Good morning! Today I'm interested to look at:

- Thalassa Holdings (LON:THAL) - final results

- Prime People (LON:PRP) - final results

- M Winkworth (LON:WINK) - return of capital

If there is time, I will then circle back to one or two stocks hanging over from earlier in the week. Cheers!

Graham

Thalassa Holdings (LON:THAL)

- Share price: 84.5p (unch.)

- No. of shares: 19.1 million

- Market cap: £16 million

Final Results for the year ended 31 December 2017

The long-awaited results from this holding company are out at last.

It's a book value play, so I'm not too concerned about the profit figure. Thalassa was profitable in 2017 due to the business which it has disposed of, so the profit figure for 2017 is in any case irrelevant to the future.

Thalassa's balance sheet equity reduced last year from $27.3 million to $25.6 million, because of its share buy-backs.

The business disposal was completed on 1 January 2018, so it is not reflected in the financial statements issued today.

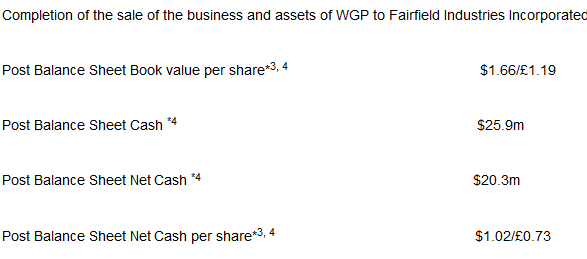

The company helpfully provides a pro forma look at the position after disposal:

The total book value includes some very uncertain values. I can break it down like this:

- Net Cash: $20.3 million = £15.3 million (latest exchange rates)

- 25% stake in Local Shopping Reit (LON:LSR) = £6.7 million (latest share price)

We then have the company's 100% stake in Autonomous Robotics Ltd ("ARL").

ARL is still in prototype stage. External financing for the project was sought in 2017, but has not materialised yet. The operating loss generated by ARL/Thalassa for the year amounts to $1.7 million.

I have no idea if ARL has positive value, so will write it down to zero for my own purposes.

A conservative estimate for Thalassa's book value is therefore £15.3 + £6.7 million = £22 million, or 115p per share, to be reduced by further short-term losses at ARL.

There is another $10 million payment the company might receive in contingent consideration for its disposal last year. This would boost NAV to 154p per share.

Strategy

The Chairman's statement is fascinating.

As Thalassa no longer generates any revenues, and is essentially now a cash shell with a start-up robotics business, there are basic questions over what its purpose is.

As I said in my earnings preview, I think that it could trade around NAV if it had a well-defined and reasonable investment strategy.

What are investors to make of this:

Management is and has been reviewing potential acquisitions without limitation to industry. As part of this exercise Management has reviewed all companies trading on AIM (883 as at 30 April 2018) but have so far failed to identify any potential and available acquisition targets selling at a discount to Management's view of their intrinsic value.

I wonder how long this exercise took - reviewing all 883 companies for their intrinsic value.

It's an impressive feat. I study companies for a living, and I manage to take a brief look at maybe 5 or 6 a day at the most. Usually, these are companies I've looked at before and excluding a bunch of sectors where I know that I have no expertise.

To examine all 883 companies trading on AIM and to value them must have taken a serious amount of work and involved considerable expertise.

And then to find that none of them are currently trading below intrinsic value? How miserly, to find that not a single stock out of 883 is trading at an attractive price!

Like me, the Chairman also likes to focus on Berkshire Hathaway's cash balance as an important financial metric. I do agree with him that cash is an attractive asset and that equities in general are probably overpriced. But I would still be inclined to think that there must be at least a few AIM shares trading at attractive prices.

(Actually, there is one AIM stock which Thalassa does believe to be undervalued, and which it is happy to purchase - its own.)

The Board "will continue to return cash either through the ongoing share buy-back programme or through a planned reduction in capital, as and when deemed appropriate".

This comes with a warning:

I would, however, point out that any premature return of capital could jeopardise Management's ability to realise targeted returns on the Company's current holdings.

My view

I'd love to find an attractive deep value situation, but I'm still on the sidelines as far as this stock is concerned.

My concern remains that the investment strategy is too vague and that it's impossible to predict how Thalassa's cash balance will be used. The Chairman believes that no AIM stocks are trading below intrinsic value, but is happy to buy and hold Local Shopping Reit (LON:LSR) and a highly speculative start-up. So really, anything could happen as far as future investments are concerned.

When we have clarity on the strategy, and assuming that the strategy is sensible, I would be very keen to buy into this at a deep discount to NAV. But probably not before then.

Prime People (LON:PRP)

- Share price: 79p (-6.5%)

- No. of shares: 11.8 million

- Market cap: £9 million

This group of recruitment businesses falls marginally below our £10 million cut-off.

Reminding myself what they do:

Since 2008 the Group has successfully broadened its focus to include provision of recruitment services for customer insight staff in the market research and data analysis sector, branded as Prime Insight, to the energy, & environmental sector as Macdonald & Company and the pharmaceutical research sector as Prime Pharma.

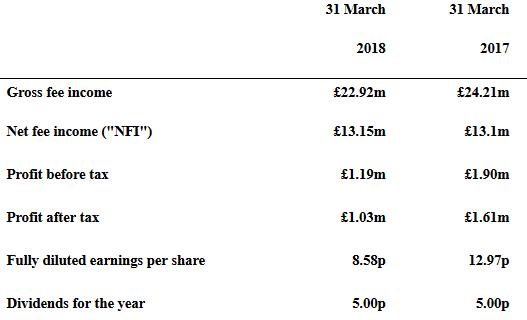

The dividend is unchanged this year, but most of the numbers are going the wrong way.

Revenues are down as contractors have had to move to the PAYE system under the new rules (IR35), and as a result, contracting revenues are down as a percentage of total.

Contract recruitment tends to be a more attractive business than permanent recruitment (higher lifetime value), but Permanent now accounts for more than 90% of PRP's revenues.

That makes for a less attractive profile compared to SThree (LON:STHR), for example, where Contract accounts for 67% of gross profits.

Anyway, here are PRP's numbers:

Profit has been hit by weaker performance in the international business, acquisition costs, higher staff costs and an IT upgrade.

Outlook is mostly positive but doesn't give anything away.

My opinion

PRP has a really clear set of KPIs which I won't go into here, but the bottom line is that I think profitability has a good chance to recover as management focus on returning these to their previous levels.

The detractors from profitability this year do strike me as "one-off" expenses, and it's refreshing that today's statement didn't try to hide them by using adjusted profit measures.

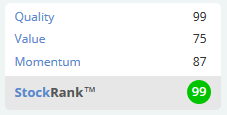

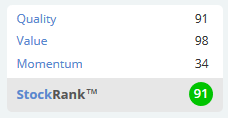

This stock has a mighty StockRank of 91 and although I'm not strongly motivated to invest in the recruitment sector myself, I imagine that investors will get a reasonable return from this.

M Winkworth (LON:WINK)

- Share price: 135p (+7%)

- No. of shares: 12.7 million

- Market cap: £17 million

It's nice to see a company being nice to its shareholders.

Winkworth is a franchised estate agency with about 100 offices, predominantly in London.

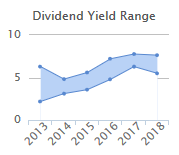

Its dividend yield has been creeping higher for several years:

Stocko puts the latest dividend yield at over 6% (using last night's figures).

The smallest companies tend to trade at the cheapest valuations. The flip-side of this is that when they perform well, and have shareholder-oriented management teams, you can get enormous dividends from them.

Winkworth has so much cash flowing, it has decided to get rid of an extra £1.1 million, via a return of capital to shareholders. Shareholders will get 9p in cash.

The company has been making quarterly (!) dividend payments, and these have recently crept up to 1.85p each. So the yield based on ordinary dividends alone is worth around 5.5% at the latest share price, according to my maths.

In its most recent results announcement, Winkworth condeded that its economic background was "testing".

Given its strong cash flows and modest growth ambitions in this environment, returning as much cash as possible to shareholders is the right thing to do.

And it can always ask shareholders to put money back into the business, if necessary:

We remain alert to acquisition opportunities and, should the need arise, we will approach shareholders to help fund any sizeable acquisitions. In the meantime, we continue to successfully grow our franchise network organically, with a further eight offices scheduled to be added in 2018."My opinion

Trading well in difficult conditions and generating plenty of cash for shareholders, there is lots to like about this tiddler.

I'm going to call it a day here. Have a fine weekend everyone.

Best,

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.