Good morning, it's Paul here with Friday's SCVR.

Today's report is now finished.

Catch up day! Today I'll be writing about;

Sosandar (LON:SOS) - interesting points from my call with management

Robinson (LON:RBN) - results from Tuesday

Sureserve (LON:SUR) - trading update from Weds

Van Elle Holdings (LON:VANL) - final results from Thurs

.

Sosandar (LON:SOS)

15.88p - mkt cap £30.5m

(I hold)

Call with management -

Subjectively, management struck me as more confident & calm than previously.

Key points;

Marketing - the TV ads in autumn, and early spring, lead to a large number of new sign ups, registering interest on Sosandar's website. These then often convert into sales at a later date, as emails & direct mail catalogues stimulate buying interest. Hence sales growth this year has been boosted by last year's marketing spend. Database now much bigger, so can utilise free channels (like email), and social media posts. Hence marketing activity ongoing, but drastically scaled back in spending terms, to conserve cash. Still getting a decent (but reduced) number of new sign ups on website. Intention is to cautiously expand marketing spend in Sept onwards for peak season. Likely to be about half level of last year. Will flex marketing activities depending on what works best at the time. Was overly reliant on Facebook ads, broadening it now. Will split marketing spend in future about a third each in: social media, direct mail, and TV. Customer acquisition cost is c.£40 - 1 year payback (2 orders).

NB - cost of marketing is now falling, as there's less competition for online ad spend, and TV, due to competitors reining in their marketing spend.

Cash burn - as stated in RNS, virtually no cash burn from May-July. I (mistakenly) thought that creditors must have been stretched in order to achieve this (e.g. VAT, payroll taxes). CFO confirmed that there has been no deferral of VAT, and only a low amount of other taxes deferred (with agreement of HMRC), under £100k. This is very significant. It means the business genuinely ran at cash breakeven for 3 months May-July. True, those conditions were not normal - e.g. a lot of staff furloughed (most are now back at work), and cash is likely to be needed to stock up for the peak Sept-Dec season. But even so, it's an important demonstration that, when cash is tight, costs can be drastically scaled back. I find that very encouraging. Physical retailers would love to have that kind of flexibility on costs, it's a big competitive advantage for Sosandar & other online retailers. "Incredibly agile business" (CEO). Very low fixed cost base.

Product - "we got the product right". "We're good at anticipating needs of customers". Repeat orders strong. Average customer orders twice per year - good customer loyalty. Difficulty of doing photo-shoots during lockdown, so have changed tack - models get their boyfriends to take shots of them at home/in garden on iPhones! Works really well, as resulting images are relevant to lockdown customers (who can't relate to models in glamorous overseas locations). Some customers are buying holiday clothing, possibly for escapism! (sit in garden in a bikini, pretending they're on holiday?).

Reaction to covid/lockdown - reduced the number of new styles. Reduced minimum order quantity by about half, then repeat styles which work best (test & repeat). New in stock is selling out faster than ever - helps sell at full price, as educates customers to buy now, or lose it. Focus on new denim ranges has worked well, strong sellers. Footwear also doing well. Much more evenly spread product mix - less dependent on dresses - also helps reduce returns rate, as dresses are a more complex fit.

John Lewis/Next - launching in 2 weeks. Cautiously optimistic. Business model for this, is to send all the product to Next, who look after everything - warehousing, dispatch, returns, etc. They charge a commission for this. Restrictions on price discounting (which Next/JL don't like). Investors should focus on the bottom line per sale, not the gross margin, i.e.

Sale through Sosandar's own website - carries a £40 CAC, so first sale to that individual customer is overall at a loss, but second & all subsequent sales then profitable.

Sale through Next/JL - gross margin lower, but there is zero CAC, hence all sales are profitable.

Next/JL will only hold a small ("capsule") range of Sosandar product, so if customers like the brand, the hope is they will seek out Sosandar's own website & maybe order direct in future. It's therefore mainly a marketing thing.

Fundraising? - these questions were partially dodged! I suppose that's not surprising, as they can't say anything about this issue. CFO indicated he's running a range of scenarios, and left it at that. Anyone who's looked at the numbers should be able to work out for themselves that another fundraising is going to be needed. Personally that doesn't bother me. As demonstrated before, Sosandar has no trouble raising top-up funding. A (say) £3m placing would only be 10% dilution, and should be easy to do, so what's the problem? This is not a deal-breaker for me anyway. Management didn't give any indication either way about whether they will raise more money. Let's just assume they will, and then nobody will be surprised.

Tough comparatives? - the company is currently trading strongly up, but against soft prior year comparatives. The autumn/winter season will be harder to beat prior year comps, because that was when the big marketing spending kicked in last year. Management acknowledged that, yes, the comps will get tougher in the autumn, but that the bottom line improvement should be massive (since marketing spend in 2020 will be so much lower).

My opinion - the key points for me are;

Creditors not stretched, therefore cash breakeven from May-July 2020 is very encouraging, although costs artificially low due to furlough

Increased revenues, and greatly reduced costs, should see a big reduction in losses this year FY 03/2021

This year has demonstrated how Sosandar is highly flexible, with a very low fixed cost base.

I'm happy to hold at a £30m mkt cap. My view is that this is definitely going to work - remember that the original (very ambitious) revenue targets of Yr1:£1m, Yr2: £3m, Yr3: £9m have been achieved, or beaten. The only question is how long it will take to reach breakeven, and how much more fresh equity will need to be raised to get there. The original business plan woefully under-estimated the cash burn required to achieve that growth. But who cares now? Those are sunk costs, and someone buying the shares now is buying into the current situation, not the historical position.

There are no other online-only fashion businesses in the UK stock market, other than Asos (LON:ASC) and Boohoo (LON:BOO) , both of which have been stunningly successful for investors. Therefore, I reckon SOS could have scarcity value, and soar in market cap, if future trading is strong. Which may or may not happen of course, time will tell.

Summary - speculative, definitely needs another fundraise I think, but prospects look potentially good, in my view.

.

Robinson (LON:RBN)

Share price: 148p

No. shares: 16.6m

Market cap: £24.6m

Robinson plc ("Robinson" or the "Group" stock code: RBN), the custom manufacturer of plastic and paperboard packaging based in Chesterfield, announces its interim results for the six months ended 30 June 2020.

These figures came out on Tuesday, and caught my eye as looking good, but I ran out of time to review them on the day.

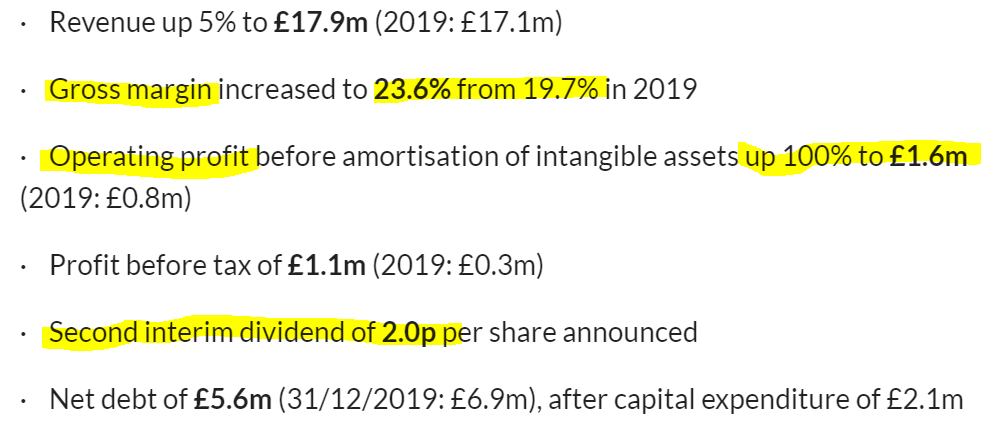

Financial highlights look good (bear in mind that many companies cherry-pick the best figures here, so we need to look at the full numbers also, for the full picture);

.

.

Note the low, but improved gross margin of 23.6% (LY H1: 19.7%)

Similar revenue growth is expected in H2

Operating costs will be "significantly higher" than in 2019

Guidance -

Notwithstanding this increase and subject to any disruption to trading that may arise from the ongoing pandemic, we expect full year earnings to be slightly higher than last year and remain committed to ongoing delivery of our target of 6-8% return on sales*."

That's rather disappointing, given that H1 profits are much higher than last year.

Property - there's surplus property, providing hidden upside potentially, although I don't know what sort of money we're talking here, in terms of disposal proceeds? Do any readers know?

Negotiations are progressing for disposal of parts of the surplus property in Chesterfield. Subject to the necessary planning approvals, we would expect sales to be achieved in the latter part of 2021 or early 2022. The intention of the Group remains, over time, to realise the maximum value from the disposal of surplus properties and to reinvest the proceeds in developing our packaging business.

Doesn't sound like a special dividend is in the offing from property disposals. But it should reduce debt, and allow further expansion of the business.

It's a capital-intensive business, with £2.1m capex in H1. I prefer capital-light business models.

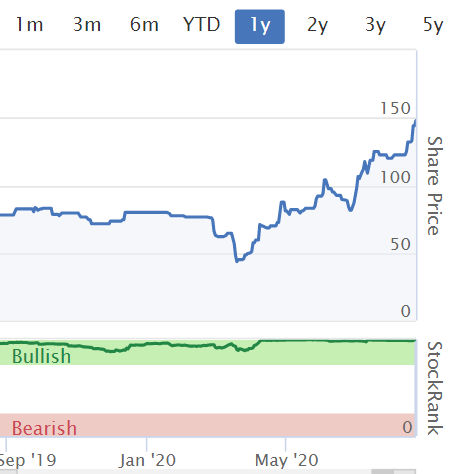

My opinion - shares have done well recently. The key question is how much value is likely to be extracted from freehold property disposals? The packaging business itself looks fairly uninteresting. Shares are very illiquid.

I see that RBN qualifies for the "Tiny Titans" Stockopedia screen (inspired by James O'Shaughnessy), which is an interesting screen that sometimes throws up some good stock ideas, I've noticed in the past. Worth a look (link below);

.

.

.

Sureserve (LON:SUR)

Share price: 47p

No. shares: 159.3m

Market cap: £74.9m

Trading Update: Delivering a strong performance

Sureserve, the compliance and energy services Group, is pleased to provide an update on trading.

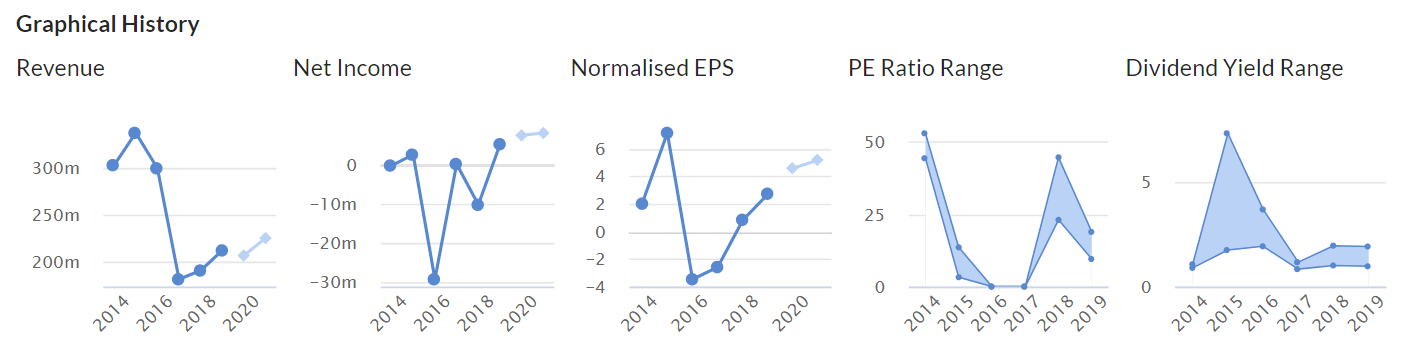

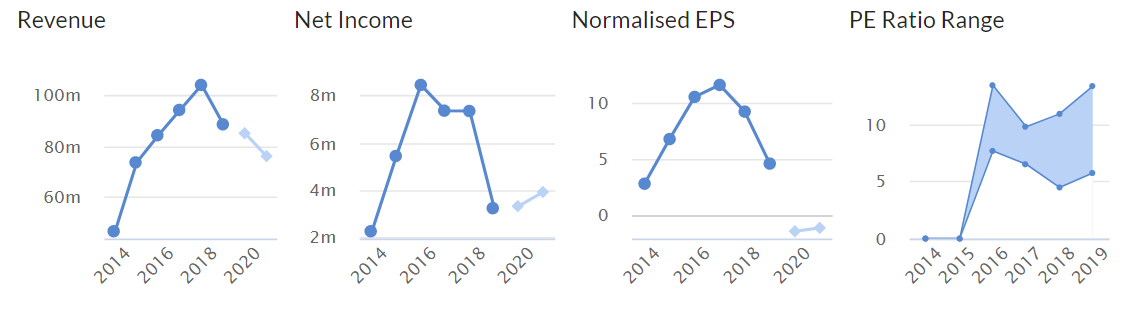

This company used to be called Lakehouse. It floated in 2015, then got into a mess, but seems to be recovering, judging from the improving EPS graph in the middle, below. Its financial year end is 30 Sept 2020.

.

.

I've had a quick look at the most recent interims, 6m to 31 Mar 2020, and those (mainly pre-covid) results look OK. The balance sheet is weakish, with only £2.7m NTAV.

Latest update is reassuring;

Despite the challenging circumstances, our financial performance is strong, demonstrating the resilient nature of the business and the essential nature of much of the work we perform. The Board remains confident that trading for the financial year ended 30 September 2020 will be in line with management's expectations.

Order book - strong. Strengthened bidding team, to win more new business.

Dividends - considering a sustainable dividend policy.

Liquidity - paid off all its borrowings at end July. That's quite impressive, if sustained. Also a £25m RCF facility available. So no concerns here over cash.

My opinion - I don't invest in this sector (contracting businesses), but this is more a maintenance/inspection type business, which is a lot lower risk than building major infrastructure. So I suppose it's really a recurring services type of business.

Overall it looks OK, nothing special. Valuation is reasonable - about 10 times current year earnings, and it's shown resilience during covid. I'm not motivated to buy any, but can't see anything wrong with the share either. There could be upside if it can demonstrate more growth, and higher profits in future.

.

Van Elle Holdings (LON:VANL)

Share price: 36p

No. shares: 106.7m

Market cap: 38.4m

Van Elle Holdings plc, the UK's largest independent ground engineering contractor, announces its results for the year ended 30 April 2020 ('FY2020').

Poor results, even though covid only hit the last 6 weeks of the year, although the company says this is a "critical trading period", and resulted in the loss of about £10m in revenues. Take account of operational gearing, and it stacks up that this would have hurt profit quite badly.

- Underlying PBT has plunged from £4.7m to £(0.9m) loss.

- Placing in April raised £6.3m, at 25p per share, and was material dilution at 33%.

- Q1 (May-July) activity improving, slightly ahead of mgt expectations

- Advanced discussions with lenders re larger borrowing facilities

Balance sheet - quite strong, but top-heavy with lots of fixed assets (£38.6m) - so a capital intensive business. NTAV: £43.7m, which is more than the market cap - indicating that the market currently thinks this business is making inefficient use of its capital.

Outlook -

Whilst the majority of customer sites have safely re-opened and trading for the first quarter of FY2021 was encouraging in the circumstances, the exact trajectory of the wider industry recovery remains uncertain. The Board is mindful that this market uncertainty will likely persist well into the current financial year. However, the Group's customer focused approach and committed investment programmes across several sectors, gives the Board confidence for the Group's prospects over the medium-term.

.

My opinion - on a quick skim of the numbers, I think this looks a potentially interesting recovery share. If it can get back to the level of profits made in 2016-18 (see graph 2 below), then the share price would be a good bit higher than it is now. Although as graph 4 shows, it's never going to be on a high PER, which limits the upside.

.

.

Another key positive for me, is the asset backing. That underpins, and limits the downside risk, and banks like lending against assets, as it gives them some level of security. Looking at the 2019 Annual Report, it has £6.2m freehold property (security for bank borrowings).

Overall then, quite an interesting potential recovery share, that looks well underpinned by assets.

.

That's it from me today, and for the week! Thank you for your interesting comments!

Have a great weekend :-)

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.