Good morning everyone,

The RNS stream today is not exactly fireworks, but you've made a few suggestions in the comments so I will have a look at:

- Carillion (LON:CLLN)

- Mobile Streams (LON:MOS)

- Action Hotels (LON:AHCG)

I'm also making a short comment on Bitcoin, adding to Paul's comments yesterday, so I hope you don't have Bitcoin fatigue!

Regards,

Graham

Bitcoin (obligatory comment)

Firstly, bear in mind that I am a nocoiner (someone who doesn't own any crypto-coins). So perhaps I'm bitter about never buying any, despite being aware of them for longer than most people? I don't think I am bitter. But maybe it's unconscious?

Anyway, I did consider the investment merits of bitcoin, and rejected it.

The practical argument

In simple terms, my reason was as follows: while the supply of bitcoin may be limited, the supply of crypto-currency in general is unlimited. There are over 1,000 crypto-currencies, and more are being created all the time.

So buying bitcoin as an investment is not a bet on crypto-currency in general succeeding. It's a bet on that specific crypto-currency succeeding.

Based on my limited reading on the subject, litecoin appears to be a far superior currency than bitcoin. And as things currently stand, the size of the bitcoin network has resulted in transaction fees running into the tens of dollars. This makes bitcoin impractical for micro-payments and effectively renders it useless as an everyday medium of exchange.

There are plenty of other currencies to choose from, so why should bitcoin be the best? It's quite reasonable to think that some other crypto-currency will eventually overtake it in popularity, despite bitcoin's first-mover advantage.

Maybe I should have bought a crypto ETF, to hedge my doubts about bitcoin and my lack of ability to predict a crypto-winner? Perhaps. That's a much stronger argument versus buying one coin in particular.

The economic argument

But there's something else holding me back.

I've made no secret about the fact that I'm a goldbug, and have always had an interest in the gold standard.

There's a thing in economics called the Regression Theorem (by Mises). My understanding of this, which I developed before bitcoin was invented, explained that money gradually emerged as the most marketable commodity in a barter economy.

If you think of a pre-money economy, you have people bartering cattle, wheat, metals, etc. At some point, a commodity which is widely demanded becomes attractive merely for its use in exchange. So you get people accepting it as a means of payment, even though they don't plan to use it themselves. But they know they can use it to buy things, since other people want to use it.

Eventually, one commodity becomes the common means of payment for the entire economy - the money.

The problem with crypto-currency is that it has no use, except as a currency. Unlike gold and silver, we can't do anything with in the real world, except use it as a currency.

So crypto lacks that foundation, that underlying reason for someone to want to hold it. The Regression Theorem doesn't apply.

We can understand why people use paper monies: because we are legally compelled to. We have to use these paper successors to gold. And that's always a strong economic argument to do something - to avoid going to prison. But crypto lacks both the underlying use value and the legal compulsion.

Conclusion

I might add, in conclusion, that my practical and economic arguments are related to each other. It's no coincidence that an asset with an infinity supply is also an asset which has no economic value. Those two qualities tend to be related to each other! For example, it's not easy to sell air in normal conditions and at normal altitudes. It has an infinite supply in normal conditions, so even though it's useful, it has no economic value.

I should add that some people have gone to great lengths to revise and update the Regression Theorem, and to explain how crypto does not violate it and therefore makes good economic sense to be used as money. Perhaps I am not smart enough or have not spent enough time trying to understand these arguments. I will happily revise my opinion if it turns out that I'm wrong, but these arguments are unconvincing to me. I think that anyone who railed against "fiat currency" prior to 2009, should still be sceptical about it today.

Perhaps if I was really smart, I would have done the same as Charlie Munger (at 38:40). Charlie says regarding crypto-currencies:

"I think it's perfectly asinine to even pause to think about them."

Carillion (LON:CLLN)

- Share price: 17.6p (+2%)

- No. of shares: 430 million

- Market cap: £76 million

Update on financial covenant deferral

A quick update on this large support services business which has fallen on hard times.

It has achieved deferral of its covenant tests from 31 December until 30 April 2018.

This is standard procedure for a company in breach of its tests.

Discussions with stakeholders (i.e. lenders) are "progressing well", as it seeks a solution to reduce debt and fix the balance sheet.

Checking my notes and previous comments on Carillion, net debt for 2017 is c. £900 million on average.

So the enterprise value here is significant. If it does fix the balance sheet and avoid shrinking too much, it will probably once again be too large for coverage in the SCVR. Although I suppose it's possible that sceptical investors might give new-Carillion a much weaker valuation rating, in which case we might be covering it for a while!

Carillion is still the UK's most shorted stock, whether measured by the number of shares sold short in disclosable positions, or the number of funds who have disclosed their shorts on it.

I'm a bit surprised that this is still the case. Surely a market cap of £76 million is getting into the sort of small-cap territory where the risk of a short squeeze begins to outweigh the benefits of maintaining the short?

These funds apparently beg to differ and are holding on for a maximum additional gain of just £12 million, if the shares head to zero from here.

At least they will be enjoying a little bit of Christmas cheer, unlike the long-suffering shareholders. In my opinion, these shares are close to worthless prior to recapitalisation.

Mobile Streams (LON:MOS)

- Share price: 2.75p (unchanged)

- No. of shares: 91.6 million

- Market cap: £2.5 million

I agreed to cover this before checking the market cap. Silly mistake! I bet that a handful of you own houses worth more than this.

Anyway, let's see what it's all about. Paul (who owns shares in £MOS) can also be found commenting on it in the thread below.

Mobile Streams licenses and distributes a wide range of mobile content including games and apps that are retailed around the world, primarily in emerging markets. The Company's main operations are in Latin America and in particular Argentina, with recent expansion into India.

Sales for the year to June 2017 collapsed by more than 50% as a consequence of weakness in the company's main operation in Argentina. The explanation is partially as follows:

During the period, both the Group's Mobile Internet revenues and its Mobile Operator revenues decreased. As consumers steadily update their phones from legacy feature and flip phone models to smartphones, they have generally used the operator content portals less.

I hope I'll be corrected if I'm wrong, but the company is buying up games and then seeking to distribute them via carrier portals. The problem with this is that people don't use carrier portals when they have an iPhone or a good Android phone. They use the Apple Store or Google Play.

The company owns mobilegaming.com, which looks terrible on a desktop but does look a little bit better on a phone.

The first game on sale there is Flying Birds 2, which is an obvious rip-off of Angry Birds. The second game is Farm Ninja, which is an obvious rip-off of Fruit Ninja. It's also got Solitaire, math games, etc.

So it looks to me as if the company is buying rip-offs of famous games, and other very cheap titles, and selling them to consumers who can't afford or can't access anything else.

And since the Argentinian consumer has moved up the food chain, Mobile Streams is moving on to try this model in Indian.

The roll-out in India is progressing well:

Mobile Streams now has direct carrier billing with five of the leading six Indian telecom operators so that it can bill its mobilegaming.com games service conveniently and easily. Four of these connections are live and one is currently in the integration phase.

So perhaps there will be an opportunity for them to make money in India, for a while?

The company made a £1.5 million pre-tax loss in the most recent financial year, on £5.7 million of revenue. It had cash of £2.2 million.

In the prior year, when revenues were more than twice that level, it still made a loss.

It has reduced headcount very significantly, so perhaps the costs will be under control now. And revenues in Argentina are said to have stabilised.

On balance, It looks to me as if the company will do extremely well to avoid raising any more funds. Not investment-grade by any means. This is punting territory!

Action Hotels (LON:AHCG)

- Share price: 28p (unchanged)

- No. of shares: 148 million

- Market cap: £41 million

Related party transaction and trading update

Red-flag alert. This is an AIM-listed stock which is incorporated in Jersey, has most of its operations in the Middle East, and 66% of shares are held by the Chairman who is also a major lender to the company.

So let's tread with caution.

This is a hotel group which owns and operates 3- and 4-star branded hotels, mostly under the ibis brand name (ibis is owned by Accor, listed in Paris with ticker ACP).

As with every property company, I immediately check the NAV. At the interim results (for June 2017), NAV was $192 million 106p per share. So this is trading at a very considerable discount.

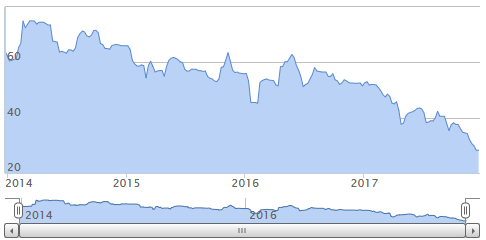

The shares have been sliding more or less continuously since the Dec 2013 IPO:

The NAV calculation for June 2017 was based on hotels and land valued at c. $475 million, offset by $253 million of borrowings (of course there are plenty of other items on the balance sheet).

If you trust the numbers and the management, this looks highly attractive at first glance.

Related party deals

The main question here is probably whether minority shareholders are going to ultimately get a good deal from the major shareholder, from whom the company is borrowing money and leasing hotels.

Actions both borrows from and lends to related parties (controlled by the major shareholder). It buys services from related parties. And according to last year's annual report, it sold an investment property to its major shareholder. It also "wrote off related party balances" worth some $600k. In other words, it is constantly interacting with its major shareholder.

Also, there is a very complicated corporate structure which means that Action does not own the voting shares in its own operating subsidiary! Instead, the related party owns all of the voting rights, but it gives Action the power of attorney to vote on its behalf.

I can't see what the overall interest rate is, but Action is paying interest at rates of between 4-8% on various international loans, and 9.9% in loans to its related parties. This is a higher rate than the rate which it receives on loans to related parties.

The result is that finance costs have mostly cancelled out Action's adjusted EBITDA, and it has been making a loss since 2016. It has also failed to comply with terms of various loan agreements (i.e. covenants), but lenders have been forgiving.

Today's news

Sorry for the preamble, but the above seems like essential background info!

Today, we learn that the related party is giving Action a waiver on some rent which Action owes, as a "one-off occurrence". This will help to mitigate this year's expected poor performance against original expectations, and I interpret it as a gesture of goodwill from the related party to Action's minority shareholders.

We also learn the company is delaying another hotel opening, in order to concentrate available resources on a project in Australia opening in April 2018.

My opinion

I'm actually quite intrigued about this share. Maybe it has reached such a bombed-out discount to NAV that it actually represents good value, despite all the issues it faces?

The hotel valuations are continuously updated, so if they are at all reliable then the NAV should indeed be a decent measure of the book value. The complicating factors are:

- Very complicated relationship with the related party, with many opportunities for minority shareholders to potentially be mistreated. So there is a lot of trust needed in the majority shareholder.

- The economy in the Gulf is still suffering from lower oil prices than were anticipated several years ago. Luxury spending has been badly hurt. Action says it is positioned in the mid-market sector, so it is not hurting quite so badly as the five-star hotels.

- If the valuations are wrong, then this has a disproportionate effect on the NAV, given the leverage involved.

- Failure to comply with loan covenants suggests there is some potential for distress, though lenders have been very relaxed about it.

- High interest rates on loans make it difficult for Action to generate really strong returns for equity investors.

I'll keep an eye on this one from now on, in case it turns out to be a diamond in the rough!

Real Good Food (LON:RGD)

- Share price: 21.75p (+2%) - market closed before results announcement.

- No. of shares: 78 million

- Market cap: £17 million

Interim results/further funding

This is a very sneaky move by this food manufacturer and distributor - putting an RNS out after the market closed. Thanks to shanklin in the comments for bringing this to my attention.

As part of a re-forecasting exercise the Board has identified that further substantial additional funding will be required over the coming twelve months for working capital and investment purposes in order to implement the Group's business plan as it continues to grow. The Board is currently exploring its options as to how this additional funding will be financed, which include, inter alia, the issuance of new equity.

Th company is suffering a cash crunch and in order to survive Q1 2018 and release its interim statements with a going concern basis, it is raising £3 million from its major shareholders, at a 10% interest rate.

Note 2:

An additional £3m funding... will ensure that the Group remains a going concern until the end of the first quarter based upon current forecasts and the Board believes this will provide sufficient time to source the additional funding. In the event that the Board is unable to source this additional finance, and in the unlikely event that the major shareholders, whose support has thus far been strong and continuing, decide not to provide further support, then the Directors cannot be certain that the Group will be able to continue as a going concern.

We definitely need to put a black mark against companies which release statements at the last available opportunity or when they hope everybody will be on holiday. Why not just admit things are going badly?

That's it from me for the long weekend. Have a great Christmas and I will see you at some stage next week.

Best wishes

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.