Good morning!

There's a lot of Brexit-related news at the moment but it's unlikely to help us find the next great small-cap opportunity, so I'm going to pretend it's not happening.

Today we have:

- Record (LON:REC)

- Safestyle UK (LON:SFE)

- Pendragon (LON:PDG)

- Smithson Investment Trust (LON:SSON)

Record (LON:REC)

- Share price: 31p (-12%)

- No. of shares: 199 million

- Market cap: £62 million

(Please note that I currently hold REC shares.)

Not a great update from Record.

This is a specialist fund manager providing currency services. I own shares in it because of my positive impression of management (conservative and well-aligned), excellent cash generation characteristics, and my belief, at the time I invested at least, that it served an important financial niche.

Unfortunately, it hasn't achieved much in terms of growth in the last few years - but then, this has been reflected in the valuation.

Its share price has also been a victim of the recent general market correction, and then when you add in the effect of today's trading update, it's dropping deeper into what I hope will eventually prove to be "cheap" territory.

When it comes to valuation, we should bear in mind that the company had equity (as or March 2018) of £26.5 million, almost entirely tangible and liquid, including cash and money market instruments worth £22.5 million.

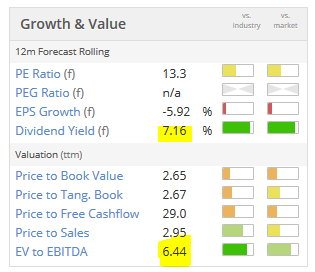

The Stocko valuation chart shows what I'm talking about: forecast dividend yield of 7% and EV/EBITDA ratio of 6.4x (prior to today's sell-off, so it's cheaper now).

Today's update is not too encouraging, sadly. Assets under Management Equivalent (AUME) are up by 1.1% when expressed in GBP, but this was driven by market movements, not by client inflows. There was a small client outflow during the period.

Additionally, 7 clients (out of 66) are leaving, taking $2.5 billion of AUME with them (out of $61.8 billion). They use the Passive Hedging product, which is the cheapest one, so the total loss in terms of fees will probably not be huge. But it's hardly good news.

Fees - "Fee rates for most products were broadly unchanged". Again, this doesn't sound great. The overall trend in fees appears to be negative. No performance fees were earned during the period.

CEO comment:

"We are seeing an encouraging range of new business opportunities across products and geographies, although this has to be balanced against continued competition and fee pressure in passive hedging in particular. With our diversified product suite and our ability to offer tailored solutions to clients and potential clients, we aim to make further progress in the second half of the financial year."

My view - Unfortunately, Record's Passive Hedging product doesn't seem to stand out in the crowd (and charges low fees), while the Dynamic Hedging product, with higher fees, is a very small percentage of overall AUME and is in a negative long-term trend.

That said, due to my sluggish investment style, I have no immediate plans to sell my position.

On the bright side, I think it has the potential to recover some positive momentum in a period of extreme FX volatility, when institutions might be desperate for currency advice and might be willing to try the Dynamic Hedging product again, and I see the balance sheet and management as factors which reduce the risk of staying invested.

Safestyle UK (LON:SFE)

- Share price: 57.5p (+14.5%)

- No. of shares: 83 million

- Market cap: £48 million

Curious news from Safestyle, the windows and doors company which got hammered by aggressive competition, eventually taking its rival SafeGlaze to court. As a result, SafeGlaze is being forced to change its name and its behaviour.

Today's update:

The Board of Safestyle UK plc ("Safestyle") has become aware of certain rumours in the market and confirms that it is not in discussions to acquire NIAMAC Developments Ltd (trading as SafeGlaze UK) ("NIAMAC") nor to acquire its business or assets. The Board of Safestyle is however considering certain other arrangements with key stakeholders in NIAMAC that could benefit Safestyle's business and accelerate its recovery.

Not sure what these arrangements might be, does anyone have any guesses?

This company doesn't pass my quality filters but perhaps it could make for an interesting speculation if the competition is going to cool down and performance will turn upwards again?

Pendragon (LON:PDG)

- Share price: 23.3p (-11.5%)

- No. of shares: 1404 million

- Market cap: £327 million

Another victim of the EU's introduction of WLTP emissions tests, Pendragon's results are going to take a hit from supply disruption to new vehicles.

It's a sector-wide issue and most or perhaps all dealerships need to be marked down as a result.

Additionally, investment in the Used Car business has been accelerated.

And so:

As a result of the combination of these factors our underlying profit before tax for 2018 is expected to be £50m.

It's a pet peeve of mine when companies leave out prior-year comparisons. For the record, underlying PBT last year was £60 million. The year before that, it was £75 million.

My view - a cheap car dealership that has been buying back its own shares, I would be keenly interested in this if I wanted to get involved in this sector. The issues causing today's profit warning are, I think, temporary.

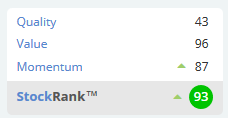

A portfolio based on the StockRanks would also be interested:

Smithson Investment Trust (LON:SSON)

- Share price: 1016.4p (+2%)

- No. of shares: 82 million

- Market cap: £835 million

Terry Smith's new vehicle hits the market: "a quality small and mid-cap global equity fund". I look forward to tracking its progress.

Paul is back next week. Have a great weekend!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.