Good morning, it's just Paul here today, with the SCVR for Friday.

Today's report is now finished.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to cover trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Agenda -

Paul's Section:

Vertu Motors (LON:VTU) (I hold) - another big upgrade to H1 profits, and the full year. Exceptional conditions won't last forever, but even if we normalise earnings, this share looks very good value. Fully underpinned by tangible net assets too. Divis & share buybacks are resuming. This is strikingly cheap, I reckon.

Also I summarise the recent webinar with VTU management, and a quick review of recent ITV Undercover Big Boss episode featuring Vertu's CEO.

Nothing else of interest today from small caps.

Paul’s Section

Vertu Motors (LON:VTU)

(I hold)

47.2p (pre market open) - mkt cap £174m

It was only a few days ago here on 29 July, when I covered the last in a series of positive trading updates from this car dealership (its main brand is Bristol Street Motors, as well as Vertu).

Share Buybacks - announced today that these will resume.

Vertu has already bought back about 7.5% of its shares in the last 3 years. I’m generally not a big fan of share buybacks, unless the share is trading at an irrationally low valuation, which is certainly the case here. VTU shares are below NTAV, and on top of that the company is enjoying a current trading bonanza. So buybacks are an excellent idea in my view, if there is surplus cash that is not required for other investments. It enhances EPS for existing shareholders, removes loose stock from the market, and should therefore drive shareholder value in the medium to long term.

Today’s buyback announcements is -

- From now to 28 Feb 2022

- Maximum of £3.0m - so not large, at under 2% of the market cap

- Zeus Capital will carry out the purchases on VTU’s behalf, which is normal

My opinion - this share looks irrationally cheap to me, so share buybacks make complete sense. The more, the merrier!

...the Group is providing an update on current trading and a further upgrade to the full year outlook.

Exceptionally favourable conditions for used cars sales & margins are continuing

Adj profit before tax (PBT) for H1 upgraded to at least £50m - that’s a huge upgrade coming in the last month of the H1 period (6m to 31 Aug 2021). We were last guided, on 29 July at >£40m adj PBT for H1.

New vehicles - order intake for Sept 2021 is above last year

Supply shortages likely to result in delivery delays (a widely known factor, so nothing new)

Shortages of new vehicles may also restrict supply of used vehicles

Labour issues reiterated - covid absences, high vacancies, upward pay pressure, labour shortages

Dividends - to be reinstated when interim results finalised

“Very confident” in the prospects for the group

Revised full year guidance - upped from £40-45m, to £50-55m for the full year to FY 02/2022. This implies no change to H2 performance, at £0-5m for Sep 21- Feb 22. All the increase has come from obviously exceptionally strong trading in Aug 2021.

Hence I wouldn’t be surprised if we get more upgrades later this year, as the bar has been set low for H2 - although note that the business does have a natural seasonality with H1 profits being much higher than H2.

My opinion - the whole sector look cheap, but VTU is the pick of the bunch for me, because it has such an outstandingly strong balance sheet - made up of freehold property, and working capital. Other car dealers I’ve looked at have much less balance sheet strength, as measured by price to NTAV ratio.

Even though current year trading is a one-off, it will leave a permanent boost to the balance sheets & liquidity of all car dealers. Hence they are worth more now than they were say 6 months ago. Expect consolidation in the sector.

VTU strikes me as the most obviously under-priced share in the small caps space right now. It could stay cheap though, often value shares are just unfashionable with investors, and they can stay cheap for a long time. That doesn’t matter to me, as long as dividends are flowing (which are resuming shortly), then sitting tight is very comfortable.

I think it’s a sitting duck for a takeover bid from private equity too, given all the freehold property, and very low PER.

There was a really excellent webinar with VTU management recently, which I took notes on, so as there’s nothing much else of interest today, will type up my notes below. That will take me about an hour, so should be up here by about 09:30.

.

Vertu webinar - this is a really interesting & quite entertaining (the CEO of 15 years, Robert Forrester, is quite a character!). My notes are below, it's a bit unstructured, because the commentary jumped about a bit, especially during Q&A -

.

My notes on this webinar - as always, my notes are not complete, and may contain unintentional errors or omissions. I jot down the most important points (to me) only -

Lockdowns have been frustrating, because CEO likes to spend his time out & about visiting branches - “Got to see the coal face, it’s the only way you find out what’s going on. Sitting down for 90 minutes with staff in branches, is best use of my time”

Click & Drive sales technology is best in the business. We use data extensively.

36 new outlets added since Jan 2020 - e.g. BMW/Mini, and MG

Current number of sites: Bristol Street Motors (82), Vertu (59), Macklin Motors (14)

Also acquired some ancillary businesses, e.g. Ace Parts - online parts company

IT - VTU has 45 full time software developers - cost is expensed, not capitalised, because it’s an ongoing payroll cost of running the business

Bricks & Clicks - online only doesn’t work, as only 0.8% conversion

Car dealers - it’s a low margin sector, so driving down costs & improving efficiency are key

Financial review by CFO - aftersales is 43% of gross profit (splits down as 74% servicing, 21% parts, and 5% accident repair). Used cars: 31% of gross profit. New cars: only 18% of gross profit. Fleet & commercial: 8%

Aftersales margin has been improving in recent years.

Net Tangible Asset Value (NTAV) is 50.2p per share.

Surplus properties have sold for above book value.

Net debt only £4.6m

20 year mortgages recently negotiated.

“We have firepower to grow, with strong balance sheet”

Share buybacks - potential to do more (announced subsequently, today). Have bought back 7.5% of total equity in last 3 years.

Internet only car dealers (e.g. Cazoo, Cinch) - very small. Pure eCommerce is not viable. Have to spend a fortune on marketing, for very low conversion rate of 0.5-0.8%

Change in dealer/,manufacturer relationships - in the pipeline, still being negotiated. Shouldn’t make much difference to us. This is the industry trend, it’s designed to reduce discounting & allow manufacturers to better control the price of new cars. Will kick in in 2023.

Electric cars - latest data shows the servicing bills are actually higher. New tech tends to go wrong (at least in first 5 years).

Online sales - VTU sold 434 cars online only, out of 8,500 in total (not stated over what period. So online only is small beer. Not many people are comfortable just buying online. 75% want to test drive. Most customers want to flex between physical & online.

“We can do everything the online only competition can do. The only advantage they have, is more marketing dollars”

TV appearance last week - Undercover Big Boss - was to drive brand awareness & share the values of the group. Has worked well, with web traffic, etc responding positively.

Manufacturers selling direct to the public - e.g. Tesla. Is this a threat? Don’t think so. Polestar, and a Hyundai startup are also trying this, but don’t see major manufacturers switching.

Aftersales are very busy at the moment.

Massive shortage of MoT capacity, so likely to remain busy.

Record trading conditions - “in 20 years I’ve never seen anything like it”.

Used cars are currently making exceptional profits - strong demand, and tight supply.

New cars - supply is still constrained. “All the cars booked for delivery in Sept are not likely to arrive in Sept in my view”.

Very strange environment - “if you’re not making money now, you never will!”

Unique situation, and new car constraints could last another 9 months.

“Very favourable conditions, so we must not get delusional”.

Cost pressures emerging - especially over wages. We have to pay more to retain & attract good people.

Supply chains - should improve in Q1, but varies by manufacturer.

“But remember, every time we see shortages of vehicles, our margins go up!”

Are Parkers Guide prices reliable? Yes, they’re accurate, and up-to-date.

Demand for cars should remain robust, due to full employment & nervousness about using public transport - where possible people prefer to use a car.

There will be another shortage of used cars in 3 years’ time, when shortage of current new cars feeds through to secondhand market. So it will take a long time for things to completely normalise.

Stellantis (Fiat, Chrysler) - risk re contract? Not a risk to the number of outlets. Too early to say re other effects. Having discussions with manufacturers over future relationships.

Electric vehicles - I don’t draw much distinction, it’s just another car for us to sell. Will take decades for the full impacts to feed through (of phasing out of petrol/diesel), much longer than most investors timescales.

Is Ford a declining part of your business? No, it’s our most profitable division!

Robots (i.e. special software to automate processes) - we have active robots, doing things like managing bookings, taxing cars electronically, contact centre, anything that involves re-keying is targeted for automation. Planning a 4th robot soon, to automate car buying. 5 or 6 robotic engineers will be busy for a while.

Shortage of car technicians - so wages are going up.

Selling a 3 year maintenance plan is great business, as customer pays monthly & greatly improves customer stickiness.

Asked about claimed competitive advantages (disruption) of online only competition - absolute nonsense! For a while we were buying cars from Cazoo, because they underpriced them! But that’s stopped now. But new competitors will get better. The used car market is near enough a perfect market. So the idea someone can enter that market and disrupt it by buying cheaper, is nonsense! They have no buying advantages at all.

Question about what makes a good CEO? Someone who builds a good team, with a good culture, understands data and the modern world. And definitely needs good mentors - I had great mentors.

TV Show

I watched this on catchup. It’s entertaining, and shows the CEO in an ill-fitting wig, pretending to be a history teacher, shadowing various staff in the branches.

Lee, the laddish van salesman - is praised for his high energy, successful online videos, which have worked well. But given a telling-off for his immaturity, swearing, and laddish sexual innuendo in videos. Made to sweat, but then rewarded with a promotion to overseeing group-wide training & promotion of online videos, and cleaning up the content.

Salesman - very good at his job, but revealed he was having family troubles (unspecified) and found challenging sales targets too much pressure, so was threatening to leave. Was given a pep talk, and an all inclusive holiday as a reward, and decided to stay.

Valeter - works flat-out, but only employed on an agency contract with no job security. Rewarded with a proper contract, and £15k towards a house deposit.

Did the company come across well? Yes an no. It was good that the boss went out there to find out what was going on. But the impression I was left with, is a company that hasn’t been properly looking after its best staff, so putting that right is hardly earth-shattering.

.

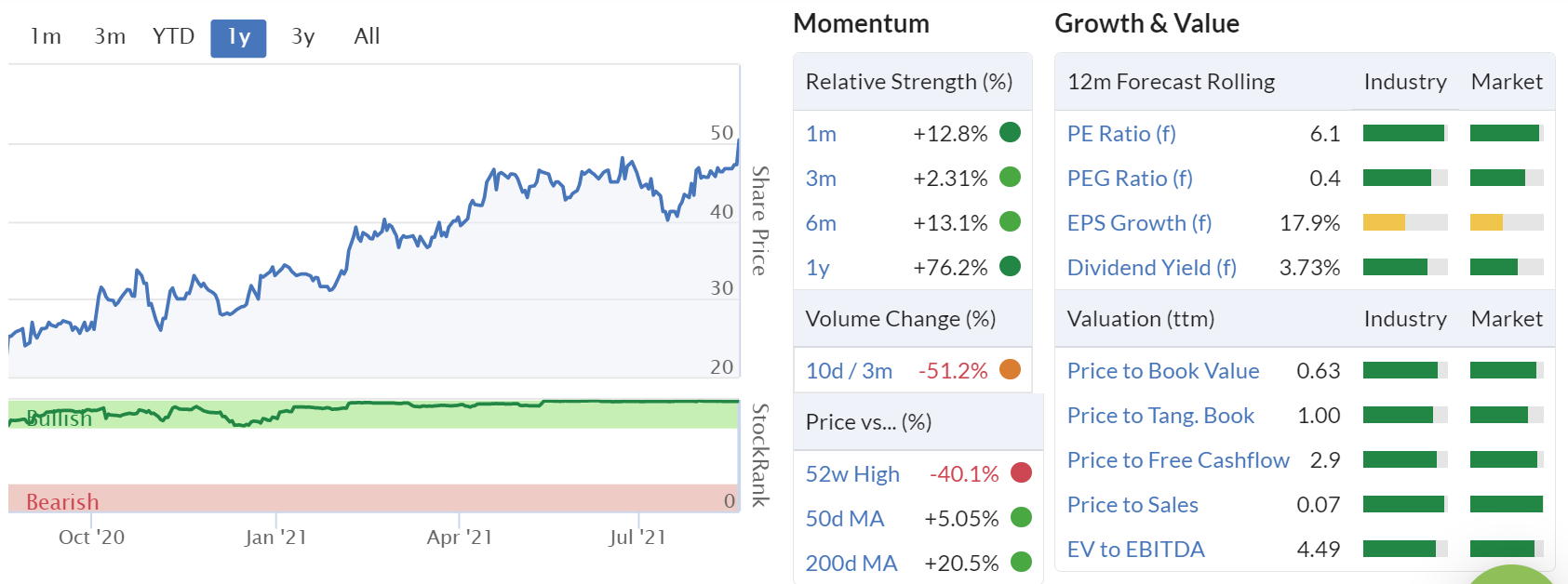

Look at all this green!

.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.