Good morning, it's Paul here.

Apologies, I forgot to put up a placeholder article last night, so here it is.

It's a quiet day for results & trading updates today.

Earthport (LON:EPO)

Share price: 18.5p (down 4.5% today)

No. shares: 630m

Market cap: £116.6m

Final results - for the year ended 30 Jun 2017.

This is an international payments company, which has been listed on AIM since Jan 2001, with an utterly dismal track record. Over that time it has accumulated total post-tax losses of £152m.

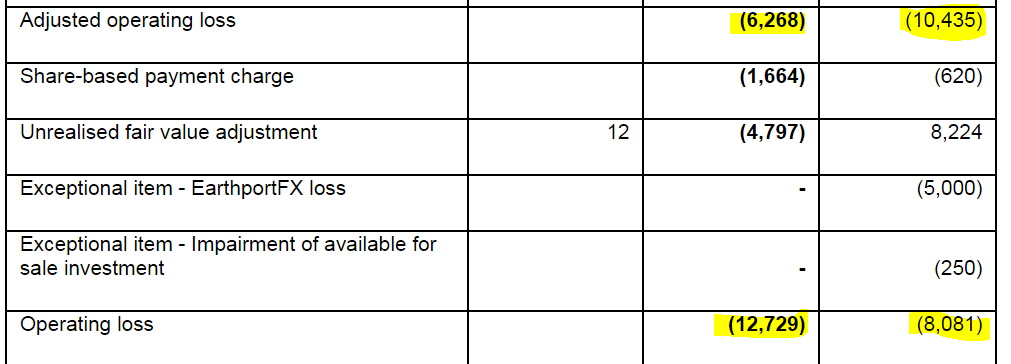

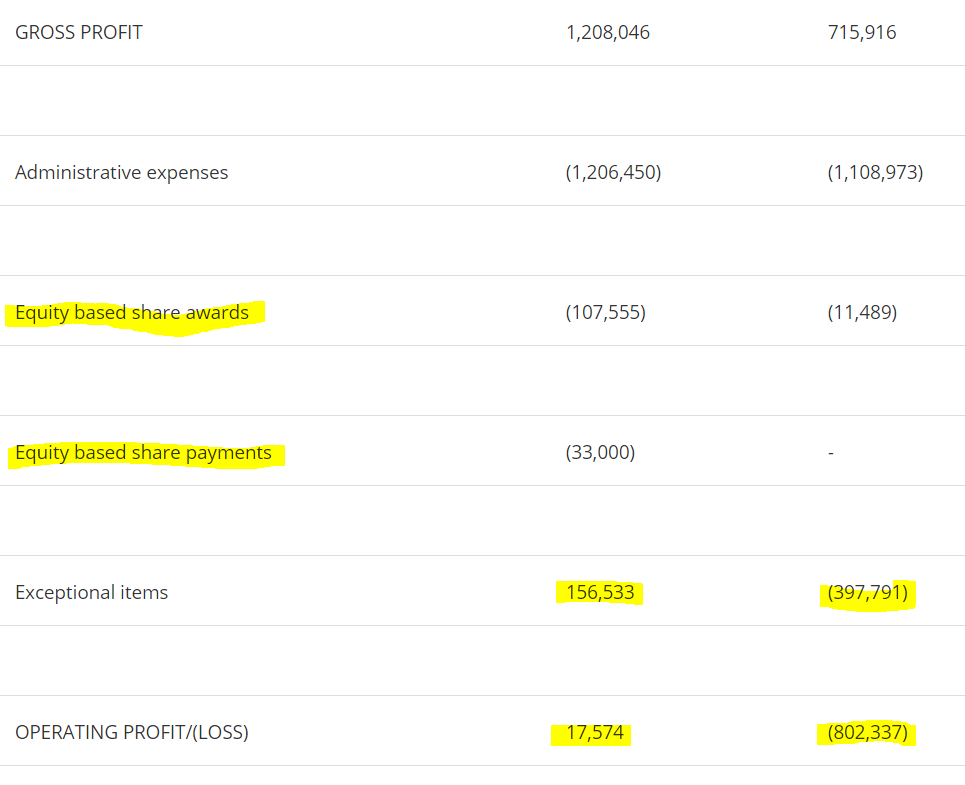

Profitability (or rather, losses) have either got better, or got worse compared with last year, depending on whether you focus on adjusted, or statutory operating profit, as shown in the P&L excerpt below;

The cheerful narrative obviously focuses on the adjusted operating loss, which shows an improvement from -£10.435m loss last year, to £-£6.268m loss this year. Only in the bonkers alternative reality world of Earthport, can this be seen as a "positive year.."

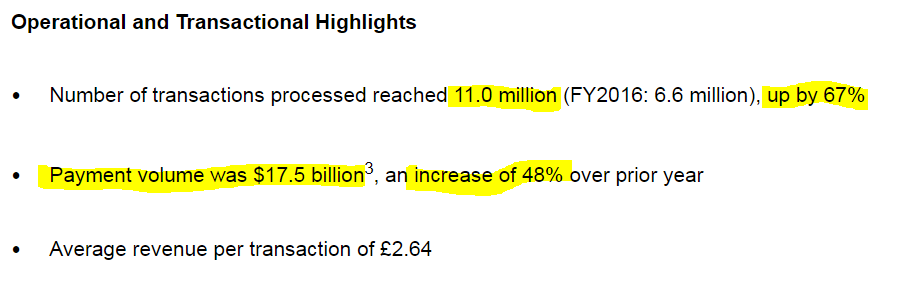

That said, there is some impressive growth reported in revenues & transaction volumes;

11m transactions processed is actually quite impressive. So how come the company cannot make any profit on that? It reports gross margin of 67%, but of course it depends how costs are classified. A big gross margin can be reported if most costs are reported lower down the P&L, in administrative costs. Although note that, despite good top line growth, admin costs only rose marginally, which does support the idea that there could be good operational gearing here, maybe;

Administrative expenses marginally increased by £0.6 million to £26.4 million (FY2016: £25.8 million). Administrative expenses as a percentage of revenue were 87%, compared to 113% for the previous year, mainly due to increase in revenues and cost efficiency.

This supports the idea that if big increases in revenues continue, then the trading performance could transform. I'm starting to warm to this company a little.

Balance sheet - this is already out of date, as the company raised £24m (after fees) in a placing priced at 20p, on 4 Oct 2017. When you adjust the balance sheet for this recent fundraising, it looks fine. Net cash of £11.9m would rise to a pro forma basis of £35.9m, which seems ample, in relation to cash burn.

I'm not madly keen on the "derivative financial instruments" of £7.3m shown within current assets, and £3.3m shown within current liabilities. Note 13 gives more detail - these are forex hedging instruments. I don't like that - it introduces risk of something going wrong, if poorly managed.

Outlook comments can usually be safely ignored with this company. The pattern in the past has been unrelenting optimism, despite continued trading losses. The company has not reached its target of cashflow breakeven.

On current trading it says;

Current trading, including core operational metrics in the first quarter of FY 2018, are broadly in-line with management's expectations and ahead of the same period in FY 2017.

The progress made in FY2017 has established a solid platform from which we can continue to grow, and we look forward to FY2018 with confidence in both our operational and financial performance.

EU passporting rights is a key issue for financial services companies;

...The Brexit vote, followed by the hung parliament result following the general election in May complicates the negotiating stance that the UK has with the European Union (EU). We continuously monitor the progress made at the EU negotiating table, to assess the lasting impact for Earthport.

We must plan for all eventualities in order to maintain our ability to transact within the Single Euro Payments Area (SEPA). If we were to lose our intra-country ability to passport our regulatory status across all the countries within the European Economic Area (EEA), Earthport and other cross-border payment providers would need to have some form of physical licenced operation in an EU member country in order to operate effectively. These uncertainties will continue to play out over the coming years, and we remain vigilant of any significant change.

That sounds like it could be costly, for this relatively small company.

My opinion - I've been bearish on this stock for many years, due to its lamentable financial performance. However, when the facts change, we should change our minds. In my view, there is a glimmer of light here. If the company can continue strong growth in transactions, and then benefit from operational gearing of a 67% gross margin, then the picture could improve considerably.

Overall, I wouldn't consider buying shares in this serial disappointer. However, I certainly wouldn't want to be short of this share either, now that it's reporting decent revenue growth.

ULS Technology (LON:ULS)

Share price: 141.7p (up 8.7% today)

No. shares: 64.8m

Market cap: £91.8m

Trading update - covering the 6 months to 30 Sep 2017.

ULS Technology plc (AIM:ULS), the provider of online B2B platforms for the UK conveyancing and financial intermediary markets...

I've not written about this company here before. Although it did crop up on a screen a while ago. I remember considering it for investment, but decided against. Pity, as the share price has done a very nice stair step move upwards;

I was reading a chapter about charts in my favourite investing book, by Mark Minervini, the other day. He favours charts like the one above. This stair step move up is a sign of investors accumulating the stock (obviously), and is one of the most positive charts you can have. The danger with this type of movement, is that shares can run to over-valuations, and then suddenly plunge when reality bites.

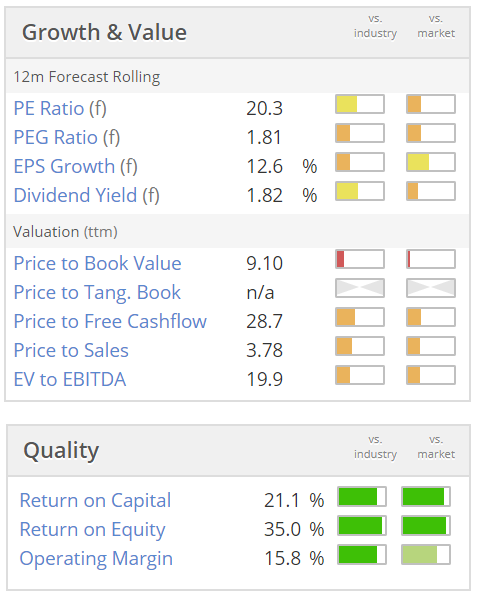

Also, as I mentioned recently, we're seeing a general move up in PE multiples. So stocks which used to trade on a PER of 14, now seem to be moving up to a PER of 20. Sure enough, that is the case here. Stockopedia shows a forward PER of 20.3. If you use the "Print" button, and drop down menu to look back at the StockReport a year ago, from Oct 2016, this share was indeed on a forward PER of 13.9 .

The company has also been beating broker forecasts. A year ago broker consensus was 4.6 EPS for y/e 31 Mar 2017. The company actually achieved 5.06p - usefully ahead.

Forecast for the current year is 6.13p, whereas a year ago the forecast was 4.9p - that works out at a 25% increase in forecast EPS in the space of a year - impressive. I very much like companies where forecasts are rising, and earnings beats occur. In that type of scenario a company which initially looks expensive, might turn out to have been good value, because it was set up to beat forecasts.

That's why I think it's very important to always remember that broker forecasts are usually wrong - companies over, or under shoot, often by very considerable amounts. Hence why it pays to look for companies that seem to be well set up to beat forecasts. The flipside being to avoid companies where the broker forecasts look too optimistic.

Anyway, this is what the company says today;

The Group has continued to trade well during the first half of the financial year with revenue and profit before tax ahead of the Board's expectations for the period...

Helpfully, the company gives us its forecast for H1 performance;

Revenue for the period is expected to be approximately 56% up on last year at £15.28m (H1 2017: £9.78m), with underlying profit before tax up approximately 42% to £2.74m (H1 2017: £1.95m).

These increases are partly due to the acquisition of Conveyancing Alliance Holdings Limited ("CAL") in December 2016 but also due to organic growth in the remainder of the Group.

This growth was achieved against the backdrop of a housing market where overall transaction numbers continue to remain markedly below long-term averages.

Cash generation continues to be strong and net debt has been reduced.

Since it was acquired in Dec 2016, CAL will have contributed a full 6 months trading in H1 this year, but nothing in H1 last year. It's a pity the company didn't specify how much profit growth is organic, and how much due to the acquisition.

Referring back to my point previously, this acquisition is probably what drove the broker forecast increases, or some of it anyway. Therefore the growth in earnings is less impressive than if it had been just down to organic growth.

Outlook - sounds positive, despite a slow housing market;

The Group continues to win new contracts and has a healthy pipeline of new business which the Board believes will enable the Group to continue its strong performance during the second half of the current year and increase its conveyancing market share...

...Although we have had success in pretty much all our market segments over the period, it is especially pleasing that we are gathering good momentum with mortgage lenders, a market segment that we are focused on achieving further success in."

Valuation - this table will update overnight, to reflect the higher share price, and should update again after that for increased broker forecasts. I imagine that those 2 changes would roughly offset, leaving the PER about the same;

Note the excellent quality scores above.

My opinion - I've had a quick look at the last reported accounts, for year ended 31 Mar 2017, and I'm impressed. This is a strongly profitable, and cash generative business. As such, the weakish balance sheet doesn't really matter. Although it does restrict the company's ability to pay dividends.

Overall, I quite like this company. It's not cheap, but seems to be carving out market share in the UK conveyancing market. It seems to offer niche services, like conveyancing price comparison websites, etc.

I probably won't invest here, because I'm not sure how scalable this business model is? With internet disrupters, generally I look for something that could scale up 5-10 fold long-term, or more, to justify paying a high price. I'm not sure if that is likely here or not. Having said that, a PER of about 20 isn't actually a high price these days.

Overall, it looks quite a nice business, and might be worth some deeper research maybe?

Wey Education (LON:WEY)

Share price: 24.4p (up 28.3% today)

No. shares: 104.0m

Market cap: £25.4m

Preliminary results - for the year ended 31 Aug 2017.

...the education group operating the UK's only online fee paying secondary school...

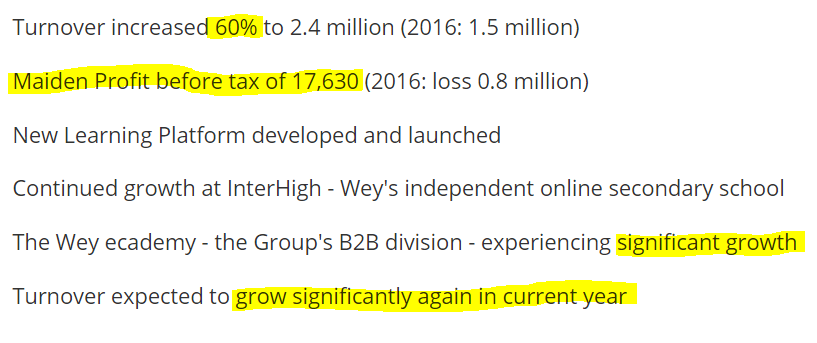

This is an online education business, which operates an online secondary school, plus a consultancy business. What an interesting idea - running a school online. I've never looked at this company before, but Graham mentioned it here on 31 Aug 2017. Graham was sceptical about the valuation, at 22p per share then. He also pointed out the small free float. On the positive side, the company flagged strong revenue growth of 60%, and a maiden profit).

I like online disrupters, and 60% top line growth is enough to make me want to take a closer look. Unfortunately, I wasn't paying attention on 31 Aug, so I didn't see Graham's report linked to above.

Here are the highlights, with my highlighting added;

Whilst the growth is very good, these are still tiny numbers, for a £25.4m market cap. So clearly the market is pricing in continued growth. Moving from a loss of £0.8m last year, to a tiny profit this year, is impressive though - that suggests good operational gearing. If the business can scale up decently, then this could become a much more profitable company. This share is clearly a growth type share, not a value share - so the valuation won't make sense on a PER basis.

A word of caution though, it always pays to look at the full numbers, as often highlights can be misleading! In this case, a positive exceptional item this year, and a negative one last year, has skewed the operating profit improvement quite a lot;

If we strip out the exceptional items, then the adjusted figures would be;

y/e 8/2017: loss of -£139k

y/e 8/2016: loss of -£405k

That's clearly still an improvement, but a much smaller improvement of £266k, as opposed to the £0.8m improvement trumpeted in the highlights! That's a little bit naughty really. I think maybe this announcement has been a bit over-PR'd!

Balance sheet - as you would expect, this is a capital-light business model. Tangible fixed assets are only £102k. It's remarkable that a secondary school with over 1,000 pupils (WH Ireland estimate) can operate online with only £102k in tangible fixed assets.

Overall, the balance sheet looks OK to me. It's small, but has an adequate net cash balance of £1.0m (up from £0.9m a year earlier). Total liabilities are very low, at just £0.65m.

So providing the company doesn't incur losses in future, then I don't see any need for further fundraisings, hence probably no more dilution.

Cashflow statement - I don't see anything untoward. Note that development costs of £267k were capitalised. This is not too far away from the amortisation charge of £160k.

Outlook - sounds positive;

The Group's turnover grew 60% this year and the Board's ambition is to at least maintain that rate of growth in the current year and beyond.

More detail is given for each division, so see the RNS for that.

I do wonder if 60%+ growth is manageable? There's a risk that if the company expands too fast, quality & control could drop.

My opinion - this looks potentially interesting, in my view. I'm going to do some more research on it. My initial reaction is favourable towards the business model, but sceptical about the current valuation. That said, as we know, if you want strong growth in a bull market, you have to cough up for it.

Key questions for me, are to try and get hold of independent reviews of the company from pupils/parents/teachers - is it any good? Are there any problems? What is the pupil churn rate? What are the backgrounds of the Directors?

I see (from the company's website) that the fees are only £2,700 per annum, which is clearly much more affordable than bricks & mortar private schools (which admittedly provide a much more rounded service). For kids who need to be home schooled for whatever reason, I can see how WEY could be an interesting option.

That's all for today. Sorry I didn't get round to looking at Cerillion (LON:CER) .

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.