Good morning, it's Paul here.

Just so you know what today's timings are, I'm on the afternoon shift - so am writing between 11am- expected finish time c. 3:30pm. I've got nothing else on today, so no distractions thankfully. Well, just the market being open, which is a constant distraction of course.

Takeover activity

This is turning into something of a frenzy, with practically every day bringing news of another UK listed company receiving bid interest. I suspect there might be many more to come - because the weak pound makes UK assets attractive to overseas buyers. Takeovers provide us with lots of potential opportunities to make money, so I'm rather excited about this theme.

Also, some markets e.g. USA, look expensive right now, therefore in comparison UK shares look cheap. Therefore, buying in growth through relatively cheap takeovers of UK companies, looks a very sensible strategy for American companies. There's also the potential for a USA-UK trade deal post-Brexit, which could enhance the attractiveness of some UK companies to an American buyer. Language helps too.

Positioning ourselves in companies' shares which look well set up as a potential bid target can be lucrative if there's a decent bid premium. However, sometimes bids can be at a poor premium (e.g. recently Sanderson (LON:SND) only about 10%), or in financially distressed cases, at a discount - who can forget the Flybe bid at just 1p, when shares had been c.16p days beforehand?)

Although it's mostly luck, as nobody really knows which companies might receive bids. It's often very surprising which ones do! (Earthport & PTSG spring to mind). Sometimes bidders can see something good in a company which UK investors might think is not good. And/or, American buyers, particularly VC/PE seem happy to put gigantic, unfathomable, valuations on tech companies. That's fine by me, if they want to buy any of my holdings at greatly inflated prices.

Talking of potential takeover bids, Staffline (in which I hold a long position) has caught my eye this week, not for results, but as a possible takeover target. I wouldn't normally cover this kind of thing, but it looks a good opportunity in my view, and it will be interesting to hear what subscribers think, in the comments section below.

Staffline (LON:STAF)

Share price: 140p (down c.7% today, at 12:01)

No. shares: 68.9m

Market cap: £96.5m

(at the time of writing, I hold a long position in this share)

New Singapore shareholder - in case you hadn't spotted it, a potentially interesting situation is developing with Staffline (LON:STAF) . You might recall that the share price collapsed due to problems emerging with non-compliance re minimum wage regulations. Plus a general profit warning due to clients taking some staff in house, due to a tight labour market. An emergency fundraising was recently completed at just 100p.

Note that the former CEO, Andy Hogarth, had sold his stake in Jan 2018 at just over 10 times the share price of the recent refinancing, banking £10.3m. Very lucky timing it seems. Another example of why it's often best to sell up, if a key Director/founder dumps their entire stake. Problems often seem to emerge in the following year. Funny that.

I picked up some of these in the 100p placing recently, as the figures looked to me like a survivable financial crisis.

On 22 July, there were 3 successive "holding in company" announcements, showing that A Singapore company called HRnet Group had bought 7.39% of Staffline. A bit of googling showed that HRnet is a Singapore listed staffing company. I'm always interested when a buyer in the same sector (UK or overseas) crops up with a disclosable stake, as it can sometimes be a precursor to a takeover bid.

I've never looked at any Singapore companies before, so this was quite interesting to find out how to go about it. HRnet has an investor relations section on its website, and it all looks very similar to UK listed companies.

Purchases at 180p - this is a much more interesting announcement, on 31 July. HRnet itself put out this RNS, rather than it just being a "holding in company" RNS from the company itself (which came later). So clearly HRnet wanted the world to know that it had increased its stake to 25%. Bear in mind that the share price was 115p on the day that HRnet bought some large blocks of shares, paying 180p per share, a massive 56% premium.

There are 2 ways of looking at this;

1) Paying such a large premium suggests to me that HRnet is at least considering bidding for the whole thing, at 180p or more. That seems to be what usually happens in these situations, where a large premium is paid anyway.

2) This could be a blocking stake - i.e. 25%+ blocks anyone else from buying Staffline. Then HRnet can bide its time, and bid at a later date, or not, as it wishes.

Whatever the outcome, HRnet paying 180p certainly confirms that the shares are undervalued at 140p or less. Hence I've been happy to increase my position here.

Note that HRnet has also recently increased its stake in Gattaca (LON:GATC) to 5.53%.

Gattaca has a market cap of £43.1m last night (at 134p), and Staffline has a market cap of £96.5m. HRnet has a very strong balance sheet, last reported as having S$304.5m net cash as at 31 Mar 2019. That is c.£183m in sterling (1 Singapore dollar = 60 pence). Therefore, HRnet has enough cash on hand to buy both Gattaca and Staffline, if it wishes to.

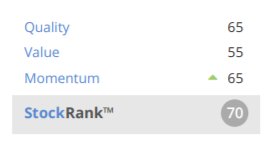

Stockopedia covers international shares too, in the premium subscription packages. Reviewing the StockReport for HRnet, it looks rather good as a potential investment. I'm struck by how high the operating profit margin is at 16.1%. It is also asset backed, with a PTBV of 2.06, with the bulk of the net assets being net cash. It pays a 4.3% dividend.

Here is the StockRank for HRnet (Singapore);

My opinion - I like Staffline shares at this level anyway. Having a potential bidder sniffing around, which has just paid 180p for a blocking stake, confirms to me that the shares look very good value. It doesn't make sense to me that the share price is languishing at 140p, so this looks a good opportunity to me.

Gattaca is probably worth a fresh look too.

I wouldn't normally be interested in this sector right now, due to macro uncertainty. However, when valuations reach bombed out levels, and overseas buyers are taking stakes, then it's worth looking at.

Airea (LON:AIEA)

Share price: 42p (down c.18% today, at 12:54)

No. shares: 41.4m

Market cap: £17.4m

The principal activity of the group is the manufacturing, marketing and distribution of commercial floor coverings.

Today's report covers the 6 months to 30 June 2019.

Unfortunately for shareholders, this seems to be a double dip on disappointing trading. I reported here on 28 June on its profit warning, which hit the share price badly, as you can see from the usual 2-year chart below;

It's surprising how often this happens actually - i.e. a sharp fall on a profit warning, then a second sharp fall when the next set of figures come out. Sometimes these can be buying opportunities, when the price sells of excessively, but as we all know, falling knife catching can be very painful. Even though I should know better, I still find them irresistible sometimes.

This is what the company said on 28 June 2019;

- Very strong order book

- Good Q1, tougher Q2

- H1 revenue slightly down

- Lower operating profit (no indication of how much down)

As I commented at the time, this update was unclear, and with no broker research available, we were left somewhat in the dark.

That's the background covered, so let's have a look at the interim results & outlook.

Interim report - key points;

- Revenue down 2.7% to £8.89m - that's OK, as it ties in with the "slightly down" indicated previously

- Operating profit down 27% to £1.085m - that's a larger drop in profit than I was expecting

- Dividend (interim) cut from 1.75p last year, to 0.8p this year. That might have rattled some investors maybe? Although I note that the last final divi was also cut significantly, from 5p to 2p. I'm not very happy about this - shareholders seem to be paying the price for the decision to gear up to buy out the CEO's shareholding. The balance sheet would otherwise have been strong enough to maintain divis.

Outlook comments - are things improving? Not really by the sounds of it, which is hardly surprising in the current circumstances;

Although disappointed with the sales performance during the last six weeks of the first half we are pleased by the progress made during the period improving the foundations of the Group. Sales growth will continue to be challenging given the uncertainty that remains whilst awaiting the outcome of Brexit negotiations; however, as a UK manufacturer with a strong position in the UK and internationally and an ever increasing product portfolio, we are well placed to moderate these risks and take advantage of growth opportunities as they arise.

Airea should be a beneficiary of the weaker pound, as the value add element of its UK costs (i.e. selling price, less imported raw materials) become cheaper compared with international competitors, both in exports, and strengthening Airea's competitive positive vs imports.

If tariffs come in after 31 Oct 2019, then Airea would of course have to reduce its prices for exports (thus lower profits) to compensate, however would gain from increased market share (and/or profits) from its UK sales, as overseas competitors would themselves face tariffs on goods they bring into the UK. People often forget that tariffs work both ways, on imports and exports. It's anybody's guess how the net position would pan out.

Balance sheet - quick review;

- Investment property of £3.4m - nice to have - roughly offset by;

- Pension deficit (accounting basis) of £2.6m - this is quite material, as the company is paying in £400k p.a. in deficit recovery payments

- NAV: £13.7m - hardly any intangibles, so that's a solid balance sheet

- Big jump in receivables, from £2.87m a year earlier, to £4.6m at 30 June 2019 - needs looking into

- Inventories also quite high in absolute terms, at £7.36m, up a bit due to Brexit stockpiling (makes sense to me)

- Current ratio looks very healthy, at 3.25

- Net cash/(debt) position has deteriorated, due to adverse working capital movements. A new loan of £1,551k has appeared in non-current liabilities, and cash is down by about £1m a year earlier, to £1.4m. Overall it looks fine, but worth noting. The company is soundly financed, but I'd like to see working capital tightened up somewhat. Maybe they just have to keep a lot of items in stock, for customers to draw down? I know that is an issue with floor coverings businesses. Geoff Wilding of Victoria (LON:VCP) mentioned this, saying that he can often strip out a lot of working capital from acquired companies in this sector, which part-funds his acquisitions.

Cashflow statement - interestingly, the company also saw negative working capital movements in H1 last year, which reversed in H2. That reassures me that these could just be normal seasonal movements.

Note in the financing section, that a new loan of £1.7m was drawn down, in order to fund a £2.0m loan granted by the company to its own employee benefit trust. I seem to recall there was some investor unhappiness about this, as I believe the shares purchased were sold by the CEO, before the profit warning.

My opinion - these figures are a bit worse than I expected, so can understand why the share price has sold off again today. It's very illiquid, so price moves can be large, on little volume.

The divis are still quite attractive, when worked out on the lower share price. Although I'm not impressed with the company cutting divis quite so readily. Maybe it would have made more sense to sell the investment property, and maintain better dividends?

It's difficult to see any immediate upside on the share price, unless the company attracts bidding interest, which is possible. After all, European carpet makers (there are a lot in Belgium, I believe) might want a UK manufacturing base, to circumvent future tariffs?

If I held, I wouldn't be selling now that the price has fallen so much. It looks quite good value, if you think trading performance will improve in future. One for long-term shareholders, rather than speculators.

Goals Soccer Centres (LON:GOAL)

Update - looks like game over for shareholders, I'm afraid.

... it has become very recently evident that there has been improper behaviour within the Company.

Recently?!! It was obvious that someone was fiddling the figures.

Shares won't be relisted, so looks like it could be a 100% loss. Sorry for anyone who got caught out on this one.

Having said that, the recent trading performance noted today looks excellent. And the bank is bearing with them, so who knows, there could be a vague possibility that some shareholder value might be salvaged?

Discussions with the debt providers remain positive and they have confirmed to the Company that the existing debt facilities will remain in place post the initial 31 July 2019 review date, albeit that one of its covenant thresholds has been exceeded.

Year-to-date sales across the 45 sites in the UK on a gross like-for-like basis are up +11.5%. The Company's US gross like-for-like sales are up +14.5%.

I have to down tools for now.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.