontrust's other acquisitions over the last decade.

At least the price tag was denominated in shares, rather than cash! That would have been much more painful.

First interim dividend: unchanged at 22p. The yield is 6.5% according to Stockopedia.

Outlook

The company acknowledges that asset management sales are being hurt by macro conditions, and confirms that “the industry trend in the UK has continued in the third quarter of 2022”, i.e. it remains very difficult to convince investors to pour money into funds in this environment.

On the other hand, there has been a pickup in AuMA since the end of September (£31.7 billion): as of mid-November, AuMA has improved to £33.5 billion. That will be due to the recent bounce in asset prices rather than inflows.

Here’s the outlook statement:

Despite the challenging year so far, we are optimistic about the future growth of the Company. The confidence is based on the fact the business is financially strong, we have robust investment processes, we have been diversifying our investment capability and distribution, and the brand profile continues to be positive and strong. This belief is reflected in the Interim dividend payment we have announced.

My view

I’ve just run a back-of-the-envelope calculation, and I think you get c. £46 of AuMA for every £1 invested in Liontrust at the current share price. This should be significantly better value than Liontrust shares have historically offered.

For example, in mid-2019, Liontrust only had £14 billion of AuM. Again, a quick calculation suggests around £30-£35 of AuM for every £1 invested in Liontrust at that time.

If you’re bullish on the “sustainable” investment theme, then these shares might be a useful way to invest around that idea: Liontrust’s focus is very much geared to “sustainability”, ESG and Net Zero.

Personally, I think there are a lot of opportunities in this space currently, so I’m not sure if I’d put Liontrust top of the list. There are some very cheap fund manager shares to be had, and there are some other truly excellent fund managers who are also trading at historically low prices. In no particular order:

- Abrdn (LON:ABDN)

- Schroders (LON:SDR)

- Polar Capital Holdings (LON:POLR)

- Jupiter Fund Management (LON:JUP)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.