Good morning!

News today has thankfully calmed down a little, at least as far as UK small-caps are concerned.

This means I can go back and look at some of the stories I've missed this week:

Volvere (LON:VLE)- Sopheon (LON:SPE)

- Portmeirion (LON:PMP)

- FW Thorpe (LON:TFW)

- Xaar (LON:XAR)

- Safestyle UK (LON:SFE)

From today's news, I might look at:

- Henry Boot (LON:BOOT)

- Robinson (LON:RBN)

Volvere (LON:VLE)

- Share price: £11.25p

- No. of shares: 3.1 million

- Market cap: £35 million

(Please note that I have a long position in VLE.)

I've been slow to update on Volvere. This might seem strange, given that it's my biggest holding, at 16% of my portfolio.

However, I felt there was little to say, since not much had changed as a consequence of Tuesday's trading update.

This update was the first piece of news since October. Things move slowly in Volvere-land!

Results for the year ending December 2018:

- revenue from continuing operations improved to £18.6 million from £16.2 million. £18.3 million of revenue is attributable to Shire Foods. The rest to Sira Defence.

- underlying result before tax from continuing operations is £100k.

Segmental Analysis

Shire's profit before tax and intra-group charges was £790k.

Volvere plans to invest £2 million into Shire in 2019, in the form of new plant and equipment.

Francis wrote a great comment on Wednesday after attending the company presentation, explaining that the focus is now on expanding Shire's vegan/vegetarian and healthy pies. The product range has already expanded a lot over the past year.

I still have a pretty good impression of Shire: could it be worth £10 million+ on eventual disposal, or is that too much to hope for? It has a freehold property in Leamington Spa, blue-chip customers and a decent track record. I'd like to see it generate PBT before intra-group charges of £1 million+ this year, but I know that it operates in a fairly competitively sector so I'm not going to get carried away at this point.

On top of that we have Sira. Up until now, its results have been too small to move the needle. It remains small: revenues of £300k, profits of £60k.

Nice comment on Sira in the trading update, suggesting progress could be seen in 2019:

Although the company's financial performance was very similar to 2017, a number of reseller partnerships were signed in the period, which are expected to make a contribution in 2019 and beyond. The company continues to invest in its intellectual property which it believes is unique.

I'm not in a position to assess Sira's technology. Dozens of police forces are said to be using it, at least. If it does turn out to be a winner, I will see that as a bonus. At any rate, I'm confident that Volvere management won't lose money on it!

Cash

So that's where we are in terms of the operating businesses.

As far as the balance sheet is concerned, Volvere has net assets of £40.3 million, of which cash is £34.1 million. These numbers translate to NAV per share of 1292p and cash per share of 1100p.

I suppose the main problem for prospective investors might be the spread: there seems to be very little liquidity available in the shares, with a 1050p bid and a 1200p ask. Making a quick turn on this share is unlikely. If we hang around for a long time, however, I think we might do well. I've been here since May 2016.

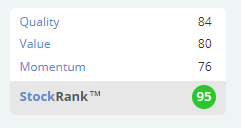

The StockRanks love it, calling it a Super Stock. This is before the Value Rank gets updated for the much higher book value following 2018's success!

Sopheon (LON:SPE)

- Share price: 915p (-6.6%)

- No. of shares: 10.1 million

- Market cap: £92 million ($121 million)

This share was near 1150p on Wednesday. A nasty fall over two days.

I've written about this software company before. thinking that it's strong performance justified a share price in the region of 1000p.

2018 numbers are great, as expected. They are "comfortably in line with already upgraded market expectations".

- Revenue $33.9 million (2017: $28.5 million)

- PBT $6.4 million (2017: $5.1 million)

- Net cash $16.7 million (2017: $9.5 million).

The enterprise value (market cap minus the December 2018 cash balance) is therefore $105 million.

Customer wins keep growing (18 versus 13 last year) and the company remains bullish on the widening applicability of its software for innovation and strategic management.

Current year revenue visibility is $20.6 million, 7% higher than a year ago. Two-thirds of revenues are coming from existing customers, suggesting some robustness to the company's income streams.

Outlook - confident that the company has a big opportunity. There is a significant increase to the proposed dividend. And there is the possibility of M&A deals, "provided they align with our strategic priorities".

Scary prospect - "over 40% of companies on the S&P 500 will no longer exist within 10 years due to their inability to operate with agility and speed in today's hyper paced changing markets". If that's true, it shows the importance of finding companies immune from the disruption (or which cause the disruption!).

Clear writing - I applaud Sopheon for writing clear and understandable prose throughout the results statement.

Why the share price fall?

It turns out that FY 2019 forecasts were slightly reduced as the Chairman signalled an intention "to accelerate investment and solidify our leadership position". The adjusted EBITDA estimate was reduced by 1%.

That might not seem like much, but when you have a company rated at a high level, I suppose there is always that risk of a re-rating lower, if growth starts to look a little weak. Revenue growth in 2019 is forecast at 9%, and adjusted EBITDA is expected to reduce year-on-year.

It's not the end of the world by any means. Long-term, the outlook here still sounds bright (though I've not had a close look at the company's products, so take that with all the necessary grains of salt!).

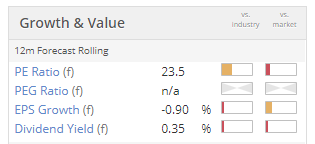

The problem is just that the rating demands the quick resumption of growth:

Considering the cash balance, which supports the valuation, I would think that this is worthy of further research at the current level. EV/trailing EBIT is c. 16x.

Portmeirion (LON:PMP)

- Share price: £10.70p (unch. today)

- No. of shares: 11 million

- Market cap: £117 million

This tableware group keeps making steady progress. 2018 was another record year.

It runs an efficient operation with good margins (around 11%) translating to even better ROE and ROCE, thanks in part to strong asset turnover (I discussed this metric earlier this week in relation to IQE (LON:IQE), and wanted to give a counter-example of a company whose asset turnover is actually rather good!).

Average assets at Portmeirion during 2018 were c. £66 million, from which it generated revenues of almost £90 million.

Only modest borrowings were used, and the current ratio finished the year with a very secure reading of almost 3x.

In other words, this looks to me like a solid copany earning good returns, in a safe way.

It has five brands: Portmeirion, Spode, Royal Worcester, Pimpernel and Way Lyrical.

There currently seems to be a mismatch between the valuation of Churchill China (LON:CHH) and the valuation at Portmeirion (LON:PMP), with PMP being the much cheaper of the two. Does anyone know why? CHH does earn a higher operating margin.

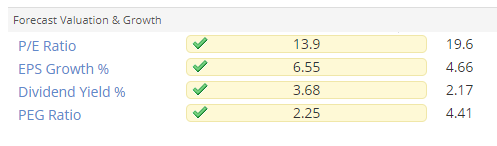

Looking at some valuation metrics, PMP is on the left-hand side and CHH is on the right-hand side (using Stocko's comparison tool):

FW Thorpe (LON:TFW)

- Share price: 325.5p (-0.2%)

- No. of shares: 116 million

- Market cap: £377 million

FW Thorpe Plc - a group of companies that design, manufacture and supply professional lighting systems - is pleased to announce its interim results for the six months ended 31 December 2018.

This is a highly-rated, family-controlled business.

These H1 FY 2019 interim results aren't great - a 10% decrease in operating profit - but the company says that most of the subsidiaries are trading around their H1 FY 2018 levels.

The company which lagged behind in H1 (Thorlux) is also said to be "back to 2018 levels".

However, results at some international sales offices are disappointing.

Outlook - this year won't be as good as last year, but it won't be a disaster, either. H2 should be better than H1. Conditions are "more buoyant than we previously predicted".

My view - not motivated to look into this any further, as the valuation looks very full and I think it will be difficult to find ways to justify this.

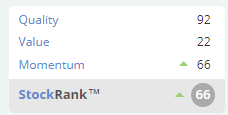

StockRanks agree with my assessment:

Xaar (LON:XAR)

- Share price: 118p (+1%)

- No. of shares: 78 million

- Market cap: £92 million

Xaar makes a big loss in 2018, as expected.

The cash balance has fallen a lot, too, due to investments in new technologies (3D printing!).

The old revenue stream, based on unstable demand from the Chinese ceramics market, has collapsed. The company says that 79% of 2018 revenue was derived from products and businesses introduced in the last 3 years.

Outlook - an "exciting future, even with some risks plainly in view".

My view - I'd be interested to buy into this on a deep value basis, i.e. the valuation fell so low that a competitor or larger business could buy it up "for free".

The balance sheet shows net assets of £132 million, or net tangible assets of £94 million.

More losses are set to be incurred this year and next year, so unfortunately it's probably still too soon to get into this as a deep value play. I might keep an eye on it, though.

Safestyle UK (LON:SFE)

- Share price: 72.7p (+3%)

- No. of shares: 83 million

- Market cap: £60 million

Safestyle UK plc (AIM: SFE), the leading UK-focused retailer and manufacturer of PVCu replacement windows and doors for the homeowner market, today announces its final results for the 12 months ended 31 December 2018.

Another share with predictably bad results. I mention it just out of morbid curiosity.

There is an underlying loss of £8.7 million (2017: £15.1 million profit) and a statutory loss of £16.3 million (2017: £13.8 million).

What an amazing deterioration in performance. The cause was "an aggressive new market entrant", i.e. SafeGlaze.

SafeGlaze has itself gone into administration. It went into administration shortly after it signed a commercial agreement not to compete with Safestyle.

The founder of Safeglaze also happens to be a co-founder of Safestyle, and it sounds like he will be very handsomely rewarded by this commercial agreement.

Outlook - the turnaround is underway and the company is striving to get back to profitability.

My view - not something I'd want to invest in, seeing how easily it was disrupted by a former employee. But I'll be interested to see how it does now that the former employee has promised not to dirsupt them for the time being.

That's all for now. Thanks for dropping by and for your comments.

Cheers

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.