Good morning!

Stocks of interest today include:

- Record (LON:REC)

- 600 (LON:SIXH)

- Athelney Trust (LON:ATY)

- Bango (LON:BGO)

- Midwich (LON:MIDW)

- Venture Life (LON:VLG)

Record (LON:REC)

- Share price: 43.3p (+4%)

- No. of shares: 199 million

- Market cap: £86 million

(Please note that I currently own REC shares.)

This is a specialist currency manager whose shares I've held for about six months now.

I like many things about this company and its financial characteristics, and have likely mentioned them in previous editions of this report.

The only thing it's lacking is growth. This is why it remains one of my smaller positions. If it showed signs of growth, and the valuation remained reasonable, I'd be interested to promote it.

This update shows a few signs of life. Key points:

- AuME (assets under management equivalent) down from $62.2 billion to $61.9 billion. Not good, but....

- Client net inflows of $0.6 billion, with an inflow to the higher-margin Currency for Return product.

- Number of clients increases by four to 64

My view - I still don't have enough conviction to take a large position in this stock, and I may end up selling out of it to go into something where I have more conviction.

The benefit to holding it is that it is very good at generating cash, and most earnings are being paid out as dividends.

For example, nearly all of 2018 EPS is being paid out, including a special dividend. I think the trailing yield based on today's share price is 6.5%. Record is achieving that even while maintaining a very strong balance sheet.

So for someone who likes a bumper dividend yield and isn't too concerned about growth, this may be of interest.

600 (LON:SIXH)

- Share price: 17.75p (+8%)

- No. of shares: 113 million

- Market cap: £20 million

In truth, these final results are of less interest to me than yesterday's announcement: Buyout of Pension Scheme Agreement.

After the plunge at MPAC (LON:MPAC) this week, lots of people have been scratching their heads over the true danger of having a large pension scheme attached to their companies.

600 (LON:SIXH) has come up with a handy solution to get rid of its £200 million pension problem entirely: selling it to an insurance company.

Note that 600 had an actuarial surplus of £12.2 million as of October 2017, and an accounting surplus of £42 million as of March 2018 (the accounting calculations tend to be more optimistic than the actuarial ones).

This made it attractive for an insurance company to come along and take it off its hands.

The insurance company will be compensated for taking on the risk of the fund, but will return surplus funds after wind-up back to 600. This is estimated to be less than £4 million.

600 will lose its accounting surplus from its balance sheet, but will be freed from having to worry about these liabilities.

From an investment point of view, it is nice to have a simple business proposition without having to worry about interest rates and investment returns and all the other variables that go into a pension fund.

Besides the uncertainty they create, large pension schemes can restrict what a company can do with its cash flow.

As the Chairman says today:

At one point a prominent portfolio manager observed that the Scheme effectively controlled the company. In a sense he was correct as there were undertakings and security arrangements in place which severely limited our flexibility.

So I think 600 might be worth a fresh look, now that the pension scheme is off its back.

As for MPAC (LON:MPAC), I would continue to view it as a very difficult situation for investors.

Its pension scheme liabilities are twice as large as 600's, and it has a much smaller accounting surplus compared to what 600 had. Annual payments of nearly £2 million into its pension scheme are required.

While this hangs over it, the shares are a bet on interest rates and investment returns more than they are a bet on operating results or earnings.

Athelney Trust (LON:ATY)

- Share price: 251p (unch.)

- No. of shares: 2.2 million

- Market cap: £5.5 million

As before, I bring this to your attention not for its investment merits (on which I have no opinion) but for its entertaining commentary.

Bango (LON:BGO)

- Share price: 156.5p (-3%)

- No. of shares: 70 million

- Market cap: £110 million

Trading Update & Notice of Results

I've not written about this one before. The last time Paul covered it in a little bit of detail was back in September 2017.

In Paul's words, it "processes small payments for phone apps, via the end user's mobile phone bill". Sounds very much like Zamano (LON:ZMNO) (which has ceased to exist as an operating business, is now just a shell).

This growth in "end user spend" reported today is encouraging:

End User Spend (EUS) continues its four-year growth trend of at least doubling every twelve months.

If full-year 2018 user spending is more than double the full-year 2017 user spending, it will be more than £540 million.

Bango says its platform with the current cost base could process more than $5 billion of EUS per year, i.e. to grow by 7x from the level which 2018 might achieve.

Cash - it says it is "fully funded to reach Group profitability", having cash of £5.8 million.

My view - I am intrigued as to whether this might be one of those speculative Sucker Stocks (as classified by Stocko) which has a real chance of success. The growth rates and partnerships with the likes of Amazon have piqued my interest.

At the last results statement, for 2017, Bango converted 1.5% of EUS to revenues.

If it succeeded in reaching $5 billion of EUS per year, that would translate to juicy revenues at that 1.5% conversion rate.

But the conversion rate is likely to fall, I think. The recent trend for this rate has been lower, and I assume that bulk sales will attract discounts, and that competition will heat up.

If we assume a 1% conversion rate, then Bango would generate $50 million (GBP £38 million) of revenues on that $5 billion of user spending.

I would expect the marketing budget, executive pay, etc to increase. So administrative expenses would be higher than the £8 million recorded last year. There should still be meaningful net income, unless costs ballooned out of control.

Putting it all together, I think there is an investment case to be made for this stock.

The market cap is pricing in that end user spending will double again and keep going. If you feel comfortable with the technology and trust management to deliver, then I can see how it might be reasonable to give this a chance.

Midwich (LON:MIDW)

- Share price: 690p (+4%)

- No. of shares: 79 million

- Market cap: £548 million

Midwich, a specialist audio visual and document solutions distributor to the trade market, is today providing a trading update for the six months ended 30 June 2018.

Midwich listed in May 2016 at 230p, so it's now a three-bagger.

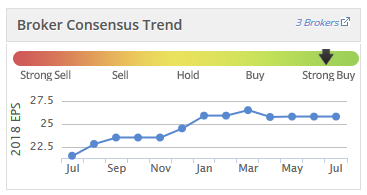

Earnings have generally been revised upwards since IPO. Underlying sales growth has been positive, while acquisitions and sterling weakness have helped:

It's an equipment distributor. Not the type of company I would typically be interested to invest in. But it is clearly getting something right.

One of the reasons I don't typically invest in distributors is that their competitive advantage is often tied to the specific attributes of their employees, rather than to any assets owned by shareholders.

For example - on its website, Midwich attributes its competitive position to its "technical expertise, product knowledge and customer service offering".

But It keeps outperforming, so it deserves credit for that. After a strong first half, and with positive sales momentum, performance for the full year is anticipated to be ahead of expectations.

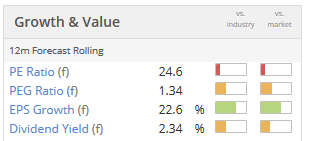

It's categorised by Stocko as a High Flyer, with strong Quality and Momentum. Statistically, therefore, things are looking good for shareholders.

But at the current rather elevated share price, I would now be a bit concerned that it is more than fully valued.

Venture Life (LON:VLG)

- Share price: 42p (+1%)

- No. of shares: 37 million

- Market cap: £15 million

Placing, Proposed Acquisition and Notice of GM

This is an "international consumer self-care group focused on developing, manufacturing and commercialising products for the self-care market".

I know a little bit about it, because I used its UltraDEX mouthwash for a short while. That is an effective but tasteless and somewhat niche product.

Today it announces a conditional, oversubscribed placing to raise up to £18.75 million (gross). It will more than double the share count.

How the funds will be used:

- £4.2 million to purchase Dentyl mouthwash and the right to distribute Dentyl BB mints in the UK.

- £3.7 million to repay loan notes and expensive convertible bonds.

- the rest for growth & further acquisitions.

Bear in mind that the VLG strategy is to buy brands which aren't performing very well, that are "unloved", and try to turn them around. It expects to "reverse the declining sales" at Dentyl.

Dentyl generated £1.2 million of pre-tax profits from just £2.9 million of sales in 2017 (using management accounts).

We can assume that 2018 figures are smaller than this. VLG might be paying a multiple of something like 4x or 5x PBT. Nice and cheap, but this is a very small business in decline.

My view

This looks like it has a lot of potential to me.

VLG has been doing a good job with UltraDEX. Revenue from that brand increased by 24% last year. Distribution has been widened in Boots and Lloyds Pharmacy for the UK market and there has been a big international drive, too.

Shareholders are betting on continued success with that brand and for something similar to happen with Dentyl and other future acquisitions.

Operating profit last year was £600k, before some heavy finance costs. With the newly-structured balance sheet, those finance costs should be significantly reduced in future.

So I suspect we are due for a very significant improvement in the current year, and brokers agree. There are pre-existing forecasts for VLG to generate EBIT of £1.3 million in the current year, rising to £1.9 million in 2019.

Definitely worth doing more research into this one, then!

Calling it a day there. Have a fine weekend!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.