Good morning from Paul!

Podcast mystery share this weekend (21/9/2024) is: Warpaint London (LON:W7L)

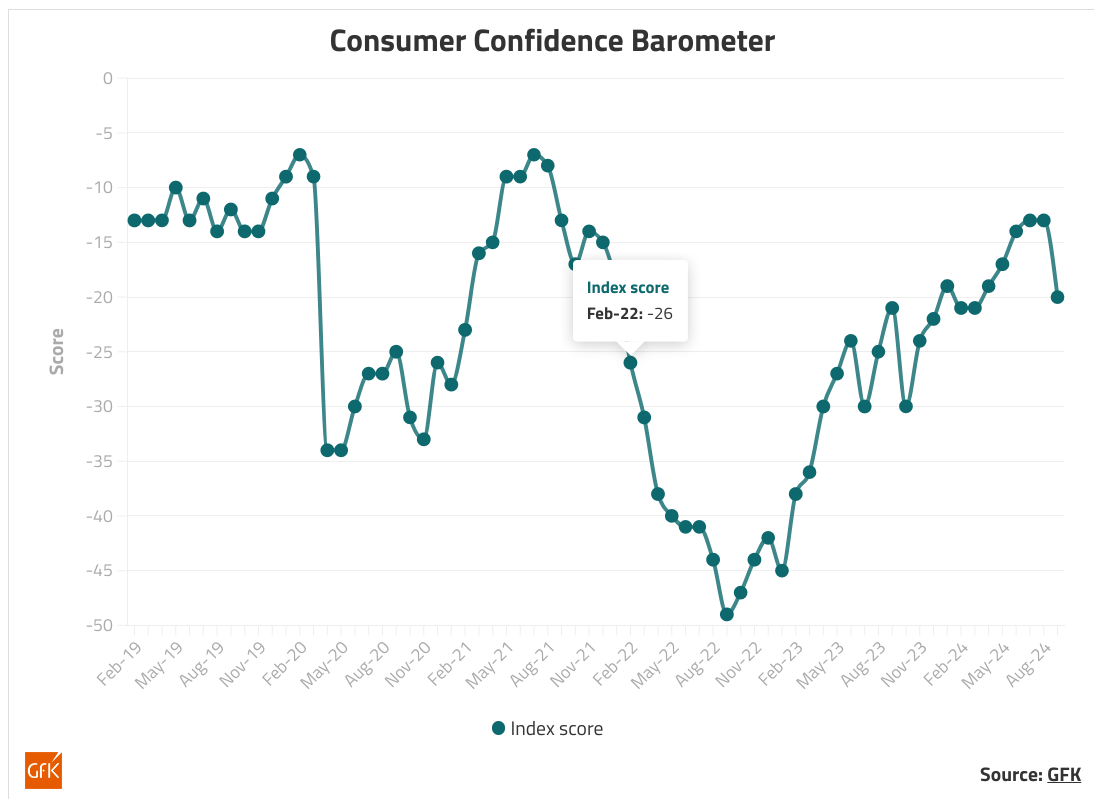

Consumer confidence drops sharply

Data out today (I can't find the source on GfK's website, so have used a free article from Retail Week, many thanks to them).

This shows below a sharp fall in the widely followed consumer confidence survey from GfK, dropping from -13 in August, to -20 in September, undoing the steady improvements which had been occurring earlier in 2024. I'm livid about this, as it's obviously been caused by the inept messaging from the new Govt, about a supposed black hole, taking the fuel allowance away from pensioners, and how a dreadful budget is on the way. They clearly have no understanding of the economy needing confidence in order to grow, for both businesses and consumers. So a pretty dreadful start I'm afraid, with basic, schoolboy errors. Let's hope they realise they're saying all the wrong things, and remedy the situation with a more positive approach in future.

Possible small cap bargains?

New video looking at screening for potential bargains: click here

Also now published on Youtube, to help anyone who struggled with the bandwidth on the original link (buy a new computer, cheapskates LOL!)

?si=sFNoSygICdRT36SKAnnoyingly, I got up early today to record a video looking for bargains in small caps. Dutifully done, but it didn't record any sound, so I had to do it again (edit: done, link above) now with the sound on. Please see below some of the share ideas which came up for further research on my manual and screening approach to find recent fallers which may or may not be bargains. My thinking being that we could be seeing some irrational, fear & tax-driven selling in UK small caps, whilst US markets rise to new all-time highs, which should be good for UK shares in due course, once the end Oct budget is out of the way.

Here are some ideas for you to properly research yourself in more depth -

Mortgage Advice Bureau (Holdings) (LON:MAB1) - note reader comment flagging potential regulatory issues - thanks for that.

Frontier Developments (LON:FDEV)

Sanderson Design (LON:SDG)

Tristel (LON:TSTL)

Tribal (LON:TRB)

Vertu Motors (LON:VTU)

Beeks Financial Cloud (LON:BKS) (I hold)

Volex (LON:VLX) (I hold)

Brickability (LON:BRCK)

Spectra Systems (LON:SPSY) (I hold)

Hunting (LON:HTG) (I hold)

Osb (LON:OSB) (I hold)

Warpaint London (LON:W7L)

Hollywood Bowl (LON:BOWL) (I hold)

J D Wetherspoon (LON:JDW) (I hold)

Zotefoams (LON:ZTF) (I hold)

Gulf Marine Services (LON:GMS) (I hold)

Gaming Realms (LON:GMR)

A late one I forgot earlier: Eurocell (LON:ECEL) (I hold)

More details on each share idea above are in the "Discuss" tab of each company, all have been discussed at length here in the SCVRs previously.

Explanatory notes -

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom), Video update of results so far, June 2024.

** New SCVR summary spreadsheet for calendar 2024 ** This is the live one! (updated 6/9/2024)

Archive - SCVR summary spreadsheet for calendar 2023.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Phil Hanson's data analysis measuring performance of our colour-coding system in the SCVRs, from July 2023- Mar 2024 (with live prices). My video explaining/reviewing it.

My other video (June 2024) - How to screen for broker upgrades on Stockopedia. More stock screening strategies here (Sept 2024)

Companies Reporting

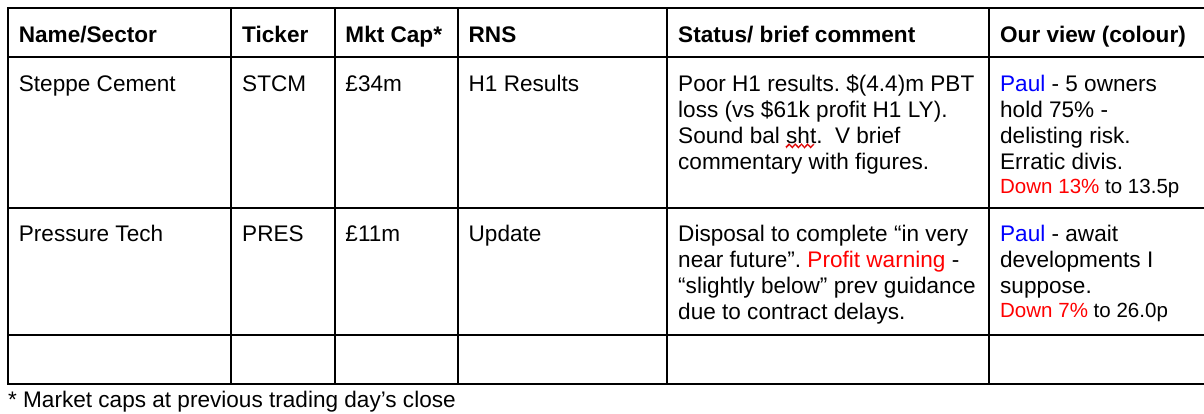

Hardly any news today, here's my quick commentary on what there is (I won't be expanding on these, as they don't interest me) -

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.