Good morning from Paul!

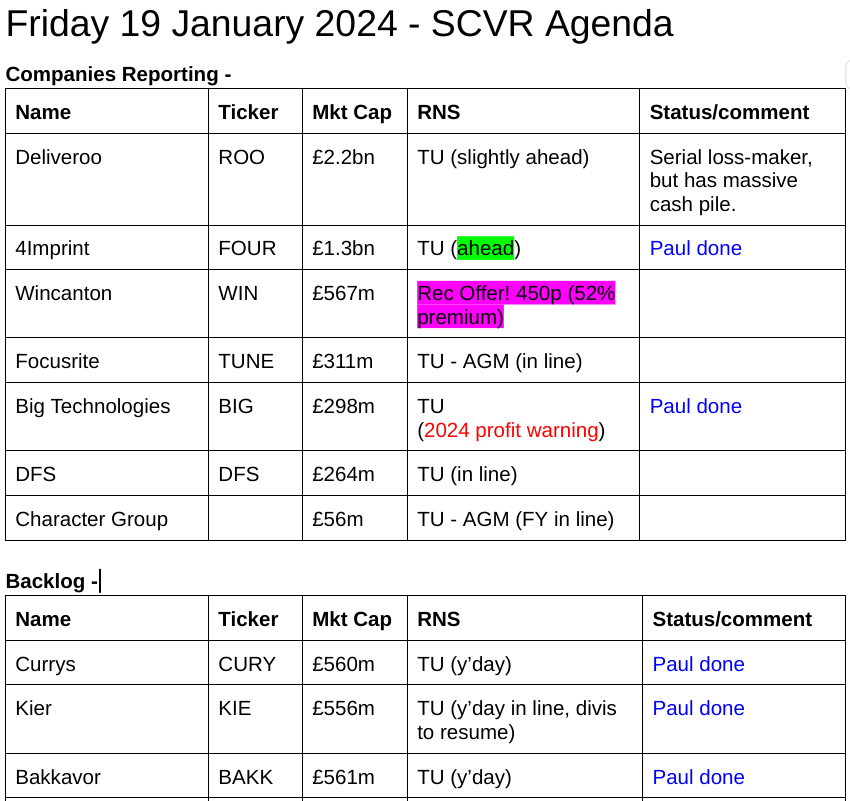

I've done 3 backlog sections for you to get off to a flying start today.

Today's report is now finished. Have a lovely weekend! Podcast tomorrow morning.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. OR it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom),

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Summaries

Bakkavor (LON:BAKK) - up 6% to 97p (£561m) - Trading Update [upper end range] - Paul - AMBER/RED

Slightly ahead update for FY 12/2023. Outlook sounds OK. I also run through the negatives below, mainly a weak, heavily indebted balance sheet. Divis look too generous given that it should be focusing more on debt reduction. I can't get excited about this low margin, indebted business.

Kier (LON:KIE) - up 11% y’day to 125p (£556m) - Trading Update [in line] - Paul - AMBER/GREEN

An in line update from this big contracting business. Low margins, and balance sheet isn't the best. However, performance is OK, and divis are about to resume. Still quite good value, but given shares have doubled in the last year, I'm moderating my view from green, to amber/green.

Currys (LON:CURY) - up 9% to 49.4p y’day (£560m) - Trading Update [ahead] - Paul - AMBER/RED

I was expecting bad news, given recent PW from Marks Electrical (LON:MRK, but CURY has performed OK, and raises guidance a little. Greek disposal pending should eliminate bank debt, but remember it relies on huge trade credit from suppliers. I can see potential upside if consumer spending recovers, but for me the weak balance sheet and very cash hungry pension deficit put me off.

4imprint (LON:FOUR) - 4635p (pre-market) £1.31bn - Trading Update [slightly ahead] - Paul - GREEN

Positive update today, with 2 brokers raising FY 12/2023 forecast earnings by 7-8%. Valuation still looks reasonable for a company with a superb long-term track record that 50-bagged over 15 years. Looks good to me!

Big Technologies (LON:BIG) - down 21% to 101.5p (£294m) - Trading Update - Paul - BLACK (profit warning flag), AMBER/GREEN on fundamentals.

2023 trading is fine, in line. However it reveals imminent loss of a large contract in Colombia will hit 2024 numbers, along with increased costs to ramp up sales efforts in the US. Zeus reduces 2024 forecast by about a quarter. Shares plunged first thing, but have bounced somewhat now. I think it actually looks quite interesting now, with the valuation now only a fraction of the inflated 2021 IPO price. The large cash pile is curiously not mentioned today.

Bakkavor (LON:BAKK)

Up 6% to 97p (£561m) - Trading Update [upper end range] - Paul - AMBER/RED

I did a quick review of this ready meals manufacturer a few days ago here on 15/1/2024, coming away unimpressed with the heavy debt burden (high finance costs), low margins, but intrigued by a 20% stake changing hands (potential bid target maybe?)

It provided a year end update yesterday -

Bakkavor Group plc ("Bakkavor" or the "Group"), the leading international provider of fresh prepared food ("FPF"), today updates on trading for the 52 weeks to 30 December 2023 ("FY23"), ahead of the publication of its full year results on 5 March 2024.

This sounds positive -

2023 profits, net debt and leverage ahead of market expectations with encouraging outlook for 2024…

The Group anticipates FY23 Group adjusted operating profit to be at least in line with the upper end of the range of market expectations2

Is that in line, or ahead? It’s a bit of both really!

The range is very tight -

2. Based on company compiled consensus ("Consensus") which includes; Citi, Goodbody, HSBC, Investec, Kepler, Numis and Peel Hunt. Adjusted operating profit Consensus for 2023 of £90.2m, with a range of £89.7m to £91.1m.

Operating profit is not a good measure for a highly indebted company like this, as finance charges consume a good chunk of operating profit.

Net debt has come down more than expected, to a still substantial £230m.

BAKK overpays divis, and should cut them back in my view, and instead focus on deleveraging. So I don’t see the high dividend yield as being necessarily safe in a downturn.

The forecast yield is 7.6%

Outlook - a bit mixed, but overall sounds positive I think -

The smaller US and China businesses have been poor performers, but seem to have scope to improve, which should help the overall group results.

Paul’s opinion - margins are low, and it’s just not a very interesting business, supplying supermarkets, so under constant pricing pressure. As I mentioned a few days ago, after hefty finance charges, the PBT margin is only about 3%. Growth seems limited.

Not madly exciting then, but shares have had a bit of a rebound recently - although we’re seeing lots of situations where dormant sellers use price rebounds and increased liquidity to resume their selling.

What’s the upside case? Pre-pandemic, EPS was over double the current levels, and there’s been no dilution since then. So if BAKK can regain previously higher margins, then the shares could recover perhaps? Although note that higher interest rates now mean the debt costs a good bit more, so earnings could be permanently lower for that reason perhaps?

It’s not been a successful 6 years since floating, although divis have softened the losses somewhat, with c.26p paid out in total since floating.

I’m struggling to find a compelling reason to get involved here, when there are so many other more interesting (and good value) companies to look at.

Kier (LON:KIE)

Up 11% y’day to 125p (£556m) - Trading Update [in line] - Paul - AMBER/GREEN

Kier Group plc ("Kier" or the "Group"), a leading infrastructure services, construction and property group issues a trading update for the six months ended 31 December 2023 ("the period" or "first half"). The Group will publish its results for the six months ended 31 December 2023 ("half year results") on 7 March 2024.

Trading - this sounds reassuring -

Consistent with the update in November 2023, the first half of the current financial year continued to trade above the prior period and was in line with the Board's expectations. This was driven by strong volume growth, particularly in Construction. Similar to last year, the Group's performance is expected to be second-half weighted.

Order book is huge, and gives good visibility -

The order book as at 31 December 2023 was c.£10.7bn, a c.6% increase on the year-end position (30 June 2023: £10.1bn) and the prior year comparative (31 December 2022: £10.1bn). The Group has secured revenue of 92% for FY24, providing a high degree of visibility. Long-term framework positions are excluded from the order book and represent an additional opportunity. Bidding discipline and risk management embedded across the business continue to drive the high quality and profitable order book.

Cash/debt - I like the reporting of average month end, but average daily would be better -

Kier's focus on operational delivery and cash management alongside the cash generation from the strong volume growth has successfully resulted in the Group continuing to deleverage materially with average month-end net debt of c.£(140)m (HY23: £(243)m) showing a significant improvement of c.£100m.

Kier is expected to report a modest net cash position at 31 December 2023 (HY23: £(131)m).

Balance sheet - I’ve checked the June 2023 one. It’s large and complicated, but NTAV is negative at £(132)m - not good, but not terrible either, given that public sector projects tend to be good payers, helping working capital.

Dividends - balance sheet weakness limits the divis it can pay, and nothing has been paid to shareholders since 2019. Although the good news is that it expected to recommence divis, starting with the H1 results (to Dec 2023) which should be out in March 2024.

Paul’s opinion - I only looked at KIE once in 2023, giving it a GREEN view on 16/11/2023, mainly due to cheapness, trading well, good outlook & order book, and a 5% forecast yield.

That remains the case now, with a forward PER of 5.9x, and forecast 4.5% yield.

The main downside here is the risks associated with all these large contracts, and a wafer thin profit margin - leaving very little profit to absorb any contract losses (that sooner or later always surface in this sector).

That said, KIE shares are clearly in a nice uptrend, having doubled in the last year, and it seems to be trading well, and still looks quite cheap. At some point people will probably want to bank profits though, that’s very much the feel of UK small caps at the moment.

It’s had a good run, so think I’ll shift down a bit to AMBER/GREEN.

It's also worth pointing out the long-term track record -

Currys (LON:CURY)

Up 9% to 49.4p y’day (£560m) - Trading Update [ahead] - Paul - AMBER/RED

The giant UK/Nordics electrical retailer pulled a positive surprise out of the hat, with a slightly ahead of expectations update, with upwardly revised guidance -

Group adjusted profit before tax is expected to be £105-115m, ahead of consensus expectations2

2. Consensus forecasts FY 2023/24 adjusted PBT of £104m. Company compiled consensus for FY 2023/24

Although the surplus is little more than a rounding error on c.£9bn revenues expected for FY 4/2024.

Also note they have not removed the Greek subsidiary (pending disposal) from this £105-115m guidance, which is wrong I think, it should be eliminated as a discontinued activity. That’s £18m of profit to come off the £105-115m guidance above.

Greece disposal is expected to complete soon, and should then result in CURY having a net cash position - a useful improvement, but lower profit in future obviously. The disposal price of £156m after costs looks favourable to me, and reduces balance sheet risk considerably. Although the whole business is financed by enormous credit provided by its suppliers, which has always concerned me.

Year-to-date LFL revenues were weak though, negative (3)% in the UK, and (5)% in the Nordics.

I heard an interview with the CEO on Ian King’s Sky podcast, who said that Red Sea shipping had introduced delays of 1-2 weeks on some products, but that “customers won’t notice”, and little to no financial impact is expected. They’re used to dealing with supply chain chaos, given the events of the last 4 years. Being the biggest retailer in the sector, they’re “first in the queue” when product supply is restricted. He sounded pretty relaxed about things.

Paul’s opinion - I’m tempted to move up again from amber/red to amber, but still have concerns, namely -

Weak balance sheet - NTAV is about negative £(700)m

Cash-hungry pension deficit

Dependence on trade credit to finance the whole business

Very low margin, only just over 1% at PBT level

Another big increase in living wage pending from April 2024, increasing costs.

Aggressive online competition, eg AO World (LON:AO.). & Marks Electrical (LON:MRK) so margins are always going to be low.

Little to no pricing power, as it’s selling third party brands mainly.

On the upside, it’s survived the last few years surprisingly well, remaining (just about) profitable despite all the disruption and headwinds. Very large revenues of c.£9bn means there could be considerable upside if consumers do relax spending, which I expect given the large increases in real wages, benefits & state pension in the pipeline.

As mentioned before, the whole sector of electrical retail doesn’t interest me at all, and I wouldn’t buy any of them.

CURY doing reasonably OK, does raise questions over MRK, which recently warned on profits, halving its forecast, blaming price conscious customers and lower margins. That seems more a home-grown problem, as CURY has clearly avoided those pitfalls, further undermining the investment case for MRK.

With CURY, I’ll stick with AMBER/RED, given the considerable bear points noted above, but I’ll be happy to be proven wrong if the consumer does increasingly get their purses out in 2024. Many electrical purchases are forced purchases when existing equipment breaks.

Note that CURY share count has actually gone down (from buybacks) over the last 5 years, so theoretically shares could regain previous levels, if revenues and profits were to return to pre-pandemic levels. So there is an upside case here, if you’re bullish on consumer spending.

4imprint (LON:FOUR)

4635p (pre-market) £1.31bn - Trading Update [slightly ahead] - Paul - GREEN

This share has been a stunning success in the last 15 years, roughly 50-bagging from low to high. It sells marketing/promotional goods, mainly in the USA.

I’ve long admired the company, but never imagined the shares would be such a rip-roaring success, and they often looked too pricey on the way up - there’s a lesson there!

4imprint Group plc (the "Group"), the leading international direct marketer of promotional products, will announce its final results for the year ended 30 December 2023 on Wednesday, 13 March 2024. Ahead of this, the Group today provides a trading update.

The update today is self-explanatory, so here it is in full -

Excellent progress has been made by the Group during the course of 2023, giving rise to a strong financial performance for the year.

Unaudited Group revenue for 2023 is anticipated to be $1.33bn, an increase of $186m or 16% compared to $1.14bn in 2022. Unaudited profit before tax in 2023 is expected to be not less than $140m (2022: $104m), slightly above the upper end of the current range of analysts' forecasts.

Unaudited cash and bank deposits at the 2023 year-end were $105m, (2022: $87m), leaving the Group very well funded entering the 2024 financial year.

The Group has made significant operational progress in 2023, reflecting a clear strategy and a highly resilient business model. The Board remains confident in the Group's prospects.

That’s a big increase in adj PBT, up 35% vs 2022.

Note the US dollar reporting.

Liberum & Cavendish both update us today via Research Tree.

Cavendish ups FY 12/2023 EPS by 8% from 346c to 372c, which is 293p, so the PER is now 15.8x, which seems good value to me, given the growth and the amazing track record.

Given that the share price is likely to rise today, the PER would go up a bit I expect, and might end the day nearer 17x at a guess (writing this pre market open). That still seems a reasonable price for an outstanding business.

Given the size of the US economy, I imagine c.$1.3bn revenues probably leaves plenty of scope for further growth.

Paul’s opinion - this looks good. GREEN from me.

Big Technologies (LON:BIG)

Down 21% to 101.5p (£294m) - Trading Update - Paul - BLACK (profit warning flag), AMBER/GREEN on fundamentals.

Big Technologies plc, the UK-based remote people monitoring technology company, issues the following trading update ahead of the announcement scheduled for 26 March 2024 of its full year results for the year ended 31 December 2023.

This share went into freefall in the first few minutes of trading, bottoming c.75p, since bouncing a good amount up to 101.5p at the time of writing, although that could be out-of-date by the time I’ve finished this section! A nice trade there early for the brave.

I’ve only looked at BIG once, here on 20/9/2023, where I detailed:

Bull points - very high margins, cash generative, owner/manager with a big stake still, recurring revenues, surplus cash pile.

Bear points - 2021 float, mgt greed re share options, and valuation too high.

2023 trading - is fine, in line with expectations -

The Group has continued to perform in line with the board's expectations with revenue for the year ended 31 December 2023 expected to be approximately £55 million (2022: £50.2 million) and adjusted EBITDA to be approximately £33 million (2022: £30.5 million). These results are in line with current market expectations1.

1: The Company has compiled forecasts from four analysts with current market forecasts for 2023 revenue to be in the range of £54.0 to £54.5m, with a consensus of £54.3m, and for adjusted EBITDA to be in the range of £32.7m to £32.8m, with a consensus of £32.7m.

A black mark for only revealing adj EBITDA. Zeus comes to our rescue with an update note, to translate adj EBITDA into real profit.

Zeus has FY 12/2023 as adj EBITDA £33.0m, and adj EBIT (operating profit) of £28.9m. It doesn’t show adj PBT, which I presume will be higher than EBIT due to interest received on the big cash pile. Adj dil EPS is 8.9p, so a PER of only 11.4x - looks cheap.

2024 guidance - it’s cheap on a 2023 earnings multiple because we have a profit warning for 2024. Adj EBIT forecast has been lowered by 25% to £23.9m, which is a 17% drop on 2023 actual.

What’s gone wrong? A large contract in Colombia has been “subject to short term renewals since September 2021”, but is now expected to end in H1 of 2024.

This has been partly mitigated with several other new contract wins.

“Investment” in expanding its sales efforts in the USA will cost more in 2024 and reduce short term profits, for a (hopefully) acceleration of growth in the medium term.

It says 2024 revenues should “at least” match 2022, which was £50.2m.

What about profit though? It doesn’t provide profit guidance for 2024, saying it will update when more is known re Colombia in March 2024, so we’re in limbo until then.

Zeus has pencilled in 7.3p for FY 12/2024. That would be a PER of about 13.9x, which strikes me as probably a fair price.

Outlook - it’s not all doom & gloom -

The Group continues to see opportunities to expand market share and scale-up the business and is in the process of releasing its first innovative substance detection technology to priority customers. We have enjoyed contract renewals across the business and won a number of new customers in recent months which will start to contribute revenues during 2024 and 2025. A return to growth is expected for 2025 and beyond.

Cash - is a key bull point for this share, as it has a lovely balance sheet. At June 2023, it had £99m NTAV, of which £76m was cash, almost all of which I regard as surplus cash. That’s just over a quarter of the £294m market cap (at 101p/share).

I imagine cash has probably gone up in the last 6 months, which makes it all the more perplexing as to why today’s update doesn’t mention cash at all. Talk about an own goal!

Paul’s opinion - I think this share looks quite interesting at the new, reduced valuation. Especially when you take into account the big cash pile too.

What today’s profit warning reminds us, is that many smaller companies are highly dependent on one or a few big customers and contracts. If Colombia was only being renewed on a short term basis since 2021, then that really should have been disclosed to the market previously, I wonder if it’s in the IPO documentation as a risk factor?

As I always say, outsiders don’t really know what’s going on inside any company, and there can be hidden risks like this at almost any company.

Given the cash pile, and the various other positive things about BIG, combined with a now much more sensible valuation, I’m going to lean slightly positively towards it for a potential medium term recovery, so I’ll go AMBER/GREEN on fundamentals.

Although for the purposes of my spreadsheet, it’s BLACK, to flag the profit warning today.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.