Good morning, it's Paul here, with Friday's SCVR.

I'll start early, with some catch up sections from yesterday.

Estimated timings today - the lockdown seems to have turned me nocturnal, so I did 4 hours writing overnight, and needed to sleep more recently. I'm writing more now (from 11:57) and am likely to keep going until about 3pm.

Your Covid-19 comments - I read with considerable interest all the different views yesterday (and previously) about the virus, and how it might affect our investments. Can I just make one suggestion though? It seems that most people who are giving their views, and making predictions, phrase it as if their views are incontrovertible fact, and that anyone who disagrees is a fool! E.g. most comments seem to be phrased along the lines of "This or that will happen...", when actually all the comment really is, is educated guesswork. Nobody has any idea how this will pan out. All we can actually say is, "My view is that this or that might, or could possibly happen". Or, "I think the most likely outcome could be ....", etc.

This is a point made in a terrific book I'm reading at the moment, which I've mentioned here before, highly recommended: Super forecasting. This book points out that the media loves commentators (on economics, shares, world affairs, politics, etc) that are strident, emphatically give one point of view, don't change their minds even when they're wrong, and are very frequently wrong yet never called to account for their poor forecasting. It calls commentators like this "hedgehogs". This type of commentator is often strident & refuses to even contemplate alternative views. I think it's fair to say that I often fall into this trap myself. Hence I'm making a greater effort to mention different views on stocks when I remember. I'm also making an effort to change my "this will happen...." into "I think the most likely outcome is .... but there's a fair chance this other outcome could happen". Or this is the upside, and this is the downside case.

My personal view is that I think many of yesterday's reader comments seem way too pessimistic. I'm working on the basis that bars and restaurants could be open again by July. My suggestion would be to initially limit customers to healthy under-50s with no pre-existing health conditions (where the statistics show the risk to life is minimal), and for temperatures of every client to be taken on the door with a handheld thermometer, as they do in the Far East.

Just watching a TV report from Italy, people are now seriously questioning the lockdown, and the terrible impact it is having particularly on mental health. One person comments, "This is not life", meaning that they are finding the lockdown intolerable, the longer it goes on. I think greater efforts should be made to lock down the elderly & vulnerable, and that everyone else should (in stages) be allowed to resume reasonably normal life, with as much social distancing as possible. The effectiveness of South Korea's response is striking. We probably need to do more of what they're doing.

Trifast (LON:TRI)

Share price: 122p (flat on the day)

No. shares: 122.6m

Market cap: £149.6m

Trifast (Main market LSE Symbol: TRI) issues the following unaudited Trading Update covering the Group's financial year ended 31 March 2020 ahead of the announcement of its preliminary financial results.

"Holding the world together" - International specialist in the design, engineering, manufacture, and distribution of high quality industrial and Category 'C' fastenings principally to major global assembly industries

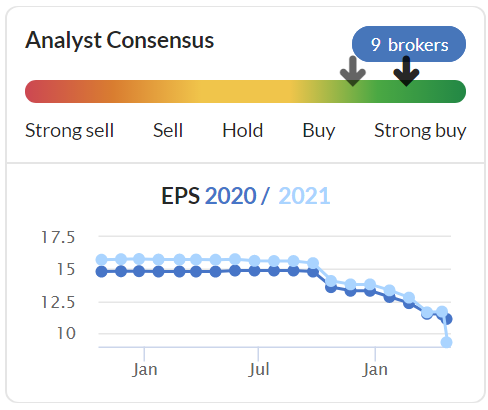

TRI issued a mild profit warning, which I covered here on 14 Feb 2020. Re-reading my notes from then, it's interesting to see that the Covid-19 worry at that time was about China supply chains. That was before the pandemic had happened globally. I didn't see any reason to get involved then. The share price has since dropped another 27%, as you would expect given the far worse macro picture currently.

FY 03/2020 turned out OK, although bear in mind that forecasts had been lowered several times (see graph below). Hence broadly in line isn't good, but Covid-19 would presumably have started to have some impact towards the end of the year (31 March).

Despite a challenging finish to the year:

o Revenue levels held up well against the prior year

o Underlying profit before tax remained broadly in line with market expectations

Covid-19 - the comments immediately below relate to the impact up to 31 March 2020, and presumably are likely to be a lot worse in the new financial year just started? I'll come on to that next.

Over the course of the last six weeks of FY2020, the effect of the Covid-19 pandemic significantly widened. Leading to government mandated temporary site closures in Malaysia, Italy and Spain and customer production line shutdowns predominantly in the automotive sector. This in conjunction with a general reduction in manufacturing volumes across almost all end markets, has reduced year end trading levels across the Group.

The impact of this weakness has led to a corresponding reduction in gross and operating margins against a semi-fixed cost base. However, despite these challenges underlying profit remains broadly in line with market expectations.

"Semi-fixed cost base" is ringing my alarm bells.

Actions taken are the usual that we're seeing from many companies - e.g. use of furlough schemes (not stated what % of workers), Board taking temporary 20% pay cut, cutting non-essential costs, no final divi (but does mention possibility of a special divi later) etc. All sensible stuff.

All sites are open for business, and have achieved "essential business lockdown exemptions" in some countries.

Current trading - uncertain, guidance removed for the new year, FY 03/2021. More confident about medium to longer term pipeline.

Liquidity - this sounds OK, providing the bank remains onside, and there are no covenant breaches;

Our balance sheet is in a strong position, with leverage well inside our banking covenants.

Significant undrawn revolving credit facilities, together with our existing cash resources, provide substantial liquidity headroom with which to navigate an extended period of uncertainty.

That's fine for now, but if EBITDA tumbles, then that could trigger issues with bank covenants later. That said, generally banks are being supportive for decent businesses, so it's not necessarily panic stations if trading deteriorates.

Balance sheet - as regulars know, for years I've been heavily focused on checking balance sheet strength here, which has turned out to be very pertinent in this crisis.

In this case, Trifast last reported its balance sheet on 30 Sept 2019, and it looks fine to me.

NTAV was £77.3m, which is good (I calculate NTAV as NAV, less intangible assets)

Working capital looks great, with a current ratio of 3.27.

Long-term interest-bearing debt is not excessive at £40.2m, and in any case was offset considerably by cash of £25.0m.

Overall then, I doubt the bank would play up, even if trading deteriorates in FY 03/2021, which I imagine is likely. It looks pretty secure.

My opinion - tricky one this. It seems a fundamentally sound, and well managed business. However, we've got no visibility for current year earnings, which I imagine are likely to be poor. As is the case with so many shares, this really gives investors 2 options;

- Ride out the current crisis, on the assumption that the business should survive (due to fairly strong balance sheet), and accept the risk that the share price could fall on lousy figures later this year, or

- Sit on the sidelines, and await clarity on earnings, and possibly buy in cheaper at a later date.

Those options are applicable to practically every share at the moment!

I don't have any particularly strong view either way with Trifast. It's not really a business that excites me, and the share price performance was lacklustre before Covid-19 struck, due to its exposure to the automotive sector. There must be thousands of companies worldwide that can make fastenings, so Trifast's strong (10%-ish) operating margins have always slightly puzzled me, but there we are. Presumably it might benefit from weaker competitors going bust this year, and that could present more acquisition opportunities.

There could be some upside here from 122p as economies start to come out of lockdown, possibly? Trifast probably won't need to raise fresh equity, therefore I can see some merit for buying/holding this share, if you're prepared to be patient, and take the risk of it plummeting if dire figures come out later this year. That may not happen, but it's a big risk, given that economies are tanking right now.

.

Taylor Wimpey (LON:TW.)

Share price: 148p (up 9% yesterday)

No. shares: 3,283.9m

Market cap: £4,860.2m

(at the time of writing, I hold a long position in this share)

Not a small cap, but it's interesting, so I'm going to write about it.

After reading the OBR report recently, which I reported about here on 15 April, I became convinced that lockdown has to end soon, in stages, due to it being staggeringly expensive, and on track to ruin millions of peoples' lives if it goes on much longer. For questionable benefits, that could arguably be achieved in other, less destructive ways.

That got me thinking about buying shares in companies that are likely to benefit from lockdown being removed. My earlier strategy of buying bombed-out but reasonably financially secure property REITs (Hammerson (LON:HMSO) and Newriver Reit (LON:NRR)) just wasn't working, so I've now ditched HMSO, and greatly reduced my position size in NRR. Instead I've turned my attention to housebuilders for this part of my portfolio.

I cannot see any reason why building sites were mothballed in the first place, given that it's mostly work in the outdoors, and social distancing is easy to do. Also, housebuilders generally have great balance sheets now, and demand for new houses is likely to continue, as long as interest rates remain low. Even though banks are tightening mortgage availability, I reckon there are probably enough buyers around to keep the housebuilders busy.

For this reason (and wider read-across to the whole economy), I'm interested in updates from housebuilders. I often cover them here, even in normal times, as they're a good gauge of the general health of the economy, and consumer confidence.

Here's what TW says today -

- Recap - it closed all its sites at the end of March, to assess situation

- Has plan in place, so will re-start (phased) from 4 May (only 2 weeks away)

- Sales have continued remotely, and digitally - encouraging, as clearly there is still demand

- Cancellations less that 1% of order book - that's fantastic I think

- Order book has continued to increase and as at week ending 19 April 2020, the total value stood at approximately £2,677 million (2019 week 16: £2,399 million) - wow, very impressive

- Strong balance sheet and gross cash position of c.£836 million as at 22 April 2020 - I'd rather have the gross, and net cash/(debt) positions.

Change in way new houses are sold - could this become permanent I wonder? Probably not, but why not, if it works?

Sales centres, show homes and regional offices to remain closed while we monitor latest guidance around social distancing. We will continue to provide service to customers and sell remotely and digitally

Balance sheet - is not just good, it's stunningly good. Consider this, as at 31 Dec 2019. Current assets were just under £5bn, including £630m in cash. The rest is mainly inventories of £4.2bn. Current liabilities? Only £1.1bn. Therefore, even if house prices halved, it would still have a comfortable working capital position. Is there tons of long-term debt? No, only £85m of bank debt. There's also an £85m pension deficit, and £500m of trade/other payables (presumably for deferred land purchases at a guess?), but the overall total of £745 long-term creditors look OK in the context of the huge working capital surplus higher up the balance sheet.

NTAV is £3.3bn, which supports 68% of the £4.86bn market cap .

My opinion - obviously as I'm long, I see things bullishly.

The key questions are whether we're heading for a house price crash, and whether Help To Buy scheme is likely to be extended, which has been a massive boost for housebuilders. Personally, I don't see any reason why the price of new houses would drop much, because mortgage payments are so cheap, people can easily afford new houses if they can come up with a decent deposit. Over time, that's the main driver of house prices - the level of interest rates on mortgages.

I don't know what will happen with Help To Buy, but I feel the share prices of housebuilders have probably factored in that risk.

If you take a more bearish view, that house prices could fall substantially, and that demand might dry up, then obviously this sector is one to avoid.

Casting my mind back to the Brexit vote in 2016, housebuilder shares got smashed up really badly there, and I remember thinking that was an opportunity & writing about it here. Sure enough, they came all the way back up again in less than a year. Maybe a similar thing could happen with this latest (more serious) shock to the system? Or maybe not, only time will tell.

.

Luceco (LON:LUCE)

Share price: 89p (up 5% yesterday)

No. shares: 160.8m

Market cap: £143.1m

Luceco plc ("Luceco", or the "Group" or the "Company"), a manufacturer and distributor of high quality and innovative wiring accessories, LED lighting products, and portable power products, today announces its audited results for the year ended 31 December 2019 ("FY 2019" or "the period").

Absolutely cracking results these, with adj PBT up 150% to £15.8m. That's 7.7p adj EPS (2018: 2.9p)

That's why the share price did so well in 2019, peaking in early 2020 at 146p. Of course, 2019 seems like a different world now, hence why the share price is now off about 40% from that peak.

Covid-19/outlook - this is all that matters now. Key points;

- Supply chain disruption from China in Feb/Mar, now resolved

- Demand now affected by European lockdown, running at half usual levels

- Monthly cash outflow running at £0.5m per month - hence the P&L monthly loss is probably worse than this, if it's deferring some creditor payments, as seems likely. Edit: actually I could be wrong on that, as it later says EBITDA is currently running close to breakeven

- Cash conservation measures similar to what many other companies are doing - e.g. divi paused, pay cuts, etc

Liquidity - some useful detail given on this;

o Adequate liquidity to fund this rate of loss: £24.5m of undrawn facilities at the end of Q1 2020, committed until end of 2021 · Resilience and optionality added to the funding plan:

o Agreement reached with relationship bank to: § Loosen banking covenants in late 2020 to accommodate severe downside scenarios

§ Swap £10.0m of existing invoice financing facility for £10.0m of Revolving Credit Facility to underpin debt capacity

o COVID Corporate Finance Facility applied for

o China mortgage lending available

I particularly like the bit about loosening banking covenants. That's very reassuring for shareholders.

Stress testing - this section below is absolutely superb, and really shows that management are on the ball, and fully in control. As opposed to potentially sleep-walking into a crisis later this year.

All companies should be publishing stress testing results like this (apologies for the huge copy/paste, but it's very interesting);

Coronavirus stress testing and liquidity assessment

We have reviewed and stress-tested our funding arrangements in light of the coronavirus. We have considered both base case and severe but plausible downside case scenarios.

In our base case, we have assumed that Group revenue remains at circa 50% of normal levels until the end of June 2020, gradually recovering to 80% by August 2020, then 100% from January 2021. We have assumed that the mitigating actions described in the Chief Executive Officer's Review remain in place to an appropriate extent for the duration of the downturn.

In our severe but plausible downside case, we have modelled a second virus-driven lockdown from September to November 2020, which leaves Group revenue at 25% of normal levels for its duration, gradually recovering to 100% of normal levels by February 2021. All other assumptions remain the same as the base case, including the application of the same mitigating actions for the duration of the second downturn.

In both scenarios, the Group has adequate headroom in existing bank facilities to fund itself. In the severe but plausible downside case only, the Group exceeds the financial covenants applicable to its existing facilities shown above in Q4 2020 and Q1 2021. Subject to contract, our relationship bank has therefore agreed to reset the covenants limits applicable in 2020 as shown....

That's so impressive, getting the bank covenants amended well in advance, for a downside case scenario.

Also, this is the first company that I have seen which is planning to cope with a second lockdown in autumn 2020, if Covid-19 resurges. Again, very impressive forethought.

China mortgage - the CFO has this in his back pocket. It would have been nice to have put a ballpark figure on this though, so I don't know if this is significant or not:

The Group has historically used mortgage lending in China and has the option to do so again.

Balance sheet - looks reasonably OK to me. NTAV is £24.5m

My opinion - this looks a good, well managed company. I particularly like the prompt action to strengthen & safeguard its liquidity, through amended facilities & covenants. The stress-testing section is absolutely superb.

This looks like the type of company that should survive 2020, and recover in 2021, assuming generally improving economic activity & the virus in retreat. That's a big assumption of course, and may not be the case.

For me, right now, it's not quite cheap enough. Also, bear in mind that things went badly wrong for this company from late 2017, for about a year. Before buying this share, I would want to look back at that again, and remind myself what wrong, and whether it could happen again?

.

Dart (LON:DTG)

Share price: 590p (down 3.6% today)

No. shares: 148.9m

Market cap: £878.5m

This airline/holiday/logistics group issues an update for FY 03/2020, and current trading.

It's high on my watch list, because it has a fantastic multi-year track record of growth, including setting up a highly successful package holidays business from scratch in recent years. Also I like the superb balance sheet, so it looks a rare bright spot in a sector (airlines) that I wouldn't normally touch with a bargepole, especially now.

With high fixed costs, and planes sitting idle on the ground, not to mention chaotic fuel price movements & hedging problems, plus the question of whether Governments should bail out airlines or not, this sector looks a total minefield.

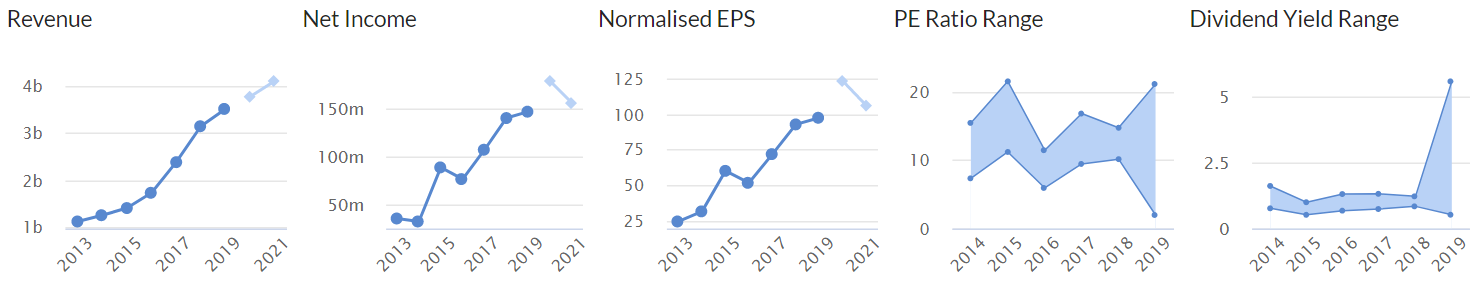

Assuming Dart survives (which I think it should), and we get back to something like normality in 2021 or 2022, then Dart shares could possibly reach several times the current price. After all, it got close to 2000p per share recently, before covid. Look at the superb historical track record below. Obviously ignore the forecast light blue blobs, as they're defunct now;

.

Clearly there's going to be a terrible set of figures for FY 03/2021, but for patient investors, prepared to wait maybe 2 years, then I reckon earnings could reach new peaks. After all, DTG was trouncing the competition before covid, so why wouldn't it after (especially as there's likely to be less competition in future)?

FY 03/2020 results - a fantastic year, but this is already ancient history;

Further to the Trading Update issued on 18 March 2020, the Board expects to report pre-exceptional Group profit before foreign exchange revaluation and taxation for the financial year ended 31 March 2020 of between £265m - £270m, an increase of approximately 49% on the prior year.

Fuel & forex hedges went bad, and it will take a £109m exceptional charge in the FY 03/2020 results.

Hotel deposits - this is yet another problem, and seems likely to require another write-off. It's a pity that DTG doesn't give any guidance on the size of this problem. It might be in broker research, which I'll check out later. The risk must be high that hotels at destinations might go bust, taking DTG's deposits down with them. More clarity on this is needed from Dart.

We continue to actively monitor the financial health of our hotel counterparts in respect of our advance deposits and their potential for recovery. Contractually the majority of these deposits are able to be reallocated to future seasons' bookings.

Current year - too difficult, so they fob us off with this;

The impact and duration of Covid-19 remains difficult to determine, and the Board has no clarity as to how this will affect Group profit before foreign exchange revaluation and taxation for the financial year ending 31 March 2021.

We all know it's difficult, but as Luceco (LON:LUCE) demonstrated yesterday, it's possible to stress test outcomes on a base case, and a plausible downside case. We know Dart will have done those sums internally, they've just chosen to withhold the information from the market. That's just not good enough. More openness is required at this stage.

Action taken -

- Aircraft fleet grounded - I'm surprised at this. Surely they could be operating some planes, for freight, repatriations, etc.? Air Partner (LON:AIR) recently said it was doing OK, with that type of business (using other peoples' aircraft)

- 80% of staff furloughed under Govt schemes

- Reduced flying schedule on sale from 17 June 2020

- Cost-cutting & cash- preserving measures taken - including 30% pay cuts for everyone, including Directors. No bonuses or divis to be paid

Liquidity - not enough information given, but it does say this;

We have prudently fully drawn down our Revolving Credit Facility of £100m and have also begun the process to confirm our eligibility and access to the Covid Corporate Financing Facility, launched by the Bank of England. In addition, we remain in ongoing constructive discussions with our existing liquidity providers, who recognise the strength of our business model.

Customer bookings - this is very pleasing. I think a pattern is beginning to emerge of the UK public being more resilient, and less frightened, than might have been thought. See yesterday's report where I covered a surprisingly upbeat update from housebuilder Taylor Wimpey (LON:TW.) , saying that the order book is strong, demand high, and cancellations negligible. I reckon many (particularly younger) people are itching to go on holiday, and once the virus has subsided, my hunch is that demand could return strongly. Although perhaps older people might understandably not want to take the (for them) much higher risk. Judging by Dart's jet2.com TV ads, they seem to be already appealing to families, not pensioners.

Positively, and despite the considerable uncertainty, we are seeing customers still making bookings for late summer 20 and winter 20/21, with encouraging numbers choosing to rebook rather than cancel. In addition, and though very early, summer 21 bookings to date are very promising.

That's excellent news. Re-booking not cancelling means DTG gets to sit on the customers' cash, helping its liquidity.

Fowler Welch - distribution business, is doing well.

My opinion - it's a pity that today's update doesn't give enough clarity on the outlook. I was looking for some guidance, and stress-testing figures to base my investment decision on. Without that, it's too much like guesswork. Which is a pity, because I want to buy back into this share, but today's update doesn't give me enough information to make that decision.

Persimmon (LON:PSN)

Share price: 2194p (flat on the day)

No. shares: 318.9m

Market cap: £6,996.7m

I reported yesterday on a surprisingly upbeat statement from Taylor Wimpey (LON:TW.)

Today we have another big housebuilder updating. It is also about to resume work on its building sites, after a brief shutdown;

... phased restart to work on site with effect from 27 April 2020, in response to the UK Government's objective of getting the construction sector back to work.

Clearly that's good news, and has been anticipated by the stock market awarding 20%-ish price rises to housebuilding shares in recent weeks.

Persimmon's update is almost a carbon copy of what Taylor Wimpey said yesterday, e.g.;

... continued to serve new and existing customers, making use of online resources, including virtual viewings and digitalised reservation processes. This has resulted in c. 820 gross private sales reservations being secured in the five weeks ended 19 April 2020.

Cancellation rates remain at historically low levels.

People will always want to buy new houses, and there seem to be enough buyers able & willing to proceed, from what I can make out.

This is a strong statement;

The Group has not made use of the Government's Coronavirus Job Retention Scheme to furlough staff, has no current plans to access any of the UK Government's COVID-19 funding programmes and continues to pay all taxes promptly.

My opinion - I think it makes obvious sense to re-start the construction industry. This should also help the many suppliers to the sector to hopefully survive, and recover from the relatively short cessation of activity. That could have read-across to lots of smaller caps serving this sector.

Uncertainty remains over the crucial Help To Buy scheme.

Profit in 2020 is bound to be impacted to some extent by all this disruption.

Like Taylor Wimpey, Persimmon has a stunningly strong balance sheet. It's an absolute cash cow (partly thanks to Help To Buy), and personally I cannot see any reason why house prices would fall substantially, given that interest rates remain at historic lows.

I think there's a good chance that this sector could continue to see further recovery in share prices. Hence I'm happy to hold.

As you can see from the 1-year chart below, arguably the share price overshot on the upside, then overshot on the downside in the Covid-19 panic. Maybe it's settling back down in the middle now?

.

I'm taking a break for lunch now. I'll update on Lookers (LON:LOOK) at some point later today. There's about a 50% risk that I might succumb to sitting in the sun with a couple of cold tinnies. This lockdown is driving me round the bend, so I'll do whatever it takes to keep going!

Staffline (LON:STAF) - rats leaving the sinking ship possibly? This looks potentially terminal to me. I don't like the look of this, at all.

All I can remember, is the selling CEO, being so charming at about £10 per share, a few years ago, trying to sell the shares to private investors. What a piece of shit! He's running a hotel now apparently, with his ill-gotten gains. What a scumbag. People might feel cheated. My dogs left a small turd on our chequered pattern tiles this morning. I wiped it off, with disdain, and thought to myself, Staffline.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.