Good morning!

Today we have:

- Fulham Shore (LON:FUL) - AGM statement and trading update

- Sopheon (LON:SPE) - half yearly report

- Macfarlane (LON:MACF) - half year report

- Wey Education (LON:WEY) - trading update

- Arcontech (LON:ARC) - final results

Tracsis (LON:TRCS)

- Share price: 723p (unch.)

- No. of shares: 28 million

- Market cap: £205 million

Before we get into today's news, I'd like to mention that John McArthur (CEO of Tracsis (LON:TRCS) ) joined us in the comments thread for yesterday's report.

I had said that I wouldn't pay its high valuation multiple for any company in its sector, and Mr McArthur asked me to explain.

The simple answer is that I viewed Tracsis as a transportation consultancy, software and hardware business, on the basis of what it says on its own website, and having browsed the websites for its various services.

Speaking to Leo in the comments, Mr McArthur writes:

"We are not a 'software consultancy' business but simply a technology business in its purest sense i.e. we are first and foremost a software company that develops and licenses over a dozen software products which we own all the IP for. We were originally a spin out from the University of Leeds School of Computing and employ over 100 full time professional software developers who generally have very strong maths/physics or engineering backgrounds. Latterly we have also developed our own hardware and now also do a variety of data capture work using all sorts of novel technologies.

I understand the point you are trying to make about consultancy businesses and 'people businesses' but this simply isn't the case with Tracsis. The vast majority of our profit is derived from long term, software licensing contracts with blue chip customers and less than 10% of our income is consultancy. The consultancy we do undertake is highly specialised and is generally derived from doing bespoke projects by using our own products which will be similar to all software companies."

It's always helpful to hear things from management's point of view, so thank you very much John for putting this across!

Within reason, I agree with companies having a "right to reply" when we speak about them. That's why I'm happy to paste this comment here.

With regard to Tracsis as an investment, less than 10% of income being derived from consultancy work improves my perception of the quality of the business.

My concern, and the reason I wouldn't pay a high rating for the shares as an outsider, is that it seems very difficult (for an outsider) to predict the future success or failure of this type of company (while acknowledging that Tracsis may be, and probably is, a stand-out leader in its field).

For example, yesterday's trading update refers "to the ongoing delivery of a major software implementation at a major UK Train Operating Company", and "the renewal of a major multi-year contract for traffic analysis across the national road network".

These are lumpy contracts with big customers. According to Tracsis' annual report for 2017, 16% of revenues were from its largest customer:

The Group has a large number of customers but derives a significant amount of business from one key customer for a large part of its rail Technology & Services offering. There can be no guarantee as to the timing or quantum of any potential future orders from this customer. Furthermore, the Group’s Traffic & Data Services division operates under a number of Framework Agreements with one large one in particular from whom a significant amount of revenue is obtained.

This is very far from Terry Smith's preferred type of company, which makes its money from "a large number of everyday repeat transactions".

Other concerns relating to the type of business are:

- Software improves so quickly that it can be hard to predict (as an outsider) which particular companies will still be competitive in 5 or 10 years. To make for a high-quality investment, it must have outstanding barriers to entry (e.g. Windows).

- To the extent that a company relies on extremely skilled developers, there is a risk of losing them to private companies who can pay them more (since private companies don't have to worry about PLC costs and dividends to outsiders).

Tracsis has made significant share based payments to staff, which has doubtless helped with retention. In 2016, it made £1.1 million of share based payments (PBT was £4 million) and in 2017 it made £1.3 million of share based payments (PBT was £4.6 million). Dilution for the external shareholder is the cost of keeping good staff.

Mr McArthur himself could be granted more than 125,000 effectively nil-cost share options (strike price 0.4p), depending on EPS targets and on total shareholder return each year (share price gains plus dividends).

For example, 43,000 options from the 2016 LTIP (worth about £300k at a 720p share price) will be granted based on EPS and share price movements in the current year as follows:

Full award is only payable should statutory diluted EPS for the year ending 31 July 2019 be 17.38p, and TSR versus the peer group is in the top quartile.

Regular readers will know that I don't believe management teams should be incentivised on the basis of share price movements, but it is a common feature of remuneration plans today.

Having said that, I'm sure it is necessary to pay the senior management and the staff at Tracsis very well. After all, they are engaged in highly specialised software development, and these skills are rare.

Does it make for a good investment? I defer to the wisdom of Peter Lynch, who said:

“Go for a business that any idiot can run – because sooner or later any idiot probably is going to be running it.”

Fulham Shore (LON:FUL)

- Share price: 12.25p (+8%)

- No. of shares: 571 million

- Market cap: £70 million

AGM Statement and Trading Update

This group of restaurants (Franco Manca and The Real Greek) reports "encouraging revenues increases" in the first 21 weeks of the financial year.

The portfolio of restaurants increases marginally to 58 (16x The Real Greek and 42x Franco Manca).

In a short update, the company says

- it is negotiating for a number of new locations

- it will fund them "largely through internally generated cash flow"

- more properties are becoming available thanks to conditions in the wider retail and dining out sectors.

The last time Paul covered this share, in March, he said Fulham Shore was "the only decent casual dining sector share to even consider buying right now" (at a share price of 9p).

He's not the only one with a positive view of the company. This morning, independent advisory service Langton Capital said that Fulham Shore's announcement confirms there are some winners in the casual dining sector.

We all know that things are bad for restaurants right now. Perhaps the Franco Manca business model - cheap sourdough pizzas from a limited menu - is sufficiently original that it can emerge into a position of strength over the next few years?

If you're determined to invest in restaurants despite the obvious macro headwinds, it would make sense to take a close look at this.

Sopheon (LON:SPE)

- Share price: 1000p (+6%)

- No. of shares: 10.1 million

- Market cap: £101 million

Sopheon plc, the international provider of software and services for Enterprise Innovation Management solutions, announces its unaudited half-yearly financial report for the six months ended 30 June 2018 together....

This software company has been performing extremely well, and the trend continues. It has a habit of beating its owns forecasts.

Trading remains comfortably in line with expectations.

We have a 27% increase in revenue and a 62% increase in PBT for H1 2018.

These are statutory (or as I like to say, "actual") results, not adjusted numbers.

$1.2 million of development costs were capitalised (last year: $1 million), but these are matched by an amortisation charge of $1.1 million (last year: $1.1 million), so I don't view this as problematic.

Revenue visibility for the full year is $27.2 million, up by 34% compared to the same measurement a year ago.

Putting it roughly, this refers to the revenue that has already been signed for the full-year, including recurring revenue streams. It doesn't include new business expected to be signed during the rest of the year.

Reaching $27.2 million leaves just another few million to go, to hit the Stocko forecast of $31 million for 2018.

Last year, the difference between half-year visibility and the full-year out-turn was $8.2 million, though it will probably be difficult to repeat such a strong performance.

I should note that business has been a bit lumpy in the past. Last year, Sopheon's largest customer was responsible for 7% of sales. The previous year, that same customer was responsible for 20% of sales.

I'd be encouraged to see the customer concentration risk continue to fall. Signs are positive in this regard: it made 9 new customer wins in H1 2018, compared to 6 in H1 2017.

What's really interesting is the widespread application of Sopheon's software. New customers have been won in the following industries: vehicle manufacturing, food, industrial manufacturing, aerospace and defense.

Balance sheet - continues to look good, net assets of $21.6 million or NCAV (current assets minus total liabilities) of $13.1 million. A strong net cash position.

My view - I retain my positive impression of Sopheon. It has an increasingly diverse customer base and a software platform that is flexible enough to be used for a variety of purposes across different industries.

In terms of the immediate outlook, pre-tax profit is expected to dip during the current year, thanks to the company's hiring plans. It admits that finding the right people is a challenge, "as it is for many other technology companies". Expenses are set to increase, holding back profitability this year, but we should hopefully see profitability improving again in 2019.

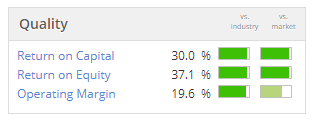

Overall, the company's financial returns have been excellent:

Given its very strong track record in relation to ROCE, the diverse applicability of its software platform, and its reduced customer concentration risk (hopefully reducing again in 2018), this is an example of a software company where I suspect that its high rating is justified.

Macfarlane (LON:MACF)

- Share price: 107p (+5%)

- No. of shares: 157.5 million

- Market cap: £169 million

This Scottish packaging distribution business is one that I've been meaning to study for a while. It has been a solid performer, growing by acquisitions and also with some organic growth.

H1 highlights:

- Packaging distribution sales up 5% organically, 14% in total.

- PBT up 39% to £3.5 million. Seasonal uplift from e-commerce expected in H2 (Christmas gift season?), so the board has confidence that full year expectations will be achieved.

- Net debt falls to £11.1 million, very light in comparison to profitability of the business. Bank facility is £30 million.

- Interim dividend increases 8%.

There have been a couple of acquisitions so far in H2, but they are very small: max consideration £3.5 million for both. That's fine.

Outlook statement doesn't reveal any additional detail. 2018 is set to be another successful year.

My view

The commentary released today is very short so we haven't got a huge amount to work with. Overall, though, I do have a positive impression of this group.

The manufacturing business doesn't seem to be making much money, but the distribution segment is consistently profitable.

I'm intrigued by the potential for top-line growth to continue feeding down into even faster bottom line growth.

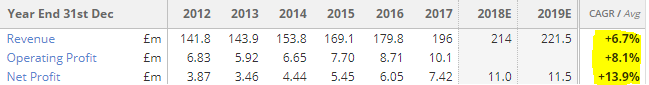

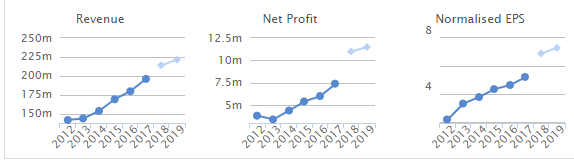

Stocko calculates the CAGR (compound annual growth rate) of revenues to be 6.7%, while the CAGR for net income is 13.9%, i.e. bottom line growing much faster than top line:

We saw more of the same today, as PBT growth vastly outstripped revenue growth.

Within the packaging division, I estimate the degree of operating leverage to be c. 7x, i.e. at constant gross margins, with fixed overheads, operating profit could grow at 7x the rate of sales growth.

This is also a source of risk, but for a company with positive momentum behind it, the value of the opportunity can outweigh the risk.

See how the forecasts are for momentum to build:

So I have a positive view of the company and don't view the shares as expensive at current levels (despite the fact that they have already multi-bagged over the past few years).

Wey Education (LON:WEY)

- Share price: 15.75p (+12%)

- No. of shares: 130 million

- Market cap: £20.5 million

Wey Education plc (AIM: WEY), the educational services group provides this trading update for its year ending 31 August 2018 and announces certain other matters.

I looked at this company when it released interim results in May, on a day when the share price crashed by over 30%.

The shares have continued to drift lower since then.

Thankfully, today's update is a lot more positive. Sales will exceed expectations, while underlying P&L will be in line with expectations.

Sales in its online high school business, Interhigh, improved by 20%.

Its Chinese JV is about to start making sales, and the Nigerian subsidiary should begin operating some time in the Autumn.

Adjusted PBT is set to come in at £400k - £500k, but that's only after very heavily adjusting it. It's still at a very early stage in its plans, so it's not making any real profits.

There are no "current intentions" to issue shares, but the Board is seeking the authority to issue up to 40 million new shares, so we can't rule out the possibility that they will. Paul was caught out when the company did a placing at a 33% discount to the prevailing share price last November.

My view

Online education is a growing sector all around the world, and I wish the company well in its new activities in China and Nigeria.

For the same reasons as I mentioned last time, it's not something I would personally invest in yet. But I will keep an eye on it for signs that it is succeeding.

Arcontech (LON:ARC)

- Share price: 128.5p (+9%)

- No. of shares: 13 million

- Market cap: £17 million

Arcontech (AIM: ARC), the provider of products and services for real-time financial market data processing and trading, is pleased to announce its final audited results for the year ended 30 June 2018.

This company has been listed since 2000, and these are record results:

- Revenue up 9% to £2.5 million.

- PBT £600k.

- Cash £3.2 million.

The company signed up two new clients during the year and has six other clients running trials.

Outlook: a positive sales pipeline, but with a long and complex sales cycle.

My view: Looks very small and slow-moving, but maybe it has potential? There is nothing jumping out at me from these results.

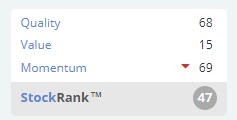

The algorithms also view it as fairly average:

Ok, I'm out of time for today. Cheers!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.