Good morning!

DX (Group) (LON:DX.)

- Share price: 8.45p (+2%)

- No. of shares: 200.5 million

- Market cap: £17 million

Financing Update, Property Disposal, Gatemore Loan

I have previously written this logistics player off as uninvestable in its current state, and that remains my view on this RNS.

Indeed, I'm surprised the shares haven't already fallen to a much lower level on today's news:

the Board has identified a near term material funding requirement, over and above the Company's existing resources, to address a working capital shortfall, caused by the Company's recently reduced levels of profitability, and to provide funds for the planned investment into improving the financial performance of the DX business

Elsewhere in the announcement, we learn that the company has sold £4.5 million in properties (sale and leaseback), and has borrowed £2 million from a shareholder, both in order to replace a term loan from its bank.

But the overall debt pile was significantly bigger than that (£19 million last seen) and dilution is on the cards. This could become investable again after the refinancing, but not before then. Why prop up the share price before new shares get issued to institutions?

Volvere (LON:VLE)

- Share price: 785p (+5% yesterday)

- No. of shares: 4.1 million

- Market cap: £32 million

(I currently have a long position in VLE)

I'm struggling to find good companies to write about today, so might as well circle back to yesterday and talk about Volvere.

Volvere is now my largest individual position after recent share price gains, including yesterday's 5% move. It looked like it was going to make a larger gain, but ended up closing on its lows.

This is an investment company which I've written about before. It's run by a very small team and buys into special situations, usually where a business needs financial restructuring.

It's very concentrated and currently only has three investee companies, of which one of them is still tiny. So it's effectively just holding two companies, and a huge pile of liquidity.

I was delighted with these results before the market opened, and clearly I wasn't the only one.

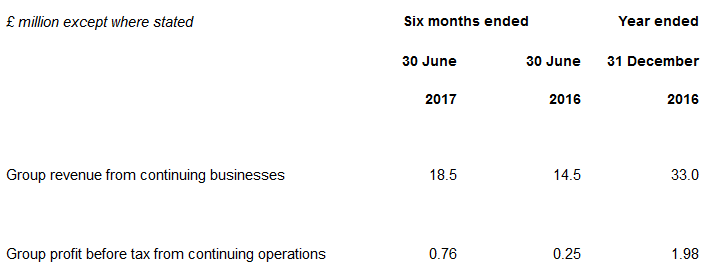

First up, the aggregate numbers:

Volvere also reports NAV, which comes in at 623p per share at June 2017 (up from 617p at December 2016).

The NAV is a sort of pointless statistic in this case, though. Volvere can't mark up its investee companies to market when they perform well, so the NAV in this case is just Volvere's book value, much like the book value of any other stock.

The really impressive element to yesterday's results was the strong profitability at Impetus Automotive, a consultancy serving the sales efforts of car manufacturers.

Volvere settled Impetus' debts and bought the business for a total of £1.3 million in 2015. It has just announced H1 revenues up 50% to £12 million, and H1 profit (before tax and intra-group charges) up by £1 million to £1.5 million.

The underlying growth rate was 20%, but Impetus also benefited from a large outsourced training contract - which only commenced in April, and therefore the results only reflect the impact of three months of this contract.

Elsewhere, Shire Foods unfortunately made a loss of £250k as a consequence of Sterling devaluation. It is typically weighted towards a stronger H2 performance, though, so hopefully it will be back in profitability by the year-end. To give you a sense of the size of this business, annual revenues are c. £15 million.

Financial Strength: Volvere has £20.5 million in cash and financial investments.

There hasn't been any acquisition since Impetus in 2015. Is that a problem? It does appear less than ideal to have such a large cash balance sitting around for an extended period of time.

On the other hand, it's also a sign of the extreme patience and the opportunism of the managers, who have proven themselves willing and able to wait until they can find a really good deal that they understand. They are heavily invested, and it shows in their level of risk-aversion. This risk-aversion combined with opportunism has served Volvere shareholders well over the years.

If I was to put my bear hat on for a minute, I'd say that Impetus and Shire probably aren't businesses which I'd want to buy into in normal circumstances. On their own, they might not pass my tests of quality. For example, they both have customer concentration risk:

in the automotive consulting and food manufacturing segments, there is a dependency on a small number of customers and a reduction in the volume or range of products or services supplied to those customers or the loss of any one of them could impact the Group materially.

But even if I wouldn't buy into these individual businesses in normal circumstances, the point is that I'm not buying into them in normal circumstances. They are owned via Volvere, a turnaround specialist, which finds businesses in need of restructuring, fixes them and improves them. It's a very specific proposition.

Valuation: I clearly believe there is further to go here. I think the market cap should represent £20 million in liquid worth plus a fair multiple on the earnings of both Impetus and Shire (the third subsidiary is still too small). The combined Impetus/Shire PBT this year might be in the region of £4 million. So yes, I still think the market cap (£32 million) is too low. Please do your own research and let me know what you think.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.