Hi, here's the usual placeholder article for use in the morning.

Just a quick reminder - I'm only really interested in commenting on small caps which have issued trading updates or results statements on the day. Regards, Paul.

Good morning! Thank you for the reader comments today, requesting me to look at particular companies. Thank you also for mainly keeping them on topic - i.e. small caps, which have issued trading updates or results statements. I don't comment on day-to-day share price movements, just to be clear, only on significant announcements.

Ab Dynamics (LON:ABDP)

Share price: 732p (down 4.0% today)

No. shares: 19.2m

Market cap: £140.5m

Final results - for year ended 31 Aug 2017.

The company is;

... a designer, manufacturer and supplier of advanced testing systems and measurement products to the global automotive industry

There's a very good recent video here, of ABDP management presenting at a ShareSoc growth company seminar, which is well worth watching.

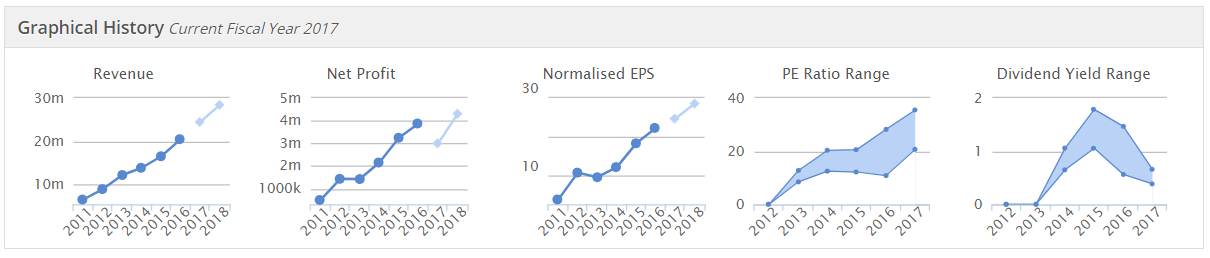

As you can see from the Stockopedia graphs below, there's been a good progression in sales & profits. However, the PER has become very warm now - see the 4th graph below - the PER has inflated considerably. A lofty PER may not be sustainable, and very much requires continued out-performance. This looks a small company for £140m market cap. So I'm approaching today's results with an initial view that this share might possibly be too expensive after big rises? It's almost 5-bagged since Jan 2015.

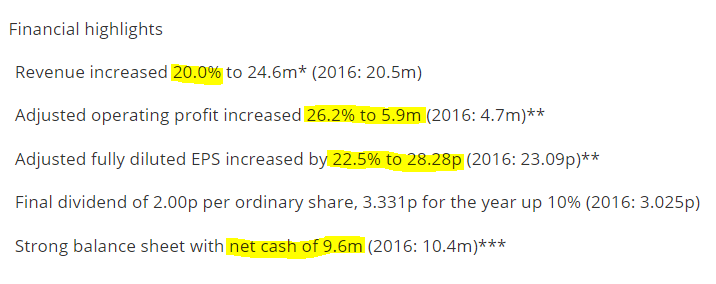

My fears are already receding, as the highlights section below shows strong growth;

Outlook comments - light on specifics, but the order book & visibility comments are reassuring;

Since its formation in 1982, Anthony Best Dynamics has gone through many changes to establish itself as a market leader in its targeted segments within the automotive R&D market. Our customers remain very active in introducing Advanced Driver Assistance Systems and in the development of semi and fully autonomous vehicles.

Our order book is at a record level and we have visibility into the third quarter of our new financial year. Alongside our enhanced facilities and the potential of our new product pipeline, the Board remains confident that, under the leadership of a new CEO, we can continue to move forward with renewed vigour and enthusiasm.

I haven't yet managed to track down any updated broker notes. Stockopedia is showing broker consensus forecast of only 10.7% EPS growth. Whereas the actual result is up 22.8%, so this looks like an earnings beat.

Forex - I imagine that the company would be benefiting from weak sterling, because it's a UK producer, which exports nearly everything it makes. There is no mention of how currency has affected these figures, but it's bound to have been positive.

New facility - the company seems to be in the process of moving to its new factory. This could be a stimulus for future growth, as it sounds like the company was capacity constrained in the recent past.

Share based payments - looks high, at £1.46m. Note that the growth in profit is only achieved by ignoring this cost. Once you take this into account, then operating profit only rose 0.6% to £4.4m. So this effectively means that employees got all the benefit of the underlying increase in profits.

Dividends - are miniscule, at a yield of only 0.5%. Given the cash pile, and the cash generative nature of the business, I'm surprised shareholders are not pushing for a more generous dividend policy. Maybe that will happen once the company has finished its big capex spending on the new factory?

Balance sheet - is excellent, very strong, with plenty of cash. So no issues here at all.

Note that PPE (property, plant & equipment) has risen from £2.7m to £10.5m, due to the new factory being built & fitted out. I do wonder if that might have been a little excessive? Did they really need to spend so much on a relatively small new factory? It's only 3,030 sq.m., or about 30,000 sq.ft.. Note that additional land has been acquired on an adjacent site, for future expansion - very sensible.

My opinion - is positive. This is clearly a high quality company, with pricing power - hence strong net profit margin. I like the balance sheet, and the positive outlook.

Valuation? It looks fully-priced, so there's no margin for error if anything goes wrong. Plus we seem to be in a market where lots of people are profit-taking, and the strongest rising shares are generally selling off. That hasn't happened (yet) with this share, but it might do. For that reason, I don't think this looks a good time to open a new long position in this share - the price seems up with events. However, for committed long term holders, I can see a good case for just ignoring the day-to-day market fluctuations, and holding for the long-term.

GAME Digital (LON:GMD)

Share price: 37.0p (down 7.6% today)

No. shares: 170.9m

Market cap: £63.2m

(at the time of writing, I hold a long position in this share)

Final results - for the 52 weeks ended 29 Jul 2017.

This is a computer/console games retailer, operating "GAME" shops across the UK and Spain. In an earlier incarnation it went bust, but was refloated on the stock market with a greatly improved balance sheet.

I'm indebted to Graham, who spotted the value opportunity here in June. As a result of reading his analysis, and doing my own research, I bought some in a (for once!) perfectly timed purchase for BMUS and in real life, at 20p. What Graham spotted was;

Balance sheet is very strong, with pots of cash.

Most of its shop leases are coming up for renewal in 2018. This is of immense importance, as it will allow the company to just walk away from loss-making shops. Plus it will give the opportunity to negotiate rent reductions, which could be substantial.

Other positive points to consider are;

- Favourable point in the cycle for launch of new gaming consoles, stimulating demand

- Possible upside from sale of Multiplay Digital

- Improving trading outlook (see below)

- eSports is becoming a big thing (where people spectate computer gamers)

- Revamping its store format to include live, pay-to-play computer gaming, branded "Belong"

- Possible collaboration with Sports Direct, which owns 26% of Game Digital.

So those are the positives & what makes it interesting to me as a speculative special situation. Although I fully accept that to most investors, this share won't be of interest!

The negatives are;

- Worries that downloads will eventually replace physical discs or cartridges (although gamers tell me they much prefer to own the physical software, as that can be sold, lent, and can't be taken away from them by the software company)

- In its original incarnation, Game went bust. So will the latest incarnation also follow the same route eventually?

- It's currently loss-making (slightly)

- Online competition - whilst Game also sells online, it seems to be under-cut on price by online competition. Therefore this might further erode its sales, and cause mounting losses, if its other initiatives are unsuccessful.

- Capex requirement for the "Belong" store revamps, re-siting stores when leases expire, is likely to erode the cash pile in the next couple of years.

- Usual cost pressures faced by retailers, especially Living Wage, apprenticeship levy, pensions, business rates, etc. Although I think the lease renewals mean that Game should be able to offset rising costs with reduced rents. I hope they are brutal with landlords, and just walk away from shops which they cannot secure on competitive rents.

Let me know in the comments section below if I've missed anything. I thought it would be useful to recap on the positive and negative points, before delving in to today's figures.

Onto the numbers next.

In terms of profits, we're presented with a range of options. Also, it's important to distinguish between the core retail business, and the loss-making digital activities;

Events, Esports and Digital EBITDA loss of £6.0 million (2016: £3.1 million), reflecting investments made in the period to support significant planned future growth

The way I view this, is that the losses are discretionary - i.e. if push came to shove, it would be easy to shut down, or sell loss-making digital activities, thus reducing overall losses & cash outflows. Plus, there's some potential future upside here - the company wouldn't be doing these activities unless it saw future benefit from them.

Looking at the most favourable view of profitability, these are the EBITDA numbers, which as you can see, are well down on last year (as expected though);

- Group Adjusted EBITDA of £8.0 million (2016: £25.6 million)

- Core Retail Adjusted EBITDA of £14.0 million (2016: £28.7 million)

- Statutory profit before tax is a -£10.0m loss, versus £1.1m profit in the prior year

I won't go through all the numbers here - but point you in the direction of the company's results presentation slides published today on its investor relations website. Obviously this will present a rose-tinted view of things, as all companies do.

Dividends - the final divi has been scrapped. This is not surprising, given that the company has a lot of capex planned for 2018, in dealing with lease events (i.e. potentially relocating some stores on expiry or break clauses, if agreement cannot be reached with landlords for a reduced rent), and rolling out the "Belong" concept.

Forecasts - results today of £8.0m EBITDA came in slightly ahead of forecast (£7.8m).

One decent broker has increased their forecasts today, up by 6.7% for the current year FY 07/2018, and up by 14.2% to £13.9m for FY 07/2019. EBITDA is a perfectly good measure for retailers, as it approximates to cashflow. However, it ignores capex of course (both historic, and planned), so it's essential to combine EBITDA with what sort of capex is going to be necessary to drive the business forwards - which could be substantial with Game.

Outlook & current trading - this looks positive to me, and I'm quite surprised the share price hasn't risen today;

Trading for the first 15 weeks of the year has been ahead of Group plans, with Group Retail GTV up 5.4%. GTV in both UK and Spain are up on last year 1.8% and 9.2% respectively in local currencies reflecting the benefits of Nintendo Switch, the recent launch of Xbox One X and a stronger performance from new game releases this year.

Over the same 15 week period, mint sales in UK and Spain are up on last year 8.8% and 10.7% respectively. Accordingly, at this early time in the year, the Board remains comfortable, alongside all the strategic initiatives moving forward, with the prospects of the Group in the future.

Not bad at all actually, considering how bombed out the market cap is. The core business is still viable, and there could be nice upside from the newer initiatives - and the company has plenty of cash to implement changes. Note that Spain seems to be doing well.

Balance sheet - it is important to understand that Game Digital has a much stronger balance sheet than its former self, which went bust. In a previous article here I compared the 2 balance sheets.

So the strong current balance sheet gives Game Digital the time & resources to reinvent itself. This combined with a virtually unique opportunity to reduce its rents on the bulk of its shops, is almost akin to doing a CVA, but without all the problems. These factors are why I'm taking an interest in this company, as a special situation - because the downside is protected (for now anyway).

Some key stats;

NAV: £109.2m

NTAV: £61.7m (very close to the £63.2m market cap)

Current ratio (working capital) looks solid, at 1.45 - that's good, because retailers don't have much receivables, as they collect most sales in cash from customers, instead of offering sales on credit, like most non-retail companies.

Long term creditors are only £5.4m, and in any case this is dwarfed by cash of £47.2m

Overall then, this is a well-financed company, which won't be going bust any time soon - providing trading doesn't dramatically deteriorate in future.

My opinion - I certainly wouldn't buy this share as a buy & hold forever investment. It's a special situation. The original core business is still viable, and should see big cost cuts in 2018 from lease renegotiations & relocations. There is potential upside from its newer activites - computer gaming as a sport is becoming big, and Game Digital seems to be trying out ideas in that space.

At £63m market cap, with net cash of £47.2m, I see this as a copper-bottomed share, with speculative upside thrown in for free. That said, I reserve the right to change my mind if the trading performance deteriorates. I don't want to be holding this share if it starts to look like the losses are getting worse & worse. It could then be a situation like HMV, where it withers away.

For now though, it's interesting, but one where I'll be keeping my eye on the trading updates, and heading promptly for the exit if things go wrong. That doesn't look imminent though, with positive current trading reported, sales now rising, and brokers increasing their profit forecasts today. I could see further upside on the share price here. Plus there's always a chance that 26% shareholder Sports Direct might bid for the whole thing? It would be relatively loose change for them.

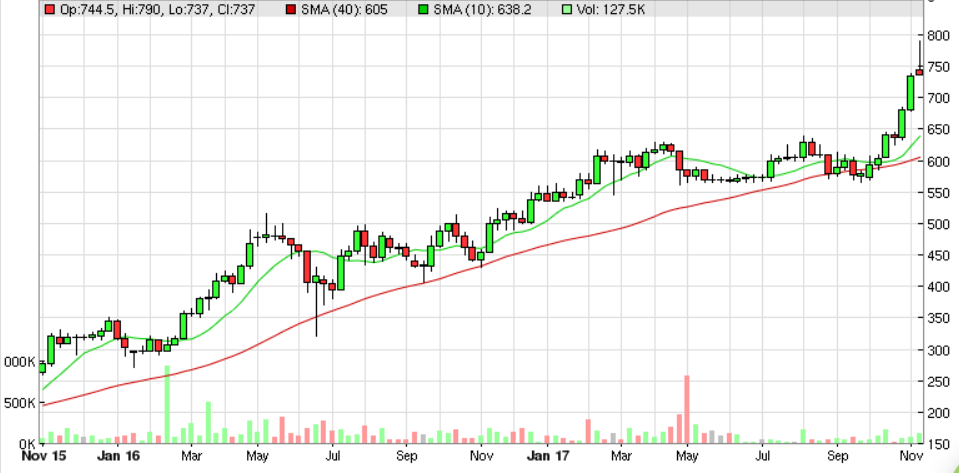

Chart fans might want to note that GMD broke through its 200-day moving average in Aug 2017, and seems to be happy to stay above it since. Could this be a base forming? It looks that way to me.

Wey Education (LON:WEY)

Share price: 28.0p (down 15.2% today)

No. shares: 104.0m shares before + 22.7 placing shares = 126.7m

Market cap: £35.5m

(at the time of writing, I hold a long position in this share)

Placing at 22p - this is an online disrupter in the education sector. It operates an online school, based on the UK, where lessons are held in real time. Qualified teachers work from home, whilst pupils from all over the world log in via bespoke software, using a laptop & headset. The more research I've done on this company, since reporting on it here on 31 Oct 2017, the more I like the concept.

Anyway, I've been building up a position in the company, which is quite hefty now (relative to my portfolio), paying prices up to 33p. So imagine my horror this morning to read that the company was doing an accelerated bookbuild to place 22.7m new shares at a whopping 33% discount, at just 22p.

In my experience, the deal is already done, when the announcement comes out about an accelerated bookbuild. Occasionally you can nip in, if you're quick, and get a small allocation, but that's unusual in my experience.

The company has raised £5m before expenses, to drive expansion, and make a complementary acquisition. I'm happy for them to drive the (already impressive) growth rate higher still. However, I'm livid about being diluted by people who've been allowed in on the cheap. The company should not have given away such a big discount. I accept that large buyers can justify demanding a discount, because micro caps like this are too illiquid for them to be able to exit, if something goes wrong. So a discount of up to say 10% is OK. However, a 33% discount is outrageous, and alienates existing shareholders, if we're not given access to the cheaper new shares. There was no open offer, to allow in existing holders - that's very wrong.

Having said that, I see the share price only dropped to close at 28p today. So it seems that the new shareholders are not tempted to flip them - by forward selling, or using a CFD short - which means people don't have to wait the few days for new stock to be issued. It can effectively be sold short straight away. Hopefully then the fundraising has been limited to serious long-term investors, and not spivvy flippers.

The key thing here is that the company is already operating at about breakeven, on very small turnover. So the operationally geared impact of rapid growth could be very exciting.

This share is exactly what I look for - an internet disrupter, in an established niche, with big upside potential. Sure the valuation looks nuts on the historic numbers, but the 60% growth now being achieved (from a very low base) means that this share should be valued on future potential, not historic numbers.

I mistakenly thought that the company would not need to raise any more cash. That said, it has only enlarged the share count by 21.8% today, and has raised £5.0m before costs, so maybe £4.5m after costs? That's highly material to this tiny company, which has been run on a shoestring so far. So I reckon we could see some sparkling growth figures from the company next year, once this cash has been deployed.

It's bull market stuff, and obviously speculative (not value), but this one ticks all the right boxes for me. I see that Leon Boros (a renowned quality company investor) has just Tweeted that he took some of the 22p placing shares. Well done Leon, (he says through gritted teeth!).

Just to clarify, for me this share is a 5-year+ type of investment, because I see an opportunity for this to grow into a much bigger business. Its online school has already been running for about 10 years, and there's lots of very interesting stuff about it online, including this charming video from one of its sixth-form students.

he more I look into structured home schooling online, the more I feel this could be a very viable option for many children in the UK and abroad. Better than all the bullying & nastiness of conventional schools perhaps? For many people school days are not happy times at all, but a tremendous ordeal, which don't actually equip you at all well for adult life.

Wey Education's Chairman, David Massie, said: "We are very happy to have concluded this placing and to have attracted a number of significant institutional investors who we hope and trust will support the Company in the long term as we pursue our plan to build Wey into a leading international educational services provider.

The additional working capital provides the board with the confidence to pursue a number of new initiatives particularly regarding increased marketing in the UK and overseas, which we hope will generate substantial returns over the medium term. Negotiations regarding the proposed acquisition continue and we will make a further announcement regarding such in due course."

That's reassuring about key institutional investors.

It's obvious that the market cap is largely based on future hopes for the company. So if the growth doesn't continue, then the share price would plummet, probably down to something like 5-10p. Therefore this share is definitely high risk, but high potential long-term reward.

Walker Greenbank (LON:WGB)

Share price: 150.5p (down 28.5% today)

No. shares: 70.9m

Market cap: £106.7m

Trading update (profit warning) - relating to the year ending 31 Jan 2018.

This is a;

... luxury interior furnishings group

UK demand has slowed down unfortunately;

In its interim results announcement on 4 October 2017, the Company stated that order intake was growing ahead of last year and on an improving trend in the run-up to the key autumn selling period.

Since that announcement, momentum in order intake has not been sustained and Brand sales in the UK, excluding Clarke & Clarke, have weakened significantly against management's expectations.

The company helpfully quantifies the impact on revenues;

The Company is more than half way through the key autumn selling period and, owing to the disappointing UK Brand sales and knock-on effect on manufacturing, the Board now expects that profits for the year ending 31 January 2018 are likely to be approximately 10 per cent lower than its expectations.

The trouble with this, is that 10% lower for the whole year, being reported quite late in the year (ending 01/2018), must mean that current trading is quite a lot lower than planned.

It's not all doom & gloom though;

Whilst the UK remains Walker Greenbank's largest market, the Board is focused on driving the Company's international business where Brand sales are ahead of the same period last year.

Licensing income continues to grow strongly and the Board expects full year licensing income to be up approximately 15 per cent on a like-for-like basis, in line with its expectations.

Broker forecasts - obviously it's impossible for me to have my own forecasts for the c.600 companies covered in these reports, so I have to rely on broker notes, when I can get hold of them.

Two brokers have today put out brief update notes, both giving identical downgrades to forecasts of 10% for FY 01/2018, and 12.5% for FY 01/2019. Applying those drops to the most recent detailed forecasts I have (from Edison), gives revised EPS forecasts of;

FY 01/2018: 14.5p, a PER of 10.4

FY 01/2019: 14.9p, a PER of 10.1

Therefore, at 150.5p, and assuming those forecasts are realistic, then the PER seems attractively low. I suppose the market is worried that something more serious might be going wrong?

Balance sheet - I thought it would be worth a quick recap on that. Basically, the last balance sheet looks fine to me. There is a small amount of debt, and a small pension deficit, but nothing to worry about in my view.

My opinion - I've always quite liked this company, so buying after a profit warning makes it more attractive to me, because it's cheaper. However, the big question is whether this is just a blip in trading, or the start of a more serious trading downturn?

The downturn in UK luxury furnishings could possibly be a symptom of the downturn in London property activity, particularly at the top end, where Stamp Duty changes have killed off activity. So perhaps this could be fixed if the Chancellor takes dramatic action to kick-start top end property taxes?

Overall, whilst the valuation on revised forecasts now looks pretty attractive, my instincts tell me that it might be best to hold fire, and try to find out more about what's going on, before plunging in to buy any cheaper WGB shares. There could be more, maybe bigger downgrades in the pipeline, if the UK economy continues to slow.

What do readers think?

Sorry this report was finished late, I got there in the end!

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.