Good morning! A few bits to look at today and then we can go enjoy the bank holiday weekend.

- Macro Musings

- Fulham Shore (LON:FUL)

- Pebble Beach Systems (LON:PEB)

- Air Partner (LON:AIR)

- Henry Boot (LON:BOOT)

Macro Musings - Ageing Bull

Firstly, there are a couple of macro themes on my mind today. If this isn't your thing, just skip ahead to the next sections! When the RNS feed is quiet, I often prefer to focus on the bigger picture.

As of Wednesday, US markets achieved their longest ever bull market, i.e. from March 2009 to the present day. This entire period has passed without a 20% correction.

The previous longest bull market was from 1990 to 2000, and ended in misery for all sorts of investors who got caught up in the dotcom rush.

The S&P Index enjoyed a P/E rating of between 25x and 30x just before that crash, way above its historical average.

Today, however, the S&P Index is at a much more modest rating of 18x. This is not extreme compared to the long-term average of 17x (since 1990).

The FTSE also does not appear stretched. According to Stocko, the median forecast P/E ratio for all UK shares with estimates is 13.4x.

On this simple view, it is difficult to argue that markets are wildly overvalued at present.

On the other hand, if you use cyclically-adjusted earnings, taking into account the traditional volatility of profits, then US indexes do appear overvalued, On a cyclically-adjusted basis, the US P/E ratio is 33x, not far off double its long term average. This means that US shares are vulnerable to an earnings wobble.

Another red flag is the market's concentration in a small number of high-flying tech stocks. The FAANGs are collectively worth $3.5 trillion at the moment. If a few of them were to fall out of favour, that could be the trigger for a more general loss of confidence. Stockopedia gives these stocks an average Value Rank of 20, i.e. they are a heavily overvalued group.

It could also be argued that earnings today are less supported by strong corporate balance sheets than they have previously been, after $4 trillion of share buybacks over the past 10 years and heavy junk bond issuance.

Buybacks have the double whammy effect of decapitalising a company's balance sheet and simultaneously supporting its share price at what some might view as an artificial level.

I'm often a supporter of buybacks, but I acknowledge that many companies don't time them particularly well. Trump's tax cuts have given US firms the confidence to increase share buybacks by a whopping 76% this year. In hindsight, we may look back and say that many of these companies should have been more careful with their spare funds.

The other big macro theme I'd like to mention, and it's on a related note, is that interest rates are almost certain to keep rising. There are recent, strong indications that rates will continue rising through the first half of 2019.

This means we could easily have a US dollar base rate of 3% twelve months from now, with the Bank of England lagging far beyond.

That would cause a great deal of US dollar strength as people shift to US-denominated assets (readers will know that I have already done this with a big chunk of my own portfolio, buying lots of US junk bonds).

It could also cause a flattening or even an inversion of the yield curve, unless long-term interest rates respond by rising too. I expect that long-term rates will rise, and that this will be another drag on equities.

In conclusion, I view US equities as vulnerable at present. Given the various red flags (heavy buybacks, concentration in FAANG stocks, and rising interest rates), I do think that the bull market should end soon, and that we should get our 20% correction. Let's say over the next 12-18 months.

UK shares are likely to be held back in this environment, but will be supported by the less aggressive valuation they are starting from, and by lower interest rates. The Bank of England, as the Brexit situation unfolds, will continue to drag its feet on rates.

I was bullish on Pound Sterling on the basis that it would recover when Brexit negotiations were complete, and I remain bullish on it versus the Euro, but my top currency pick for the foreseeable future is US dollar. Make of that what you will - FX is notoriously difficult to forecast!

Fulham Shore (LON:FUL)

- Share price: 12.75p (+5%)

- No. of shares: 571 million

- Market cap: £73 million

Fulham Shore's MD has picked up 127,000 for 12p. At first, I got excited and thought that it was big news, and then I realised it was only £15,000 worth of shares.

It's a nice little gesture to accompany the AGM and trading update, but it's not material in the grand scheme of things.

Pebble Beach Systems (LON:PEB)

- Share price: 3.75p (unch.)

- No. of shares; 125 million

- Market cap: £5 million

This leftover company from what was Vislink is not showing much signs of life yet. There is a loss from continuing operations of £0.8 million in the first six months of the year, which is in line with expectations.

There is an "increased backlog" and a "growing pipeline", which is nice.

Central overhead costs have been reduced by £1 million compared to last year - good news. Sounds like it is operating at a structure more appropriate to its current size.

Outlook is "challenging".

My view: With over £10 million of net debt still hanging over it, the situation for the equity continues to look rather uncomfortable.

Air Partner (LON:AIR)

- Share price: 114.25p (+1%)

- No. of shares: 52 million

- Market cap: £60 million

This is an aviation services group. It had a nasty accounting mishap which I covered in June. That issue looks to be behind it now.

Today's H1 update is in line with expectations.

Charter division - "strong performance" in H1 after a record year in 2017.

Consulting & Training Division - winning new contracts, in line with expectations.

New auditors are being hired, I guess to further underline that the past is in the past.

Outlook - confident for "the full year and beyond".

My view - my interest in this one is growing as I learn about it. The market for private air travel is surely only going to go in one direction in the years ahead, as it becomes within reach of more and more corporates and individuals.

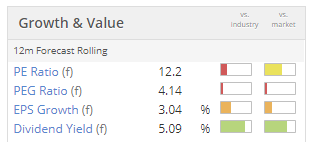

It's expensive compared to others in the airline/transportation industry, but it seems highly inappropriate to compare it with the likes of Ryanair Holdings (LON:RYA) and Easyjet (LON:EZJ).

Henry Boot (LON:BOOT)

- Share price: 280.5p (+4%)

- No. of shares: 133 million

- Market cap: £373 million

Henry Boot PLC, a company engaged in land promotion, property investment and development, and construction, announces its interim results for the period ended 30 June 2018.

A great result over 12 months. NAV per share increases by 18% over period from June 2017 to June 2018. The company also paid 8p in dividends over this time.

The outlook for the full year and for 2019 is in line with expectations, i.e. all forecasts are unchanged.

The share price premium to NAV is now 29%. That's not overly expensive, so if you like this company's management team and its prospects then it could be worth a look.

Personally, I tend to be very stingy, and only buy property companies when they are around or below NAV.

Net debt at £26 million is low compared to the overall size of the group, so financial risk should be low.

Outlook - the company talks of an uncertain investment environment due to the UK's ongoing negotiations with the EU, but says the housing market remains resilient within that. So there is no need to change any forecasts.

My view - a nice property company that is worth a look, if you take an interest in this sector.

Ok, that's a wrap. Enjoy the long weekend!

Cheers,

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.