Good morning from Paul!

All done for this week! Thanks for dropping in, and for leaving interesting comments too. Have a great weekend!

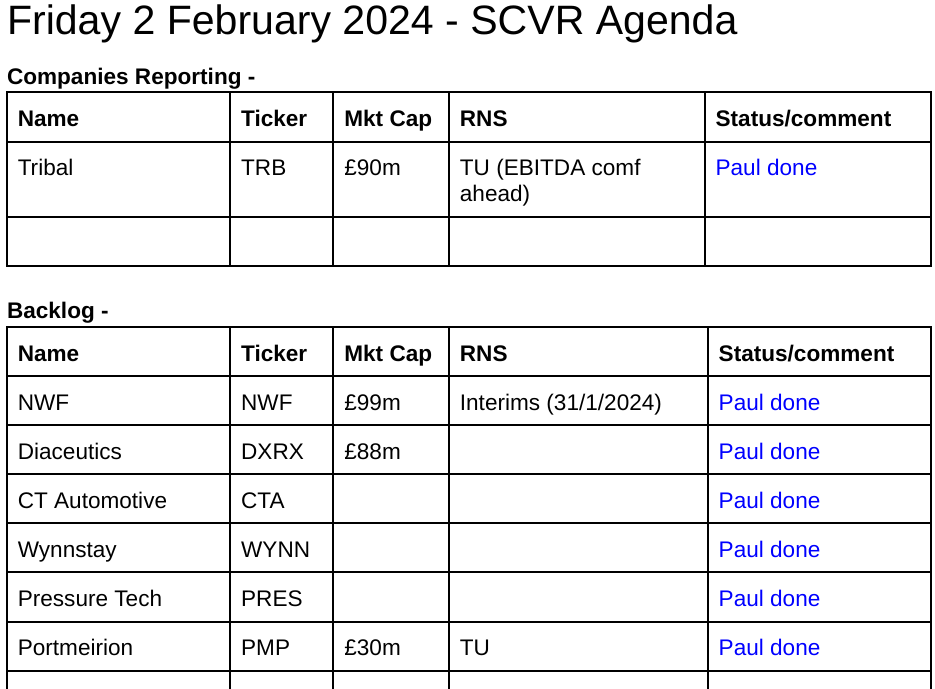

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. OR it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom),

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Other mid-morning movers -

Superdry (LON:SDRY) - up 85% to 38p at 11:48 - fun & games here, with The Times article “Hedge fund builds stake in Superdry” triggering a speculative frenzy this morning. A Norwegian investor has picked up a 5.3% stake (only c.£1m). The Times claims “sources” have suggested the brand could be worth £400-600m to a brand management company. That seems far-fetched to me, but it’s a nice story, and is allowing traders a profitable exit. SDRY has already sold off some of its international rights, and seems to be in the process of selling anything else it can. I think a CVA looks most likely, which may or may not leave any value for existing equity. Too risky for me, either long or short, due to the wide range of potential outcomes. As a standalone business though, the interims were so bad, it’s difficult to see any value in equity.

UPDATE : Superdry issues an RNS, Dunkerton is considering taking it private (don't assume it will necessarily be at a premium though - why would he be generous?) -

Julian Dunkerton has since confirmed to the Transaction Committee that he is engaged in discussions with potential financing partners (“Potential Sponsors”) for the purposes of considering options in respect of the Company, which may include a possible cash offer for the entire issued

and to be issued share capital of the Company, not already owned by him. These discussions are at a preliminary stage and no decisions have been made.

NWF (LON:NWF)

200p (£99m) - Interim Results - Paul - AMBER/GREEN

Dropped 9% on Weds with H1 results not going down well. H1 profit sharply lower, adj PBT down 45% to £3.4m (on £473m revenues, very low margin). NWF supplies agricultural feed and drop ships fuel. Mgt says results as expected, as prices normalise after unusually profitable years in FY 5/2022 and FY 5/2023. Full year expectations unchanged, but broker consensus has dropped recently from c.22p to 19.4p. Only 5.1p EPS achieved in H1 (down 49%), but H2 is seasonally stronger (more feed & fuel used in winter by farmers). Fwd PER about 9 - cheap, but it should be cheap, due to lack of growth, and low margins.

1.0p interim divi unchanged. Forecast yield is 4.1%, covered 2.4x, has been a reliable dividend payer even through pandemic - so income is the main reason to buy/hold this share.

Adequate balance sheet, £46m NTAV, price to book is 2.15x. Building a new warehouse, planned capex seems heavy at £8.5m, also setup costs will drag on profits.

Paul's quick view - Graham & Roland quite like it, marking it green last year, but I can’t muster much enthusiasm - it took 15 years to double in share price from 2009 to now. Plus divis, OK I suppose that’s not bad, but not exciting either. Maybe AMBER/GREEN, let’s be kind, as there’s not actually anything wrong with it, and reliable divis are worth having.

Diaceutics (LON:DXRX)

104p (£88m) - Trading Update - Paul - AMBER/GREEN

We’ve not looked at this company before, it provides services for pharmaceutical clients, and is based in Belfast. Cenkos floated it on AIM in Mar 2019 at 76p, with 22.4m new shares raising fresh cash, and 4.9m sale shares. The track record so far seems to be of small profits. I noticed it for the first time when the share price rose this week on a trading update, so let’s have a quick look to get something into our system here in the SCVRs.

The trading update bombards us with multiple headlines, but these all sound really good to me -

Diaceutics grows revenues by 22% in 2023 and delivers order book growth of 57%

Over 50% of revenues are now recurring in nature

Four enterprise-wide engagements secured in FY 2023

DXRX platform adoption by large pharma customers continues to drive business momentum

Diaceutics becoming the primary commercialisation partner for pharma and biotech launching precision medicines - 21 of the top 30 global pharma companies are Diaceutics' customers

Strong balance sheet with cash of £16.7 million - fully self-funded to execute growth plans

Balance sheet is excellent - it’s very well funded, I’ve just checked the H1 numbers. Although note it was loss-making on the P&L in H1.

Current cash is £16.7m, down from £19.8m at end 2022, the reason being that it’s spending heavily on intangible assets (development spending presumably?), which was £2.9m in H1 2023 alone.

Strong order book of £30.8m, of which £12.3m is to become revenue in 2024, so there seems fairly decent visibility.

Revenue in 2023 was up 22% to £23.7m.

No broker notes available to me.

CEO is bowing out in a planned succession.

Paul’s opinion - looks interesting, and definitely worth a closer look I think. The key area to research is obviously what the company does, and if it has competitive advantages? Being widely used by large pharmas is a great starting point for researching any company.

With the numbers, the big question is what the heavy capitalised development spending is for? Are these real costs by-passing the P&L? Certainly EBITDA would be meaningless here due to such heavy spending on intangibles,

Anyway, I quite like the look of this as something for you to do more detailed research on, due to the strong balance sheet, and good growth. So I view this as AMBER/GREEN - worth a closer look.

Tribal (LON:TRB)

42.4p (pre-market) £90m - Trading Update - Paul - AMBER/GREEN

Tribal (AIM: TRB), a leading provider of software and services to the international education market, is pleased to provide an update on trading for the year ended 31 December 2023 ("FY23" or "the Year").

Positive headline -

Cloud expansion driving growth in ARR and results ahead of market expectations

The Board anticipates a solid trading performance in FY23 with adjusted EBITDA and net debt expected to be comfortably ahead, and revenue marginally ahead, of current market expectations1.

1 In so far as the Board is aware, as at the point of this announcement, consensus market expectations for FY23 were for Revenue of £84.2m adjusted EBITDA of £12.6m, excluding share based payments, and Net Debt of £9.5m.

Why can’t they just give approximate numbers, instead of all this “comfortably ahead”, “marginally ahead” nonsense?! I appreciate they need to keep some wiggle room for audit adjustments, but even so. Instead we have to go round the houses to find the numbers that the company has told the broker to forecast!

Unfortunately, we don’t have access to any broker notes, so all I can do is guess.

Given that revenue is only “marginally ahead”, then “comfortably ahead” is not likely to be a big earnings beat. Maybe 3-5% ahead at adj EBITDA level? What do readers think? Is that the ballpark you would interpret “comfortably ahead” to mean? Isn’t this completely ridiculous, when the company has the numbers, but just won’t tell us!

So comfortably ahead of £12.6m adj EBITDA - I’ll go with £13.0m as my guess.

What is that in PBT? No idea, as there is no broker research available. I’ve looked at the H1 numbers, and the reporting there is a total muddle, so it would take too long to work out.

Instead, let’s look at existing broker consensus EPS, which is 3.34p, and just add on a bit. So I’ll go with 3.5p for FY 12/2023 adj EPS being where TRB is likely to end up. That’s a PER of about 12.1x - seems reasonably priced for a software company, albeit a very accident-prone one.

However, some of the boost to profit might be a one-off? -

This incorporates the Nanyang Technology University ("NTU") provision release disclosed in the Group's half year results.

This was a disastrous project that went so badly wrong, the customer ended up taking TRB to court. This is buried in the H1 results -

Adjusted EBITDA up 21.0% to £8.1m (H1 2022: £6.7m) reflecting a c£1m one off, net positive impact from the NTU onerous contract provision release offset by associated costs.

There’s still not any agreement on settling this dispute -

While initial exchanges have taken place with NTU, they have not yet reached a resolution and the potential outcome remains uncertain. An update will be provided as and when appropriate.

Annualised Recurring Revenue (ARR) looks to be growing -

Closing Core Annual Recurring Revenue (ARR)2 is expected to have increased by 13% to £51.1m (2022: £45.3m at constant currency), subject to audit, reflecting growth in the Group's strategic products. Overall ARR is expected to have increased by 9% to £54.5m (2022: £50.2m), reflecting the anticipated decline in the non-core Software and Services segment.

Net debt is up, but it doesn’t look to be at a worrying level. However, what happens if the dispute with NTU results in a large cash outflow? That worries me, as it’s a significant-sized contract -

The Company closed the Year with a net debt position of £7.2m (2022: net debt of £3.4m), which reflects a net cash outflow as a result of continued investments in its product portfolio, the issues surrounding the NTU contract and exceptional costs in relation to the lapsed Offer and restructuring of the Education Services business, as discussed below.

The Company has renewed its banking facilities for three years, with the option to extend for a further two years until December 2028, which consists of a £20m multicurrency loan facility. The Board is confident it has sufficient funds to execute on its growth strategy.

Outlook - seems a bit mixed -

As part of the transformation of Tribal to a pure SaaS business, the Board has instigated a restructuring of the core software business and, together with associated headcount reductions, expects this to support future profitability levels.

Whilst sales cycles are still extended, the Group has a significant pipeline across the business, and the Board is confident in the effectiveness of its cloud strategy and continued growth in 2024.

Paul’s opinion - quite a tricky company to understand, and normally I keep away from TRB, due to its long history of always seemingly managing to find something new to screw up, just when things start to look promising.

20 years of eroding shareholder value (with only modest divis along the way too) -

There is interesting potential upside though. What I like, is that a 74p cash takeover bid was agreed last year, but fell at the last hurdle, when not enough shareholders backed it in a vote, so the deal fell through.

We can now buy in the market at around 42p, a deep discount to the level a buyer was recently prepared to pay. Together with an ahead of expectations update today, makes me wonder if there could be a profitable trade to be had here, if eg the bidder comes back with a higher price, or some other company bids for Tribal? So that would be my main angle on this share, and for that reason I’ll go with AMBER/GREEN. Even though I think the company itself has been a long-term disappointment, seems badly run, and accident-prone.

Wynnstay (LON:WYN)

350p (£80m) - Final Results (30/1/2024) - Paul - GREEN

This is the other small cap agricultural supplies company, which reported FY 10/2023 results earlier this week on Tues 30/1/2024. Since I’ve already looked at the other one today, NWF, then it might be interesting to compare it with WYN.

I noticed there’s considerable interest in WYN in the community here, as it appeared in the list of most viewed stocks earlier this week, which we’re increasingly using to guide us in selecting which companies to cover.

I like the look of the chart below - are we at or near a good entry point, I wonder?

Also note lots of green on the valuation area, especially the 0.7x price to tangible book value - something which I like, but a comfortable balance sheet can suppress values like ROCE, which is one of the drawbacks of ROCE in my opinion - it might encourage companies to increase balance sheet risk in pursuit of a higher score.

Outlook -

The trading backdrop remains difficult. Farmer sentiment is cautious, reflecting uncertainty over farmgate prices and the adjustment to the Environmental Land Management Scheme and the Sustainable Farming Scheme. We anticipate current low milk prices to continue to suppress dairy feed demand, although some recovery is expected in the coming months, and arable inputs are likely to be down in the spring, following the significant reduction in autumn cereal planting. It is also reasonable to expect a smaller 2024 harvest. Energy and labour costs remain factors too.

While these are challenges for the entire sector in the short term, Wynnstay's strong balance sheet and good cash generation enable us to continue to invest across the business in support of our growth plans, and to consider acquisitions. The Group is well-placed in the marketplace and its balanced business model helps to smooth sector variations and remains a strength.

Balance sheet - is marvellous! £20m of intangible assets need to come off, but that still leaves a whopping £115m in NTAV, well above the £80m market cap. Is this an inefficient balance sheet then? Yes! But that brings opportunities - it might attract a takeover bid, say a financial buyer that looks at ways to tighten up working capital, and introduce some debt.

It’s got £31m cash, less £7m interest-bearing debt (excl leases as always here), so £24m net cash. Therefore I’d say there is plenty of scope to self-fund acquisitions, using some debt too, I think management here have potential firepower of about £40m for deals, if they find something suitable - that’s half the market cap. I think WYN needs a more ambitious growth strategy, and the good news is that it has the balance sheet to fund growth without needing to raise any fresh equity - there’s an opportunity here. It has been doing acquisitions already, and there’s plenty of scope for more.

Paul’s opinion - just a quick look today, but I think this is very nice, so I’ll go GREEN. Much better risk:reward than NWF, if I had to pick between them it would definitely be WYN. Why? Both have similar PERs, but the dividend yield at WYN is higher, and it has an impressive unbroken 20 year track record of rising divis. The bulletproof balance sheet at WYN means it has not only hidden value, but the firepower to make acquisitions that would drive EPS higher. So the PER would really be even lower than it looks, once you factor in future acquisitions.

The chart is also saying this is a nice time to buy. So thumbs up for WYN from me, and do let me know what you think in the comments, as I’ve only done a quick review so might have missed something.

Portmeirion (LON:PMP)

217p (£30m) - Trading Update (FY 12/2023) [in line] - Paul - AMBER

Portmeirion Group PLC, the owner, designer, manufacturer and omni-channel retailer of leading homeware brands in global markets, provides an update on its trading for the year ended 31 December 2023.

This update was issued on 17/1/2024, sorry for the delay in covering it.

Good Christmas trading period and full year performance in line with market expectations

Why has the share price been so weak then? I recall from reader comments at the time, that people didn’t like the 2024 broker forecasts being lowered, reflected in the consensus forecast graph below - now expecting 25p for 2024, instead of 36p previously. So arguably it slipped out a 2024 profit warning without directly saying so.

FY 12/2023 -

Revenues at least £102m (marginally ahead exps)

PBT to be in line with market exps. This is 16.9p EPS, so a PER of 12.8x

Note how a year ago, EPS of c.50p was expected, so actually 2023 has been a poor year, delivering only a third of the originally planned profit. De-stocking and weaker consumer demand are mentioned in 2 large markets, USA and S.Korea. Although it mentions stronger demand in Q4.

The PBT margin is only about 3%, £3.1m adj PBT (Singers figures, many thanks) on £102m revenues.

Working capital - no figures, but this sounds positive -

Following our focus on reducing inventory we are pleased to have seen a reduction YOY in both net debt and inventory as at the year end.

Singers reckons net debt could fall from £10.1m end 2022, to £8.1m end 2023.

Outlook - this seems contradictory - it’s going to be good, but it’s going to be bad, is how I read this! -

Following a positive Christmas performance, we expect sales to return to growth in 2024 YOY alongside a healthy operating margin improvement compared to 2023. However, we expect 2024 to be a challenging year due to ongoing macro uncertainty with customers remaining cautious in relation to H1 order flow, in particular in the US and Korean markets. In addition, we expect to continue to incur higher interest costs during the year given current rates…

Whilst we expect market conditions to remain challenging in the first half of 2024, particularly in the US and South Korea, we expect to see growth across the full year and we are confident in our long-term strategic progress and the market share gains we are making."

That sounds like an H2 weighting, which makes us nervous here at the SCVR.

Paul’s opinion - I can’t shake off an uneasy feeling that something might be going structurally wrong at Portmeirion. That’s what the 10-year chart is suggesting to us too -

That said, on the upside, PMP is still profitable despite a tough year for discretionary consumer spending in 2023. So might a recovering 2024 macro picture see its customers have a splurge on some new crockery? Or will those pandemic impulse purchases give them plenty of tableware options for years to come? They’re sturdy too, I haven’t yet broken or chipped any of my Botanic Garden tableware collection, despite being very clumsy at times. I had to opt out of the Portmeirion emails too, as you really don’t want to be prompted to buy more tableware on about a weekly basis. How many plates do they think I need, I’m not Greek!

I don’t think there’s any evidence that previous management’s acquisition strategy added any value, so let’s hope they don’t do any more deals that burn through shareholder value.

Energy and freight costs are not mentioned, which might have been helpful to give a steer on those - presumably these could be favourable for costs now?

It’s only valued at £30m market cap, which does seem intriguing, if profits can be rebuilt on improving consumer sentiment. I don’t think there’s much downside risk, unless demand really falls off a cliff (why would it?), and providing the bank remains supportive.

I think there might come a point in the next, say 6 months when this share could be worth a little punt for a recovery or at least a rebound. I wouldn’t be surprised to see it rise 50% on half-decent trading in H1 2024. Although another profit warning would also not be a big surprise either! I think we’ll have to go AMBER for now, and keep it on a watchlist.

I wouldn’t be relying on the divis either, it would probably be safest for the company to conserve cash rather than paying divis from greatly reduced profits.

Pressure Technologies (LON:PRES)

31.5p (£12m) - FY 9/2023 Results - Paul - AMBER

Pressure Technologies plc (AIM: PRES), the specialist engineering group, is pleased to announce its audited results for the 52 weeks to 30 September 2023 ("FY23")

This has been a special situation, where it came close to going under in 2022 & 2023, but was bailed out twice by shareholders. PRES is very small & illiquid, so we only looked at it twice in 2023 - to refresh our memories here are previous SCVR notes -

6/2/2023 - up 18% to 46p - AMBER - big defence contract won. Recovering from near-death experience in 2022 (propped up with small placing at 30p)

16/11/2023 - up 7% to 28p (£10m) - Debt Refinancing - AMBER. Small refinancing by major shareholders (Rockwood & Gyllenhammar) which was pre-announced in Oct 2023.

Revenue up 29% to £32m - so it’s a proper business.

Adj EBITDA much improved at £2.1m (LY: £(0.9)m loss) - but this only turns into negligible £0.1m PBT.

Statutory loss of £(1.1)m - improved from £(4.0)m loss LY.

Only modest net debt of £2.4m.

One division is pending disposal, so we don’t know how much that will fetch.

Order intake & order book look good -

Order intake of £43.0 million in FY23 (2022: £24.6 million) was 75% higher than prior year and supported a year-end order book of £20.7 million (2022: £10.4 million), the highest level for more than five years.

Balance sheet - looks fine, this group never should have been treated as a financial basket case, as Lloyds Bank seemed to do, necessitating a bail out from shareholders. This was more a liquidity crisis, than a solvency crisis. A better bank would have stood by it I think, it’s embarrassing that Lloyds called in such small loans - it’s not a reliable banking partner, as I’ve had personal experience of in the 1990s, when they pulled the plug on a business I was FD for. We managed to survive, but only just, and no thanks to Lloyds.

PRES has got £13.6m in net tangible assets, which seems pretty solid for the size of company.

Outlook - has lots of detail about its move into hydrogen, although notes there have been delays in this sector.

Looks like static EBITDA is expected for FY 9/2024 -

Given these divisional trends, the Board expects the Group's full-year FY24* revenue and Adjusted EBITDA to be in-line with current market expectations (revenue of £34 million and Adjusted EBITDA of £2.1 million).

* FY24 outlook includes CSC and PMC, on the basis that PMC is not sold in FY24 and remains a continuing operation

Paul’s opinion - it seems a pity that they’re having to sell the PMC division (or trying to anyway) just for a small amount of additional liquidity.

£2.1m adj EBITDA in both FY 9/2023 and FY 9/2024 turns into only £0.1m PBT, so it’s not trading well as such. There needs to be considerably improvement in trading to give any decent upside on the share price. Since I don’t know what the future holds, I can’t really give a view on what might happen to the share price. So it’s an AMBER from me, as upside/downside will depend entirely on future performance, which is currently unknown.

I’ve always thought the Chesterfield Cylinders core business looks interesting, but it doesn’t really make any money, so does it matter that it’s supposedly a nice business?

If you think the hydrogen side of things might have exciting upside, then I can see why this share might be of interest. That sort of thing is up to you to research & decide on. I’m just looking at the figures, which look OK to me, nothing untoward.

I think we might be over the worst, but upside recovery is as yet uncertain in size, and timing -

CT Automotive (LON:CTA)

82p (£59m) - Full Year Trading Update - Paul - AMBER/GREEN

CT Automotive, a leading designer, developer and supplier of interior components to the global automotive industry, issues the following trading update for the year ended 31 December 2023 ("FY23"), in advance of the publication of its annual results.

Time to blow my own trumpet now! I spotted the turnaround at this previously troubled automotive parts supplier, and flagged that there was a possible 100% upside here on 16/6/2023 when it was 41p - which is exactly what has happened! It’s since doubled to 82p. It was also a podcast mystery share, but nobody seemed to be interested.

In the latest update it confirms that FY 12/2023 underlying profits have been c.$8m. That’s a bit below my workings in June 2023 calculating $9.9m profit.

Year end net debt of $6m is fine, that’s modest now.

Outlook - sounds OK -

The Group is encouraged by healthy order volumes and has entered FY24 with strong visibility of booked production and tooling revenue, with recent new programme wins extending visibility into future years.

The Board is closely monitoring the situation in the Red Sea and to date the Group has not experienced any material impact. The Group continues to maintain buffer stocks to mitigate any short-term disruption to shipping times. While mindful of the wider macroeconomic and geopolitical uncertainty, the Board remains confident of making progress in the year ahead and in CT Automotive's long-term growth prospects.

Paul’s opinion - my previous interest, and green view, was based on the valuation anomaly - that the company had already told us in June 2023 that trading was back on track (after severe problems caused in the pandemic).

Now that the share has achieved my target of doubling in price, it’s done its job really. More upside might be harder to gain, as it’s not the sort of business that’s likely to ever achieve a high rating. Stockopedia has it on a forward PER of 6.6x, which still looks quite attractively cheap.

It makes trim components for cars, in low cost facilities overseas.

Given the strong share price recovery, I’ll shift down from green to AMBER/GREEN, so still worth a look, but not as compelling value as it was last summer.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.