Good morning from Paul!

All done for today, and the week! Have a smashing weekend :-)

Macro/Markets News

Sorry I forgot to write this on Friday, only just remembered on Saturday.

These are a few points I jotted down this week.

Continued uncertainty & speculation about what tax increases are coming. The latest thing is leaks, and hints to the press, and Govt ministers “refusing to rule out xyz” - eg

The Guardian says Govt is planning a £3bn tax raid on the gambling sector. It’s difficult to argue against this, given the huge damage they do to many peoples’ lives. Apparently some other countries have much higher gambling taxes. This strikes me as a high likelihood for a tax-hungry Govt to target, and probably get little pushback, hence why I am avoiding this sector at the moment. Gaming Realms (LON:GMR) does look a potential bargain though, having sold off in sympathy this week.

Starmer said in an interview that claims Capital Gains Tax would rise to 39% are “wide of the mark” - suggesting there might be some increase in CGT, but not the worst case scenario? We’ll find out on 30 October, but I’m trying to work out what’s most likely. I think an increase in Employers NICs is looking highly likely - which is why I’m steering clear of any big exposure to hospitality or retail sectors right now.

Some increase in Inheritance Tax or closing of loopholes/exemptions seems likely. Let’s hope AIM isn’t clobbered with losing its IHT tax breaks.

Scuttlebutt from conversations I had this week with several estate agents in Bournemouth, who said both buyers and sellers are hesitant, with many people waiting to see what’s in the Budget before committing either way.

Inflation - good news from ONS with a sharp decrease in CPI down to 1.7% in Sept, due to a high prior year comparative dropping out. Good readers comments on this in Weds SCVR. High likelihood of further interest rate cuts in the UK. ECB cut interest rates again this week, to 3.25, now much higher than the UK’s unnecessarily high 5.0%.

ONS data on wage growth showed it slowing to 4.9% or 3.8% including bonuses. This is now well above inflation, so working households are now enjoying rising real incomes, which should translate into more healthy consumer spending - hence possibly better demand for retail & hospitality sectors in future?

Explanatory notes -

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom), Video update of results so far, June 2024.

** New SCVR summary spreadsheet for calendar 2024 ** This is the live one! (updated 6/9/2024)

Archive - SCVR summary spreadsheet for calendar 2023.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Phil Hanson's data analysis measuring performance of our colour-coding system in the SCVRs, from July 2023- Mar 2024 (with live prices). My video explaining/reviewing it.

My other video (June 2024) - How to screen for broker upgrades on Stockopedia. More stock screening strategies here (possible bargains?) - 21/9/2024.

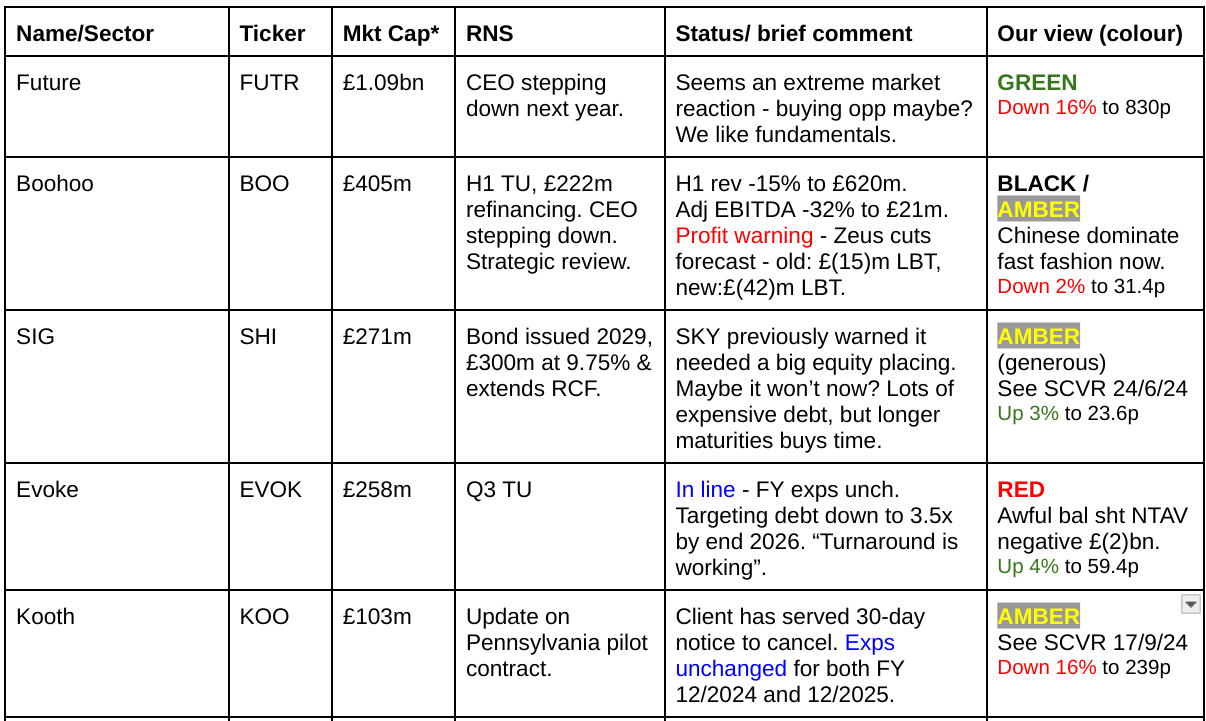

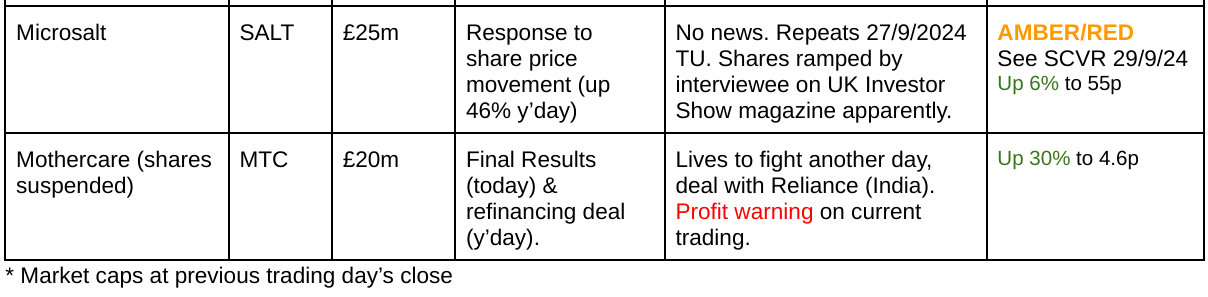

Companies Reporting

Summaries

Whitbread (LON:WTB) - 3,274p (£5.9bn) - Interim Results (Weds) - Paul - GREEN

Reported interims on Weds that were a bit below expectations, but an OK outlook and news of a fresh £100m buyback (plus very generous £2bn shareholder returns planned over next 5 years) pleased the market. Going through its numbers below reminds me what an excellent business WTB is - very much a strong GARP share. I like this a lot.

Paul’s Section:

Whitbread (LON:WTB)

3,274p (£5.9bn) - Interim Results (Weds) - Paul - GREEN

One of my favourite larger caps, this is the Premier Inn chain.

What I like -

Good market position in affordable hotel rooms, and limited branded competition, high brand recognition makes Premier Inns the go to hotel chain for many customers, and standardised service (eg. comfy beds & good breakfast).

Lots of independent competition disappeared in the pandemic.

Fantastic balance sheet with loads of freeholds and hardly any net debt (excl leases).

Strong profit margins (eg adj PBT margin is almost 25%!)

Self-funded expansion, including Germany, which should develop from being a drag on profits to becoming profitable (achieving breakeven this year).

Reasonable PER 14.4x

Good shareholder returns, with rising divis & buybacks.

Proactive management, developing the estate & rolling out the “hub” concept (cheaper, half-sized rooms in city centres)

Downside risks? -

Wages increases have dragged on profit lately.

Increase in employers NICs could hurt the sector in the forthcoming Budget.

For disclosure purposes as required, I am not currently holding this share, having banked my profits a week or two ago, as I’m nervous about the effect of the Budget, and wanted the money to top up something else (Intercede (LON:IGP) - I hold - after recent spike down to 152p).

I mystery shopped the Premier Inn in Guernsey in the summer, and found it satisfactory. The main downside was shambolic check-in, with lots of unhappy customers, a long wait, and frazzled staff, as both the self check-in computerised terminals had packed up. Hopefully an isolated incident, but let me know if you’ve had similar problems, as it could indicate wider problems with their IT perhaps?

I’m hoping to mystery shop one of the London “pod” rooms at some point. Great idea, but the main issues might be claustrophobia and possible noise pollution, if the tiny rooms don’t have adequate sound deadening. Do share any experiences you’ve had, if you’ve tried their pod hotels.

I was rather wrong-footed by the positive market reaction to interim results earlier this week.

Key points in H1 results (26 wks to 29/8/2024)

It’s the shareholder returns that really stand out -

“Increased interim dividend and further £100m share buy-back

Five-Year Plan: at least £300m more profit and over £2bn available for shareholder returns”

£2bn shareholder returns in five years is a third of the current market cap. This demonstrates just what a cash generative business this is.

Remember too that we’re in a flat economy at present, with most sectors feeling quite down, so we could have cyclical, operationally geared profit increases to come. Plus remember WTB has absorbed large increases in wages costs over the two year higher inflation period we’ve just gone through. So I think to deliver this track record in tough macro is highly impressive - fully recovered earning to pre-covid levels, despite all the cost increases -

There’s been a useful reduction in the share count too, now down to c.179m (it was over 200m, a couple of years ago).

Trading wasn’t plain sailing in H1 though, eg -

“H1 FY25 results reflect a slightly softer UK demand environment, investment in our Accelerating Growth Plan ('AGP') and lower interest receivable, partially offset by positive momentum in Germany”

I’m happy to go with the adjusted numbers below - note how profit was down, but that’s softened to -6% at the EPS level due to the lower share count from buybacks -

On the day (Weds) of H1 results, Singers said that the H1 operating profit of £340m was a £10m miss against forecast. Despite that, shares rose 4% on the day. I suspect the big shareholder returns and outlook comments outweighed a modest profit miss, but who knows, people buy & sell for all sorts of reasons.

The other problem is that because we’re plebs, we’re not allowed to see any broker research, so who knows what privileged information has been distributed by the big brokers to their clients?

There was a bit of a soft patch in the spring, and higher costs caused brokers to trim forecasts (obviously guided by the company itself), which created a nice buying opportunity in the shares when they overshot down to as low as 2,768 in Aug 2024, which we discussed here at the time -

I don’t think that was anything to worry about, and wasn’t a big problem.

The food & drink offer has been somewhat challenged, but management seems to have taken sensible action to weed out the under-performing sites, selling or converting some of them into additional hotel rooms.

Cashflow - I love businesses that can fund their own expansion, as well as paying generous shareholder returns - when you find businesses like this, at reasonable valuations, then you’re probably going to do well with the shares over the long-term I think -

“The Group remains highly cash generative and adjusted operating cashflow† was £411m reflecting the movement in adjusted operating profit† and working capital (H1 FY24: £483m). This cashflow funded our expansion in both the UK and Germany, as well as £278m of dividends and share buy-backs completed in the period”

Outlook - strange wording here, a bit ambiguous -

“No changes to our previous FY25 guidance other than: with increased cost efficiencies of £60m in FY25 (previously £40m-£50m), we now expect UK net inflation to be between 2% and 3%”

Is that in line overall? I’m not sure. Broker consensus seems to have dropped a tiny bit this week, from 210p EPS to 209p EPS. It’s already done 137p adj EPS in H1, but remember that in undisrupted years, profits tend to be heavily H1 weighted.

Longer term, the 5 year plan sounds ambitious -

“We are executing well and remain on course to deliver a step change in our profits, margins and returns as reflected in our Five-Year Plan”

“Five-Year Plan

Reflecting our increased confidence in the delivery of our plans over the period to FY30, we expect to:

· increase adjusted PBT versus FY25 by at least £300m, and

· generate more than £2bn for dividends, share buy-backs and, if suitable opportunities arise, additional high-returning investments”

"In the UK, we have a clear pathway to further extend our market-leading position and capitalise on the favourable UK supply backdrop. We are determined to build on our significant outperformance since the pandemic and whilst the market has been slightly softer than last year, we remain on course to grow our UK returns substantially over the medium-term

In Germany, we are really encouraged by our progress to date. Our trading performance and the progressive maturity of our estate mean we are set to reach breakeven on a run-rate basis later this year. Our longer-term plans to become the country's number one hotel brand are also on track, as we move towards replicating our success in the UK market, delivering double digit returns on our current open portfolio by FY30.

Net debt is only modest, and 62% of the drawn down debt is offset by cash - this business could gear up substantially more if needed (which might attract a private equity predator maybe?) -

Balance sheet is excellent. NAV £3.48bn, and that includes only £181m intangible assets, so NTAV is c.£3.3bn - very healthy indeed. Net borrowings are only £375m, which is dwarfed by mountains of freehold property - just over half its properties are freehold.

Pension schemes are almost fully funded now, see the section in the H1 results RNS.

Paul’s opinion - this is such a good business! I am reminded of that every time I go through the figures.

Pity I sold my own shares just before the results, but I’ll be buying them back on the next significant dip, as I think there’s a strong bull case for share - self-funded expansion, very little net borrowings for the size of business & its cashflows. Generous shareholder returns. Market leading UK position, and the possibility of Germany replicating that success over time as it grows.

It’s got to be GREEN again.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.