Morning folks!

Busy morning for updates today. Thanks for your suggestions in the comments, I'm looking at the following (list is subject to change!)

- Character (LON:CCT)

- Carpetright (LON:CPR) (plus United Carpets (LON:UCG), which I hold)

- Blancco Technology (LON:BLTG)

- Bonmarche Holdings (LON:BON)

- Record (LON:REC)

- Dignity (LON:DTY)

- RM2

Cheers,

Graham

Character (LON:CCT)

- Share price: 452.5p (-0.3%)

- No. of shares: 21 million

- Market cap: £95 million

This is an AGM trading update, for the meeting at 11am.

Trading for the first four months of the financial year, i.e. from September to December, was in line with expectations.

As anticipated, the Toys R Us debacle had a negative impact on international trading. But domestic sales "continued to perform well".

If the company has performed fine on the domestic front during the period, that's encouraging, and better than I expected. November was supposed to have been a disastrous month for the industry here, so well done to Character if they managed to pull through it.

Indeed, the statement says that management "speedily and skilfully (sic)" addressed the changing conditions in the marketplace, so that there are "virtually no excess stocks to deal with in-house", and the major retailers "experienced a clean sell-through" of product.

From that wording, it does sound like there may have been build-up of excess inventory at some of the smaller retailers. But hopefully nothing too catastrophic.

I've noticed that some investors are a bit unhappy with executive compensation at Character. Today's statement could also be interpreted as presenting management's argument that their ability to control inventory is something that is worth paying for, in advance of the AGM.

The statement also reiterates the company's belief that while H1 this year will be tough, H2 will see the company return to its previous growth pattern, with the help of the new Pokemon range.

My opinion

I'd probably have marked the shares a little higher on today's news (which unfortunately was not released until just before the market opened).

The big fear was that H1 was going to be a catastrophe, and that recovery through H2 would be difficult.

But H1 is in line with reduced expectations, and the company remains confident about H2. It has also reassured us on inventory management, one of the biggest problem areas in the industry.

Forecast net income for fiscal 2018 is c. £8.3 million, rising toward £10 million next year.

It makes sense that when the Toys R Us situation has stabilised, the industry can recover somewhat. There are still huge closing down sales (external link) taking place in the UK. That's a horrible environment to be working in. But it's temporary.

So my confidence in the Character recovery forecasts is growing.

The shares have never enjoyed a particularly high valuation relative to earnings, and as a consequence the dividend yield has been strong and is still about 5%.

So maybe we can start talking about this company getting back to normal now, and offering investors stable and high returns on capital, as before, along with a high dividend yield?

Carpetright (LON:CPR)

- Share price: 93p (-43%)

- No. of shares: 68 million

- Market cap: £63 million

This update is for the 11 weeks ending 13 January, i.e. the first 11 weeks of H2.

Unfortunately, trading is significantly behind expectations.

This has resulted in a huge reduction in pre-tax profit forecasts, which were previously about £14 million for the current financial year. Instead they are reduced to a £2 million - £6 million range.

Maybe this should temper my enthusiasm for Character's H2 recovery, as Carpetright had previously flagged that there would be a "significantly stronger second half" to the current financial year. Clearly, this has not materialised. H2 weightings do require a lot of caution.

And the dangers associated with operational gearing in retail have taken their toll here. Checking some historical data, I can see that Carpetright's operating margin has been less than 3% since 2011. I don't know exactly what they are spending it on, but the administrative expenses look very high.

High fixed costs combined with a modest reduction in like-for-like sales, result in a serious downswing in profitability. The gross profit margin guidance is unchanged.

In numbers: the like-for-like sales reduction in the UK is -3.6% over the 11-week period, or -7.1% in flooring since Christmas. It's a different story internationally, where Carpetright's like-for-like sales are increasing.

My opinion - I'm not tempted to dabble here, as I try to be very selective in retail, and I haven't seen anything particularly attractive about Carpetright's model.

Brokers have widened its net debt forecast by £10 million up to £40 million, within a £55 million facility. The company owns freehold property worth £60 million, so it doesn't look like it's going to be distressed, at this point.

On the other hand, why would investors choose to own a retailer which might have to sell its properties to manage its debt levels in a weak consumer environment, unless such a company could be bought extremely cheaply?

Comparison with United Carpets (in which I own shares)

I do think that retailers selling commodity products should have extremely cheap valuations. Carpetright (LON:CPR) fits the bill. And the tiny, illiquid stock in this sector which I own, United Carpets (LON:UCG), certainly does too:

The difference is in their operating models. United Carpets doesn't own too many of the properties trading under its name, and it outsources store management and much of the required investment to franchisees.

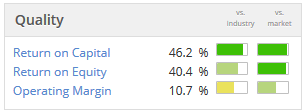

As a consequence, United Carpets earned average return on equity and return on capital over the past three years of about 34% for both metrics, vastly higher than Carpetright (LON:CPR).

High return metrics don't make for a risk-free investment by any means. United Carpets hasn't updated on post-Christmas trading yet. And any company in this sector can fail if the consumer environment is bad enough or if management trips up. But high return metrics do mean that when trading goes well, the free cash flow generation is excellent (because less cash needs to be reinvested).

On the other hand, we've remarked in previous SCVRs that Carpetright's cash flow has mostly been spent on its store refurbishment program. Unlike United Carpets, which holds net cash, has paid out special dividends, and is yielding more than 5%, Carpetright has been unable to pay dividends for many years.

Anyway, that's how I decided which stock to go for in this sector. They are probably all very risky, and I can think of a few accomplished investors who avoid this sector altogether!

Blancco Technology (LON:BLTG)

- Share price: 68p (-11%)

- No. of shares: 64 million

- Market cap: £44 million

Trading Update and Notice of Results

This company has been a serial disappointer. Even though I don't have a published list of "bargepole" stocks, it would certainly have been on this list all the way back to the days when it was known as Regenersis. I have described it as having "a sea of red flags"!

It was put together by previous owners who (in my opinion) cared more about the (temporary) share price than about building a solid PLC.

In the end, shareholders enjoyed a £50 million return of capital and were left with this data erasure business, which provides certified, permanent data erasure to businesses (i.e. using its products is better than simply pressing "delete").

Unfortunately, the new incarnation of this PLC suffers many of the same problems as the old one, as if it somehow picked up the poor habits of the businesses which it replaced. It continues to focus on over-optimistic "Adjusted" measures of operating profit.

Furthermore, big questions remain over cash flow. Last September, it had to reverse revenues which it had already recognised on some contracts for the year ending June 2017,

Today we learn about more cash flow issues in a profit warning:

Results for the six months to 31 December 2016 included a number of non-repeating volume sales deals, where revenue was recognised up front on the sale of software covering multiple future years. Several of these replaced deals previously contracted and recognised over time on a monthly basis. These were not due for renewal during December 2017 impacting Blancco's comparative year on year revenue and the contract renewal rate.

This is worrying on a few levels.

Firstly, were shareholders notified that monthly revenue recognition had been replaced by recognition covering multiple years? I've had a look at the half-year report, and I don't see where they were. This means that revenue comparisons looked better than they really were in the December 2016 period, by changing the terms of the associated contracts.

The company did show the difference between "invoiced sales" and the revenues which it was entitled to recognise under IFRS.

But if I'm reading this update correctly, it's saying that even the IFRS-compliant sales will be lower than last year's, not just the invoiced sales.

Secondly, and this is something which I've repeatedly emphasised to clients in my financial statements course, revenue should only be recognised in accordance with work done. According to the paragraph above, Blancco recognised revenue up front on software sales which covered multiple future years, i.e. not in accordance with the work or service which it had actually provided for those customers.

One of the reasons the cash flow statement is so powerful is that it cuts through all of these estimates. It's not perfect, but at least there aren't any of these problems with estimation!

The company is still looking for a replacement CEO, and had nearly £10 million in borrowings according to the figures last year. It is firmly on my bargepole list.

Bonmarche Holdings (LON:BON)

- Share price: 98p (-23%)

- No. of shares: 50 million

- Market cap: £49 million

This is a ladieswear value retailer, with a rather surprising sell-off today given that the opening line says that profit expectations are unchanged.

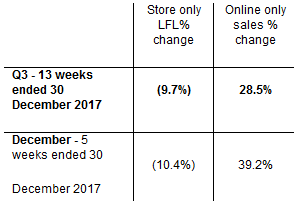

The reason for the move is that store LFL sales are down by 9.7%. Even combined with strong online growth of 28.5%, we still get an overall 5.5% reduction for sales for Q3 (ending December).

The trend was even more pronounced in the last 5 weeks of the year: store LFL down 10.4%, while online was plus 39%:

Checking my notes from when I covered this in November, I said at the time that the shares were cheap (they were also trading at 98p then), and that I would consider buying them if I didn't already own Next (LON:NXT) and other retail stocks.

The financial position seemed quite good (net cash £15 million), market share was growing, and a couple of bad periods were priced in.

At this point, I don't think much has changed. While today's share price fall must be a great disappointment for investors, it only wipes out two months of gains. We already had some strong clues that Q3 was likely to be poor, as the company had already told us about the difficulties in October.

The LFL performance has indeed been very bad, but within that the company continues to believe that it is growing market share, using industry data from Kantar.

As with Character group, inventory management was a major factor in the performance for the recent period. I think this factor must account for the unchanged profit expectations:

Anticipating the continuation of difficult market conditions during our third quarter, we adjusted our stock purchasing plans, and therefore the level of discounting was reduced compared to last year, resulting in a slight improvement in the gross margin percentage.

Conclusion

While acknowledging the high risk in this overall sector at the moment, I continue to have a positive impression of this company.

Personally, I don't want to increase my exposure to the sector, so won't be buying any more shares of this type for now. But if I did, I think I'd have to consider this one as a candidate. I have a positive impression of the brand and even a critical audience on trustpilot (external link) give it very good overall reviews.

The online growth is excellent, so I suppose the question is whether it can keep growing this part of the business fast enough to pay for any losses and difficulties in the physical stores.

It's getting cheaper, and I do think it is worth a look. The StockRank is a perfect 99.

(Please note that I own shares in Record.)

Record (LON:REC)

- Share price: 42.5p (-1%)

- No. of shares: 199 million

- Market cap: £84 million

Regulars will know that I follow the financial sector, and Record is a stock which I keep an eye on.

It's a specialist asset manager with expertise in currencies, offering passive products designed to reduce transaction costs, along with higher-margin, "dynamic" hedging which looks to exploit price patterns in currency movements.

UK clients abandoned the dynamic hedging product over the past year. I think I can understand why they would have wanted to do that if they were switching into Euros. The relentless increase in the value of EURGBP would have left them wondering why they weren't simply switching to Euros as soon as possible, rather than paying Record to attempt to time the trade.

That trend has calmed down now, however, so maybe clients can be tempted back into dynamic hedging again?

In any case, these are decent results with $1.4 billion in net inflows, and another $1.3 billion increase from market movements. So AUME (assets under management equivalent) increases from $61.2 billion to $63.9 billion over the quarter.

Reading through the performance summary, I don't see anything too extraordinary to report. US clients in dynamic hedging lost out as USD weakened, but the programmes overall performed as expected.

CEO comment says the company spent a lot of energy preparing for MiFID II, and it was ready on time. He express confidence for the rest of the year.

My opinion

I'm still a fan of this company, I think they have a great specialism and it looks like they can compete with the banks for customers who want an enterprising currency service. The trend has unfortunately been against them with the loss of interest in dynamic hedging.

Long-term, I hope they can diversify their client base more (they are up to 60 clients now). And the higher their AUME, presumably the better the rates they can achieve with their counterparties.

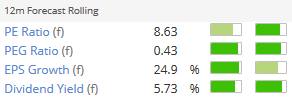

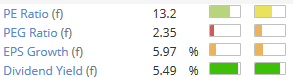

Valuation is not too extraordinary. The company has a strong balance sheet and high returns on capital too:

So I decided to put my money where my mouth is and open a small, starter position here. I wish I had bought it at sub-30p in 2016, but the value looks fine to me at this level.

Dignity (LON:DTY)

- Share price: 995.75p (-48%)

- No. of shares: 50 million

- Market cap: £497 million

Massive share price destruction today for this funeral services provider.

The statement starts with confirmation that the year ended December 2017 will be in line with expectations.

Unfortunately, 2018 is set to be substantially below expectations:

...the Board is keen to address the continuing acceleration of price competition facing its funeral business. The Board is therefore taking decisive action on its funeral pricing strategy with a view to protecting market share and repositioning the Group for future growth.

Effective immediately, the Group's simple funeral will be reduced by an average of approximately 25 per cent and there will also be a price freeze for the Group's traditional funerals in the majority of the Group's locations.

The statement remains bullish on Dignity's prospects and market position, asserting that it can provide "the best quality service at whatever price point and market segment it chooses".

The group's market share was about 11.7% in 2017 (funerals per deaths).

This market share metric (funerals per deaths) fell by 3.6% from 2004-2014, and by 6.8% from 2015-2017 (i.e. Dignity's market share fell by 6.8% from its original level, not by 6.8% of the total market).

To counteract this trend, the "simple funeral" is being reduced to a basic price of £1,995 in England & Wales, and £1,695 in Scotland, from the current average level of £2,700. These figures exclude add-ons referred to as disbursements, which will continue.

Note however that simple funerals will only represent c. 20% of total funerals in 2018. The rest are a mix of more expensive traditional funerals, and lower-price "pre-arranged" funerals.

Outlook statement is grim due to volume erosion, lower prices, an adverse change in mix, and increased promotional expense.

Finally, the company admits that the final outcome of all these changes, in terms of volumes and margins, is unclear.

My opinion

I need to do a lot more research here, but I will probably have the opportunity to do so, now that it's (sort of) within our market cap limit!

The share price had a spectacular run from 2012-2016. It's now back around where it was at the start of that run.

Note that the company's operating margins have been huge (running at around 30% for many years), so it should have the financial flexibility to reduce prices and thereby change its positioning versus competitors.

While the 25% reduction in simple funeral pricing is severe, the more expensive full service plans are merely going to have a price freeze, so the overall revenues might not suffer too greatly.

I don't think that Dignity is the market leader in the UK - from what I gather, the Co-op Funeralcare is larger. But Dignity looks like it's in the top 2 or 3 at least. Defending this position seems worthwhile.

So this is on my radar now as a potential growth/recovery play which I need to look into. See the long-term revenue trend:

Thanks for suggesting it in the comments!

RM2

- Share price: 1.25p (-23%)

- No. of shares: 407 million

- Market cap: £5 million

This pallet innovator is interesting because a certain well-known fund manager owns 28% of it, and it's going to need more money soon.

In December, it said that it would have enough cash to survive this month.

Today, it is more precise:

Taking into account production costs and known one-off costs, based on the information available to it today, the Company currently expects to have sufficient cash to continue operating through the third week of February 2018, although this date could vary depending upon the outcome of ongoing discussions with third parties, including manufacturing partners and alternative sources of financing.

Its problems are roughly as follows:

- It has received very few orders for its products

- It promised its outsourced manufacturing partners certain volumes of orders

- It has no money with which to pay those manufacturers

- Even if it did have the money to pay its manufacturers, it wouldn't be able to sell the product they made (see the first point).

I'm not expecting it to be bailed out.

That's all for this week, thanks for tuning in!

Cheers,

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.