Good morning!

These appear to be the most relevant announcements for today:

- Hostelworld (LON:HSW) - interim results

- Veltyco (LON:VLTY) - update

- Tracsis (LON:TRCS) - trading update

- Angling Direct (LON:ANG) - half year trading update

- GAME Digital (LON:GMD) - trading and business update

Paul is looking at one or two of these, so today's report is going to be a joint effort.

Cheers,

Graham

Hostelworld (LON:HSW)

- Share price: 266p (-9%)

- No. of shares: 96 million

- Market cap: £254 million

2018 Interim Results Announcement

Hostelworld, the world's leading hostel-focused online booking platform, is pleased to announce its interim results for the period ended 30 June 2018.

Paul wrote an appropriately cautious comment on this back in January, when the share price was 379p.

Value is beginning to show:

Today's results (to June) are said to be in line with expectations. But July and August were tough and the outlook sounds quite poor:

Overall, our first half results were in line with our expectations. As previously reported, the market, particularly in Europe, is increasingly competitive. In addition the World Cup and the unusually hot weather in Europe have also led to a softness in bookings in the peak summer months of July and August. If these trends continue like for like, growth in Group bookings is likely to be flat for the full year given the expected declines in our supporting brands.

Indeed, it's safe to assume that competition is fierce in this sector.

I just googled the phrase "book hostel", and the four ads which appeared at the top were airbnb, booking.com, hostelworld and hotels.com (owned by Expedia). Those are some serious companies to face off against for ad space.

The Results

Headline figures and KPIs announced today aren't that bad:

- Group bookings up 2%. The Hostelworld brand continues to do better than the rest, and accounts for the vast majority of activity.

- Average booking value up 5% on a constant-currency basis.

- Bookings from not-paid-for channels up to 64% of total.

- Marketing "investment" per booking down 7%

This is all fine.

Actually, it reminds me a little of Gocompare.Com (LON:GOCO), another website business we covered recently. It reported flat revenues but with increased margins and higher profitability per customer at its interim results.

In a similar way, HSW reports a natural reduction in variable marketing expenses in response to consumer demand.

These websites seem very flexible on costs - a nice feature.

Deferred Revenue

On the other hand, there is something going on with deferred revenue, which needs to be explained. I'll do the best I can!

Normally, a customer pays a deposit to HSW when they make their booking, and then pays the hostel the balance when they arrive.

If the deposit is non-refundable, HSW recognises it as revenue on its income statement very quickly.

HSW now allows an option where customers can cancel their booking for free, and get their deposit back.

This looks like the right decision from a business point of view, but it means that these customer deposits can't immediately be recognised as revenue, since there is a possibility they will have to be refunded. Instead, the cash amounts are matched on the balance sheet by a liability called "deferred revenue" (or an equivalent name).

HSW has €4.2 million of deferred revenue from free cancellation bookings on its balance sheet now, whereas it had none last year.

Most of this should translate into revenue on the income statement in future periods, except for those bookings which do get cancelled.

If all of this deferred revenue had made it to the income statement instead, then net revenue for the period would be more like €46.8 million for H1 2018, rather than the €42.6 million which was reported (a 9% decline compared to last year).

€46.8 million would be a little bit misleading too, since we have to presume that some customers are going to cancel their bookings. I'm in no position to guess how many.

Revenue last year (H1 2017) was €46.6 million, so it would only take €200k of cancellations (about 5% of the deferred revenue) to reduce the revenue performance for H1 2018 below that of H1 2017.

This calculation doesn't take into account the impact of currency movements, which appear to have held back the overall results by 5% - 6%.

So I suspect that on a constant currency basis, a true like-for-like comparison should have a small improvement in H1 2018 compared to H1 2017 (although this does depend on how many people end up asking for their deposits back).

Apologies if this was a bit convoluted - I tried to make it as simple as possible!

Valuation

HSW appears to be performing reasonably well. The numbers presented today need to be adjusted for the introduction of a free cancellation option. When you do that, they don't look too bad.

The balance sheet is loaded with intangibles and while the company's return on tangible capital is probably excellent, return on total capital as officially reported is not too great:

For example, the cost of its domain names is recorded at €215 million.

Every six months, it writes down the value of domain names by about €5 million as an amortisation charge.

One way to go about valuing the company would be to forget about the intangibles entirely and use free cash flow instead.

Free cash flow generation looks pretty good to me: about €13 million again during the most recent six-month period, about the same as last year. €21.5 million was generated for the full-year 2017.

The market cap is c. €280 million at latest exchange rates. This makes for a modest free cash flow multiple (c. 13x).

Of course, there is no growth expected this year. So there is a good reason for it to be cheap.

But I do believe it's worth researching in further detail. If it remains strong in its niche, then perhaps it can hold its own against airbnb and the rest?

Veltyco (LON:VLTY)

- Share price: 37.5p (unch.)

- No. of shares: 75 million

- Market cap: £28 million

Contract renewed, receivables, launch of own brand

This is an Isle of Man-registered company. It previously focused on marketing and lead generation for some gambling and financial trading websites. It's now also hoping to develop its own brands.

It had a series of very strong updates over the past year, but then warned that banks were preventing it from getting paid by financial trading customers - blaming "internal processes" at the banks.

It has suffered a loss of confidence from investors:

Let's review the contents of this update:

- Marketing agreement for the Betsafe brand (owned by Bettson) renewed in Germany until May 2021.

Veltyco already had an agreement to market Betsafe in Germany, Austria and Switzerland until 2020. So this extension for Germany until 2021 doesn't seem worth getting overly excited about.

Betsafe is described as a "core part" of Veltyco's operations. Veltyco's reliance on a small number of major clients such as this one, although hopefully diminishing over time as it develops its own brands, is a big part of the risk with this share.

- Receivables excluding some accrued income is €8.9 million. The cash balance is €1.3 million with a further €650k due by the end of this month (August).

Of the €8.9 million receivables balance, €5.4 million is due from an entity called Celestial Trading Limited, "which now operates the online financial trading brands". It owes €1.5 million in relation to activities from 2017.

"Good progress is being made with Celestial to reduce the amounts due to the Company" - it sounds like the amounts are severely overdue.

The Financial Markets Authority of Austria issued a public warning in June that Celestial Trading:

is not entitled to carry out banking transactions in Austria that require a licence. The provider is therefore neither permitted to trade on a commercial basis on its own account or on behalf of others (Article 1 para. 1 no. 7 BWG).

But if you visit Celestial Trading's website, "tradovest", it describes itself as "the world's leading trading platform", offering CFDs and FX trading on over 1,000 assets.

On its Contact Us page, it offers phone numbers for seven European states, including Austria.

Online betting is a grimy industry, and this looks to be an example of just how grimy it can get.

Maybe this is why the banks had a problem sending Veltyco its commissions. If Celestial is up to no good, maybe they didn't want to process payments for it.

Or it could be the case that Celestial is simply choosing to pay Veltyco very slowly, because it feels like it can.

The situation reminds me of that scene from the movie Casino, when the mafiosos skimming the property are disgusted to realise that they themselves are getting robbed, by their employees.

The point is that at the lower ends of the gambling and online trading business, nobody is to be trusted.

- Launch of own regulated brand

This news is a bit more positive. Rather than doing all the leg work of generating leads for various customers, it is looking to launch its own financial trading business. We already knew that it had acquired a large database of users and was planning to do this. Today it says that "good progress" is being made.

My View

This share remains extremely high-risk. The work it does for its clients is highly uncertain either in terms of how long those contracts will last (Betsafe) or the legitimacy of what its clients are doing (Celestial).

Launching its own trading operations does have the potential to make it a more high-quality business, assuming that it can pass various regulatory hurdles and survive in a more regulated environment. The biggest players in the industry are ex-growth currently thanks to the introduction of ESMA rules. I expect that it will be difficult. We'll have to see how it gets on.

I can't bring myself to invest in this share, as it's beyond my risk tolerance. High rewards are offered if things go according to plan. But it's not for me.

Tracsis (LON:TRCS)

- Share price: 690p (+9%)

- No. of shares: 28 million

- Market cap: £195 million

Tracsis plc, a leading provider of software and services for the traffic data and transportation industry, is pleased to provide the following trading update for the year ended 31 July 2018.

I'm not overly familiar with this company's operations.

According to its website, it offers a range of consultancy, software and hardware services to its transportation clients. You can browse its various websites using links from this page (external site).

Today's update:

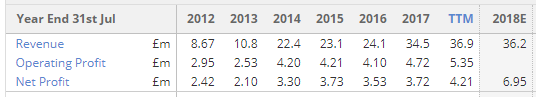

- revenues ahead of expectations at £40 million, up 16% versus 2017.

- EBITDA and adjusted profits also expected ahead of expectations.

- Cash of £22 million, no debt.

The company made a few small acquisitions in February of this year. They will have contributed a tiny sliver of the revenue growth. But most of the revenue growth looks organic to me.

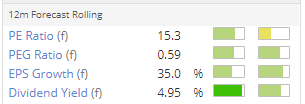

The shares are very highly rated (PER c. 25x, according to Stocko) and I assume this has something to do with its track record of fairly consistent progress:

Personally, this doesn't feel like a sector where I'd be interested to pay such a high rating for any company. regardless of how consistent its track record might be. But congratulations to Tracsis for not putting a foot wrong.

This section written by Paul Scott.

Angling Direct (LON:ANG)

- Share price: 94.5p (up 13.2% at 11:58)

- No. shares: 43.0m

- Market cap: £40.6m

(at the time of writing, Paul holds a long position in this share)

Hello everyone, it's Paul here. I'm chipping in with the odd section, for companies which interest me.

Angling Direct plc (AIM: ANG.L), the largest specialist fishing tackle and equipment retailer in the UK, is pleased to announce its trading update for the six months ended 31 July 2018.

The company has a fairly even split between online sales (53% of the total sales in H1), with the balance being from its 22 physical stores in the UK.

Key points today;

Excellent growth - H1 revenues up 56% to £21.9m - this is ahead of expectations

Growth has been both organic (LFL growth of 4.2% - presumably this is the stores only, not online), and acquisitions - ANG is a consolidator in the sector, buying up Mom & Pop fishing tackle shops at low valuations

International growth - no figures are given, but mention is made of the successful recent launch of a German website.

Online growth of 60% looks tremendous. Although a friend has just messaged me to say that he reckons some of this growth has come from acquiring a competitor with online operations

Online conversion rate has greatly improved - up from 3.7% last year, to 5.2% this year. I think that's the highest conversion rate I can remember seeing, from a growing online business. The norm seems to be 2-3%. This is important, as it suggests to me that ANG is becoming a destination website - i.e. people visit it with the intention of buying something, not just to browse.

Directorspeak - H1 performance "extremely positive"

Forecasts - there's an updated broker note available this morning on Research Tree. Their forecasts are not updated, which seems strange, since the company is clearly delivering well ahead of existing forecast. Forecasts will be re-assessed when the H1 results are published. Therefore it's pretty clear that we can expect forecast increases in due course.

Paul's opinion - there's a lot to like here. The strong online growth is the most important bit, because that should attract a very racy valuation. Online businesses which are growing strongly tend to be valued at 2-3 times revenues. That would imply a market cap here of £80-150m. Therefore the current market cap of £40m leaves good potential upside.

This reminds me a bit of Gear4music (LON:G4M) - a niche eCommerce business, which seems to be trouncing the competition. The other listed operator in this sector, Fishing Republic (LON:FISH) , is much cheaper, but is performing very badly. I did hold a small position in that, but dumped it fairly recently. There is an argument for hoping it could be a multi-bagger on a turnaround under new management. However, I prefer to invest in the company that's out-performing, which is ANG, not hoping for the best with the one that's performing badly, FISH.

Overall, I see good potential upside with ANG shares, providing the growth continues. When the growth stops, then the rating plummets, as Graham notes above, with Hostelworld (LON:HSW) .

There's the ever-present threat from Amazon to consider too. My current view is that there's room in the online market for niche businesses, selling specialist items. Companies like G4M (in which I have a long position) and ANG are niche retailers, that know their market & customer, and importantly stock many thousands of (often slow-moving) lines. That type of operation isn't of much interest to Amazon, so i could see niche markets like fishing tackle being left alone, for specialist companies to do well in.

This section also written by Paul Scott.

GAME Digital (LON:GMD)

- Share price: 30.35p (+10%)

- No. of shares: 173 million

- Market cap: £52 million

(at the time of writing, Paul holds a long position in this share)

Trading update - for the 52 weeks ended 28 July 2018.

This company is a retailer of computer games, in the UK and Spain. It is also developing a new experiential format, called BELONG, as a a JV with Sports Direct. These newer stores involve customers playing competitively, computer games in-store.

Today's update is a mild profit warning. So why has the share price gone up? Probably partly because the update today is not as bad as some might have feared, given the bombed out share price. More importantly perhaps, the company reports net cash higher than forecast, at £58m - note this is more than the market cap! It's not often you see that, for a company which is also profitable. I like shares which actually rise on bad news, as that can mean that market sentiment is so low, it can only go up!

It was Graham who spotted the value here, at 20p, last year. I bought quite a big position at that level, and was delighted when it roared up to 60p late last year. Then I got over-excited about the potential for someone to bid for it. That didn't happen (but a large overhang was cleared), and the share has spent 2018 in the doldrums again. That doesn't make much sense to me, but it's something we're seeing in many small caps right now - a gradual drift downwards, on low volume over the summer.

We all know that computer games are a tough area to retail, because the argument goes that the sector is likely to move to downloads. The "Steam" platform - here is its Wikipedia page, for more info. I've tried out Steam, and can see why it would be popular. However, a physical disc has resale value, can be swapped or sold, which I don't think you can do with downloads. So it's difficult to foresee whether downloads are going to kill off physical game sales or not?

As regards GMD, that doesn't really matter too much, as the business is thrown in for free.

GMD also has extremely short property leases - the vast majority are expiring this year. So GMD is in a situation almost like a solvent Administration - where it can just walk away from its unprofitable shops, handing them back to the landlords. Also, it can negotiate big rent reductions, and market conditions are perfect right now for that. Plus the JV with Sports Direct opens up many potential new, larger sites, on lower rents, than the traditional smaller high street stores. I hope management are being brutal in their negotiations with landlords. Also consider that Mike Ashley has just bought House of Fraser. So we could see some BELONG stores pop up in surplus space there, in due course, perhaps?

BELONG - this is the most interesting part of the business, so what does today's update say about this?

The collaboration agreement with Sports Direct to facilitate our expansion of the BELONG business was signed in February 2018 and the foundation work required to build and accelerate BELONG in the next financial year has largely been completed. This has also enabled us to increase capacity in our existing arenas by 16%.

Our first new BELONG arena under the collaboration agreement opened in Westfield Stratford on 17 August 2018, with a second arena in Lakeside Thurrock set to open in September. These two arenas have capacity for 50+ and 24 gaming desks respectively, versus the current average of 19, and represent a significant step forward in our optimisation and expansion of the BELONG business.

There's nothing ground-breaking there, but it's still early days for BELONG. A previous update gave some figures, showing that the BELONG stores are nicely profitable. So I think this format looks potentially very interesting - time will tell. Also, Sports Direct wouldn't have invested in it, and be providing store space, if they didn't also believe in BELONG. If the market cap was say £200 million, then I'd be a bit more sceptical, but the upside is in for free, with the business valued below its own net cash. I like situations like this - limited downside risk, but upside thrown in for nothing.

I've just spotted another section about BELONG, which sounds a lot more positive, saying;

"The existing 19 BELONG arenas continue to perform well with all key metrics advancing, a considerable affirmation of the offering.

Opening the first two arenas in collaboration with Sports Direct represents a significant step forward as we implement our strategy to increase the availability and scale of BELONG, our experienced based gaming offer and esports activities.

A reader here pointed out some data showing that the BELONG stores seemed to have low utilisation. That is a bit of a worry, but management have previously said that the BELONG stores are already profitable. Sports Direct is extending borrowing facilities to the JV of £55 million - suggesting that there is considerable belief in this format working out well.

Spanish business - is notably out-performing the UK. I wonder if this could be sold, at some point maybe?

Our Spanish business continues to perform well, with strong full year sales performance and sustained management of its efficient operation.

Net Cash - going back to the net cash pile of £58 million, a reader here questioned why the company needs borrowing facilities, if it has so much cash? I think the answer is due to seasonality. The company needs to spend a lot before peak trading at Christmas, then the inventories turn back into cash for the year end, and interim period ends.

Net current assets (including cash) was positive by £68.6 million when last reported, at 27 Jan 2018. This represents a current ratio of 1.5 - a very healthy position for a retailer. There is hardly anything in long term creditors too. So this is a soundly financed business, but with big seasonal swings in working capital.

Overall trading - this is a bit below expectations. There are 2 broker notes out today, both are on Research Tree. One broker today reduces its adjusted EBITDA forecast for y/e 07/2018 by 8.2% to £10.1m. I don't think that really matters very much, as the value in the company is all about how BELONG pans out, and how much rent is reduced on the new & renegotiated store portfolio. That won't show through until figures for the current, and next years (ending 07/2019 and 07/2020). So I see this share as being one which could reward patient holders very well, if the major changes underway at the moment are managed well, and if BELONG really takes off.

At the PBT level, forecasts are for a small loss. However, in this case I think EBITDA is more useful, because of the large amortisation charges. I totally disagree with Graham on this, but never got round to responding to his article a few weeks ago extolling the virtues of leaving in amortisation charges when you value shares. That's not how the City, and the banks, assess companies, so I cannot see the sense in taking a stance which it is out of kilter with what everyone else does. You'll just miss some good opportunities adopting that approach.

Margins have come under pressure, due to a sales mix that has leaned towards lower margin products more than expected.

My opinion - this is a unique special situation. It's a retailer that has an opportunity to exit from its problem stores, due to so many leases expiring this year. It can now re-site/re-size, on lower rents. The timing is perfect, as it has also come up with the new BELONG format, which needs bigger sites. The JV with Sports Direct could turn out to be very interesting, and I wouldn't be surprised if SD puts in a bid for the whole of GMD, if things go well.

There are risks though. A well-argued reader comment today points out that the console & game makers could kill off physical retailers of games if they wanted to. Whether that makes commercial sense for them, I doubt it. But who knows what the future holds?

GMD also has massive execution risk. Re-negotiating hundreds of property leases, and arranging design & fit-outs for many new sites, is a herculean undertaking. So things can & probably will go wrong.

If BELONG takes off, then we could have a 3-5 bagger here, I reckon. Meanwhile, the downside looks well protected from the strong balance sheet, laden with cash at the quiet times of the year. I don't know what the future holds, but for me personally, I view risk:reward here as being very good. So it's one I shall continue to hold, and maybe buy some more when funds permit.

Hi, Graham here.

I should mention there is still time to vote for Stockopedia in the Shares Magazine awards (categories 15 and 17). Here's the link.

Finally, I'd like to say in response to Paul that I take amortisation charges on a case-by-case basis. Sometimes I add them back in but usually I don't. It depends on what they relate to and on the context of what I'm doing.

Banks and the City like to look at things very cheerfully, because they are selling these things to everyone else. That's why they use adjusted EBITDA as a matter of routine, rather than because it enriches investors.

Rant over. See you tomorrow!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.