Good morning (alright, afternoon…),

It’s Jack here. Paul is otherwise engaged right now so I’m stepping in.

Domino’s Pizza Poland (LON:DPP)

- Share price: 8.63p

No. of shares: 249 million

- Market cap: £19.36m

Domino’s Pizza Poland has updated on first half trading. As the name suggests, this is the Master Franchise holder of the Domino’s Pizza brand in Poland. When it comes to this small cap, a picture tells a thousand words:

No surprises that what was once a High Flyer is now classified by Stockopedia’s algorithms as a “Speculative Micro Cap Sucker Stock”.

Ouch.

It has been a bumpy ride for shareholders in a company that promises much but has so far failed to deliver a single year of net profit after almost a decade as a listed enterprise.

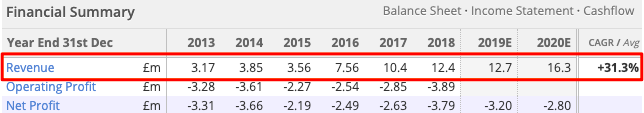

We can see that management has been busy growing the top line quite consistently, however:

DPP has been busy rolling out its store estate and this rapid growth continues to result in losses. The question is whether or not you believe there is still a pot of gold at the end of the rainbow. When it works, the Domino’s model can be almost ludicrously profitable - but it doesn’t always work, and the market today is different from when it conquered the UK in the 90s and Noughties.

Online food delivery aggregators, for example, have their eyes firmly set on the takeaway market these days, and this new breed of competition has been explicitly listed by management as a risk going forward.

It appears as though the group has turned a corner and is moving on from a period of negative like-for-like sales (definitely a phrase that a small cap growth stock is not supposed to say), with like-for-like (LfL) sales ‘building from March 2019’. Breaking that down a bit, the group had -1% LfL growth in system sales January-June 2019 on January-June 2018 but LfL growth in system sales were +5% in the March-June 2019 period (vs. same period last year).

The difference between these two figures are a set of tough January and February comps in 2018 that were boosted by a successful trial of nationwide TV advertising which has not been repeated this year (presumably DPP thinks it has not yet got the geographic coverage in terms of stores to justify regular TV ads?). Total system sales including new stores were up 10% in the period.

The group has 67 stores in 28 towns and cities. Of these, 43 are corporate (four of which have been put out on management contract) and 24 are sub-franchised. A bear point in the past has been the slower-than-anticipated influx of franchisees but this number has been ticking up in recent years. DPP now has 10 sub-franchisees across the company.

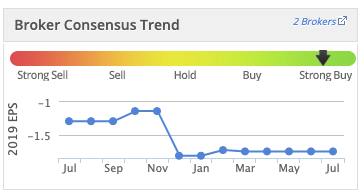

With the shares up c11% today (albeit following a c75% drop since December 2018), the market is reading this as a steadying of the ship. Brokers are forecasting breakeven by FY22 - this is a target that has been pushed back in the past. The forecast chart shows that this should be taken with a pinch of salt (although it is certainly doable):

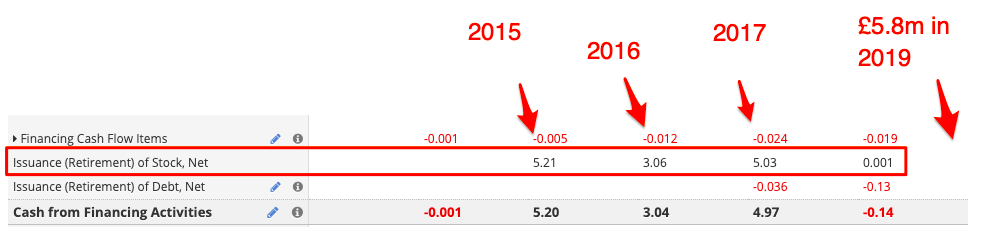

DPP raised £5.8m in a placing in February of this year - after the share price crash, unfortunately - so it does actually have a bit of a war chest. This is not the first time it has gone cap in hand to shareholders, although other placings have been at better prices:

DPP is a question of whether you believe the business model will work. The company has been a serial disappointer, but with new funds and a sub-£20m market cap, the risk:reward ratio is much more favourable than it has been in the past.

Make no mistake though, it is a risky one!

One more note: at 67 stores, DPP has to open two more units this year if it is to satisfy its Master Franchise Agreement targets. If it doesn’t, it might well be able to renegotiate, but this is still something to bear in mind.

Van Elle Holdings (LON:VANL)

- Share price: 35.6p

- No. Shares: 80m

- Market cap: £29.2m

Another profit warning from this independent ground engineering contractor, with trading performance at the end of FY2019 “largely” as anticipated. Largely is one of those words that, like “broadly”, should set some alarm bells ringing.

The inevitable warning has not perturbed the market too much, however. The group says: ‘as part of the year end process, the Board has determined it necessary to adjust a small number of specific balance sheet items and contract accruals. Whilst the results remain subject to completion of the audit, these adjustments will adversely impact FY2019 adjusted profit before taxation by a total of c.£0.5m.’

The shares are down just 2.5% today, which reflects the hammering they have taken over the past year:

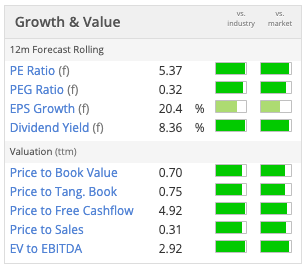

Van Elle is showing some strong value metrics now

And the company scores a respectable F-Score of 7. Couple that with a Z-Score of 2.93 and it does not appear to be in mortal danger.

Not a company I know well. Presumably, it is cyclical. Its Value, Quality, and StockRanks are all in the 90s… So this might be worth investigating further if you have an appetite for potential recovery situations.

However, when management is currently saying things like: "the Group is continuing to experience customer uncertainty in some of its markets, resulting in a quiet start to the year in some segments and increased volatility in month on month performance"

and,

"the Board is mindful that market uncertainty and the resultant volatility may persist further into the current financial year, which would limit the rate at which progress can be made."

I'm not sure quite why you would get involved right now. Nothing wrong with watching from the sidelines.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.