Good morning!

Stocks I've noticed so far are:

- Driver (LON:DRV) - trading update, "comfortably ahead of Board's expectations".

- Stanley Gibbons (LON:SGI) - proposed refinancing.

- Rightmove (LON:RMV) - final results.

If you have any further suggestions, please let me know.

Also, Paul updated yesterday's article in response to many reader requests, so there are many stocks covered in that article now. You can read it here if you like.

Thanks,

Graham

Driver (LON:DRV)

- Share price: 75p (+15%)

- No. of shares: 54 million

- Market cap: £40 million

This is a "global construction consultancy". It helps clients manage large building projects by providing a range of consultants from a wide variety of disciplines.

It was unprofitable during 2015 and 2016, then was refinanced in early 2017 and recovered to make a small profit last year. Paul described it as a "nice turnaround situation" when those results were announced.

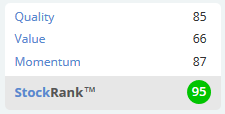

The StockRank has recovered from a very weak score a year ago, to the current fantastic score:

Today's update informs us that performance continues to improve:

Trading results in the first four months of the financial year ending 30 September 2018 are significantly ahead of both internal forecasts and the equivalent period last year. Current activity levels are also high and the Group has a healthy pipeline of potential assignments for conversion in the months ahead. Taken together these factors indicate that the outcome for the year as a whole is likely to be comfortably ahead of the Board's previous expectations.

So we are "significantly" ahead for the first four months of the financial year, and therefore the full-year results are likely to be "comfortably" ahead of expectations.

Why the discrepancy in language used between these time-frames? There is no guarantee that business will continue to be lively, of course.

At the annual results statement, the Chairman reiterated that it is "notoriously difficult to predict activity levels", and that "fluctuations in activity" are a feature of the business.

I was badly stung investing in a firm providing professional services to the construction industry, which has soured me from returning to the sector. No matter how cheap a company in the sector looks, nothing can be done about a cyclical downturn. And the staff need to be paid a salary, regardless of how bad the conditions are.

Having said that, there are investors I respect who do participate in this sector, and I believe that it may be possible to time your entry and exit into these stocks if you are extremely adept. But it's something I've found difficult, personally.

Anyway, back to Driver. Brokers have upgraded PBT forecasts by 15% for this year. The EPS upgrade is a little lower, as in a separate announcement today, 1.5 million new nil-cost options have been granted to the Chairman and top management. Versus 54 million shares currently outstanding, those new options could make a small dent in EPS.

The new adjusted PBT forecast is £3.1 million. Hopefully, the exceptional costs will be a lot lower this year (last year, the exceptional costs wiped out nearly all of the adjusted figure).

If the exceptional costs turn out to be lower, then Driver's current PE multiple might be a bit cheaper than the market as a whole. Stockopedia computers currently have it on a 15x multiple.

Is the company better than average though? I don't know if this is a share to hold for the long-term. It seems more like a share where you do well if you can time the cycle it is operating in.

Stanley Gibbons (LON:SGI)

- Share price: 5.6p (+15%)

- No. of shares: 179 million (before new issuance)

- Market cap: £10 million

It has been quiet from Stanley Gibbons since it announced interim results (to June) at the end of December.

Stanley Gibbons is primarily a stamp dealer. It was mismanaged into ruin, almost. Investors have been bracing themselves for some kind of resolution to the

At the interim results, with the share price at 3.75p and a market cap of £7 million, I argued that the shares were probably worthless, and the share price was still too high.

My reasoning was very simple . The company was still loss-making, and it told the market it was "likely" that a resolution to its balance sheet would require the "restructuring" of £17 million of bank debt. Debt restructuring is usually unkind to existing shareholders.

This proposed refinancing involves a new institutional investor putting in £19.45 million, as follows:

- £7 million of the bank debt will be acquired by Stanley Gibbons

- The rest of the bank debt (at least £10 million) to by acquired by the institution

- £2.75 million payment by the investor to buy the debt owed to Stanley Gibbons by its Guernsey subsidiary (in administration)

- £6.2 million equity injection at 2.5p, resulting in 248 million new shares. The fund will own 58% of Stanley Gibbons.

My opinion

I am surprised, to say the least. It looks as if the existing shareholders are doing well, as they will continue to own 42% of the company. That could easily have been 1% or less, in my opinion. So I would vote for the deal, if I was in their shoes.

As to the merits of the current share price, you will see that the fund is buying a majority stake in the company and is doing it at 2.5p. So I think I will remain cautious about the idea that the existing shares are worth somewhere in the 4-6p range.

The investor taking part in the deal is a successful and very competent value-oriented fund. It's quite interesting to me that they would get involved in this company - they must have seen something they like in the business, or feel that they are getting an excellent entry price.

After all it's been through, Stanley Gibbons will hopefully be a much more focused operation from now on. The balance sheet might be kept under better control, as is implied by the reference to a "capital-light" business model below:

The Directors believe that the injection of liquidity contemplated by the Subscription and also the Debt Restructuring will give the Group the opportunity to become a market-leading, capital-light, stamp and coin dealing platform.

It will continue to have that £10 million debt overhang, albeit to a shareholder rather than to the bank. So while it will benefit from presumably no longer being in breach of covenants for the foreseeable future, that debt does need to be taken into account when valuing the shares.

It's also quite possible that the company is still loss-making. The company claims today that continued poor trading is "largely" due to legacy issues.

Group trading continues to be subdued in large part due to legacy issues, including, in particular, a reduction in investment sales of high end collectibles and a shortage of working capital.

Summary

Putting this all together, we have the following major positive points:

- a very good institutional fund buying most of the shares and committing itself as a steward of the company going forward

- reduced indebtedness and an improved working capital position

On the negative side:

- the share price is much higher than the level at which the institution subscribed

- debt of £10 million still outstanding

- the company might still be loss-making, and its prospects may be poor if stamp collecting is a dying industry.

Not knowing any stamp collectors myself, I have the (possibly false) impression that stamp collecting is something pursued by previous generations, and is of little to no interest to younger people today. Am I wrong in this? If it's true that the industry is in secular decline, what will be the catalyst for trading to improve?

Overall, I do think that the negatives outweigh the positives, particularly at a large premium to the price paid by the new institutional investor. The current share price would produce a market cap of £24 million after the new shares are issued, or an enterprise value of £34 million taking into account the outstanding debt.

Rightmove (LON:RMV)

- Share price: 4419p (+2.5%)

- No. of shares: 91 million

- Market cap: £4.021 million

Big-caps

As there was a paucity of small-cap news this morning, I've decided to talk about this big-cap which most of use are familiar with.

Having checked the market caps for the FTSE 100 constituents, it looks to me like Rightmove could be challenging to enter this index soon. Hammerson (LON:HMSO) has a market cap of £3.8 billion, while G4S is just a little bit higher than Rightmove, at £4.05 billion.

As an aside, as small-cap investors, I think it's easy to underestimate the merits of big-cap investment. There are some great companies at the higher levels (they are the biggest companies, after all, so they must be doing something right).

And while their pricing might be considerably more efficient than small-caps, there is still plenty of volatility to benefit from - NMC Health (LON:NMC), easyJet (LON:EZJ) and Just Eat (LON:JE.) are all up by more than 70% over the past year, for example.

Personally, I've been buying the dip in British American Tobacco (LON:BATS). I don't expect an extraordinary return from it, at least not in the short-term, but it nicely complements the riskier parts of my portfolio.

Most readers I've spoken to do have some big-caps, US stocks, and funds, in addition to their individual UK small-cap holdings. It's always worth remembering how wide the investment landscape is.

Anyway, back to these results. Growth continues:

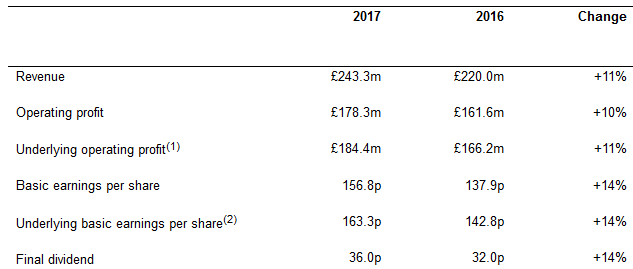

Financial Highlights

Checking the momentum of trading, I see that in 2016, revenues were up 18%, and operating profit up 18%. So we have a deceleration in sales.

These highlights remind me of one of the reasons why I like this company so much - it's a cash machine. It returned £130 million in cash to shareholders in 2016, and returned £140 million in 2017. And it continues to raise the dividend.

There are also the buybacks to consider. When a good company buys back its own shares, it results in extraordinarily good things for shareholders. It's no coincidence that two of the other big-caps I own, Burberry (LON:BRBY) and Next (LON:NXT), have a tendency to buy back their own stock.

In Rightmove's case, it has seen its share count decline from a peak of about 133 million in 2006 to just 91 million today. For context, the share price in 2006 was less than 500p.

But are its best days behind it? Certainly, the growth rates reported today are the weakest since the financial crash of 2008-2009.

So we might not want to award it a very racy valuation, if growth will be modest from now on.

On the other hand, it does tend to enjoy operating margins in the region of 73%, with a truly capital-light business model.

Also, as the number one company in the sector, ahead of ZPG (LON:ZPG) and OnTheMarket, and since it's basically a directory, it enjoys fantastic network effects. A bigger market share means more listings for consumers and more data with which to make the site better. The value of their competitive position is massive.

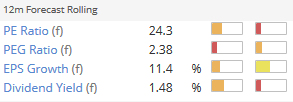

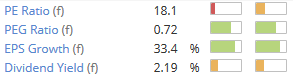

Some will disagree, but taking all of the above into account, I don't believe that this is a very ambitious valuation:

(If the dividend yield seems a little low, bear in mind that buybacks are typically about twice the size dividends. The "buyback yield" over the next year is going to be another 2.5% over the next year, if not more, if this trend continues. The combined yield of dividends and buybacks together is probably more like 4%.)

CEO - the long standing co-founder/CEO left last year, but the transition to his successor (the former COO) is said to have been "seamless".

Outlook - the outlook statement is confident:

Our clear market leadership coupled with the value of our products and data positions us well for the future. With Average Revenue Per Advertiser continuing to grow from a stable membership base the Board remains confident of making further progress in 2018.

Market share - It looks like there was a reduction in market share for Rightmove over the past year. In the Annual Bonus Plan discussion the company says "there was a lower growth in time in minutes spent on Rightmove platforms year on year than our nearest competitors."

That's certainly a concern, and it's important that this trend is improved.

The bear argument is that there aren't enough barriers to entry to prevent Rightmove from losing its #1 spot to hungry competitors.

But if you look at ZPG (LON:ZPG), it trades at an 18x multiple despite not yet having the #1 spot. The market is saying that there is plenty of value in being #2.

Conclusion - I think this is a really interesting share and it's one that I have on my watchlist for a potential purchase.

That's all for today and for the week.

See you next time!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.