Good morning! Friday, and it's Paul & Jack here to round off the week. Looking at the futures, it looks like today will be a bounce-back day, which is always nice for a Friday - less worrying over the weekend. Today's report is now finished, have a lovely weekend!

In case you missed it, lots of people were asking me to review Shoe Zone (LON:SHOE) results, so I did in yesterday's report here. It looks potentially very good, although I'm a bit wary of the household spending squeeze, which is impacting lower income households the most (due to energy & food being a higher % of their outgoings).

Agenda -

Eagle Eye Solutions (LON:EYE) - a strong trading update, with FY 6/2022 profit (well, EBITDA anyway!) guidance raised 10%. It's wildly expensive on a PER basis, so not for value investors. However, it seems clear that there's something special with EYE's product, given it is building recurring revenues with major retailers around the world. So it appeals to my more adventurous investing side.

M&C Saatchi (LON:SAA) - a surprise twist to the story here, where Vin Murria has been trying to force through a hostile takeover bid - not something you expect from one of SAA's own Directors! Today we're told that a better deal has been agreed with £NFC which looks a good outcome for SAA shareholders. There could be an 11% profit on arbitraging this deal, if I've got my figures right, at 220p per SAA share in the open market.

Works co uk (LON:WRKS) - a superficially positive trading update, but it's not as convincing once you dig into the detail. Tiny market cap, so could be worth a punt, but of the smaller retailers, I think SHOE wipes the floor with this (I hold neither).

Wincanton (LON:WIN) - a thumbs up from me, despite my dislike of its weak balance sheet. This logistics business is performing well, and open book contracts mean that it can pass on most increased costs to customers, reducing risk of a profit warning. Good order book. Low PER mainly due to large pension deficit recovery cash outflows, but that could be a receding issue now, possibly? I think this is a good share to own long-term, and with not much short-term risk apparent either.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Paul’s Section:

Eagle Eye Solutions (LON:EYE)

420p (yesterday’s close)

Market cap £110m

Eagle Eye (LSE: "EYE"), a leading SaaS technology company that creates digital connections enabling personalised, real-time marketing…

PR headline -

Strong momentum continues with go live of national US grocer, lifting expectations for the year

Good news, it’s trading ahead of expectations -

… is pleased to announce a continued positive trading performance since the release of Interim Results in March 2022. A notable development in the period is the go live of the national US grocer, announced in January 2022, secured alongside our partner, Neptune Retail Solutions.

As a result, the Board now anticipates revenues and adjusted EBITDA for the year ending 30 June 2022 ("FY22") will be ahead of current market expectations* by approximately 7% and 10% respectively.

* Market consensus for FY22 is Group revenue of £28.1m and adjusted EBITDA of £5.2m.

Thanks for the footnote on market expectations, that saves investors so much time. It needs to be become standard practice for all company announcements. Why on earth wouldn’t all companies include something that so obviously helps investors digest an update? (the only reason I can think of, is because they’re badly advised!). No complaints here though with EYE.

So it’s now saying that adj EBITDA will be c. £5.7m.

As I always point out, EBITDA is meaningless in some sectors, especially software, where they capitalise so much of the payroll (development spend) onto the balance sheet. That’s allowed under accounting standards, but it means that EBITDA is absolutely not a proxy for cash generation!

For example, a previous broker note showed that £5.2m EBITDA turned into only £1.6m adj PBT, a huge difference, hence this is a key point. That was 4.8p adj EPS.

If we uplift the profit figures by the 10% indicated today, we get to 5.3p EPS for FY 6/2022, giving a PER of 79 times. That ‘s a lot, especially in a market where tech valuations have crashed (look at NASDAQ, and it’s even worse when you strip out the mega caps).

EDIT: Update at 09:27 - a new note from Shore Capital has just come through, many thanks, revising up adj EPS to 5.7p for FY 6/2022, and the share price has moved up 10% (as at 09:27) to 458p. Combining those, the PER is now 80, so negligible change from my draft calculations above. End of edit.

Should we be valuing EYE on a PER basis? Maybe not, because it’s a credible growth story, and is gradually building a highly impressive client list, with recurring revenues. Therefore the value in EYE shares is probably more about those client relationships, and how valuable it could be to an acquirer, and long-term growth.

There again, that all sounds like boom talk, and maybe we need to un-learn the bad habits in justifying excessive valuations on tech shares in the last few years?

Anyway, whether you find the valuation attractive or not, is up to you. I’m struggling with the valuation, despite it having dropped by a third from the peak. Although an out-perform update today clearly helps.

I suppose downside risk is that some better technology comes along, and EYE becomes old hat, and withers away. Tech moves so quickly these days, it's dangerous to assume today's winners will necessarily still be going strong in say 5 years' time.

What else?

Significant new clients wins

Deepening with existing clients (so EYE clearly has an attractive product)

Outlook - positive -

Tim Mason, Chief Executive of Eagle Eye, said: "We are delighted to have taken one of the largest grocery retailers in the US live on the AIR platform so quickly, providing us with another fantastic demonstration of the relevance of our combined offering with Neptune in this substantial market. Our ability to deliver personalised, 1:1 marketing at scale is resonating with retailers around the world, as they seek to accelerate their digital marketing strategies.

"This successful go live and growing momentum in the business, combined with the underlying strength of our SaaS metrics and record new business pipeline, all combine to underpin the Board's confidence in our outperformance in the current year and prospects for sustained growth."

My opinion - it doesn’t work for me on the numbers alone, from a value investing perspective. Plus growth investors have taken a long-overdue battering recently, as often ludicrous valuations reset hugely downwards.

That said, I do think there’s clear evidence of something special with EYE - winning & retaining lots of major retailing clients, internationally, building recurring revenues, etc. It’s more about the strategic value of EYE, and what a bidder might pay for it - which could be substantial I reckon. So you probably can justify the high market cap on that basis.

Meanwhile, now it’s making money (at last), it shouldn’t need another fundraising, so dilution shouldn’t be a worry.

Overall, I think this share looks interesting, for more adventurous investors.

.

.

M&C Saatchi (LON:SAA)

214p (up 30% at 08:15)

Market cap £262m

SAA shareholders collectively get a £60m windfall today, as the share price shoots up on news of a recommended takeover bid from Next Fifteen Communications (LON:NFC) (market cap £1.2bn).

This has been a fascinating situation to follow. Renowned tech investor, Vin Murria, nicknamed “Britain’s tech queen”, joined the Board of SAA, and obviously liked the company so much that she bought up shares in it personally, and via a cash shell company £ADVT , then tried to buy SAA in a hostile takeover approach, which never made any sense at all to me - it was just an attempt to seize control of SAA, in my view.

Why would investors in SAA, a successful company, want to swap their SAA shares for shares in a cash shell, thereby handing control to Ms Murria? It was a daft idea, in my view, and really not the kind of thing I would expect a Director of any company to attempt. Shareholders want Directors that are loyal to the company, not some kind of trojan horse.

SAA rebuffed her approaches, and it now turns out they’ve been working behind the scenes on a better deal, from NFC.

Recommended acquisition - of SAA by NFC.

This is a recommended deal, i.e. agreed by SAA’s independent Directors.

Terms - it’s 40p in cash (not very much), and mostly in new NFC shares.

The trouble with paper deals, is that the takeover price changes in real time, as the NFC share price moves. The formula to work out the current value of SAA shares, if the bid goes ahead, would be:

40p + (0.1637 * NFC share price)

At the moment that would be:

40p + (0.1637 * 1258p) = 246p per SAA share.

You can currently buy SAA shares in the market for 222p, so that looks an anomaly to me, or I’ve got my formula wrong! There could be an 11% profit there for traders, arbitraging this deal, if it goes ahead. Downside risk is that Vin Murria blocks the deal, but why would she, as she’s the biggest SAA shareholder, and would probably be delighted to bank her profits, which would more than cover all the costs of her abortive bid. I’m guessing there, obviously.

Another risk is that NFC would be issuing a lot of new shares, to people who don't necessarily want to hold them. So there could be an overhang, leading to NFC shares drifting down over time, possibly?

My opinion - as you can tell, I didn’t like the Vin Murria deal, it looked opportunistic, and illogical to me. There was little logic to the deal for outside shareholders.

That seems to have forced SAA to find a white knight to take it over. Pity really, as SAA was a good company, and some shareholders might have preferred it to remain independent.

However, NFC is offering a substantial premium, and at a time when shares in PR/marketing companies would probably wilt, given the macro picture.

Hence the NFC deal looks sensible to me, and if I were a SAA shareholder, I’d accept it.

EDIT: I see AdvancedAdvT (LON:ADVT) has issued a statement, just saying that it is considering its position. Maybe they'll try to push NFC to pay more, or adjust the deal to include more cash than paper?

So far, the stock market seems to like the deal, with NFC share price now slightly up on the day, at 1284p (up 1.4%) although that's only on tiny reported volume of shares traded - but as always, there could be larger trades not yet printed, as big trades are allowed delayed reporting, or could be "working" in the background - i.e. being bought/sold piecemeal, before being reported once the trade is complete). SAA share price is now 225p to buy (at 08:55) which is offering a >10% profit, if the NFC deal goes ahead, and providing NFC shares don't drop - could be an interesting trade, for arbitrage specialists, as mentioned above)?

.

Works co uk (LON:WRKS)

57p (up 13% at 10:09)

Market cap £35m

TheWorks.co.uk plc, the multi-channel value retailer of arts, crafts, toys, books and stationery, announces a trading update for the 52 weeks ended 1 May 2022 (the "Period" or "FY22").

I’ll call that FY 4/2022, as it only includes 1 day of May.

WRKS shares have come up on the top % risers list, so I’ll prioritise reviewing this.

Here are my notes -

This only sounds in line with expectations - good, but why would that trigger a 13% share price rise? -

Improved proposition helping to offset external headwinds; FY22 EBITDA forecast of £15.0m is reiterated.

Note that only about half of EBITDA turns into profit before tax. In EPS terms, current consensus is 9.2p, a PER of 6.2 - seems cheap, but I’m not convinced that level of profitability is sustainable, due to the benefit of -

Business rates relief - a red flag here, which I raised when digging into the interim results here. It seems that business rates relief has been a massive boost to profit. That’s phased out now, so the question is whether sales can rise enough to recoup this big headwind?

Striking improvement in net cash to £16.3m, from almost nothing a year ago. The interims show net cash of £17.8m at 31 Oct 2021, which doesn’t tie in with today’s announcement, which says that net cash was £10.0m at the interim stage - strange. How come? Where did all this cash appear from in H1? Luckily I investigated cash here, when reporting on interim results. It’s vital reading to put today’s update in perspective - namely that the huge increase in net cash in H1 was largely down to favourable working capital movements - i.e. a big increase in trade payables of £10m, for an increase in inventories of only £2m. That said, net cash has only slipped back a bit in H2, which is seasonally much stronger, so it looks OK.

Put more simply, the big increase in net cash looks to be one-off in nature, not likely to repeat to anything like that extent in future, if at all.

Performance is highly seasonal, with most profits coming in H2.

Divis reinstated - OK this would be seen positively by investors, with a policy to increase divis further in future - probably behind today's investor buying interest.

Sales - the best comparison is with pre-pandemic, and it’s good - up 10.4% on a like-for-like (i.e. same stores) basis. Although that includes online, with no split given of online/stores.

Product developments, including drawing new attention to books (“BookTok” phenomenon - no idea, we’ll need to google that!)

Branded toys & games doing well (e.g. Peppa Pig - any read-across to £CCT I wonder?)

Cyber-security incident end March (RNS’d on 5 April 2022, so not news).

Store portfolio is 525, with only minor changes in the year.

Results delayed, to Sept 2022, compared with July last year. The reason given is improvements to IT, following the cybersecurity incident. Accounts shouldn’t take 6 months to prepare, so this reinforces to me that financial controls at WRKS seem weak. Although I suppose moving from July to Sept jumps the summer holidays too.

Current consumer spending - as expected is under pressure, and it’s interesting that investors have looked past this today, so perhaps markets have now factored in the macro slowdown? -

Consumer spending is widely reported to have slowed in recent months and we believe this has had an impact on our sales…

Outlook - good to hear that the company says it is budgeting prudently -

There continues to be uncertainty relating to the external environment and how this might affect levels of consumer spending in the months ahead. This has been taken into account in setting the Group's internal plans for FY23.

The Board remains confident in the future prospects of the business because of the underlying appeal and relevance of The Works' proposition, the opportunity to grow sales profitably through the implementation of its strategy, and the Group's strong financial position.

My opinion - WRKS looks good superficially, but I always find with WRKS that when I dig deeper, things are not as good as they first looked.

Bottom line for me, is that this was a float in 2018, which went disastrously wrong before the pandemic. Sure, improvements to the business have been made during the pandemic. However, I think the current bumper profits have been helped by substantial business rates relief, despite there being little impact on trading from the pandemic during this latest period, probably providing a net boost to profits.

Therefore, combined with a consumer slowdown, I reckon there’s a considerable risk of profits tumbling in the new financial year, as business rates revert to normal (which seem to be about £14m p.a., so it’s a huge cost).

That said, reinstatement of divis suggest management are confident, so who knows?

Personally I think it probably looks priced about right for now, given the macro uncertainties, and it’s fundamentally not a very good business. So not really a turnaround situation with big upside, which would interest me more.

Time will tell how it trades once everything is normalised, in particular re business rates. I reckon future profits probably aren't likely to be much more than breakeven, but as always I could be wrong, because nobody can predict the future.

If you have to buy a small cap retailer, then SHOE from yesterday’s report looks vastly better than WRKS in my opinion.

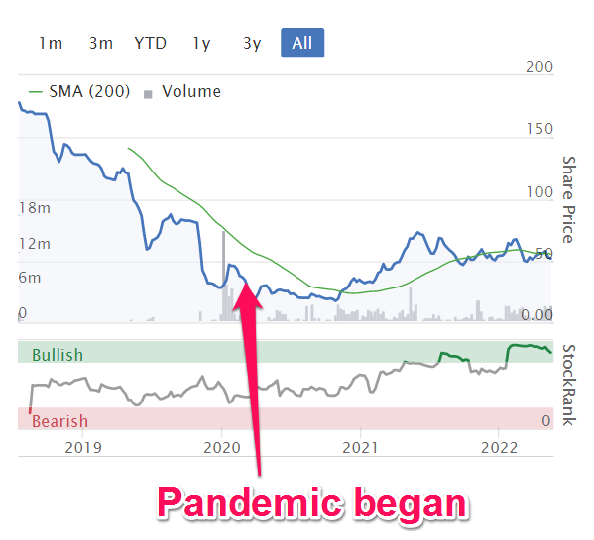

Share price since listing -

.

Wincanton (LON:WIN)

412p (up 2% at 12:24)

Market cap £511m

We’ve been reporting positively on Wincanton for a while now, with impressive trading updates. We didn’t cover it at the time, but a trading update on 5 April 2022 gave guidance for FY 3/2022 of adj PBT c.£56.5m.

Today’s actual is a c.3% beat, with adj PBT actual being £58.1m (up an impressive 23% vs LY), on revenues of £1.42bn (up 16%), so an improved PBT margin of 4.1% (LY: 3.9%).

That profit beat is all the more impressive, given that forecast EPS has been steadily rising, as you can see below, with actual adj EPS coming out at 40.8p, a PER of 10.1.

Statutory profit is 94% of adjusted profit, so not a huge difference.

.

Dividend totals 12.0p (Interim: 4p, Final: 8p) is the same as forecast. The yield is only 2.9%, due to so much cash being needed to fund the pension deficit overpayments, and the weak balance sheet.

Inflation protection - a key factor right now, that we have to think about for every investment. By using mainly open book contracts, WIN passes on cost increases to its clients. Hence this should be a robust business model in a higher inflationary world, as seems likely for the foreseeable future -

… Inflationary headwinds mitigated by management actions on costs and contract mix; less than 30% of Group revenue from closed book contracts

For investors, this means a much lower risk of a profit warning, so is of considerable importance, and makes WIN shares attractive.

Outlook - vague, but reassuring -

Outlook

· Wincanton is well positioned to maintain its positive performance across its chosen markets, driven by ongoing investment in the business and continued progress against our strategy

· While the Group remains mindful about the macro-economic headwinds and the potential impact on consumer sentiment, there is good momentum in the new business pipeline and we are confident in the future growth opportunities across all four of our sectors and in our continued ability to deliver our strategy successfully

Pension scheme(s) - still a huge issue. The commentary says £19.2m was paid in cash, into the pension scheme in FY 3/2022. Remember that is not expensed through the P&L! This is why the PER of 10.1 looks so low, for a successful business - it’s because so much of the profit/cashflow by-passes equity holders, and has to be paid into the pension scheme.

The interesting thing is that higher bond yields recently seem to be generally reducing pension deficits, sometimes by a lot (each is different in its rules, actuarial assumptions, etc).

We’re told that £20.7m is to be paid into the pension scheme for deficit recovery payments in the new financial year FY 3/2023.

This table above is useful, in showing how the higher discount rate (linked to bonds) has reduced liabilities. Although recent asset price falls looks to have reduced assets, but by a smaller amount. Giving a pension scheme surplus of £114.5m.

For people not familiar with the total mess that is pension scheme accounting, there are 2 sets of rules. Accounting rules, for the accounts. And actuarial rules (stricter) which determine the more important cash payments to rectify any deficit. So clearly the actuarial rules are far more important, as they determine real world cashflows from the company to the pension scheme.

The company does comment on the all-important actuarial deficit, saying this today -

The estimated actuarial deficit on a technical provision basis has reduced to £37m at 31 March 2022, compared to £67m at 31 March 2021. At 31 March 2022, the Scheme's investments were split between 19% in return-seeking assets and 81% in defensive assets. The inflation and interest rate risks facing the Scheme are hedged to mitigate the quantum of any future movements in the actuarial valuation.

I’m guessing here, but that seems to suggest that only 2 years’ more cash payments of c.£19m would eliminate the pension scheme actuarial deficit, and hence presumably not require any more cash payments - which would be fantastic for equity holders, as it could possibly trigger a re-rating of maybe 50-100% on the shares? Although the trouble is, as you can see above, is that the pension deficit is the difference between 2 very large numbers, which are both subject to volatility. So although things seem to be moving in the right direction, that could change again - e.g. if bond rates reduce again due to a recession & more QE, alongside assets continuing to collapse in value. Hence I would say the pension situation has improved, but remains a significant risk.

Balance sheet - is still poor, but has improved a lot, mainly due to the pension scheme “asset” having risen from £50.8m to £117.0m. The only problem is that it’s not really an asset, because the company is actually paying large deficit recovery cash payments into it.

Ignoring this £117m pension asset, and the £110.7m intangibles/goodwill, results in NTAV being negative at £(147.2)m - I’ve also written off the £16.9m deferred tax creditor, as that is probably linked to the pension scheme.

There’s little interest-bearing debt though, only £25m, and that was more than covered by cash of £28.7m on the balance sheet date, so a small net cash position.

How can this be, when NTAV is so bad? It’s because customers fund the business, by paying cash up-front. Hence why trade payables is so enormous, at £323.6m, as it contains the offsetting credit entries relating to customer cash debits.

In conclusion then, WIN is in a lovely position where it seems to have a permanently favourable negative working capital position - very much like furniture retailers.

Although I'd like to see the daily cashflows, and the average daily net cash/debt, which can sometimes be very different to a year end snapshot on one day.

The bank is clearly happy too, having extended facilities to £175m, not maturing until March 2026. WIN has plenty of headroom against its bank covenants, so no issues there. It also has some additional bank facilities of £57.5m for various purposes if needed.

My opinion - I do like this share, because the company is performing really well, and seems to attract & retain big retail customers, so it clearly must be very well organised, hence very good at distributing stuff. The weak balance sheet isn’t a deal-breaker, providing customers remain happy to pay up-front.

What intrigues me, is that if the pension deficit payments (which currently are greater cash outflows than divis to shareholders, so it’s a big issue) do reduce, or even stop, which appears to be a possibility, then that could trigger a re-rating of the shares - since it would enable divis to be doubled, to a 6% yield, and/or fuel more acquisitions.

WIN shares also have considerable inflation protection, due to its open book contracts, which is a big plus right now in current macro conditions - i.e. profits should be protected, despite higher costs, as they can be passed on within most existing contract terms.

Clipper sold for a PER way higher than 10 (Wincanton’s) suggesting there could be big upside on WIN shares long-term, and providing the pension scheme behaves itself.

Therefore, this share gets a thumbs up from me. As a reader pointed out yesterday, we should really compile a list & update it every day for shares which get the coveted thumbs up from the SCVR! We only give that to companies which are performing well, and which are reasonably priced. Not to the more speculative turnarounds that often crop up, but tend to be higher risk.

.

.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.