Good morning, it's Paul here with Friday's SCVR.

Sorry I didn't manage to do any more writing yesterday afternoon, I was too tired by the time I got home, and not in the best frame of mind, with the car having failed its MoT for the second time in a week.

Estimated timings - I've started at 7am, so should be done by 1pm.

Edit at 13:07 - today's report is now finished.

.

Staffline (LON:STAF)

Share price: 48.5p (up 52% yesterday) - currently down 17% today, to 40p, at 08:54

No. shares: 68.9m

Market cap: £33.4m

Statement re share price movement

Some kind of speculative frenzy gripped this share yesterday, with it spiking up 52% on no news. Hence the company has needed to put out a statement today. The crux is;

Staffline, the recruitment and training group, notes the recent movement in the Company's share price and confirms it is not aware of any reason for the price movement...

Further points;

Bank facilities - expects to agree & implement revised financing arrangements soon.

Results - for FY 12/2019 should be published soon (they need to get their skates on, as I think the shares would be suspended if not published by end June). Audit work not yet finalised - which will presumably hinge on bank facilities being signed off, in order to publish accounts on a going concern basis. Although this might allow shares to continue trading, possibly? -

The full report and accounts for the year ended 31 December 2019 is now expected to be published and sent to shareholders in July. Accordingly, the Company has applied to AIM Regulation for an extension to the current reporting deadline of 30 June 2020, which has been granted in accordance with the temporary measures put in place due to the impact of COVID-19.

Figures - 2019 results expected to show small underlying EBITA loss, and pre-IFRS16 net debt of £59.5m - that's a lot of debt, but remember that Staffline has a blue chip client base, with a large receivables book. So the bank has quite good security.

Cashflow - benefiting from Govt deferral of VAT & payroll taxes - "significantly improved ... liquidity through the end of 2020". Whilst this is helpful, these liabilities will still have to be paid at a later date, which the bank may not be happy to fund. Therefore, there's still insolvency risk here in my view.

My opinion - too risky for me in the current circumstances, and I don't want to touch this sector anyway.

.

Redcentric (LON:RCN)

Also says it accounts are delayed, but gives a reasonable explanation;

Redcentric plc (AIM: RCN), a leading UK IT managed services provider, announces that it now expects to report its full year results for the year ended 31 March 2020 on 21st July 2020.

The current audit is taking longer than originally expected due to the restrictions of the current lockdown and does not relate to any issues with the audit.

As announced on 3rd April 2020, trading for the year to 31st March 2020 was in line with the Board's expectations and pre IFRS16 net debt at 31st March 2020 was £13.5m.

Taking that at face value, it sounds OK.

.

Warehouse Reit (LON:WHR)

We were discussing Newriver Reit (LON:NRR) yesterday, and I've also mentioned Hammerson (LON:HMSO) before, as potential, but riskier property investments.

Warehouse Reit (LON:WHR) is altogether a safer option, and looks an attractive income share. I've covered it here before, so see the archive for more details. By specialising in buying warehouses, it has focused on an attractive subsector, where rental yields are good (and sustainable), there's increased demand (due to move towards more online shopping), and supply is tight because values can be below build cost.

To reinforce what a good stock this is, it's just announced a large (relative to its mkt cap) fundraising that has gone very well. The fundraising size has been increased from £175m to £200m, and crucially the price discount was negligible, at 110p (versus 111p market price).

My opinion - this is an excellent investment, in my view (not one I hold personally, but is on my watchlist). It provides a high yield of over 5%, which should be inflation-proofed, since rents are likely to rise over time. There's no premium to NAV, so it's good value.

I think this is one of the best shares I've come across for long-term income seekers - e.g. SIPPs in drawdown. It provides a good yield, and over time NAV should also rise. What's not to like? It won't be completely immune from the recession, but if anything is likely to be a beneficiary from the pain that retailers & their landlords are facing, as supply moves online.

The fact that it's just got away a large fundraising, at no discount, with excess demand, demonstrates very clearly that institutions are happy to back this sub-sector. Obviously do your own research as usual, because I might have missed something, but this one gets a thumbs up from me.

.

Agronomics (LON:ANIC)

Possible de-listing & tender offer

I'm not interested in the company - it's a Jim Mellon vehicle for investing in pre-revenue biotech & pharma companies.

This is an interesting announcement though. The company says it will consult shareholders on possibly delisting.

The main reason given could have wider read-across. It's struggling to raise follow-on funding from AIM, and sees better funding opportunities in the private company space;

...the Directors believe that the Company, as a private company, will be able to access substantial equity capital from investors specialising in private market investment

Tender offer - this is an excellent idea. In order to prevent the share price crashing, and to provide an exit route for shareholders that cannot, or don't want to own shares in a private company, an alternative is being offered to buy out shareholders at 6p - similar to the market bid price before this announcement. This is a nice touch, well done to Jim Mellon for providing this fair exit route.

My opinion - it's hardly surprising that AIM is losing its appeal as a place to fundraise for speculative companies, because hardly any of them actually deliver on their promises. Over the last 20 years, I've seen hundreds of rubbish companies listed on AIM, and the speculative ones nearly all go disastrously wrong. Sure, there's a continuous supply of new mug punters, who open broking accounts and get sucked into speculative rubbish, it's a rite of passage for all of us, to lose money on junk shares. And the odd one still slips through the net!

To keep AIM buoyant, brokers need to find decent companies to list, not more speculative junk - which ultimately is killing the golden goose, as investors become more cynical about everything.

I wonder how many more companies might de-list? It's a very real risk for speculative micro caps.

.

Trifast (LON:TRI)

Share price: 121.5p (down 9% today, at 09:00)

No. shares: 122.7m

Market cap: £149.1m

Trading Update & Proposed Placing

Placing - quite small, only about 10% of the market cap, to raise £15m + possible £1m ("broker option").

It's an accelerated book build (ABB) as usual, so we should get more details, including pricing, later.

Liquidity sounds OK -

Cash preservation actions have further reinforced the Group's financial position with good levels of covenant and liquidity headroom to manage through the current period of disruption

Current trading - improving;

Activity levels have shown improvement during May and into June and the Group has the ability to ramp up to full production across the business as conditions improve.

Directorspeak sounds upbeat -

"Despite Covid-19 the next couple of years for Trifast remain a very exciting time for our business. As we look to implement and invest in a number of significant and positive changes in the way that we are structured and operate"

Results FY 03/2020 - expected to be like this;

- Revenues c.£200m, resilient performance. This is in line with £201m shown as broker consensus on Stockopedia.

- Lower gross margins, as previously reported.

- Underlying PBT c.£17m.

- Net debt £16m at 31 Mar 2020. Comfortably within net debt:EBITDA covenant at 0.8x

Impact of covid-19;

- Significant impact in Q1 (Apr-Jun 2020)

- Temporary closure of some facilities. All open by end April, some at reduced capacity

- Trading volumes contract, especially in automotive

- Revenues in April c.50% down Y-on-Y

- Profit "significantly adversely impacted"

- Volumes improved in May

- Pipeline encouraging, further recovery expected in June - NB. returning to underlying profitability

That all sounds sensible to me. As you would expect, the business has taken a one-off hit to profitability, and seems to now be recovering. That shouldn't be a surprise to anyone.

Lots more detail is given, including a "reasonable worse case" scenario, which would see revenues down 27%, and an unquantified hit to profitability. In this scenario it would make additional cost cuts. It says that there's adequate cash headroom, and it would remain within banking covenants, even in this worse case - reassuring. So why do a placing then? They say it's to reduce risk, and provide further headroom. OK, fair enough.

My opinion - this looks a sensible deal, with only modest dilution (I'm guessing that the placing price is likely to be close to the prevailing share price).

TRI seems well managed, judging from its thorough RNSs, and it makes a decent profit margin for the sector.

I suspect results for FY 03/2021 could be worse than the 20% drop in forecast EPS to 8.48p. Broker forecasts often seem to overlook operational gearing, Longer term though, it sounds like TRI is set up quite well.

If you're prepared to look through likely poor results for FY 03/2021, and hold for the long term, then this could be quite a good entry point, c. 120p per share, maybe? I can't get excited about it either way - it's not really value, and it's not growth either. It's probably priced about right at the moment.

.

.

Costain (LON:COST)

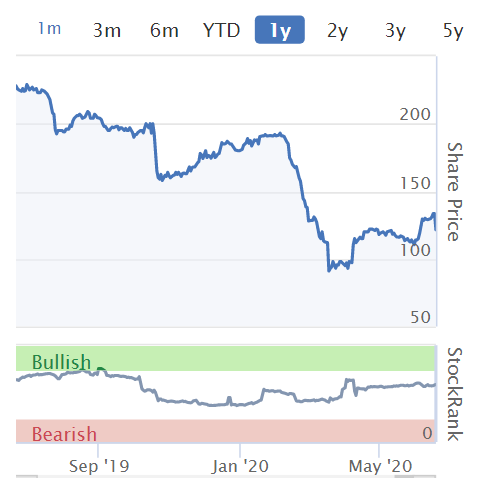

Share price: 75.7p (down c.1% today, at 12:27)

No. shares: 274.9m

Market cap: £208.1m

Trading Update (AGM)

Costain, the smart infrastructure solutions company, announces an update on trading including the impact of Covid-19 on the Group's operations...

Use of the word "smart" above made me google it, in case Costain has been involved with the disastrous so-called "smart motorways", which have turned out to be extremely dangerous, and resulted in dozens of deaths, due to the lack of a proper hard shoulder. Investors might need to look into that, to ensure no liabilities could hit Costain.

It raised £100m in fresh equity, very recently, to help shore up the balance sheet, and pay suppliers more promptly as required by the Govt's Prompt Payment Code. I reported on that here, on 11 Mar 2020, am just re-reading my notes now to refresh my memory.

Today's update says the usual thing that everyone is saying - business was interrupted by covid, but is gradually recovering.

The overall level of activity in Q2 has been broadly as anticipated at the commencement of the lockdown in March and where necessary we are working with clients to change resource levels and programmes to meet their revised requirements as a result of Covid-19.

Financial position improved with £100m fundraising, which has helped it win new contracts. It has £110m in net cash - a decent position in a sector where larger groups are often drowning in debt. Undrawn bank facilities also available. This looks good.

Order book is strong at £4.2bn, and various contract wins are listed.

Note there seems to be some contractual disputes - discussions continue. This would need to be clarified before buying any COST shares.

Outlook - covid uncertainty, but "we remain confident in the positive forward outlook..."

My opinion - I really dislike this sector. Infrastructure companies tend to make tiny profit margins, but the contracts are large & complex, and can often end up with costly disputes & over-runs. Shareholders are paid divis in the good years, but then have to stump up more cash to shore up the balance sheet when something goes wrong, as it nearly always does, eventually.

Why on earth would anyone want to invest in a company like this? Still, at least it has sound finances, and isn't likely to go bust due to the decent net cash position. So it's nowhere near as risky as some other troubled sector companies, many of which have gone bust over the last few years.

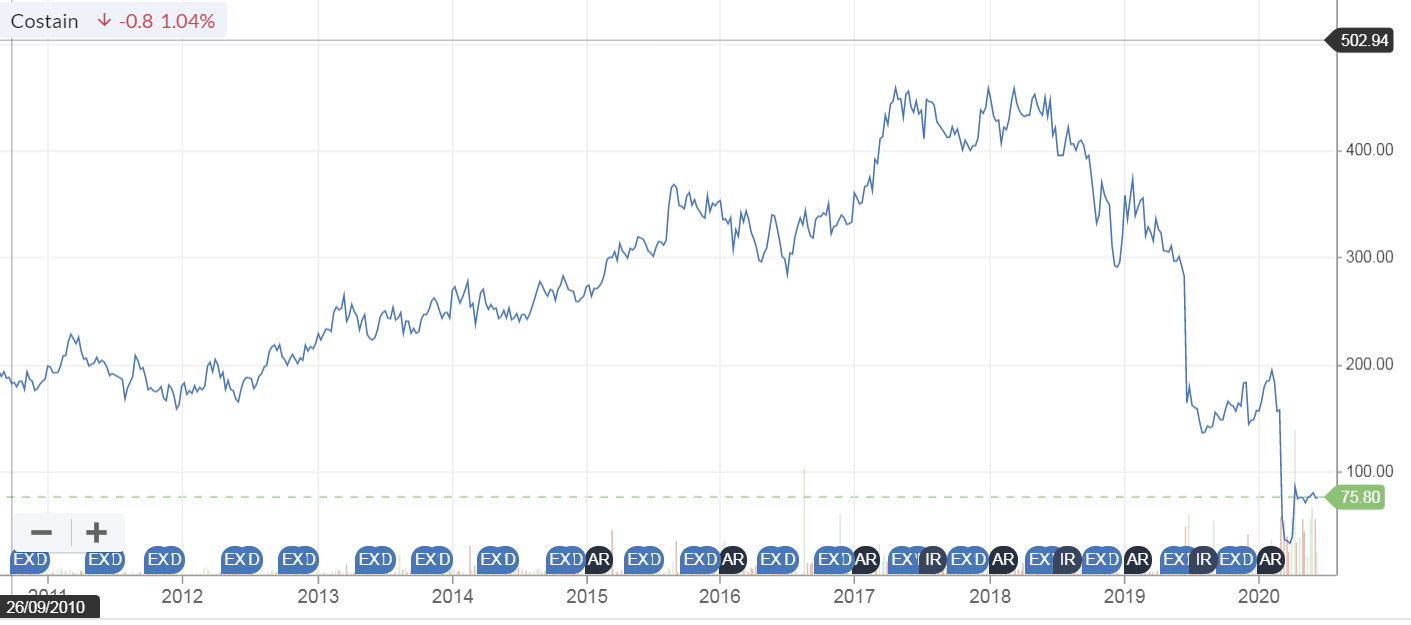

Looking at the 10-year chart below, we can see just how badly things have gone wrong, well before covid. A contrarian might be tempted to think the share could recover. A word of warning though, the share count has almost tripled in the last few fundraisings, which means that the share price is not likely to recover anywhere near previous highs, even if the company does well in future.

.

.

All done for the day, and the week. Have a smashing weekend!

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.